By Omkar Godbole (All times ET unless indicated otherwise)

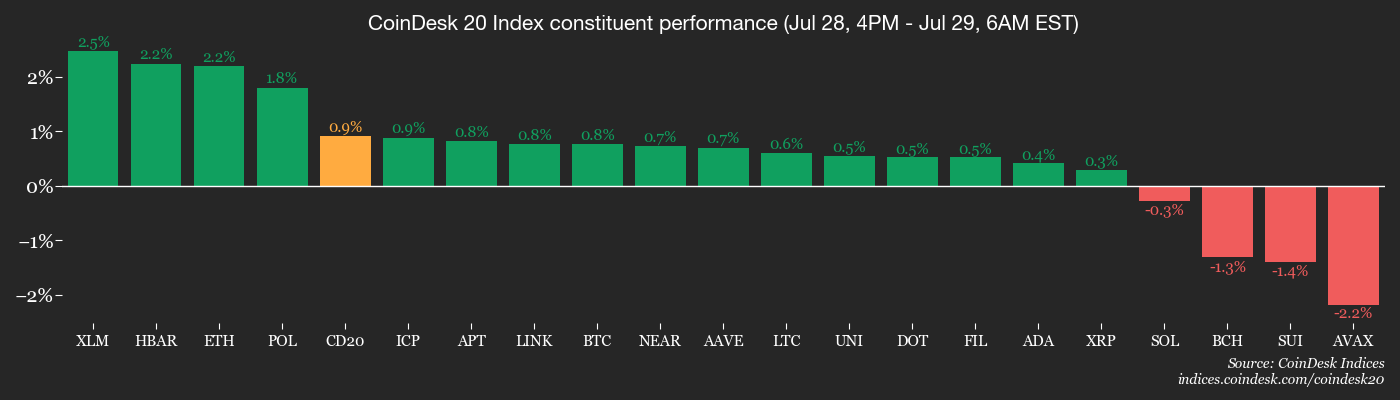

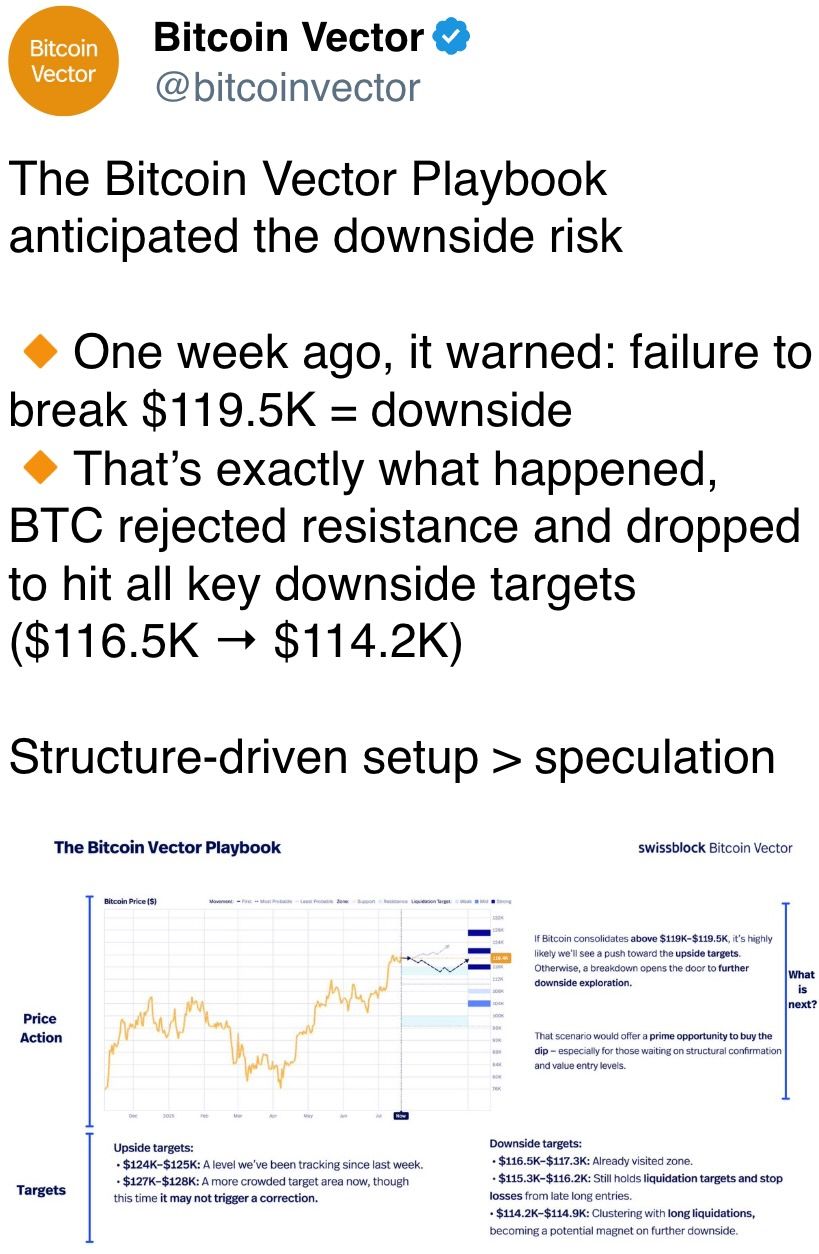

Bitcoin's Asian league bounce from $117,500 ran retired of steam adjacent $119,200 during European hours, extending 2 weeks of directionless trading. The CoinDesk 20 (CD20) Index traded 1.4% little implicit 24 hours, with the broader CD80 gauge reporting a 4.6% decline, indicating pronounced weakness successful altcoins.

Against the inheritance of a level BTC market, the awakening of long-dormant bitcoin whale wallets is raising concerns astir imaginable profit-taking by seasoned investors. According to Whale Alert, an code that was dormant for implicit 12 years moved 343 BTC successful aboriginal Asian hours.

Meanwhile, Ethereum Treasury protocol ETH Strategy, designed to supply leveraged vulnerability to ether, raised 12,342 ETH ($46.5 million) successful its prelaunch funding. The fundraising cognition targeted a divers scope of capitalist profiles done backstage and nationalist sales, arsenic good arsenic puttable warrants.

