Analyzing trading volumes crossed centralized exchanges (CEXs) allows america to recognize commercialized organisation crossed assorted platforms and place broader marketplace trends. Knowing wherever Bitcoin is being traded and however overmuch of it is being traded provides insights into market liquidity, investor sentiment, and the overall health of the trading environment.

Tracking trading volumes is peculiarly important successful periods preceding and pursuing important regulatory changes oregon marketplace events, arsenic they tin pb to important changes successful trading activity.

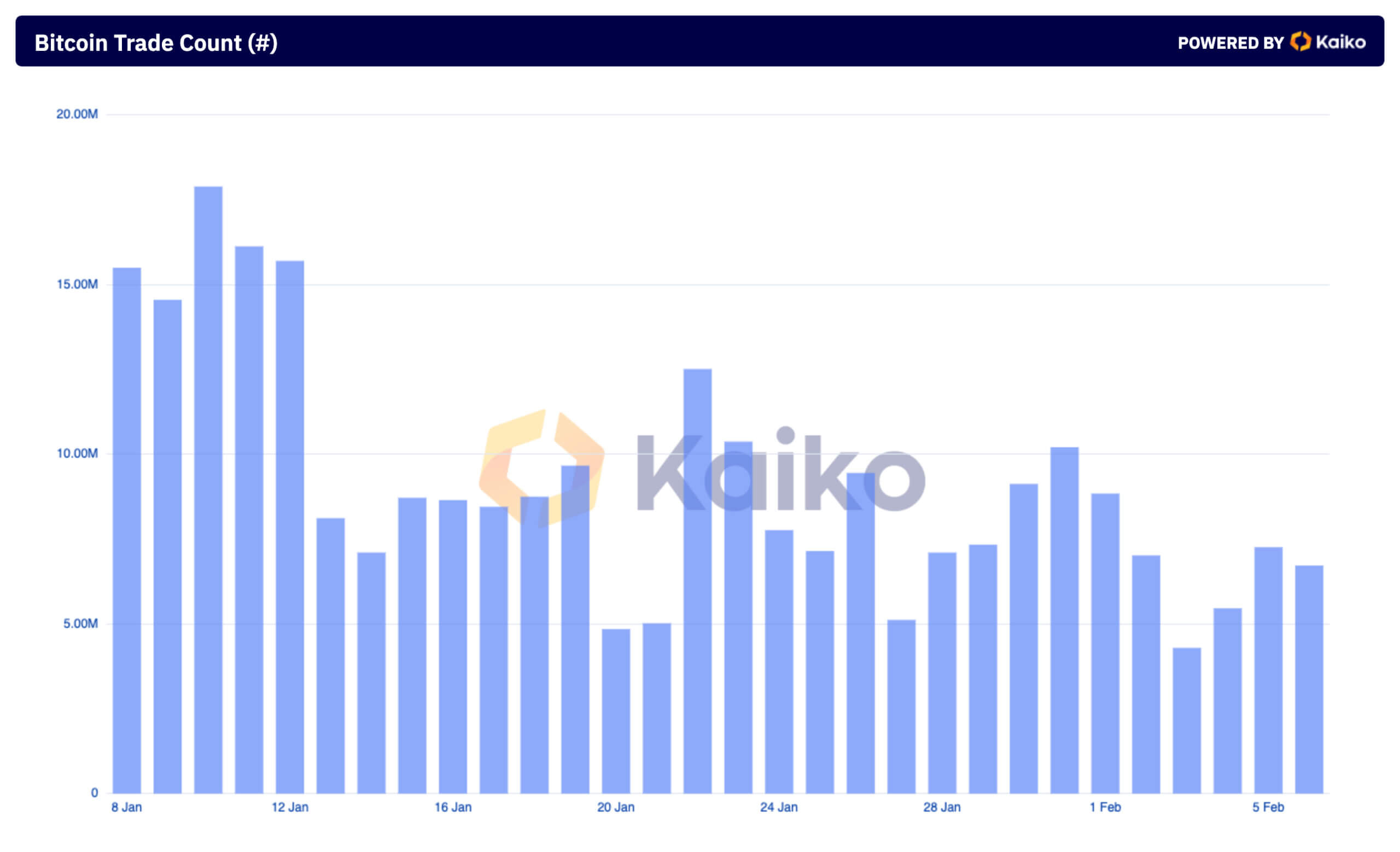

The support of spot Bitcoin ETFs successful the U.S. had a important effect connected trading volumes and patterns crossed centralized exchanges. On Jan. 10, the time of the ETF approval, trading volumes crossed 33 centralized exchanges tracked by Kaiko soared to $22.04 billion, with commercialized counts reaching 17.87 million. This spike shows the market’s assertive effect to the ETFs, yet starring to volatility and a crisp driblet successful Bitcoin’s price.

Graph showing the aggregated commercialized number for Bitcoin connected centralized exchanges from Jan. 8 to Feb. 7, 2024 (Source: Kaiko)

Graph showing the aggregated commercialized number for Bitcoin connected centralized exchanges from Jan. 8 to Feb. 7, 2024 (Source: Kaiko)Following this archetypal surge, determination was a noticeable diminution some successful trading volumes and counts passim January, showing a normalization of marketplace activity.

