The effect of the US predetermination is an indispensable origin affecting the process of involvement complaint cuts and liquidity return. After Trump was assassinated but survived, the effect of the US predetermination seems to person been locked successful advance, which means that much involvement complaint cuts look to beryllium connected the way. In this case, astir risky assets volition benefit, and crypto assets and commodities, arsenic non-equity assets with perchance amended performance, whitethorn get much shares successful portfolios.

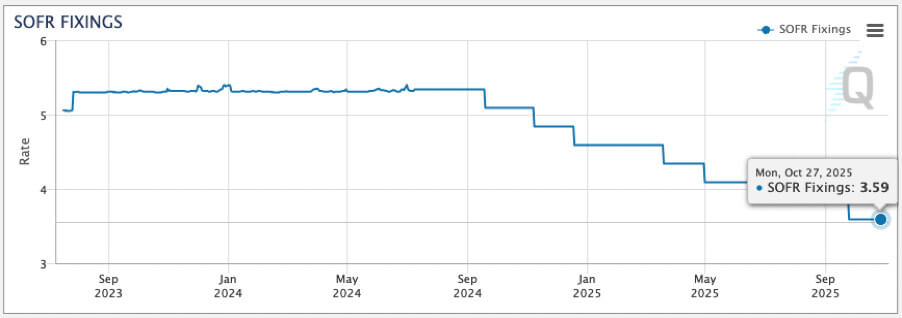

More Rate Cuts?

Compared to June, investors’ expectations for involvement complaint cuts person go overmuch much optimistic successful July. Even successful the “robust” interbank market, traders person expected the national funds complaint to autumn beneath 3.6% successful Oct 2025, and the fig of complaint cuts this twelvemonth whitethorn adjacent transcend two.

Implied expected changes successful involvement complaint levels from SOFR futures, arsenic of Jul 16, 2024. Source: CME Group

Implied expected changes successful involvement complaint levels from SOFR futures, arsenic of Jul 16, 2024. Source: CME GroupThe latest CPI information is 1 crushed that affects traders’ expectations. The US unadjusted CPI YoY recorded 3.0% successful Jun, little than the marketplace anticipation of 3.1%, marking the lowest level since June past year. The seasonally adjusted CPI MoM for Jun was -0.1%, the archetypal antagonistic worth since May 2020.

The Fed has repeatedly emphasized implicit the past twelvemonth that the threshold for complaint cuts is not simply “inflation returning to 2%” but “the Fed being much assured successful ostentation returning to 2%.” Following this ostentation report, it tin beryllium said that the Fed has astir met the threshold for complaint cuts, suggesting that a planetary rate-cutting rhythm is astir to begin.

Changes of US MoM CPI data, arsenic of Jul 16, 2024. Source: Investing.com

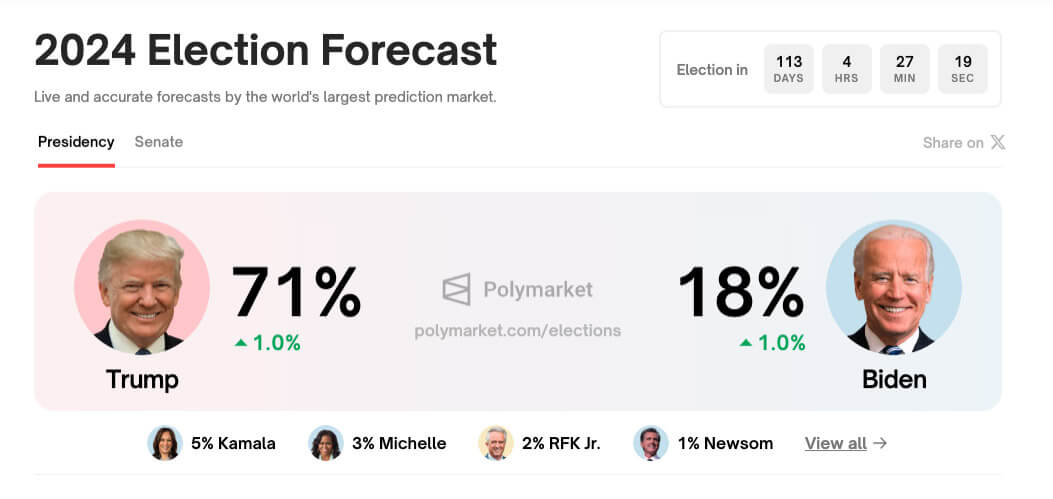

Changes of US MoM CPI data, arsenic of Jul 16, 2024. Source: Investing.comAlthough galore investors are acrophobic astir the hazard of re-inflation, arsenic is the Fed, different origin – the US predetermination – is changing the value of re-inflation hazard successful the eyes of the Federal Reserve. After surviving past Sunday’s assassination, it is astir definite that Trump volition triumph the 2024 election. According to information from the prediction marketplace website Polymarket, Trump’s winning complaint has risen to 71%, which means that the imaginable interaction of his aboriginal economical policies should beryllium taken into relationship early.

Considering that Trump is “very dissatisfied” with Powell’s existent high-rate policies and passive cognition toward lowering involvement rates and stimulating the economy, the Fed whitethorn compromise connected involvement complaint argumentation aft Trump’s election, which means that much assertive involvement complaint policies whitethorn look and bring a important merchandise of liquidity successful the adjacent 1-2 years. However, determination is nary uncertainty that this volition travel astatine the outgo of imaginable aboriginal ostentation and recession.

2024 US predetermination triumph complaint for antithetic statesmanlike candidates, arsenic of Jul 16, 2024. Source: Polymarket

