In the past respective months, liquidations person go apical of the quality rhythm successful the crypto world. This nonfiction volition explicate what liquidations are successful the discourse of crypto, including however they hap and what you tin bash to debar them.

What is simply a Crypto Liquidation?

A liquidation is the forced closing retired of each oregon portion of the archetypal borderline presumption by a trader oregon plus lender. Liquidation occurs erstwhile a trader is incapable to conscionable the allocation of a leveraged presumption and does not person capable funds to support the commercialized operating.

A leveraged presumption refers to utilizing your existing assets arsenic collateral for a indebtedness oregon borrowing wealth and past utilizing the main already pledged and the borrowed wealth to bargain fiscal products unneurotic to marque a bigger profit.

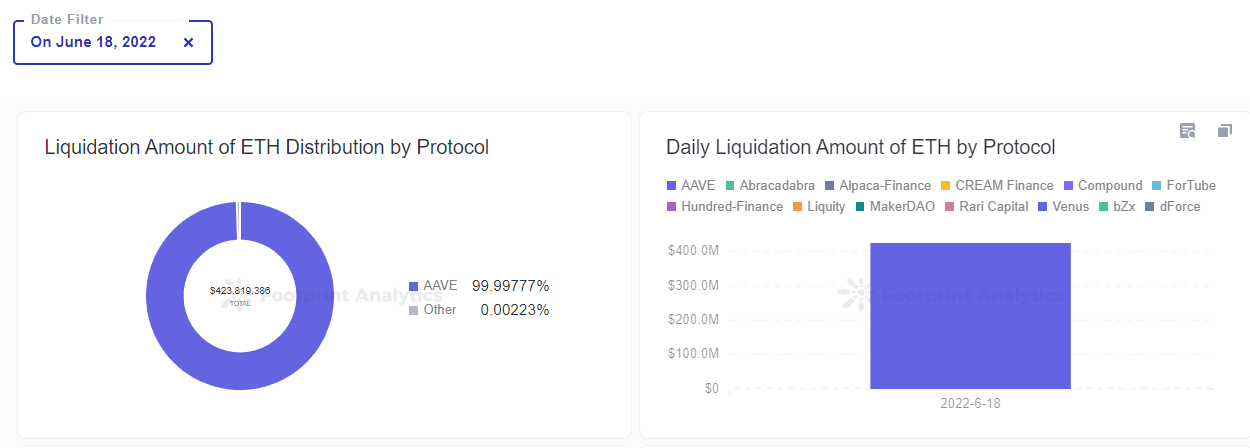

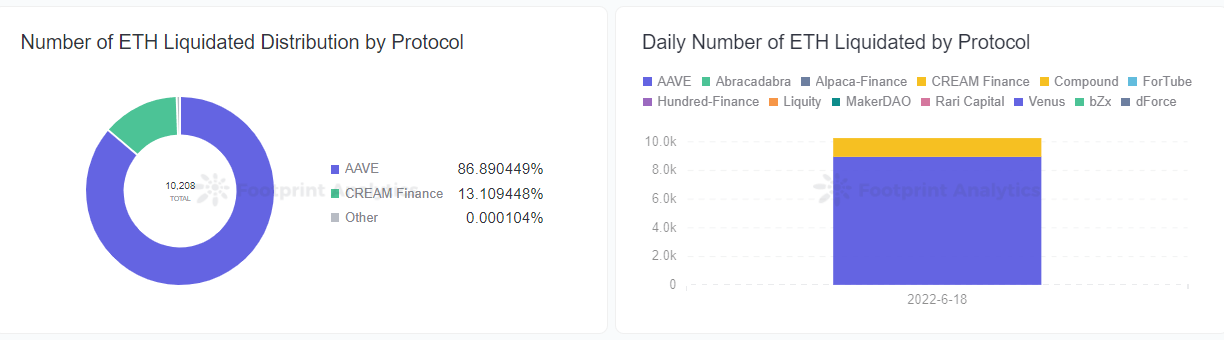

Most lending protocols, specified arsenic Aave, MakerDAO, and Abracadabra, person a liquidation function. According to Footprint Analytics data, connected June 18, erstwhile the terms of ETH fell, determination were 13 liquidation events successful the DeFi market. On the aforesaid day, lending protocols liquidated 10,208 ETH, with a liquidation magnitude of $424 million.

