The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

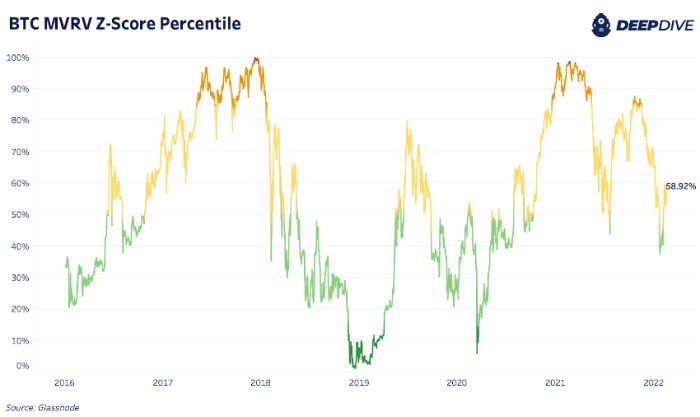

In today’s Daily Dive, we volition screen immoderate of the cardinal on-chain rhythm indicators and what they archer america astir wherever we are astatine successful the market. All of the indicators contiguous leverage a percentile analysis, looking astatine existent values implicit humanities percentiles, to amusement erstwhile indicators suggest erstwhile the marketplace is bottomed, topped, neutral oregon successful between.

Across the astir 20 on-chain rhythm indicators we track, on-chain shows a neutral to bullish marketplace setup. Yet, we cognize that on-chain, macro and derivatives each play a relation successful bitcoin’s maturation trajectory, particularly with precocious bitcoin risk-on equities correlations close now.

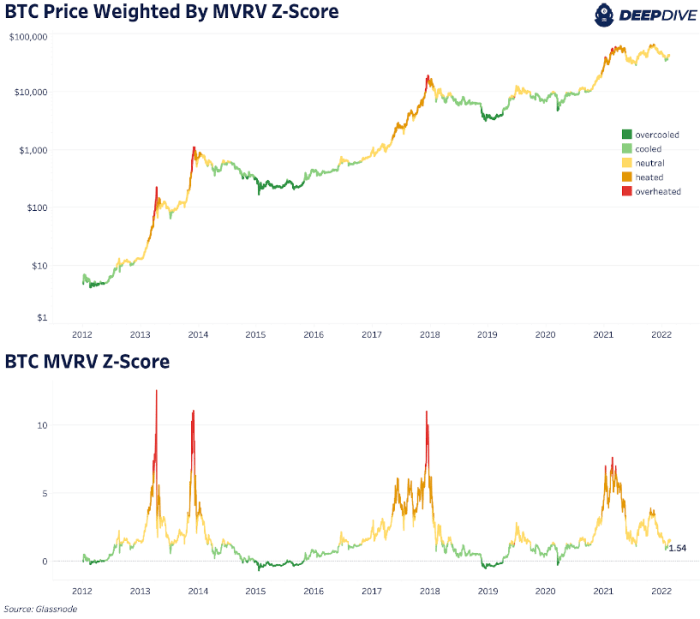

The Market Value To Realized Value Ratio (MVRV) is simply a metric we screen extensively arsenic it incorporates the existent authorities of terms comparative to bitcoin’s on-chain outgo ground oregon “fair value.” The MVRV Z-Score incorporates the modular deviation of marketplace headdress to nutrient a much prime signal.

At the erstwhile 2021 bitcoin highs, we didn’t spot the rhythm blow-off tops play retired similar erstwhile cycles. But with little upside, besides apt brings little extended downside. Currently, bitcoin’s MVRV Z-Score points to a neutral marketplace authorities aft the terms has rallied from the $30,000 scope aggregate times. Another determination down to an “over-cooled” acheronian greenish state, wherever the worth is beneath its 15th percentile, looks improbable barring a achromatic swan sell-off benignant event.

A cumulative presumption of 90-Day Coin Days Destroyed (CDD) is different cardinal indicator that helps amusement the enactment of semipermanent holders. Although we saw a emergence successful coin days destroyed during the May 2021 top, we didn’t spot overmuch spending enactment astatine each during the November 2021 top. The past fewer months person seen small question successful older coins moving, suggesting that astir “smart money” holders are sitting choky close now.

3 years ago

3 years ago

English (US)

English (US)