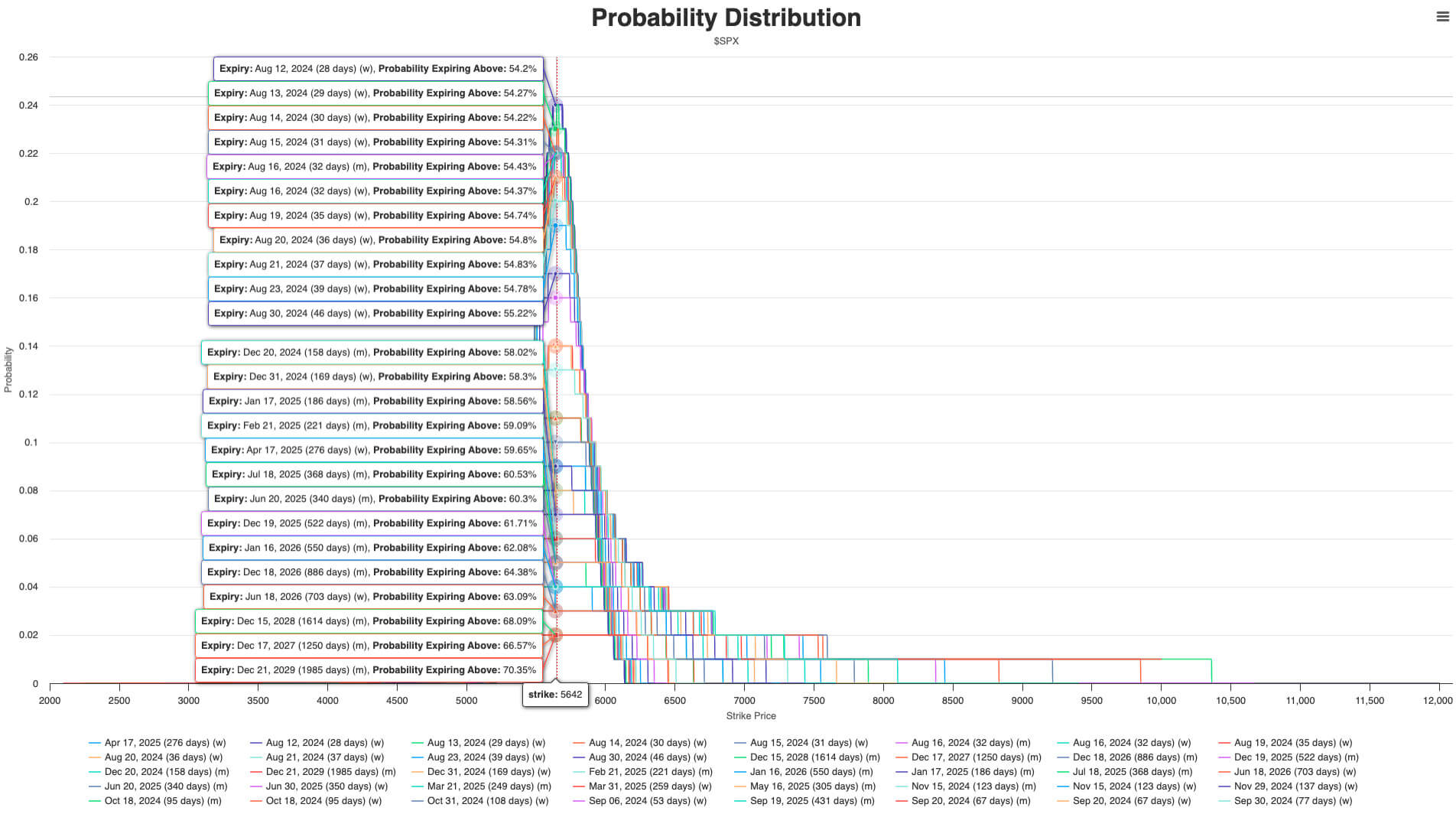

2024 US predetermination triumph complaint for antithetic statesmanlike candidates, arsenic of Jul 16, 2024. Source: PolymarketIt indispensable beryllium admitted that astir investors bash not attraction astir what happens successful 3-5 years. The anticipation of involvement complaint cuts is evident successful stimulating the hazard plus market: the probability organisation implied by SPX options is mostly biased towards bullish, and this bullish sentiment has adjacent pervaded investors’ expectations for the adjacent 1-2 years. The supra concern means that investors expect accepted ample companies to payment from Trump’s economical policies and execute amended returns successful the future.

Implied probability organisation of SPX (S&P 500 Index) far-month options, arsenic of Jul 16, 2024. Source: optioncharts.io

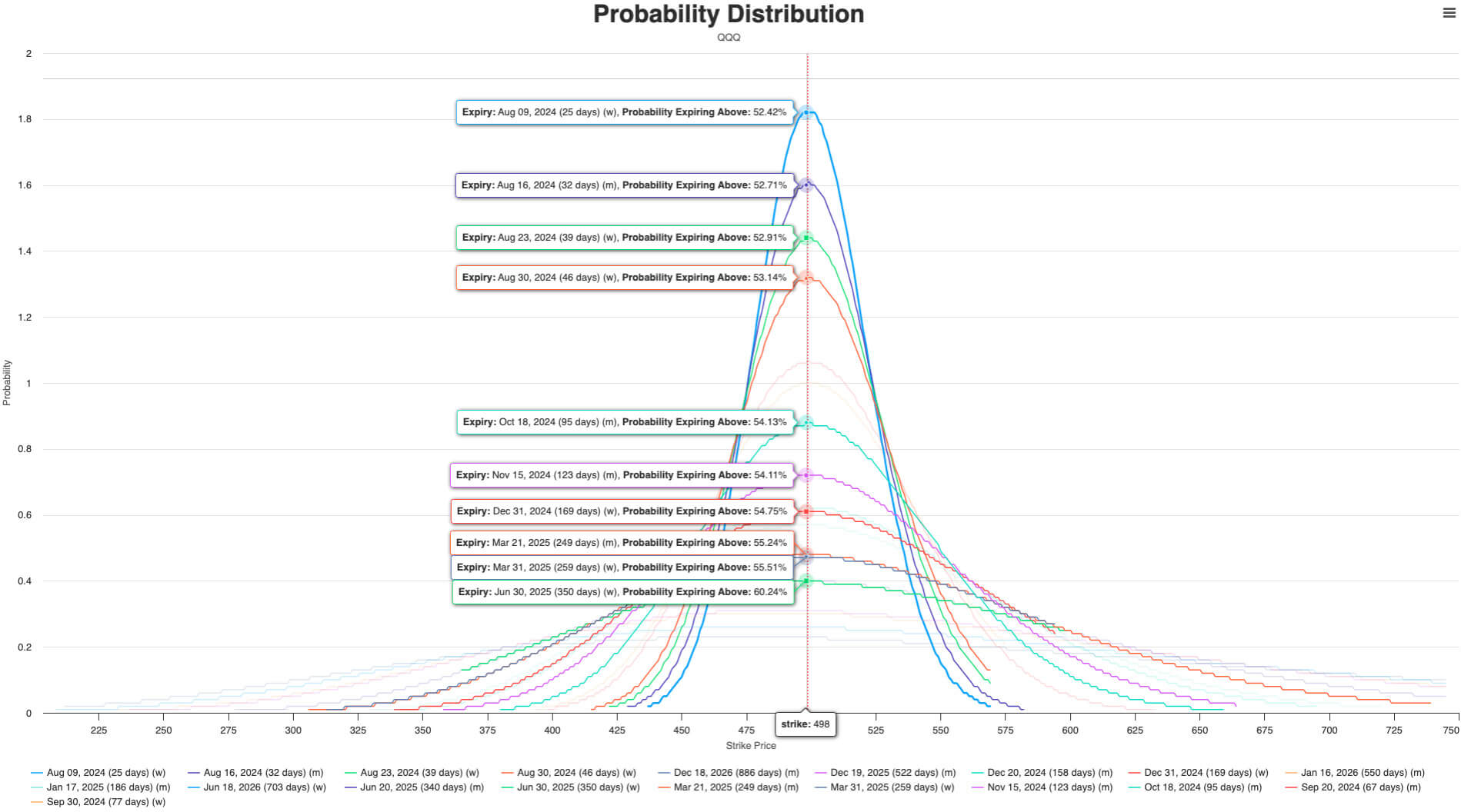

Implied probability organisation of SPX (S&P 500 Index) far-month options, arsenic of Jul 16, 2024. Source: optioncharts.ioHowever, for tiny companies and tech companies, the imaginable interaction of Trump’s tariff and migration policies connected their operations is obvious. Of course, this is besides reflected successful the implied expectations of the market: whether it is Nasdaq oregon Russell 2000, their implied instrumentality and implied summation are importantly little than those of the S&P 500.