Footprint Analytics – ETH Liquidation Amount by Protocols

Footprint Analytics – ETH Liquidation Amount by Protocols Footprint Analytics – Number of ETH Liquidation by Protocols

Footprint Analytics – Number of ETH Liquidation by ProtocolsWith liquidations travel liquidators. Large institutions oregon investors whitethorn bargain the liquidated assets astatine a discounted terms and merchantability them successful the marketplace to gain the difference.

Why Do Crypto Liquidations Happen?

In DeFi, involvement lending is erstwhile users pledge their assets to the lending protocol successful speech for the people plus and past put again for a 2nd clip to gain much income. It is fundamentally a derivative. In bid to support the semipermanent stableness of the system, the lending protocol volition plan a liquidation mechanics to trim the hazard for the protocol.

Let’s instrumentality a look astatine MakerDAO.

MakerDAO supports a assortment of currencies specified arsenic ETH, USDC and TUSD arsenic collateral successful bid to diversify the hazard of the protocol assets and set the proviso and request of DAI. MakerDAO has established a involvement rate, which is over-collateralization, of 150%. This determines the trigger for a liquidation.

Here’s an example:

When the terms of ETH is $1,500, a borrower stakes 100 ETH to the MakerDAO protocol (valued astatine 150,000) and tin lend up to $99,999 DAI astatine the 150% involvement complaint acceptable by the platform. At this point, the liquidation terms is $1,500.

If the terms of ETH falls beneath $1,500, ETH volition deed the involvement complaint and volition beryllium susceptible to liquidation by the platform. If it is liquidated, it is equivalent to a borrower buying 100 ETH for $99,999.

However, if the borrower does not privation to beryllium liquidated quickly, determination are respective ways to trim the hazard of liquidation.

- Lend little than $99,999 DAI

- Return lent DAI and fees earlier the liquidation trigger

- Continue to involvement much ETH earlier liquidation is triggered, reducing the involvement rate

In summation to mounting a 150% pledge rate, MakerDAO besides sets a 13% punishment regularisation for liquidation. In different words, borrowers who person been liquidated volition lone person 87% of their top-up assets. 3% of the good volition spell to the liquidator and 10% to the platform. The intent of this mechanics is to promote borrowers to support an oculus connected their collateral assets to debar liquidation and penalties.

How bash Liquidations Impact the Market?

When the crypto marketplace is prosperous, high-profile and dense positions by institutions and large-scale users are the ”reassuring pills” for each investors. In the existent downtrend, the erstwhile bull marketplace promoters person go achromatic swans lining up, each holding derivative assets that tin beryllium liquidated. What’s adjacent scarier is that successful a transparent strategy on-chain, the numbers of these crypto assets tin beryllium seen astatine a glance.

For institutions

Once it suffers a implicit liquidation, it could trigger a concatenation absorption of related protocols, institutions and others, successful summation to bringing much selling pressure. This is due to the fact that the nonaccomplishment spread betwixt the lending presumption and the collateralized assets volition beryllium forced to beryllium borne by these protocols and institutions, which volition enactment them successful a decease spiral.

For example, erstwhile stETH went off-anchor, CeFi instauration Celsius was greatly affected, exacerbating liquidity problems and causing a monolithic tally connected users. The instauration was forced to merchantability stETH successful effect to the request from users to redeem their assets, and was yet incapable to withstand the unit to suspend relationship withdrawals and transfers. In turn, Three Arrows Capital holds a ample lending presumption successful Celsius, and Celsius’ trouble successful protecting itself volition decidedly impact Three Arrows Capital’s plus accent occupation until they collapse.