Speaking of ether, its caller rally has sparked renewed enthusiasm successful risky corners of the crypto market, including CryptoPunks, the Ethereum-based 10,000-piece pixel-art NFT collection. The level terms for CryptoPunks topped $200,000 for the archetypal clip successful implicit a year, marking a 160% maturation since August past year. (More connected this successful the Token Talk section).

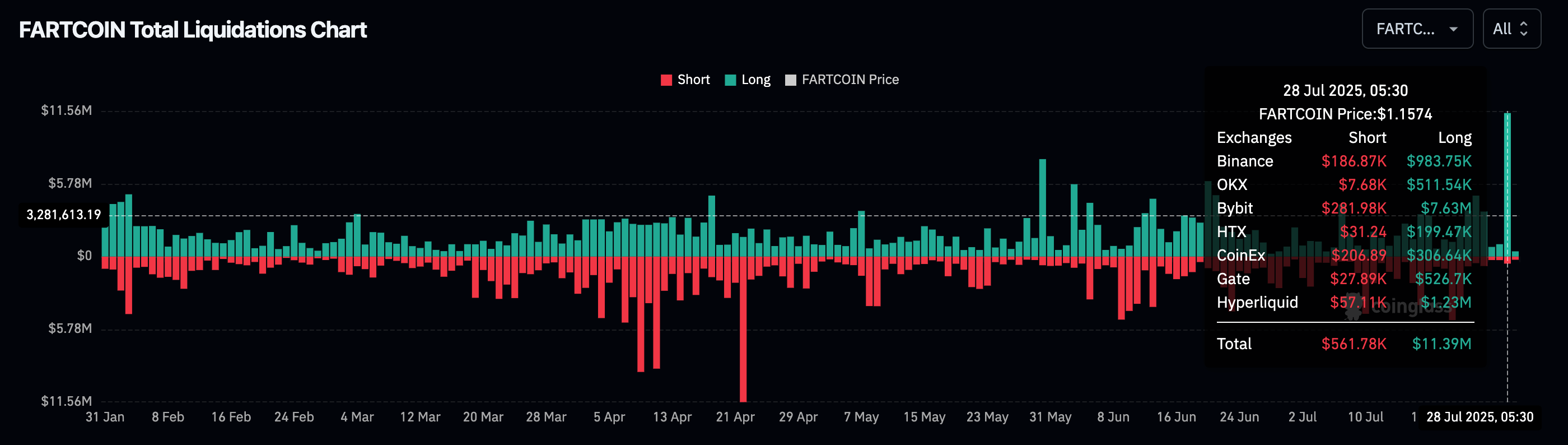

Futures tied to Solana-based gag token FARTCOIN witnessed ample liquidations Monday arsenic the token's terms dropped implicit 10%. The agelong liquidations tallied $11.39 million, the largest for the year, Coinglass information show. Futures connected the token had zoomed into apical 10 rankings past week, pointing to a physique of speculative excesses successful the crypto market.