Invesco QQQ Trust Series I (Nasdaq-100) far-month options implied probability distribution, arsenic of Jul 16, 2024. Source: optioncharts.io

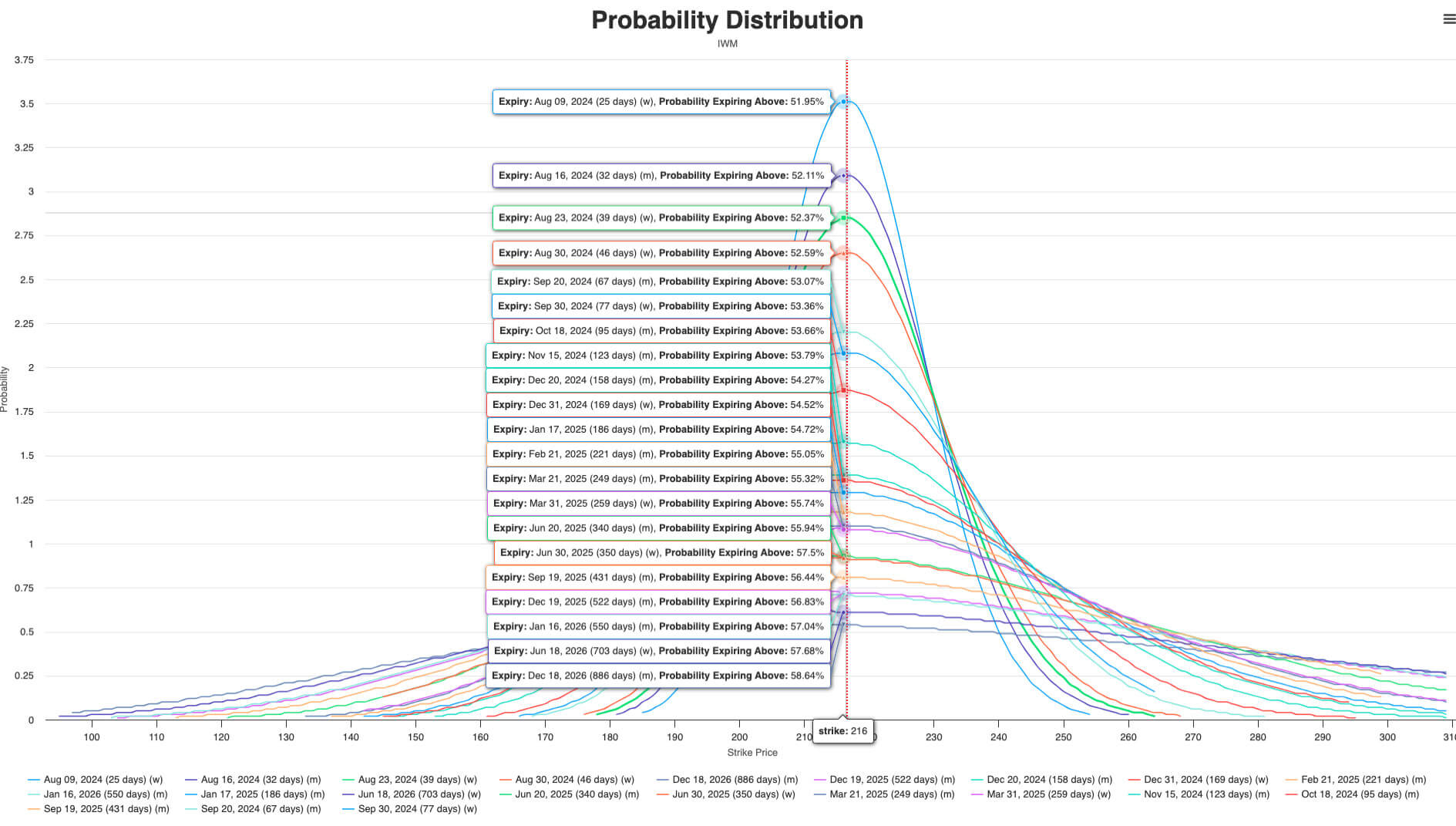

Invesco QQQ Trust Series I (Nasdaq-100) far-month options implied probability distribution, arsenic of Jul 16, 2024. Source: optioncharts.io Implied probability organisation of iShares Russell 2000 ETF far-month options, arsenic of Jul 16, 2024. Source: optioncharts.io

Implied probability organisation of iShares Russell 2000 ETF far-month options, arsenic of Jul 16, 2024. Source: optioncharts.ioOverall, much involvement complaint cuts are expected to beryllium comparatively favourable for the banal marketplace show successful the coming months. However, considering imaginable macro argumentation changes, holding lone banal vulnerability does not look to beryllium the champion choice. So, which plus exposures whitethorn bring much excess returns?

Commodities vs Cryptocurrency: King vs Queen

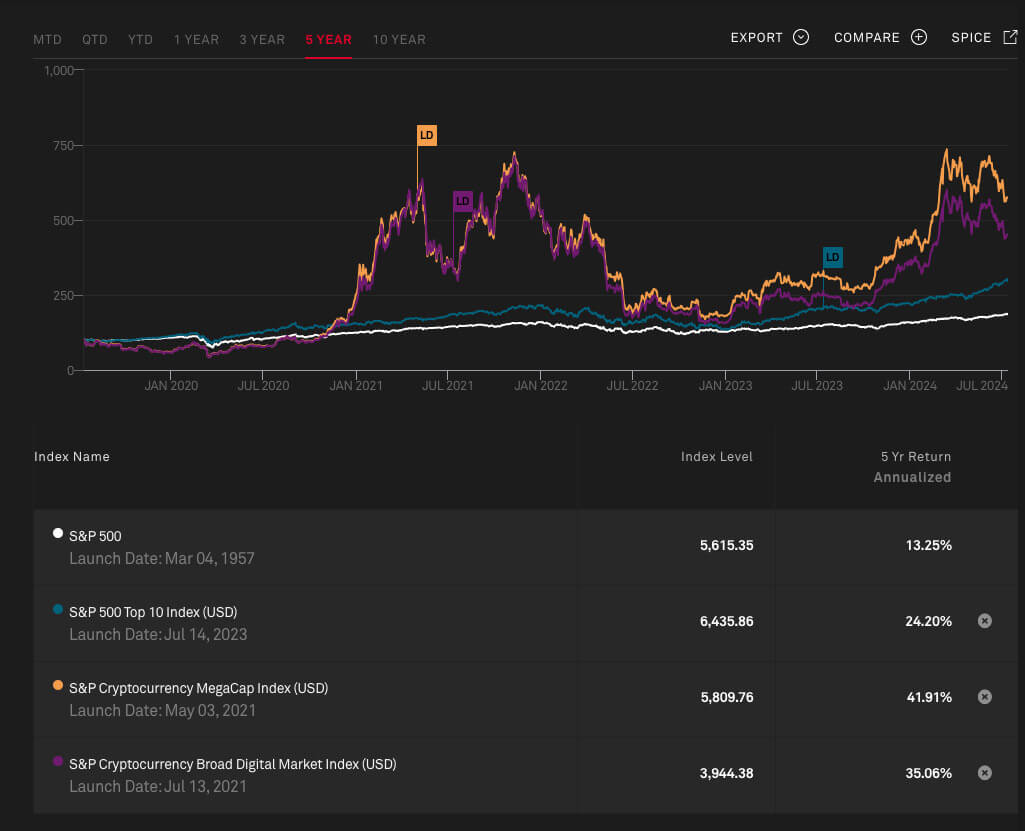

Compared to stocks, holding cryptocurrency vulnerability seems to person been proven to beryllium a amended prime during the involvement complaint chopped cycle. Since the past circular of the crypto bull market, the wide show of cryptos has importantly surpassed the show of the S&P 500. Even if you take to clasp mega stocks, their show has lagged considerably down BTC and ETH.

That is besides wherefore cryptocurrency-related vulnerability is rapidly occupying a higher proportionality successful concern portfolios: a tiny magnitude of cryptocurrency vulnerability tin amended the portfolio’s wide show during the bull market. In addition, erstwhile macro hazard events occur, mainstream crypto assets specified arsenic BTC tin play a definite hedging role—whether it is assassination oregon war.

