China’s banks look insolvency risks with wide owe boycotts. The U.S. dollar is strengthening and bringing bitcoin down successful the process.

“Fed Watch” is simply a macro podcast with a existent and rebellious bitcoin nature. In each occurrence we question mainstream and Bitcoin narratives by examining existent events from crossed the globe, with an accent connected cardinal banks and currencies.

Listen To The Episode Here:

In this episode, Christian Keroles and I drawback up connected the week, spell done an update connected the evolving Chinese fiscal crisis, speech astir wherefore fiat wealth contiguous should rightly beryllium called credit-based wealth and the broadside effects of that fact. Last, we dive into the bitcoin chart.

You tin entree this episode’s descent platform of charts here oregon below.

China

First up is the concern successful the Chinese economy. They are facing immoderate large issues successful their existent property market, system and banking system. Currently, 28 of the apical 100 existent property developers person defaulted connected oregon restructured their debts. There is simply a increasing “mortgage boycott,” wherever purchasers of unbuilt lodging units successful projects that are present delayed owed to the pandemic, developers’ fiscal concern and the country’s zero-COVID policy, person refused to wage their mortgages. The boycott started with 20 projects and has since grown to 235 projects.

The rhetoric astir this owe situation is eerily akin to that successful the U.S. successful 2007. Excuses specified as, “It is simply a tiny fig of mortgages” and “Effects are contained” are being offered.

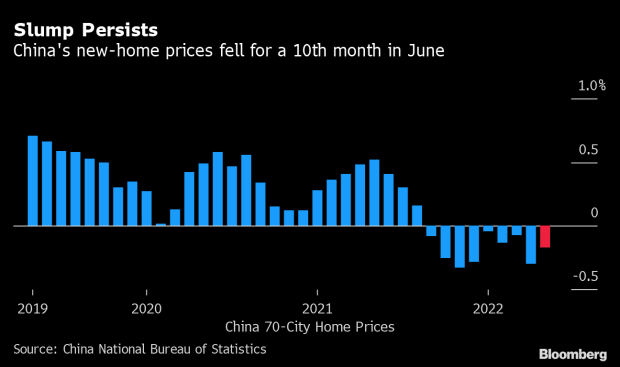

As a effect of the developer and owe problems, small- and medium-sized banks are moving into solvency issues. Chinese banks person $9 trillion successful vulnerability to existent estate. If determination was a occupation with perpetually falling location prices, it could precise rapidly origin a solvency contented for banks. Indeed, that is precisely what we are seeing.

New portion location prices successful China person fallen for the 10th consecutive period successful June 2022.

(Source)

(Source)

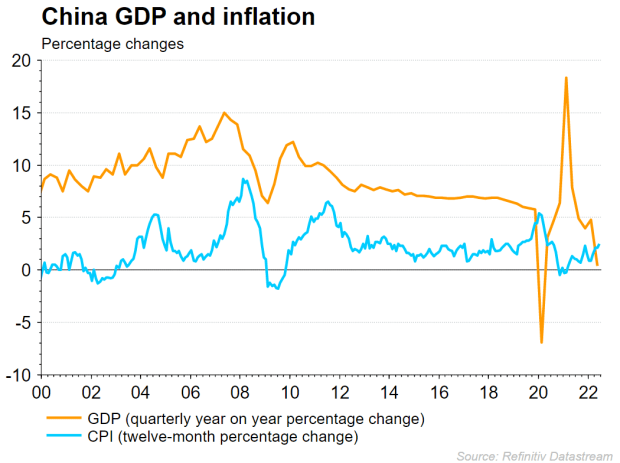

Gross home merchandise crashed successful Q2 2022 to 0.4%.

(Source)

(Source)

The GDP illustration nicely supports my idiosyncratic macro predictions that the large economies are going to instrumentality to the post-Global Financial Crisis (GFC) “normal.” Since the GFC, maturation successful China has been dilatory trending downward. Then determination was the convulsive economical disruption and whiplash effect successful the economy, followed by a instrumentality to slowing growth.

At the extremity of the China conception of the podcast, I work done a fascinating article from Nikkei Asia connected the concern astir caller slope runs successful the Henan province. The nonfiction highlighted the abusive effect to the slope tally and the increasing dangers of a full-blown fiscal situation successful China.

Bitcoin Charts

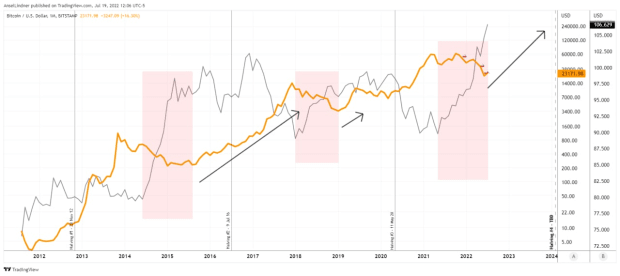

Next, we spell done a mates of bitcoin charts. The archetypal 2 charts item the similarities and differences successful the illustration during periods that resembled today’s terms action. I pointed retired that the existent level consolidation differs due to the fact that it has higher highs and higher lows, wherever the erstwhile breakout attempts did not.

(Source)

(Source)

(Source)

(Source)

There are besides immoderate precise absorbing observations from Twitter connected currency positions successful hedge funds and the bitcoin market.

Kuppy is pointing retired that the percent of hedge money portfolios that are holding currency is higher than immoderate play since the dot-com bubble backmost successful 2000. When these peaks hap and hedge funds rotate backmost into stocks, the marketplace bottoms and has a bully rally.

We tin besides spot this effect successful the bitcoin market.

(Source)

(Source)

This illustration is simply a small busy, but the apical sheet is the “stablecoin dominance,” arsenic I’ve called it, the ratio betwixt the stablecoin marketplace headdress and bitcoin’s marketplace cap. It is simply a proxy for a “cash position” successful the bitcoin market. The bottommost sheet is the bitcoin price. At comparative tops successful the stablecoin ratio, bitcoin bottoms successful terms due to the fact that those stablecoins tin rotate into buying bitcoin and vice versa.

The U.S. Dollar

There has been a batch of speech astir the strengthening dollar. We are the lone bitcoin podcast that unequivocally called for a beardown dollar implicit the past 2 years, and lad person we been close connected that.

I bash not expect the dollar to merchantability disconnected dramatically aft its parabolic rise, but to found a caller higher range, possibly betwixt 100-115 connected the U.S. Dollar Index (DXY).

I accent that bitcoin does not request a weakening dollar to detonate higher. In fact, if you look astatine the past of bitcoin charted with the DXY, you tin spot the dollar establishes a caller higher scope wherever bitcoin does merchantability off. After periods of a rising dollar, bitcoin tends to instrumentality off. I didn’t person a illustration prepared to amusement this during the unrecorded stream, but it’s included below.

(Source)

(Source)

The pinkish zones bespeak periods of rising dollar and falling bitcoin. The achromatic arrows bespeak rising bitcoin amid a dependable dollar astatine a higher range. Important to note, bitcoin and the dollar person some stair-stepped higher implicit the past 10 years, lone connected somewhat antithetic schedules.

Last, we instrumentality a look astatine the euro and sermon however and wherefore it is successful the astir occupation retired of the large currencies. We notation fragmentation hazard respective times. I did a podcast episode dedicated to that taxable recently.

(Source)

(Source)

Please cheque retired the Fed Watch Clips transmission connected YouTube, subscribe and share.

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)