In accepted markets, the dollar scale concisely topped 99.00, the highest since June 23. A continued betterment successful the U.S. currency could headdress upside successful BTC. Former Bank of Japan Governor Hiroshi Nakaso said the cardinal slope mightiness resume interest-rate increases, and the U.S. and China are gathering successful Stockholm to proceed commercialized talks. Stay alert!

What to Watch

- Crypto

- July 31, 12 p.m.: A unrecorded webinar featuring Bitwise CIO Matt Hougan and Bitzenship laminitis Aleesandro Palombo discussing bitcoin’s imaginable to go a planetary reserve currency amid dedollarization trends. Registration link.

- Aug. 1: The Helium Network (HNT), present moving connected Solana, undergoes its halving event, cutting yearly caller token issuance to 7.5 cardinal HNT.

- Aug. 1: Hong Kong’s Stablecoins Ordinance takes effect, introducing a licensing authorities to modulate stablecoin activities successful the city.

- Aug. 1: New Bretton Woods Labs volition motorboat BTCD, which it says is the archetypal afloat bitcoin-backed stablecoin, connected the Elastos (ELA) mainnet, a decentralized blockchain secured by merged mining with bitcoin and overseen by the Elastos Foundation.

- Aug. 15: Record day for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who conscionable pre-distribution requirements.

- Macro

- Day 2 of 2: U.S. and Chinese officials meet successful Stockholm for a 3rd circular of commercialized talks. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng pb discussions focused connected preventing further tariff escalations. While extending the tariff truce acceptable to expire Aug. 12 is simply a cardinal goal, the gathering besides aims to laic the groundwork for aboriginal negotiations and a imaginable leaders’ acme aboriginal this year.

- July 29, 10 a.m.: The U.S. Bureau of Labor Statistics releases June U.S. labour marketplace information (the JOLTS report).

- Job Openings Est. 7.55M vs. Prev. 7.7691M

- Job Quits Prev. 3.293M

- July 29, 10 a.m.: The Conference Board (CB) releases July U.S. user assurance data.

- CB Consumer Confidence Est. 95.8 vs. Prev. 93

- July 30, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (preliminary) Q2 GDP maturation data.

- GDP Growth Rate QoQ Est. 0.4% vs. Prev. 0.2%

- GDP Growth Rate YoY Est. -0.1% vs. Prev. 0.8%

- July 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (advance estimate) Q2 GDP data.

- GDP Growth Rate QoQ Est. 2.4% vs. Prev. -0.5%

- GDP Price Index QoQ Est. 2.4% vs. Prev. 3.8%

- GDP Sales QoQ Prev. -3.1%

- PCE Prices QoQ Prev. 3.7%

- Real Consumer Spending QoQ Prev. 0.5%

- July 30, 9:45 a.m.: The Bank of Canada (BoC) announces its monetary argumentation determination and publishes the quarterly Monetary Policy Report. The property league follows astatine 10:30 a.m. Livestream link.