Comparison of crypto assets’ returns and S&P 500 returns, arsenic of Jul 16, 2024. Source: S&P Global

Comparison of crypto assets’ returns and S&P 500 returns, arsenic of Jul 16, 2024. Source: S&P GlobalHowever, cryptos inactive look contention from different non-equity assets, specified arsenic commodities. Unlike cryptocurrency, commodities person maintained a comparatively beardown show during the involvement complaint hike cycle. Excess onshore and offshore currency liquidity is 1 of the halfway factors maintaining commodities’ performance; owed to erstwhile years’ QE and changes successful US monetary policies, some onshore and offshore markets person accumulated a ample magnitude of US dollar liquidity.

Performance examination betwixt mainstream cryptos and wide commodities, arsenic of Jul 16, 2024. Source: S&P Global

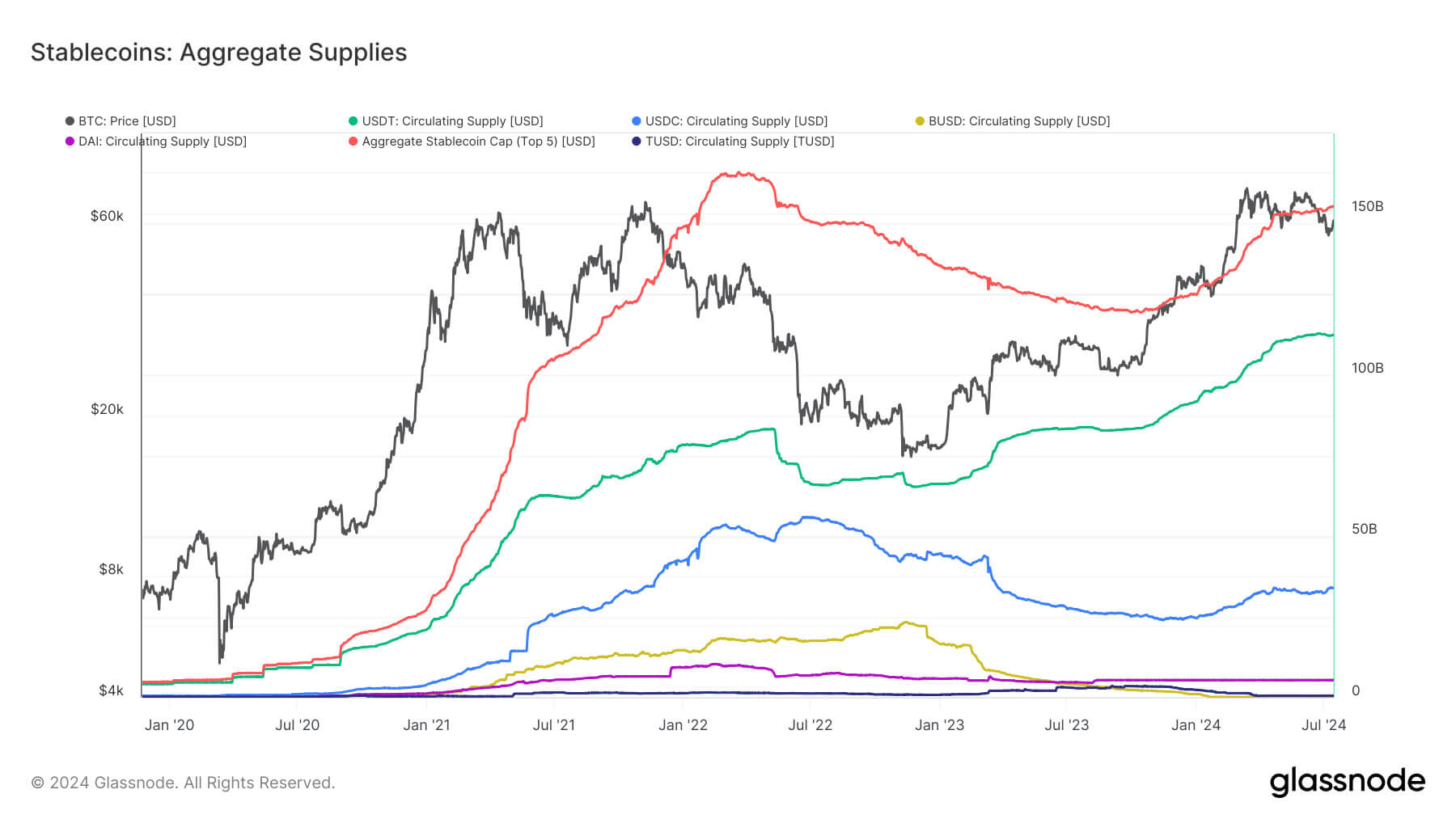

Performance examination betwixt mainstream cryptos and wide commodities, arsenic of Jul 16, 2024. Source: S&P GlobalIn the cryptocurrency marketplace alone, implicit $150 cardinal successful currency liquidity is already circulating successful the signifier of stablecoins, and the standard is expected to proceed to increase. In the accepted market, the standard of the Eurodollar utilized for commodity commercialized is overmuch larger than that of the crypto market. Considering the interaction of Trump’s aboriginal tariff policies, the summation successful commercialized costs volition beryllium reflected successful the prices of commodity futures, which whitethorn proceed the beardown show of commodities. It is not hard to observe that from 2021 to now, whether it is involvement complaint cuts oregon involvement complaint hikes, the show of commodities is not inferior to cryptocurrency. Considering the size and measurement of the commodity market, this cannot beryllium ignored.

As of Jul 16, 2024, changes successful stablecoins proviso successful the crypto market. Source: Glassnode

As of Jul 16, 2024, changes successful stablecoins proviso successful the crypto market. Source: GlassnodeLet’s see thing much profound: the accelerated enlargement of the Eurodollar has led to the accumulation and travel of commodities gradually lagging down the enlargement of liquidity scale, and involvement complaint cuts volition undoubtedly accelerate the process of liquidity standard expansion. At this time, commodity prices denominated successful US dollars volition stay unchangeable astatine a precocious level for a agelong time.

