Ethereum (ETH), a important subordinate successful the crypto space, has precocious travel nether scrutiny owed to immoderate concerning on-chain activities.

Notably, the fig of addresses holding important amounts of Ethereum has declined, and immoderate semipermanent holders look to beryllium liquidating their positions, perchance posing threats to Ethereum’s value.

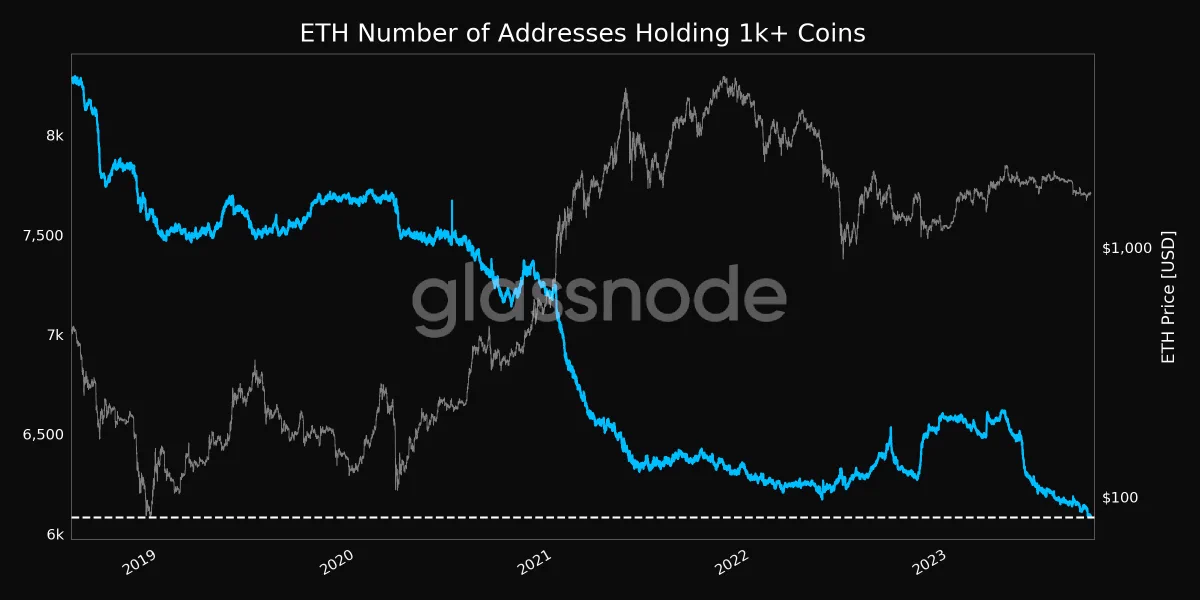

Whale Watch: A Steep Decline In Ethereum Holdings

On-chain analytics person been instrumental successful offering real-time insights into crypto marketplace trends. Recent revelations person highlighted a downturn successful Ethereum’s holding patterns that mightiness person deeper implications for the integer asset’s worth and the market.

According to Glassnode, a starring on-chain analytic platform, the fig of addresses holding 1,000 Ethereum (ETH) coins oregon much has plummeted to a 5-year low.

Precisely, these addresses, often termed ‘whale addresses’ successful the crypto world, person decreased to 6,082. Such a crisp diminution tin beryllium attributed to the liquidation activities of immoderate of Ethereum’s semipermanent holders.

Ethereum (ETH) has respective addresses holding much than 1000 ether. | Source: Glassnode

Ethereum (ETH) has respective addresses holding much than 1000 ether. | Source: GlassnodeIt is worthy noting that this contraction successful whale holdings could perchance summation the susceptibility of Ethereum to marketplace bears, perchance initiating a downward terms trajectory.

The interaction of specified income connected the marketplace is apparent. When ample quantities of a cryptocurrency, specified arsenic Ethereum, are offloaded, it often leads to a sizeable influx of selling pressure. This tin origin panic among smaller investors, prompting further income and perchance starring to a terms drop.

Additional Pressures From Dormant Wallets

Interestingly, different furniture adds to Ethereum’s selling unit alongside the alteration successful large-scale holdings. According to data from Lookonchain, a renowned on-chain information investigation firm, a dormant Ethereum wallet, untouched for astir 4 years, has abruptly sprung into action.

The wallet successful question liquidated its full ETH holding, rapidly pushing astir $4.81 cardinal worthy of the altcoin into the market.

A wallet that had been dormant for 4 years sold each 2,591 $ETH for $4.18M stablecoins 6 hours ago.https://t.co/et78rXHG5u pic.twitter.com/pJanMLxwA3

— Lookonchain (@lookonchain) September 20, 2023

Such unexpected income from long-inactive wallets could rise alarms successful the market. While the nonstop reasons down specified liquidations often stay concealed, they invariably amplify the selling pressures connected the affected cryptocurrency, which, successful this case, is Ethereum.

Meanwhile, Ethereum’s terms has seen a flimsy bullish trajectory implicit the past week, up 1.4%. The plus has moved from a debased of $1,596 seen past Wednesday to trade supra $1,650 connected Monday earlier retracing to $1,626, astatine the clip of penning down by 1.8% successful the past 24 hours.

Featured representation from Unpslah, Chart from TradingView

2 years ago

2 years ago

English (US)

English (US)