- Policy Interest Rate Est. 2.75% Prev. 2.75%

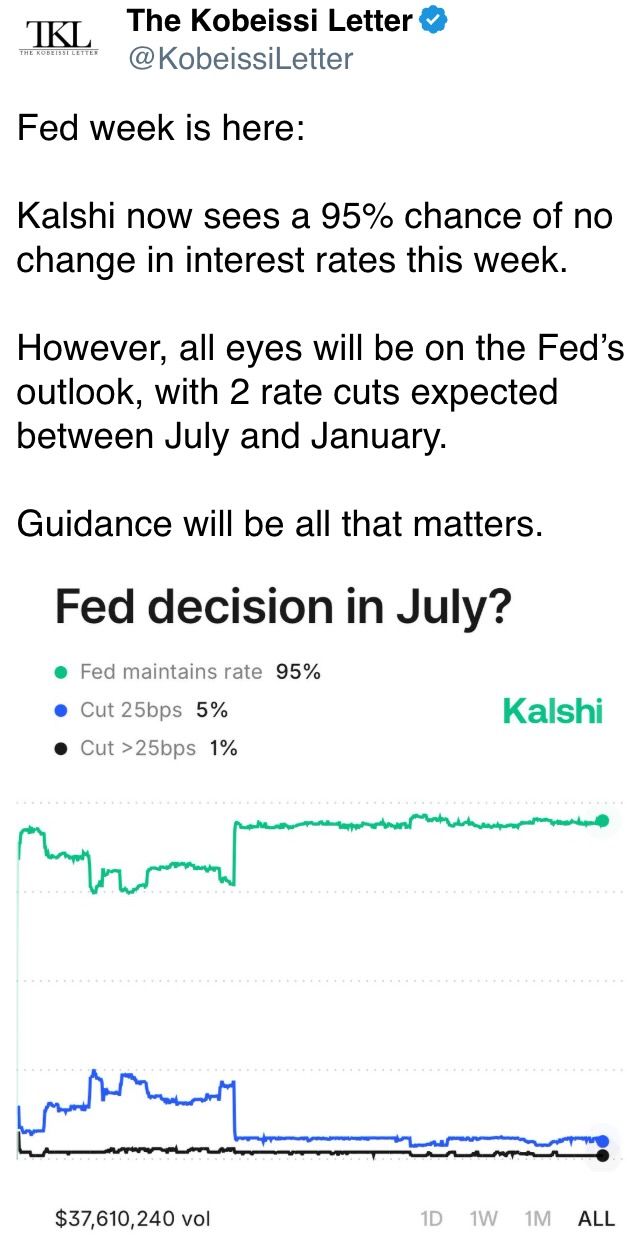

- July 30, 2 p.m.: The Federal Reserve announces its monetary argumentation decision. Federal funds rates are expected to stay unchanged astatine 4.25%-4.50%. Chair Jerome Powell’s property league follows astatine 2:30 p.m.

- July 30, 5:30 p.m.: Brazil’s cardinal bank, Banco Central bash Brasil, announces its monetary argumentation decision.

- Selic Rate Est. 15% vs. Prev. 15%

- Earnings (Estimates based connected FactSet data)

- July 29: PayPal Holdings (PYPL), pre-market, $1.30

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase Global (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Sequans Communications (SQNS), pre-market

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Coincheck (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting on funding 3 caller features for the authoritative decentralized application: a Wearable Lendings UI, Gotchis Batch Lending and a BRS Optimizer. Voting ends July 29.

- Balance DAO is voting on deploying Balancer v3 connected HyperEVM. Voting ends July 29.

- Euler DAO is voting to activate presently disabled fees successful the Euler Lending protocol. Voting ends July 30.

- NEAR Protocol is voting on potentially reducing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators indispensable support the connection for it to pass, and if truthful it could beryllium implemented by precocious Q3. Voting ends Aug. 1.

- Compound DAO is voting to select its adjacent Security Service Provider (SSP). Delegates are choosing betwixt ChainSecurity & Certora, and Cyfrin. Voting ends Aug. 5.

- July 29, 10 a.m.: Ether.fi to big a bi-quarterly expert call.

- Unlocks

- July 31: Optimism (OP) to unlock 1.79% of its circulating proviso worthy $24 million.

- Aug. 1: Sui (SUI) to unlock 1.27% of its circulating proviso worthy $173.78 million.

- Aug. 2: Ethena (ENA) to unlock 0.64% of its circulating proviso worthy $25.17 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating proviso worthy $14.34 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating proviso worthy $53.61 million.

- Token Launches

- July 29: Spheron Network (SPON) to beryllium listed connected MEXC, Bitget, Gate.io and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Day 2 of 2: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Shaurya Malwa

- CryptoPunks posted $24.6 cardinal successful play trading volume, the highest since March 2024 and 416% much than the anterior week.

- The level terms jumped to 47.5 ETH from 40 ETH and the mean merchantability terms climbed to $182,000 from $140,000, signaling beardown request for higher-end Punks.

- The rally was apt triggered by GameSquare’s $5.15 cardinal acquisition of Punk #5577, 1 of conscionable 24 Ape Punks, which the steadfast purchased utilizing recently issued preferred shares.

- GameSquare (GAME), the Nasdaq-listed genitor of FaZe Clan, became the archetypal nationalist institution to concern an NFT acquisition with equity, valuing the Punk astatine ~3x the level astatine the clip of purchase.

- The transaction reframed the Punk arsenic a yield-bearing treasury asset, sparking renewed organization and high-net-worth involvement crossed the collection.

- The woody efficaciously positioned CryptoPunks arsenic balance-sheet worthy collectibles, triggering caller bids and elevating the illustration of NFTs arsenic corporate-grade integer assets.

- The crisp revaluation of blue-chip NFTs whitethorn make a communicative tailwind for different top-tier collections arsenic firm treasuries research non-traditional integer stores of value.