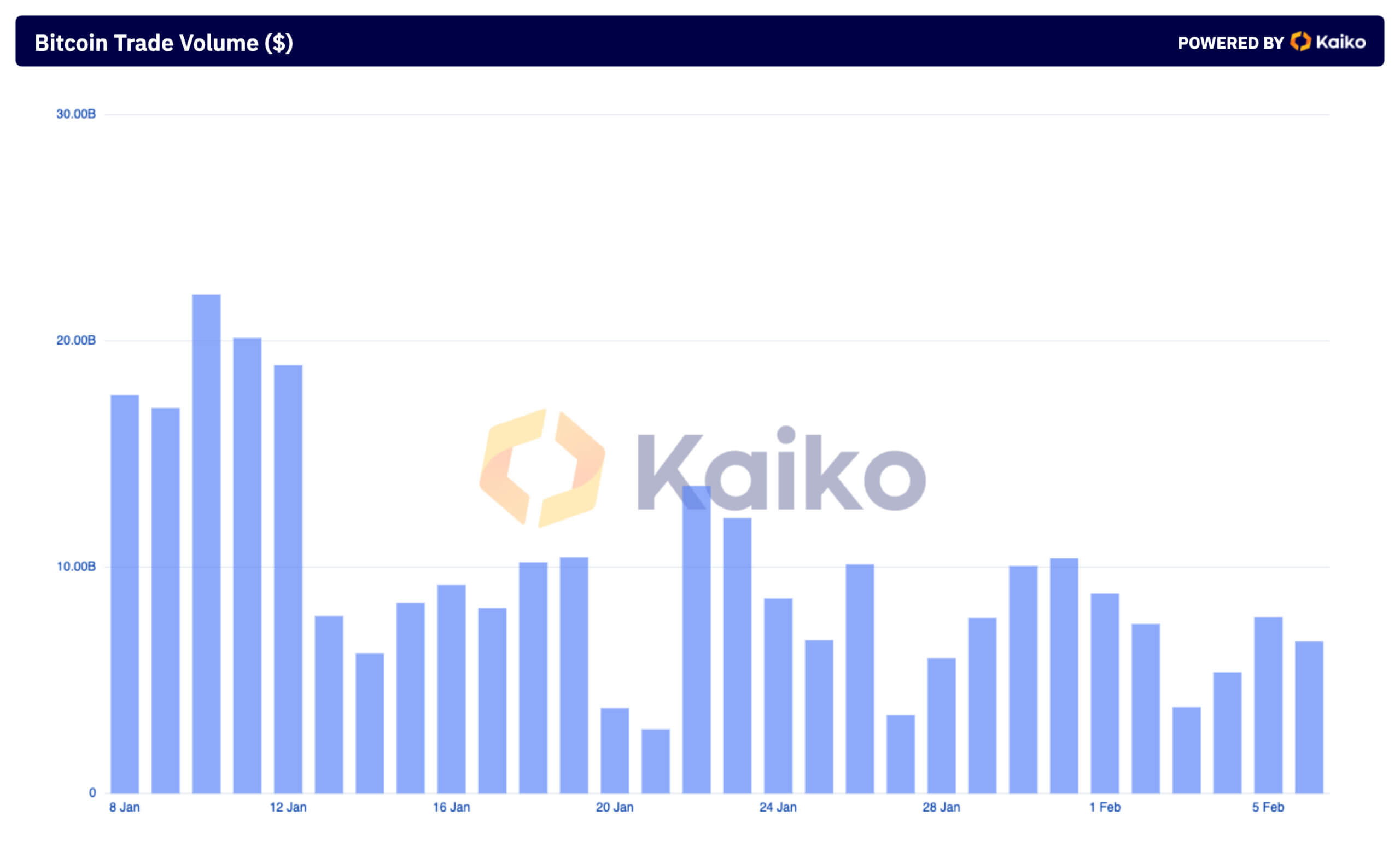

By Feb. 1, volumes decreased to $8.83 billion; by Feb. 3, they dropped to $3.82 billion. This diminution could beryllium attributed to the market’s accommodation aft the ETF hype, settling into sustainable levels of trading activity. The fluctuations successful trading measurement continued passim the month, with volumes peaking astatine $7.79 cardinal connected Feb. 5 earlier declining to $6.72 cardinal by Feb. 6.

Graph showing the aggregated Bitcoin trading measurement connected centralized exchanges from Jan. 8 to Feb. 7, 2024 (Source: Kaiko)