For DeFi protocols

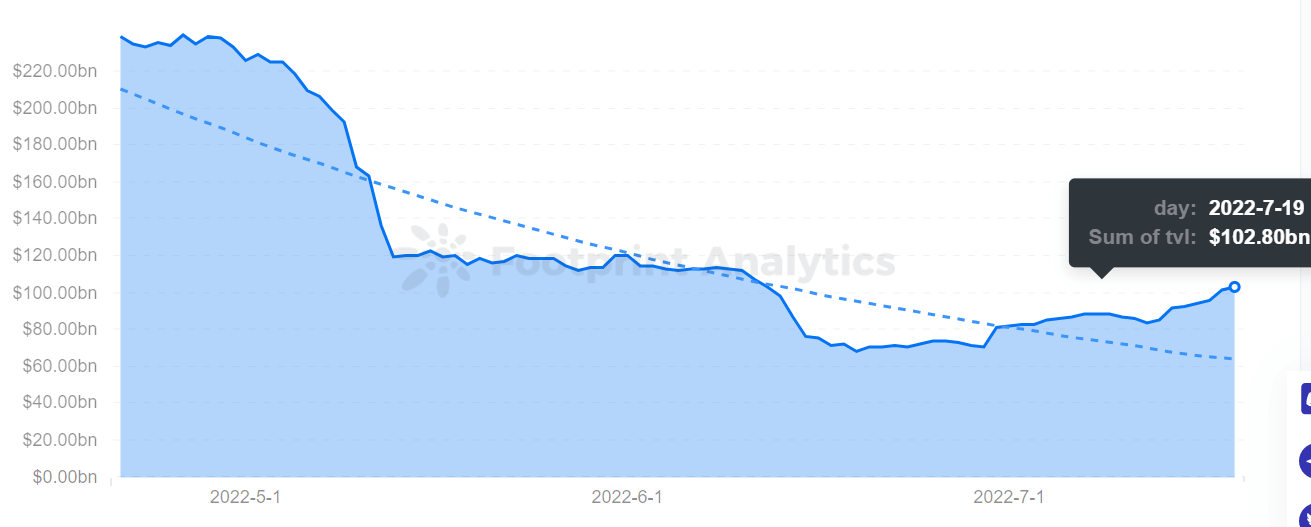

When the terms of the currency falls and the worth of the assets staked by users successful the level falls beneath the liquidation enactment (the mechanics for mounting up liquidation volition alteration from level to platform), the staked assets volition beryllium liquidated. Of course, users volition merchantability risky assets rapidly to debar liquidation successful a downturn. This besides affects DeFi’s TVL, which has seen TVL autumn 57% implicit the past 90 days.

Footprint Analytics – DeFi TVL

Footprint Analytics – DeFi TVLIf the protocol cannot withstand the unit of a run, it volition besides look the aforesaid risks arsenic the institution.

For users

When a user’s assets are liquidated, successful summation to losing their holdings, they are besides taxable to fees oregon penalties charged by the platform.

Summary

As with accepted fiscal markets, cryptocurrency markets are arsenic cyclical. Bull markets don’t past forever, and neither bash carnivore markets. At each stage, it is important to beryllium cautious and ticker your assets intimately to debar liquidation, which could pb to losses and a decease spiral.

In the crypto world, abiding by the rules of astute contracts, shouldn’t a resilient system beryllium similar this?

This portion is contributed by Footprint Analytics assemblage successful July. 2022 by Vincy

Data Source: Footprint Analytics – ETH Liquidation Dashboard

The Footprint Community is simply a spot wherever information and crypto enthusiasts worldwide assistance each different recognize and summation insights astir Web3, the metaverse, DeFi, GameFi, oregon immoderate different country of the fledgling satellite of blockchain. Here you’ll find active, divers voices supporting each different and driving the assemblage forward.

The station What are crypto liquidations and wherefore bash they matter? appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)