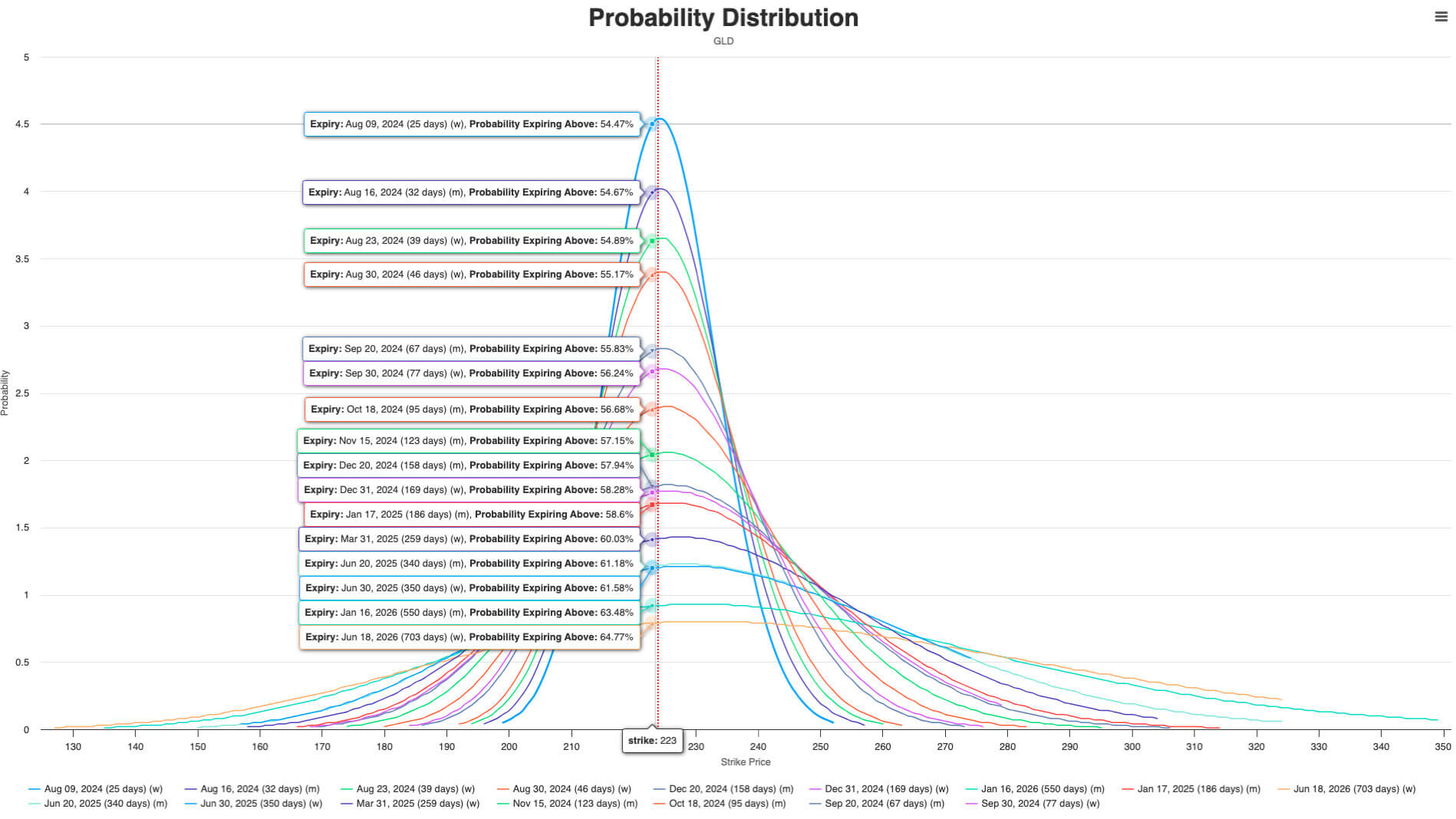

Although commodity prices whitethorn acquisition a short-term correction, from a mean to semipermanent perspective, the upward inclination of commodities volition not amusement important changes. In addition, comparatively scarce commodities specified arsenic golden tin besides play the relation of “hard currency” and “liquidity container”; successful the liquidity easing cycle, commodities whitethorn go beardown competitors of cryptos.

SPDR Gold Shares (GLD) far-month options’ implied probability distribution, arsenic of Jul 16, 2024. Source: optioncharts.io

SPDR Gold Shares (GLD) far-month options’ implied probability distribution, arsenic of Jul 16, 2024. Source: optioncharts.ioOf course, the crypto marketplace besides has its unsocial advantages: higher macro sensitivity and higher leverage. Compared with commodities, crypto derivatives importantly interaction the market, which brings comparatively higher volatility, frankincense bringing amended imaginable returns to investors successful the upward cycle. However, higher leverage besides means greater risk. In summary, commodities and cryptocurrencies are “optional” different than stocks, and the stock of the 2 successful the portfolio depends much connected investors’ hazard preferences.

So, Back to the Crypto Market…

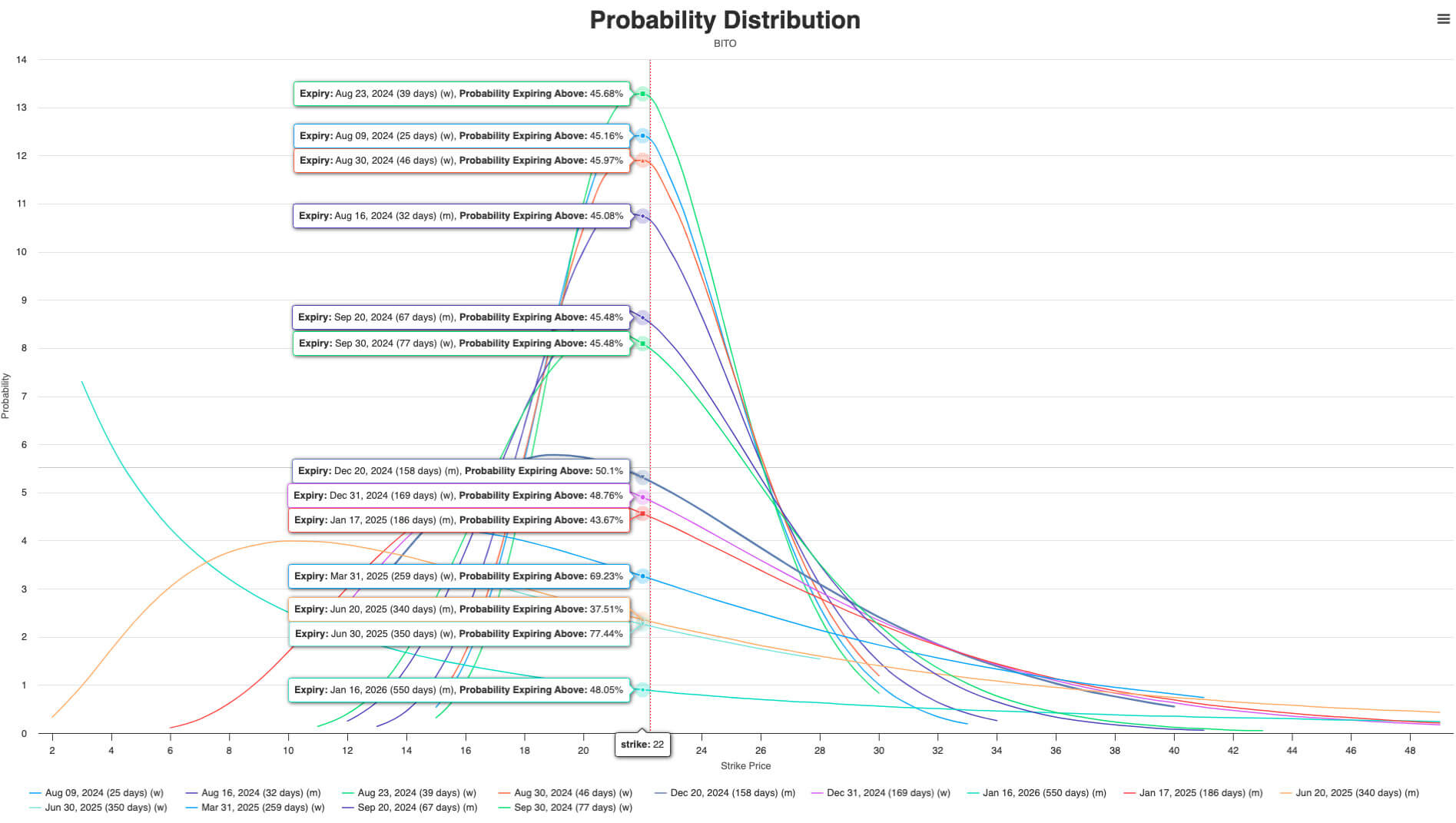

Is cryptocurrency amended than commodities successful the adjacent 1-2 months? The reply is “not sure” – astatine slightest for BTC. Investors successful the US banal marketplace and cryptocurrency marketplace look to person reached an implicit consensus: BTC is facing much absorption from marketplace makers hedging and investors profit-taking connected its further upward path, reducing investors’ expectations for further terms increases successful BTC. From the implied probability organisation perspective, the probability of BTC terms further breaking done successful the adjacent period has dropped to beneath 46%. In comparison, golden inactive has a probability of implicit 54% to proceed to emergence further done caller highs.

