Savvy bitcoin BTC and ether ETH traders are shoring up their defenses arsenic the broader marketplace continues to foresee bullish terms enactment implicit the summer.

That's the connection from an options-based strategy called 25-delta hazard reversal, which involves the simultaneous acquisition of a enactment enactment and merchantability of a call, oregon vice versa.

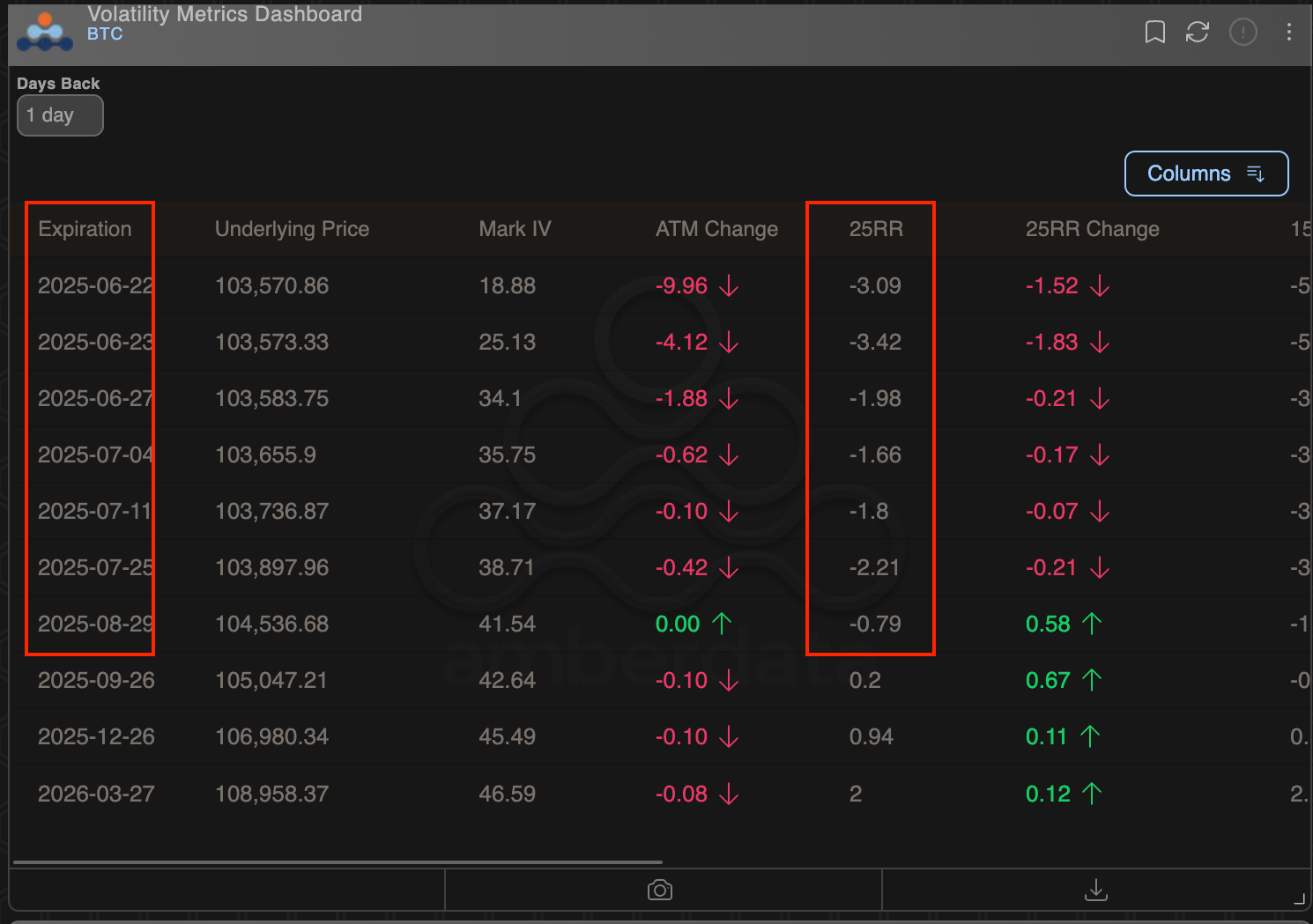

At the clip of writing, hazard reversals based connected Deribit-listed bitcoin and ether options indicated that investors were positioning for downside volatility implicit the summer.

BTC's 25-delta hazard reversals for June, July, and August tenors were negative, indicating a penchant for enactment options, which connection downside protection, implicit calls oregon bullish bets, according to information root Amberdata. In ETH's case, puts were pricier retired to the July extremity expiry.

Traders typically bargain enactment options to hedge their agelong positions successful the spot and futures markets, protecting themselves from imaginable terms declines.

"Risk reversals successful some BTC and ETH proceed to amusement a penchant for downside extortion crossed June and September tenors. This suggests that agelong holders are actively hedging spot vulnerability and preparing for imaginable drawdowns," Singapore-based QCP Capital said successful a marketplace note.

The nervousness is evident from the over-the-counter liquidity level Paradigm, wherever the apical 5 BTC trades for the week include a enactment dispersed and a bearish hazard reversal. Meanwhile, successful ETH's case, a agelong presumption successful the $2,450 enactment crossed the portion alongside a abbreviated strangle (volatility) trade.

Bitcoin, the starring cryptocurrency by marketplace value, has spent implicit 40 days trading backmost and distant supra $100,000, according to CoinDesk data. According to analysts, profit-taking by semipermanent holders and miner selling person counteracted the beardown uptake for spot ETFs, leaving prices directionless.

"Bitcoin has precocious tracked sideways, suggesting its existent terms whitethorn beryllium excessively precocious for galore retail investors. Open involvement successful BTC options has risen, with a affirmative and rising 25 delta put-call skew connected 30-day contracts, which whitethorn connote that marketplace participants are seeking short-term extortion done enactment options," Coinbase Institutional's play study noted.

On Friday, BTC closed (UTC) below the 50-day elemental moving mean (SMA) to commercialized beneath the cardinal enactment for the archetypal clip since mid-April. The breakdown whitethorn pb to much chart-driven selling, perchance resulting successful a driblet beneath $100,000.

Some observers, however, expect a rally to caller grounds highs. According to marketplace observer Cas Abbé, BTC's on-balance measurement continues to bespeak beardown buying pressure, suggesting that prices could emergence to $130,000-$135,000 by the extremity of the 3rd quarter.

5 months ago

5 months ago

English (US)

English (US)