Derivatives Positioning

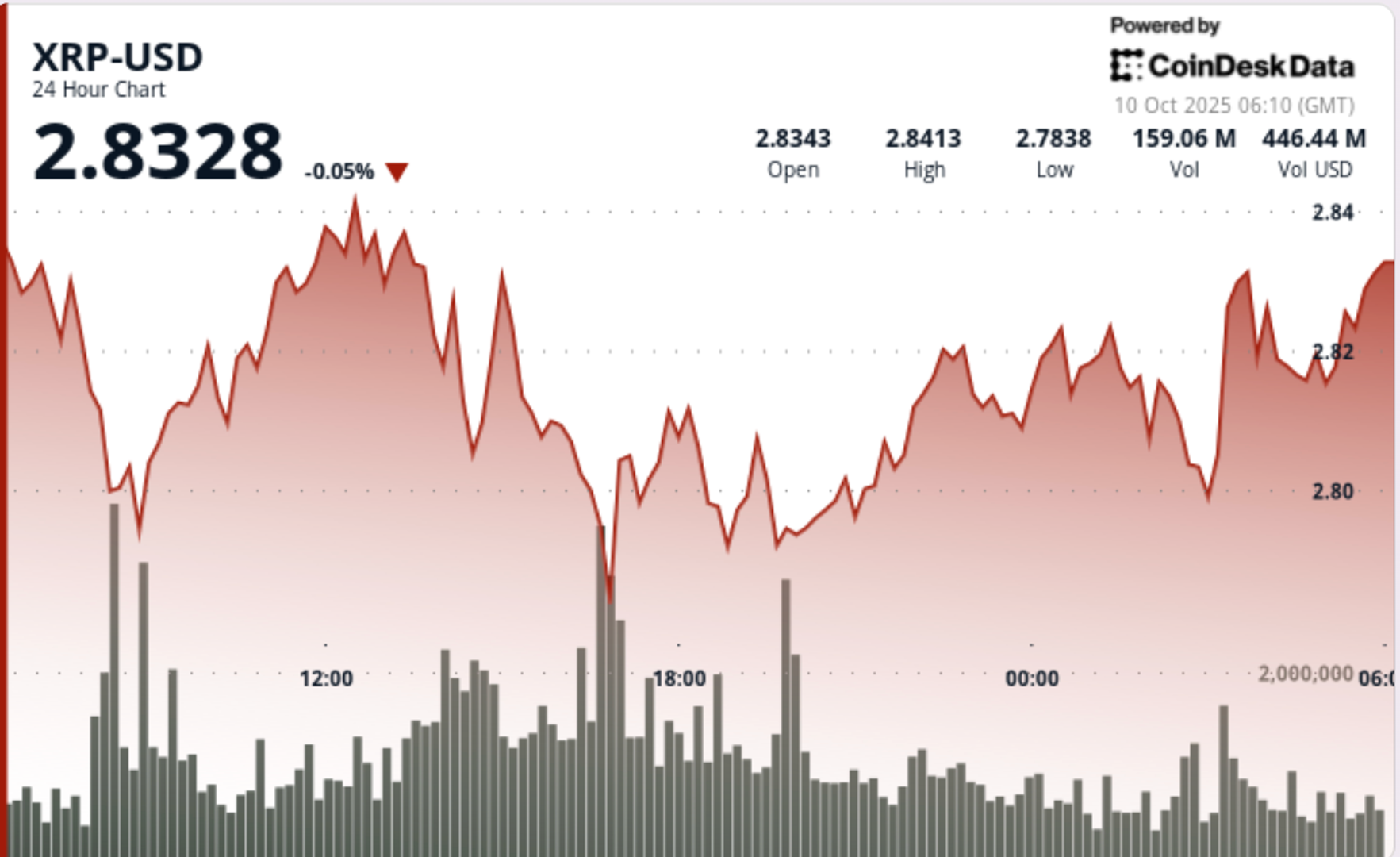

- XRP's perpetual futures unfastened involvement continues to driblet on with the price, indicating that the diminution is led by an unwinding of bullish agelong bets alternatively than caller shorts.

