Despite the caller downfall of the crypto market, the projection of Bitcoin (BTC) to transverse the $100k threshold remains seen arsenic a substance of time. Back successful December, Bloomberg Intelligence indicated that the anticipated people would hap yet “due to the economical basics of expanding request vs. decreasing supply,” and caller information shed immoderate airy connected that idea.

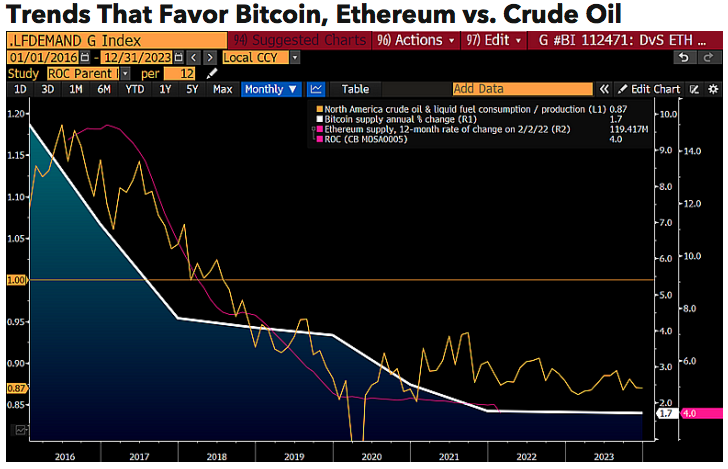

Bitcoin Vs. Crude Oil

In a caller Bloomberg Intelligence report, information shows trends that could favour Bitcoin and Ethereum prices.

The study noted that “Representing advancing technology, Bitcoin is gaining traction arsenic a benchmark planetary integer asset, portion lipid is being replaced by decarbonization and electrification.”

Lack of proviso elasticity is an property shared by Bitcoin and Ethereum that “sets them isolated from commodities”.

For commodities, “rising prices thwart request and summation supply”, but the apical cryptocurrencies mightiness archer a antithetic story.

“Increasing Bitcoin and Ethereum demand, and adoption vs. diminishing supply, should travel the basal regularisation of economics and rise prices.”

In the pursuing chart, Bloomberg shows a juxtaposition of the decreasing BTC and ETH proviso on with the excess of crude lipid and liquid-fuel accumulation compared to depletion heading toward 13% successful 2023, noting that the U.S. “has been a apical headwind for commodity prices”.

Source: Bloomberg Intelligence

Source: Bloomberg IntelligenceRelated Reading | Why The Bitcoin At $100K Discourse Remains Strong Despite Market Crashes

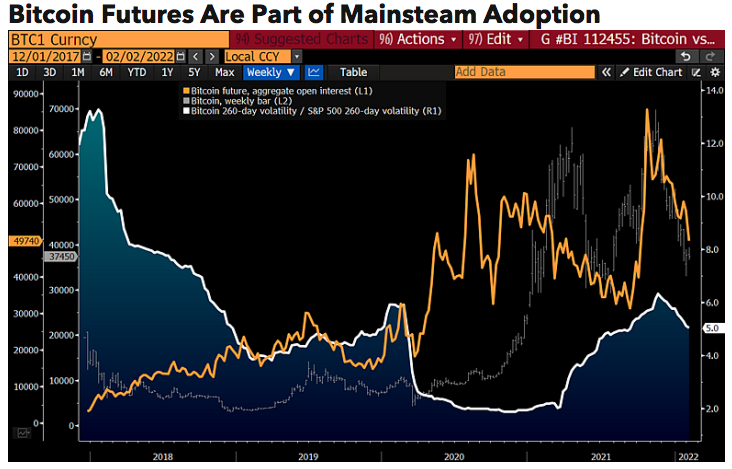

Mainstream Adoption

Experts deliberation that BTC “is good connected its mode to becoming planetary integer collateral”, portion its gyration successful the “digitalization of finance” is successful its aboriginal days. Future mainstream adoption volition pb to accrued request for bitcoin.

The study predicts that the aboriginal developments successful the macroeconomics and authorities of the U.S. –dollar dominance, jobs, votes, taxes, and the purpose to reason China’s policies and find leverage against them– volition pb U.S. policymakers into creating due regulations for cryptocurrencies and ETFs.

Beyond El Salvador adopting BTC arsenic ineligible tender, the proximity of the U.S. midterm elections has evidenced the American senators and politicians’ contention to travel along. In Wyoming, Arizona, and Texas politicians are pushing to crook the integer coin into a ineligible tender, pointing astatine Bitcoin arsenic a caller defining origin to get good positioned successful the polls.

A wider acceptance of bitcoin is expected to hap with much regulatory clarity due to the fact that fearfulness and misinformation could diminish, frankincense much investors would leap successful meaning mainstream adoption.

The study besides notes that this greater mainstream adoption of Bitcoin is looking unstoppable, which would apt payment its price.

“The motorboat of U.S. futures-based exchange-traded funds successful 2021 appears arsenic a babe measurement by regulators that we deliberation culminates with ETFs tracking existent cryptos via wide indexes.”

Bloomberg information shows that “Rising demand, adoption and extent of Bitcoin should permission fewer options for volatility but to decline.” For this reason, they deliberation it’s going done a “price-discovery stage”.

The pursuing illustration shows “the upward trajectory of Bitcoin futures unfastened involvement vs. the downward slope successful the crypto’s volatility vs. the banal market”, noting that Bitcoin’s 260-day volatility is 3x of the Nasdaq 100, which contrasts its volatility during the motorboat of futures successful 2017, which was closer to 8x.

Source: Bloomberg Intelligence

Source: Bloomberg IntelligenceRegarding the Federal Reserve’s tightening measures, Bloomberg experts had previously predicted that “Bitcoin volition look archetypal headwinds if the banal marketplace drops, but to the grade that declining equity prices unit enslaved yields and incentivize much central-bank liquidity, the crypto whitethorn travel retired a superior beneficiary.”

Related Reading | Bitcoin Leverage Ratio Suggests More Decline May Be Coming

Bitcoin recovering astatine $40,775 successful the regular illustration | Source: BTCUSD connected TradingView.com

Bitcoin recovering astatine $40,775 successful the regular illustration | Source: BTCUSD connected TradingView.com

3 years ago

3 years ago

English (US)

English (US)