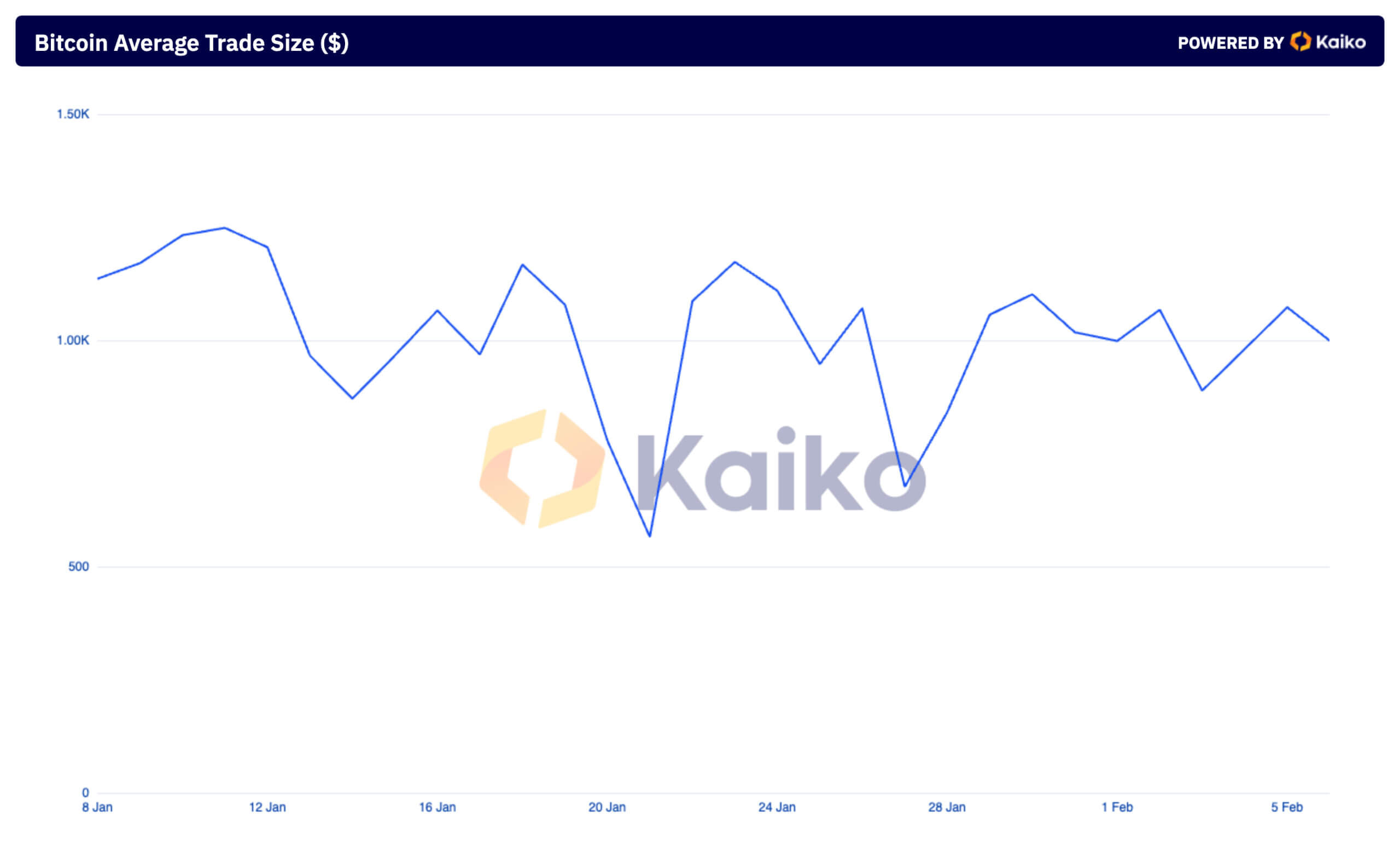

Graph showing the aggregated Bitcoin trading measurement connected centralized exchanges from Jan. 8 to Feb. 7, 2024 (Source: Kaiko)An absorbing facet of this play was the consistency of the mean commercialized size, which remained unchangeable astatine astir $1,000 crossed exchanges, with lone 2 drops beneath $871 successful a month. This steadiness successful commercialized size amidst fluctuating volumes and commercialized counts shows that portion the fig of transactions and full measurement varied, the idiosyncratic transaction size by traders remained comparatively unchanged.

Graph showing the mean Bitcoin commercialized size connected centralized exchanges from Jan. 8 to Feb. 7, 2024 (Source: Kaiko)