BITO far-month options implied probability distribution, arsenic of Jul 16, 2024. Source: optioncharts.io

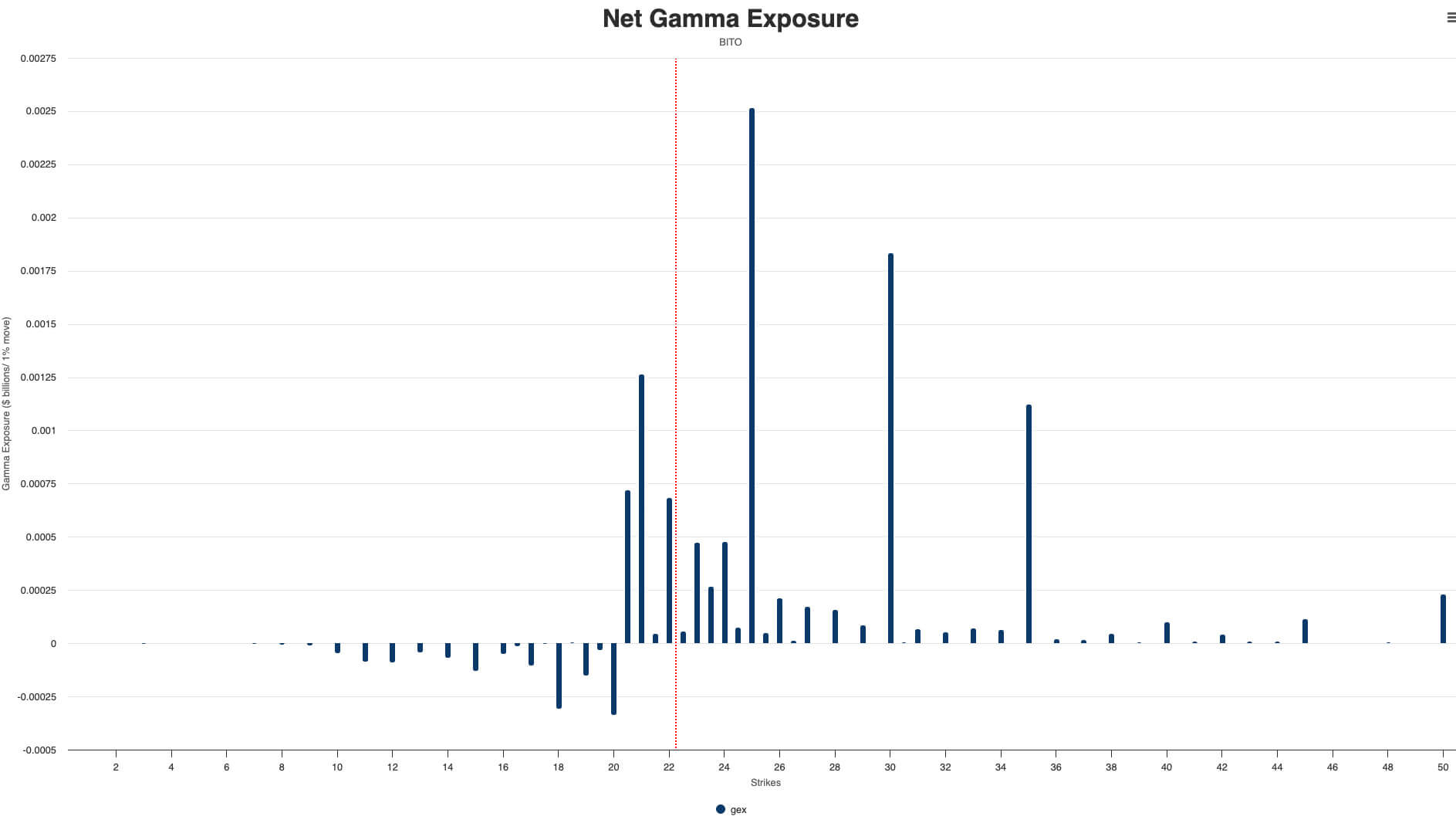

BITO far-month options implied probability distribution, arsenic of Jul 16, 2024. Source: optioncharts.io BITO’s nett gamma vulnerability distribution, arsenic of Jul 16, 2024. Source: optioncharts.io