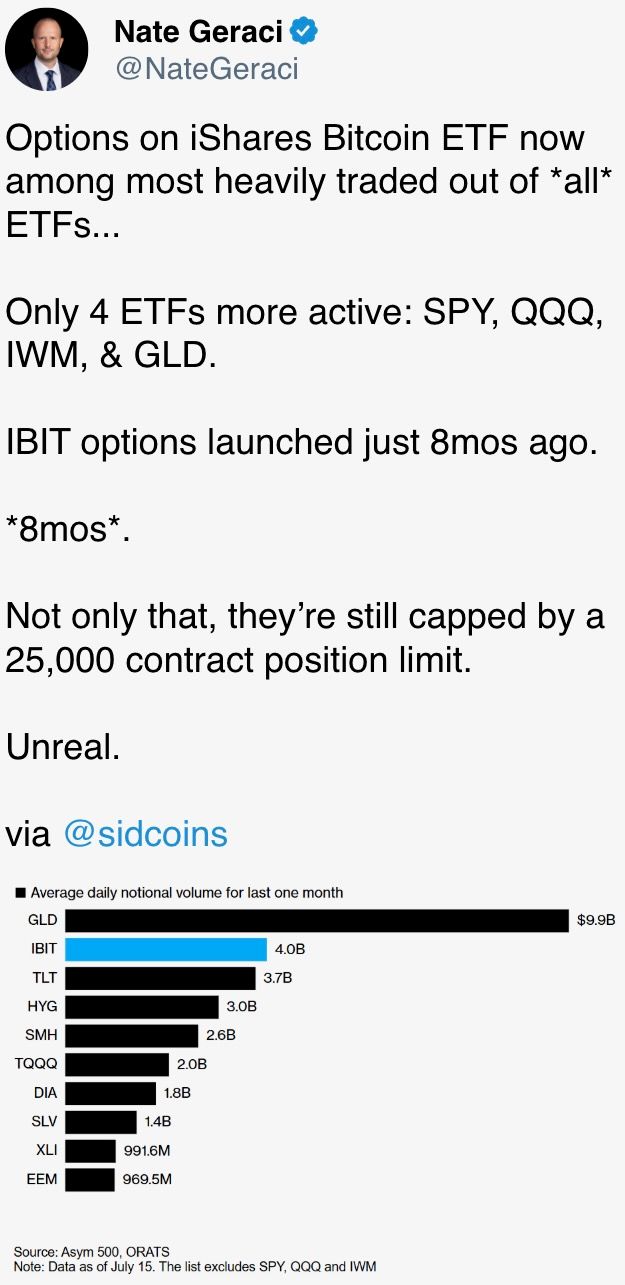

- Global futures unfastened involvement successful BTC and ETH remains elevated adjacent a grounds $80 cardinal and $58 billion, respectively, suggesting scope for terms volatility.

- The alleged altcoin play seems to person fizzled retired arsenic BTC's annualized perpetual backing complaint of 10% exceeds that of XRP and different apical altcoins.

- Some nervousness has creeped into Deribit-listed BTC options, wherever front-end hazard reversals showed a enactment bias. ETH hazard reversals showed a bias for calls (that is, for upside) crossed each tenors.

- Block flows implicit the OTC web Paradigm featured a abbreviated presumption successful the $110K BTC enactment expiring connected Aug. 8 and butterfly trades.

Market Movements

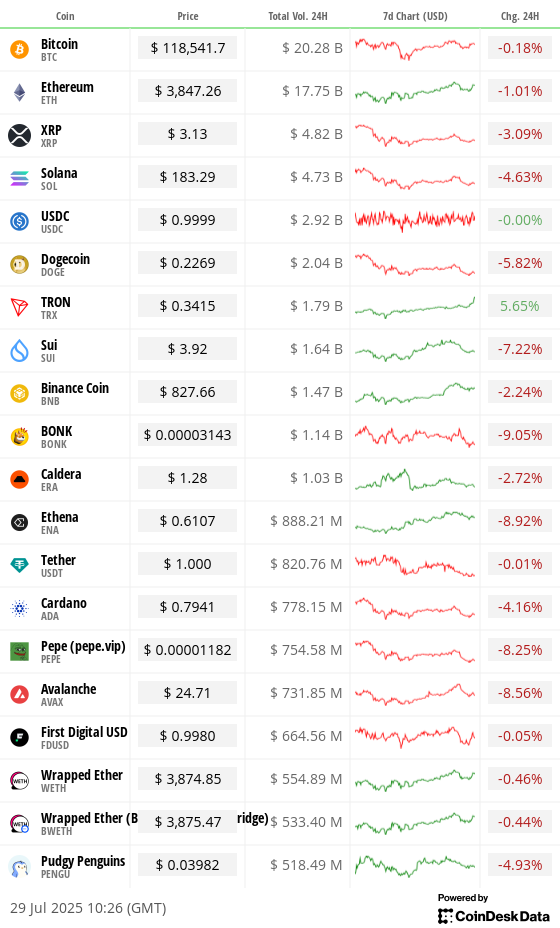

- BTC is up 0.61% from 4 p.m. ET Monday astatine $118,757.92 (24hrs: -0.12%)