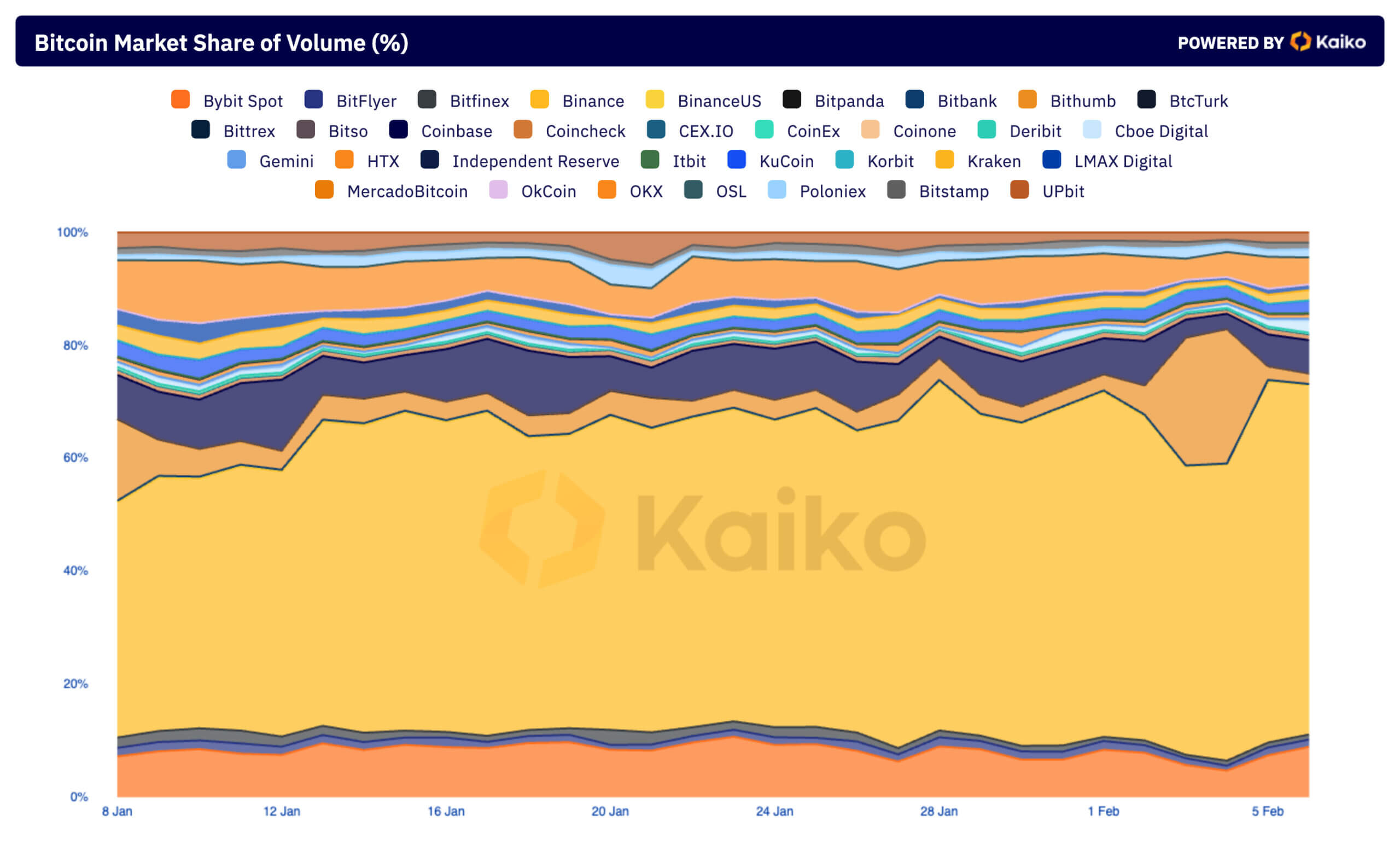

Graph showing the mean Bitcoin commercialized size connected centralized exchanges from Jan. 8 to Feb. 7, 2024 (Source: Kaiko)Analyzing marketplace stock organisation among exchanges reveals wherever astir of the trading happens. Binance solidified its marketplace dominance, expanding its stock from 44.26% of the planetary trading measurement connected Jan. 10 to 61.85% connected Feb. 6. This maturation not lone highlights Binance’s beardown marketplace presumption but besides suggests a consolidation of trading enactment astir large platforms.

Graph showing the marketplace stock of Bitcoin trading measurement connected centralized exchanges from Jan. 8 to Feb. 7, 2024 (Source: Kaiko)

Graph showing the marketplace stock of Bitcoin trading measurement connected centralized exchanges from Jan. 8 to Feb. 7, 2024 (Source: Kaiko)In contrast, Coinbase saw a alteration successful its stock of planetary trading measurement pursuing the motorboat of the ETFs, indicating that U.S. traders person been outpaced by a planetary assemblage trading connected Binance.

