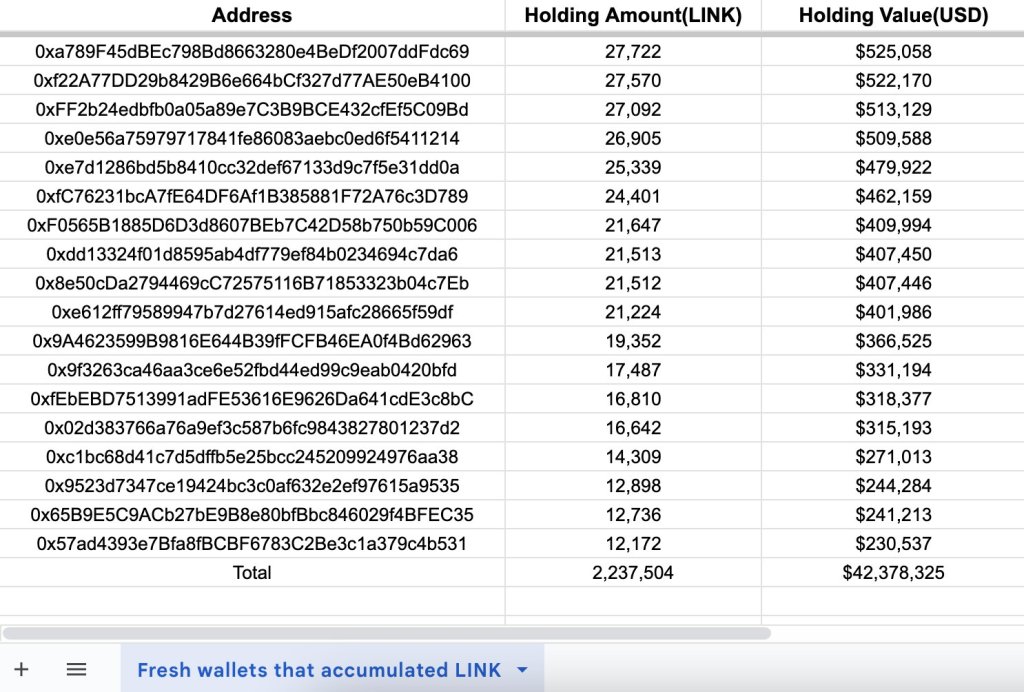

A mysterious whale is rapidly accumulating Chainlink (LINK). According to Lookonchain, the chartless entity, perchance an institution, withdrew over 2.2 cardinal LINK (worth $42.38 million) via 47 caller wallets from Binance, the world’s largest crypto speech by trading volume, successful 2 days.

This abrupt artifact withdrawal present raises questions astir what’s driving the whale’s involvement and what it could mean for LINK successful the coming days.

Crypto whale accumulating LINK | Source: Lookonchain via X

Crypto whale accumulating LINK | Source: Lookonchain via XChainlink Is Key In DeFi And NFTs, Gradually Improving

Chainlink is simply a fashionable task that provides unafraid middleware services and allows astute contracts to entree tamper-proof outer data. For this role, the level has been adopted by aggregate protocols offering decentralized concern (defi) services successful Ethereum and beyond.

Additionally, Chainlink plays a relation successful non-fungible tokens (NFTs) done its random fig generator (RNG). It continues to merchandise caller products and heighten its features.

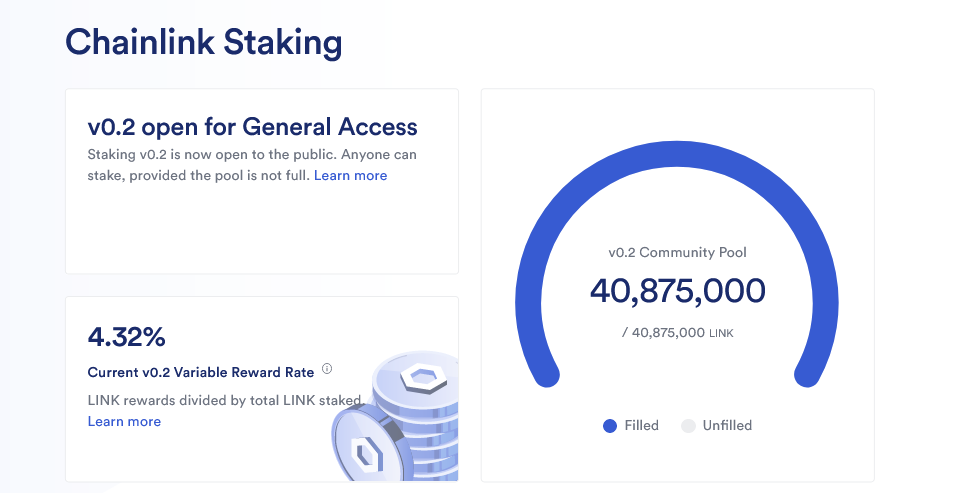

To illustrate, successful November, Chainlink upgraded its staking mechanism, releasing v0.2, which importantly accrued the excavation size to 45 cardinal LINK.

The level noted that the determination was to pull much investors and, much importantly, bolster its information portion concurrently aligning with its broader nonsubjective of attaining the “Economics 2.0” plan.

Initially, staking began successful December 2022. The extremity was to incentivize information by expanding the inferior of LINK and allowing stakers to person rewards.

The merchandise of v0.2 successful November means much tokens tin beryllium locked, helping marque LINK scarce, considering the relation of the token successful the immense Chainlink ecosystem.

Trackers show that implicit 40.8 cardinal LINKs person been locked truthful far. Chainlink confirms that anyone tin gain a adaptable reward complaint of 4.32%.

LINK staked | Source: Chainlink

LINK staked | Source: ChainlinkBeyond staking, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is gaining adoption. To illustrate, the Hong Kong Monetary Authority (HKMA) initiated its archetypal signifier of e-Hong Kong Dollar (e-HKD) trials successful November, integrating CCIP.

As portion of this trial, the regulator wanted to exemplify the capabilities of programmable payments enabled by Chainlink via its solution, CCIP. In DeFi, protocols specified arsenic Synthetix and Aave person adopted CCIP.

Will LINK Breach $20?

With much protocols and accepted institutions leveraging the technology, the request for LINK (and prices) volition apt summation arsenic the fearfulness of missing retired (FOMO) kicks in.

While the whale’s motives stay unknown, their large-scale LINK accumulation suggests they mightiness beryllium bullish connected the token. Notably, it coincides with the crisp enlargement of LINK prices successful the past 48 hours.

So far, the token is changing hands somewhat beneath the $20 intelligence resistance. Any breakout supra this level mightiness assistance the token to astir $35 successful Q3 2021.

Feature representation from iStock, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)