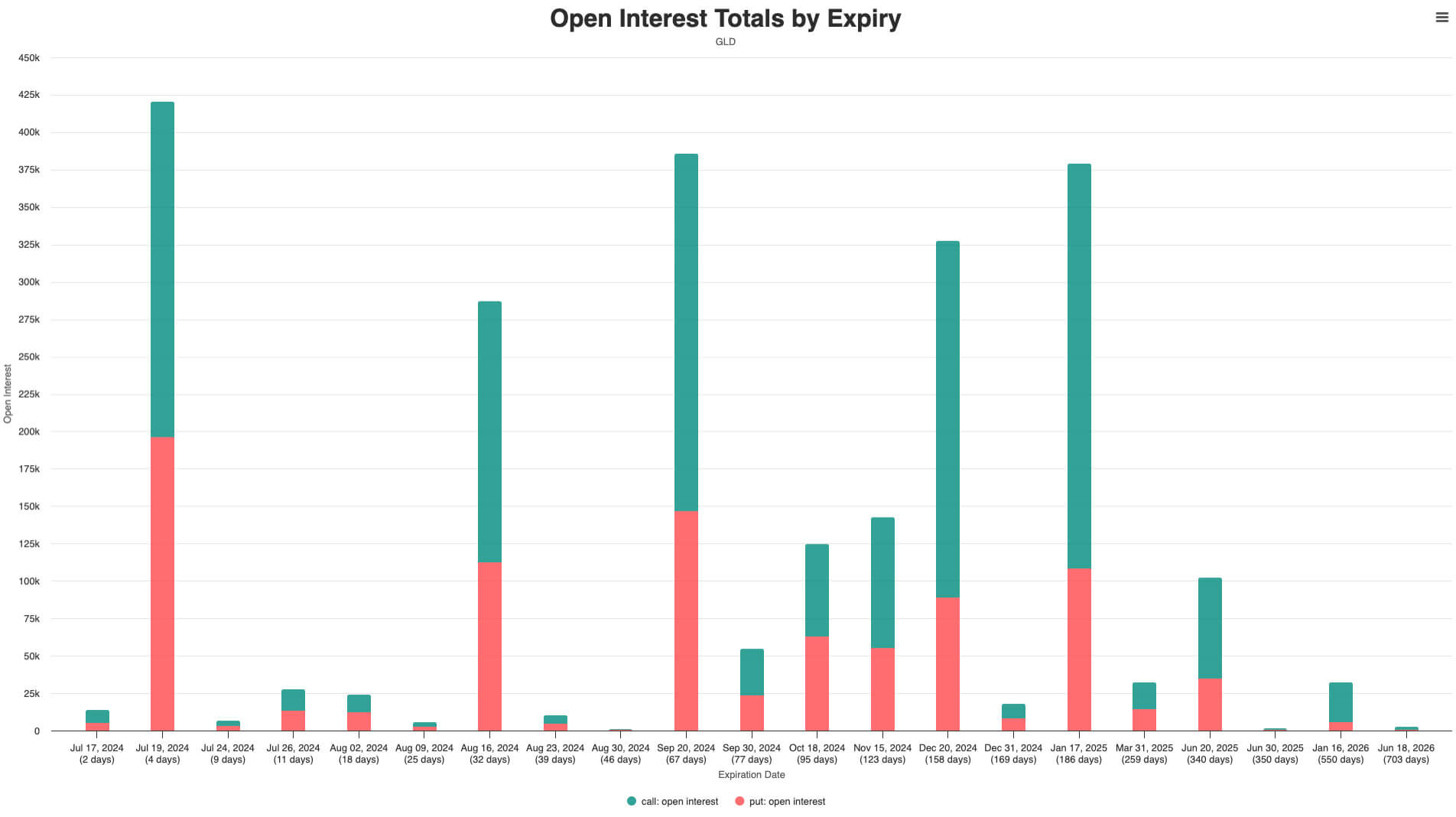

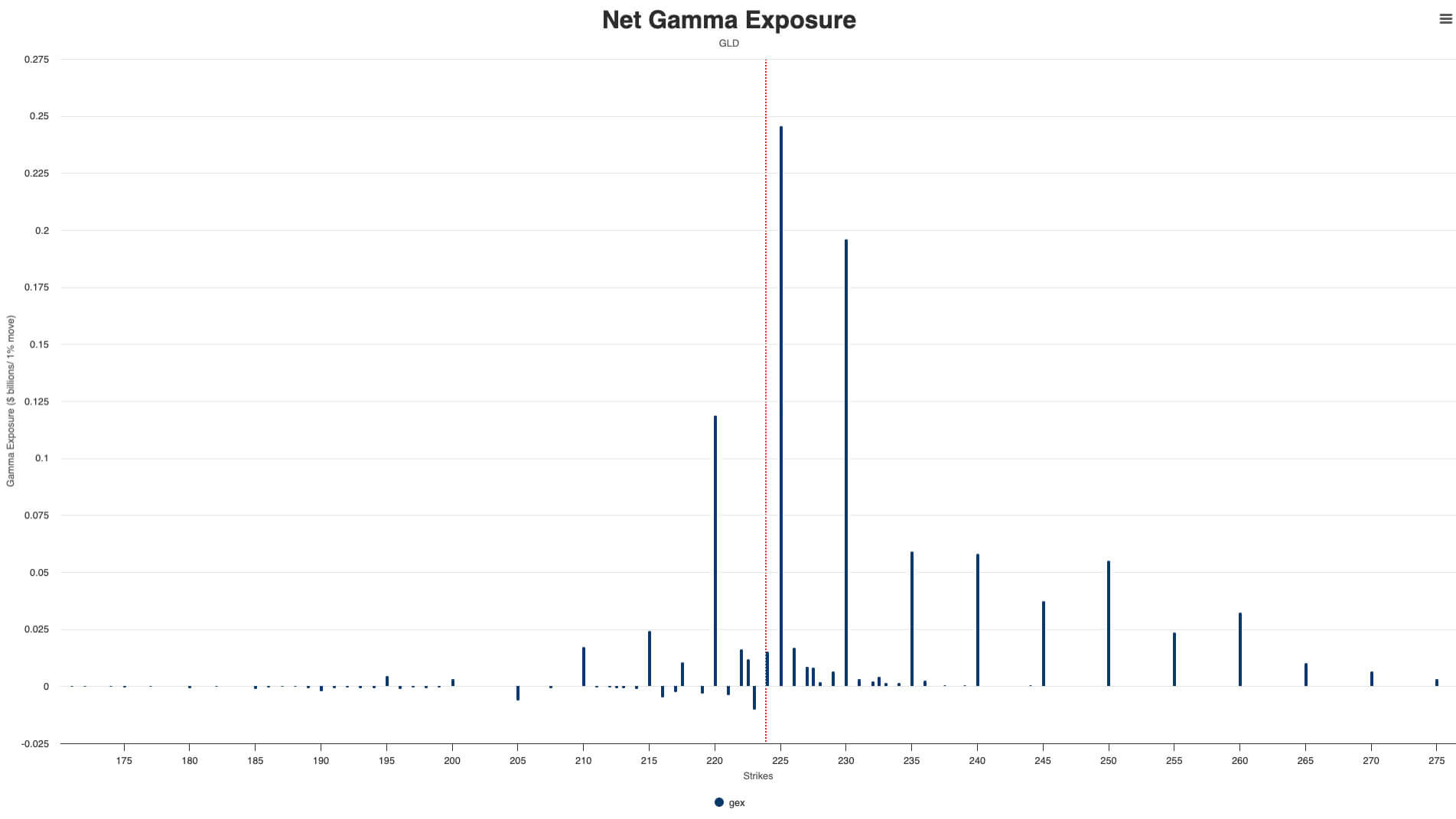

BITO’s nett gamma vulnerability distribution, arsenic of Jul 16, 2024. Source: optioncharts.ioIndeed, the absorption connected the upward way of golden is besides significant. However, comparing the enactment unfastened involvement organisation of GLD and BTC, it is not hard to find that aft July 19th, the upward absorption of golden prices mostly comes from the acold period alternatively than the beforehand month, which means that golden prices volition look comparatively tiny upward absorption successful the adjacent fewer weeks. In contrast, the front-month absorption of BTC accounts for a larger proportion, which means that the anticipation of a breakthrough successful the adjacent fewer weeks volition further decrease. The terms breakthrough of BTC whitethorn hap successful Aug, but not now.

BITO options unfastened involvement distribution, arsenic of Jul 16, 2024. Source: optioncharts.io

BITO options unfastened involvement distribution, arsenic of Jul 16, 2024. Source: optioncharts.io GLD’s nett gamma vulnerability distribution, arsenic of Jul 16, 2024. Source: optioncharts.io

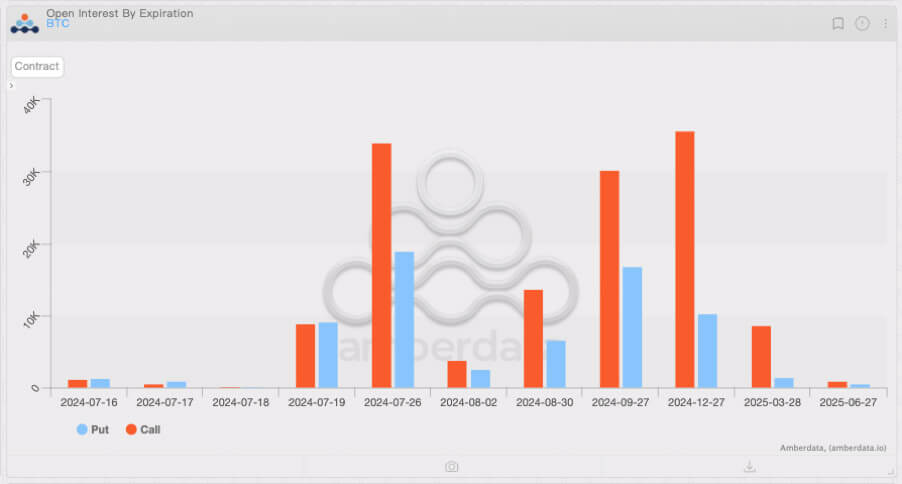

GLD’s nett gamma vulnerability distribution, arsenic of Jul 16, 2024. Source: optioncharts.io Distribution of Deribit BTC options unfastened interest, arsenic of Jul 16, 2024. Source: Amberdata Derivatives