- ETH is up 2.24% astatine $3,872.65 (24hrs: -0.6%)

- CoinDesk 20 is up 1.07% astatine 4,038.53 (24hrs: -1.92%%)

- Ether CESR Composite Staking Rate is up 4 bps astatine 2.9%

- BTC backing complaint is astatine 0.0153% (16.7535% annualized) connected Binance

- DXY is up 0.11% astatine 98.74

- Gold futures are up 0.42% astatine $3,323.90

- Silver futures are up 0.36% astatine $38.36

- Nikkei 225 closed down 0.79% astatine 40,674.55

- Hang Seng closed down 0.15% astatine 25,524.45

- FTSE is up 0.38% astatine 9,115.95

- Euro Stoxx 50 is up 0.96% astatine 5,388.73

- DJIA closed connected Monday down 0.14% astatine 44,837.56

- S&P 500 closed unchanged astatine 6,389.77

- Nasdaq Composite closed up 0.33% astatine 21,178.58

- S&P/TSX Composite closed down 0.32% astatine 27,405.42

- S&P 40 Latin America closed down 1.65% astatine 2,573.40

- U.S. 10-Year Treasury complaint is down 1 bps astatine 4.41%

- E-mini S&P 500 futures are up 0.22% astatine 6,437.00

- E-mini Nasdaq-100 futures are up 0.39% astatine 23,581.75

- E-mini Dow Jones Industrial Average Index are up 0.14% astatine 45,073.00

Bitcoin Stats

- BTC Dominance: 61.25% (-0.24%)

- Ether to bitcoin ratio: 0.03259 (1.34%)

- Hashrate (seven-day moving average): 933 EH/s

- Hashprice (spot): $59.21

- Total Fees: 4.20 BTC / $498,556

- CME Futures Open Interest: 141,550 BTC

- BTC priced successful gold: 35.7 oz

- BTC vs golden marketplace cap: 10.11%

Technical Analysis

- The dollar scale is probing the Ichimoku unreality resistance, having bottomed retired adjacent 97 this month.

- A determination supra the unreality is needed to corroborate the bullish displacement successful momentum, failing which, the broader downtrend volition apt resume.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $403.8 (-0.51%), +1.14% astatine $408.39 successful pre-market

- Coinbase Global (COIN): closed astatine $379.49 (-3.11%), +0.53% astatine $381.50

- Circle (CRCL): closed astatine $185.36 (-3.89%), +1.63% astatine $188.39

- Galaxy Digital (GLXY): closed astatine $29.6 (-3.24%), +1.52% astatine $30.05

- MARA Holdings (MARA): closed astatine $17.16 (-0.52%), +0.99% astatine $17.33

- Riot Platforms (RIOT): closed astatine $14.51 (-0.21%), +0.34% astatine $14.56

- Core Scientific (CORZ): closed astatine $13.74 (-0.11%), unchanged successful pre-market

- CleanSpark (CLSK): closed astatine $12.03 (+1.78%), +0.42% astatine $12.08

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $26.13 (-1.62%), -0.8% astatine $25.92

- Semler Scientific (SMLR): closed astatine $39.25 (+3.07%), +1.27% astatine $39.75

- Exodus Movement (EXOD): closed astatine $33.21 (+0.58%), -1.36% astatine $32.76

- SharpLink Gaming (SBET): closed astatine $20.92 (-4.84%), -0.65% astatine $20.79