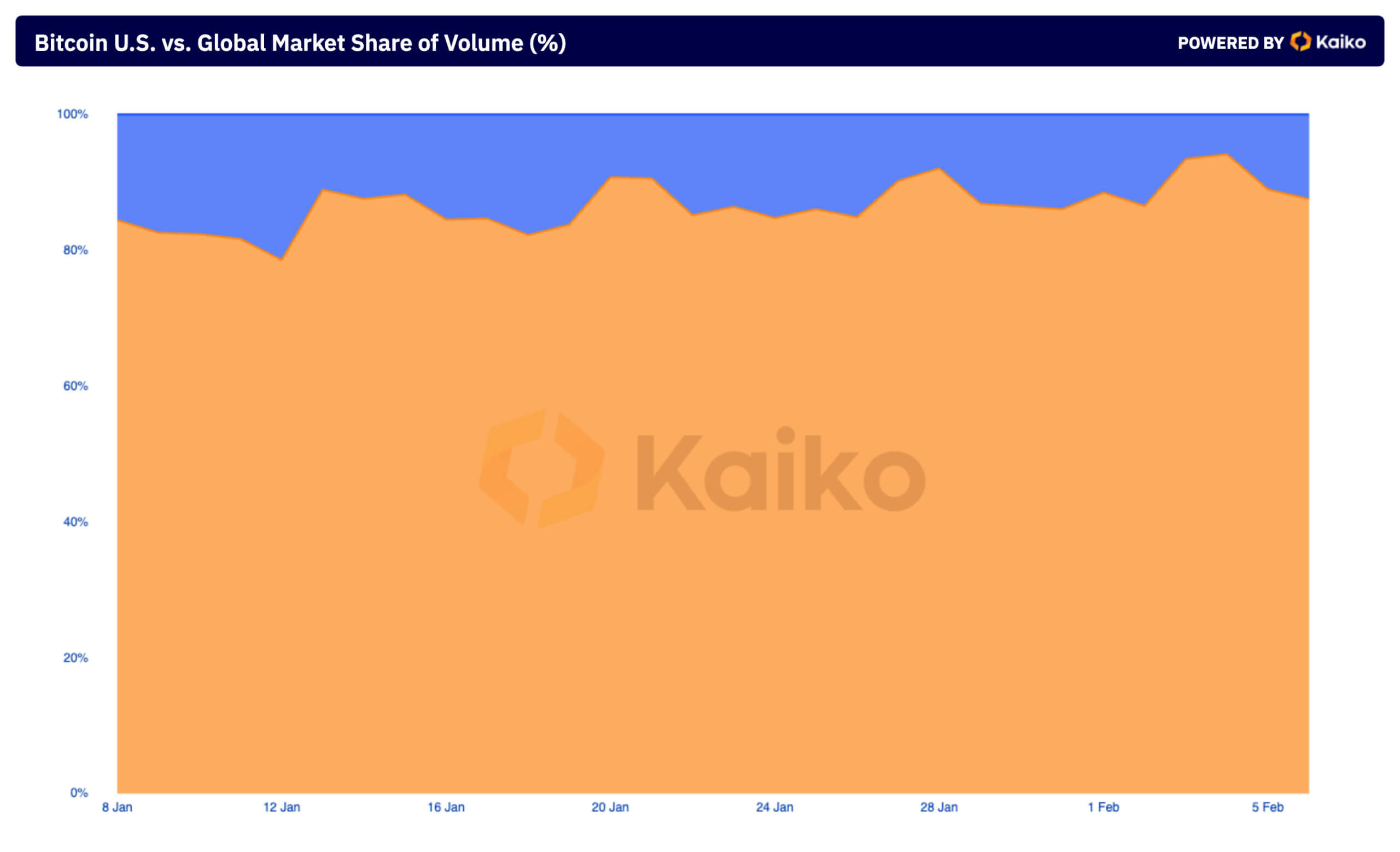

The planetary organisation of Bitcoin trading measurement further confirms this. Despite an archetypal summation successful the U.S. marketplace share, astir trading enactment continued to beryllium dominated by the planetary market. This shows conscionable however decentralized and borderless the Bitcoin marketplace is, with the astir important volumes occurring extracurricular of the U.S.

Graph showing the U.S. (blue) and planetary (orange) marketplace stock of Bitcoin trading measurement from Jan. 8 to Feb. 7, 2024 (Source: Kaiko)

Graph showing the U.S. (blue) and planetary (orange) marketplace stock of Bitcoin trading measurement from Jan. 8 to Feb. 7, 2024 (Source: Kaiko)The station What Bitcoin’s trading patterns connected centralized exchanges archer america astir the market appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)