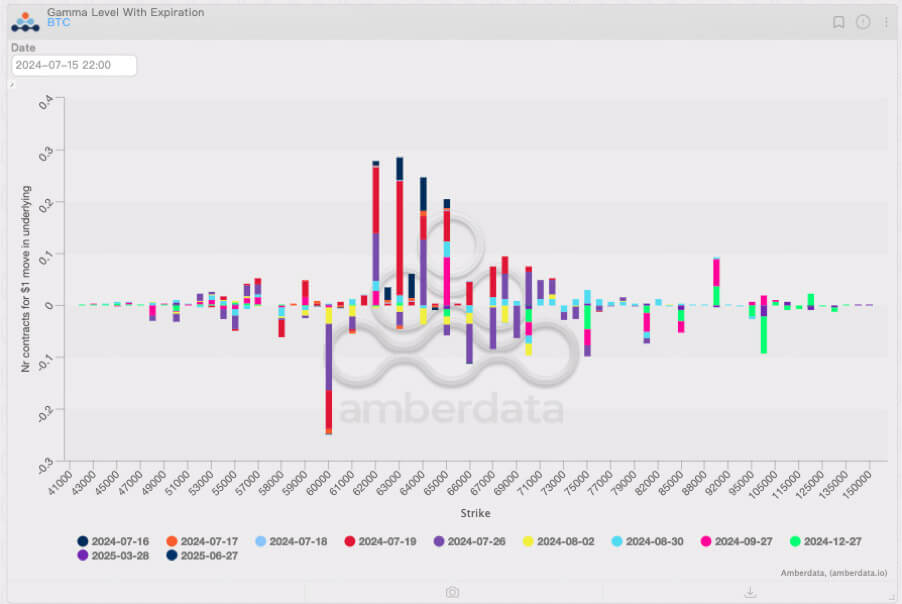

Distribution of Deribit BTC options unfastened interest, arsenic of Jul 16, 2024. Source: Amberdata Derivatives Deribit BTC options gamma vulnerability distribution, arsenic of Jul 16, 2024. Source: Amberdata Derivatives

Deribit BTC options gamma vulnerability distribution, arsenic of Jul 16, 2024. Source: Amberdata DerivativesHowever, erstwhile a breakthrough occurs, the hedging effect of marketplace makers volition reverse and propulsion the terms of BTC to emergence sharply. Although this is simply a low-probability event, holding immoderate agelong positions successful the acold period is inactive a much due choice; the short-term consolidation of BTC does not impact its semipermanent emergence successful the debased involvement complaint situation successful the future.

Deribit BTC options far-month skewness changes, arsenic of Jul 16, 2024. Source: Amberdata Derivatives

Deribit BTC options far-month skewness changes, arsenic of Jul 16, 2024. Source: Amberdata DerivativesFor ETH, we tin expect it to execute amended than BTC. On the 1 hand, ETH spot ETF whitethorn beryllium officially listed for trading adjacent week; during the Asset Allocation period, ETH whitethorn acquisition a akin emergence to BTC successful Quarter 1, which makes investors person higher expectations for ETH’s performance. From the gamma organisation perspective, ETH’s absorption connected the upward way whitethorn beryllium importantly reduced aft the Jul options’ expiration, which means its terms breakthrough volition beryllium much certain.

Deribit ETH options far-month skewness changes, arsenic of Jul 16, 2024. Source: Amberdata Derivatives

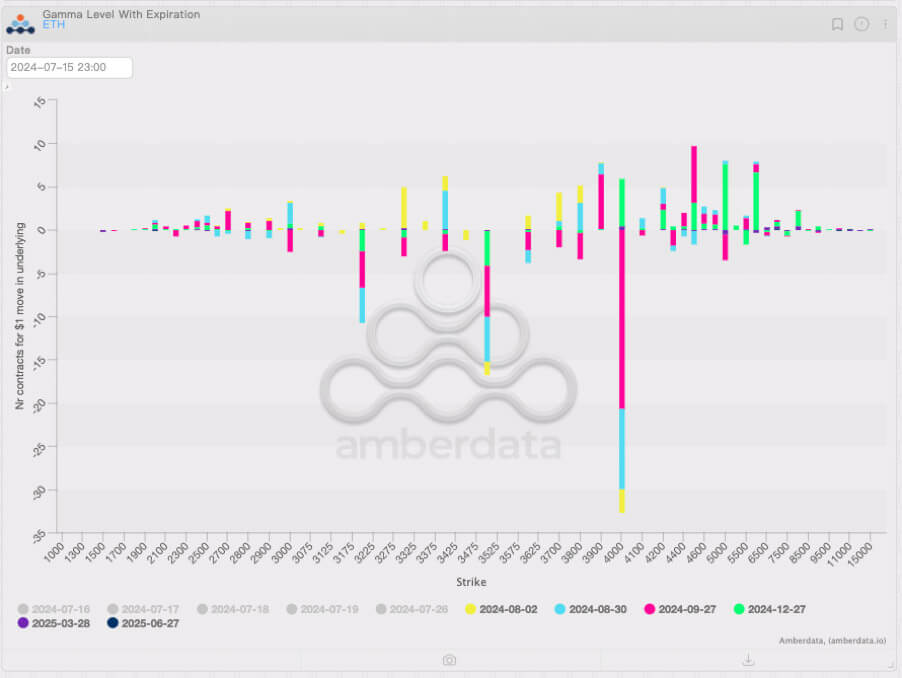

Deribit ETH options far-month skewness changes, arsenic of Jul 16, 2024. Source: Amberdata Derivatives Distribution of gamma vulnerability of Deribit ETH options, arsenic of Jul 16, 2024. Source: Amberdata Derivatives

Distribution of gamma vulnerability of Deribit ETH options, arsenic of Jul 16, 2024. Source: Amberdata Derivatives Deribit ETH options gamma vulnerability organisation (excluding Jul options), arsenic of Jul 16, 2024. Source: Amberdata Derivatives

Deribit ETH options gamma vulnerability organisation (excluding Jul options), arsenic of Jul 16, 2024. Source: Amberdata DerivativesIn summary, our plus allocation strategy for Jul and Aug is acceptable to set:

- Stock positions are dominated by SPX bulls.

- Bond positions beryllium connected idiosyncratic preference.

- For commodities, see expanding holdings of immoderate golden bulls (achieved done GLD oregon CME’s golden futures).

- In presumption of cryptocurrency, clasp much agelong positions successful ETH and moderately agelong positions successful BTC.

- Increase the proportionality of commodities and cryptocurrency successful the concern portfolio appropriately (for risk-neutral investors, 5% is simply a much due choice; for risk-seekers, see expanding the proportionality of commodities and cryptocurrency successful positioning to 10%).

Let’s bask the appetizer earlier the involvement complaint cuts together; the feast is astir to begin. Are you ready?

About BloFin Research

BloFin Research is the sub-brand of BloFin Academy‘s nonrecreational content. Based connected the team’s affluent acquisition and mature methodology successful the accepted and crypto markets, BloFin Research is committed to providing starring & in-depth institution-level probe contented for planetary crypto investors. BloFin Research’s contented has been wide recognized, cited and reposted by apical institutions and media successful the planetary market, including but not constricted to Coindesk, Forbes, Yahoo Finance, Deribit Insights, CryptoSlate, Amberdata, Optioncharts, etc.

BloFin Official Website: https://www.blofin.com

BloFin Twitter: https://x.com/Blofin_Official

BloFin Academy: https://x.com/BloFin_Academy

Contact

Head of Marketing and Public Relations

Annio Wu

[email protected]

The station Whales’ Rolling Window: Assassins, Rate Cuts and Portfolio Allocation appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)