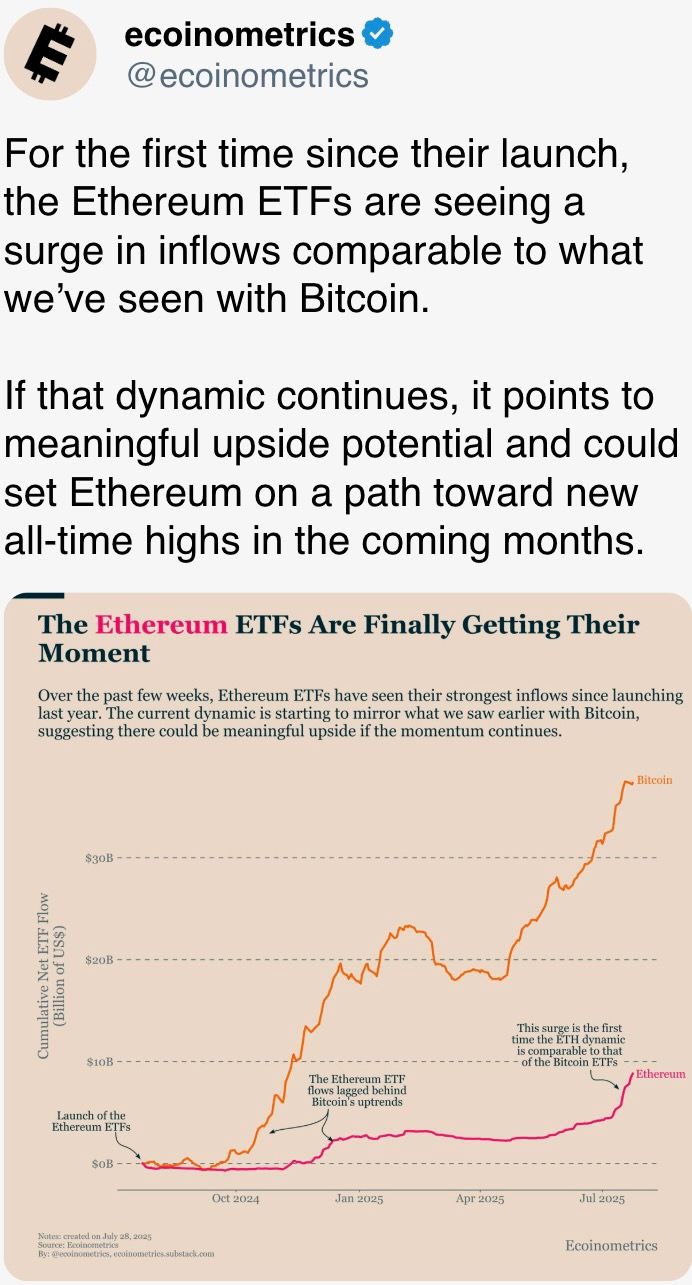

ETF Flows

Spot BTC ETFs

- Daily nett flows: $157.1 million

- Cumulative nett flows: $54.95 billion

- Total BTC holdings ~1.07 million

Spot ETH ETFs

- Daily nett flows: $65.2 million

- Cumulative nett flows: $9.42 billion

- Total ETH holdings ~3.86 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Fartcoin longs, oregon bullish bets, worthy implicit $11 cardinal were liquidated Monday, the largest tally for the year.

- Shorts, oregon bets connected declines, accounted for a tiny information of full liquidations, a motion leverage was heavy skewed bullish successful anticipation of a continued terms rise.

While You Were Sleeping

- Billionaire Ray Dalio Backs 15% Allocation to Bitcoin and Gold Amid U.S. Debt Spiral (CoinDesk): The displacement from sticking 2% successful these assets to 15% reflects interest implicit soaring U.S. borrowing needs and dollar debasement, driven by $12 trillion successful projected Treasury issuance implicit the adjacent year.

- Bitcoin Demand Shift: Coinbase's 60-Day BTC Premium Streak Is astatine Risk (CoinDesk): This premium, which measures terms divergence with Binance, turned antagonistic Tuesday for the archetypal clip since precocious May, signaling weaker U.S. organization request and supporting the lawsuit for a deeper pullback.

- A Divided Fed Eyes Future Rate Cuts but Won’t Move This Week (The Wall Street Journal): FOMC members are divided betwixt cutting now, waiting for much information oregon holding retired for wide weakness, with astir preferring to reappraisal July and August ostentation and jobs information earlier deciding.

- China Crypto Firm Bitmain Plans First U.S. Factory successful Trump Gambit (Bloomberg): The person successful bitcoin mining hardware plans to unfastened a installation successful Texas oregon Florida this quarter, aligning with Trump’s “Made successful America” propulsion portion aiming to amended service U.S. clients.

- Colombia Ex-President Uribe Guilty of Abuse of Process, Bribery of Public Official (Reuters): Colombia’s erstwhile leader, present the archetypal ex-president convicted successful a transgression court, faces sentencing Friday, 10 months up of the 2026 statesmanlike election, wherever respective of his allies are moving for office.

- CoinShares Launches Zero-Fee SEI ETP With Staking Yield Across Europe (CoinDesk): Listed connected Switzerland’s SIX exchange, the merchandise makes it easier for European institutions to entree SEI and launches soon aft CoinShares became the archetypal steadfast licensed nether Europe’s caller MiCA framework.

In the Ether

2 months ago

2 months ago

English (US)

English (US)