PayPal’s entrance into the stablecoin market connected Aug. 7, 2023, was welcomed by galore successful the industry, with Circle CEO Jeremy Allaire stating that contention from PayPal was ‘great to have.’

The quality of the motorboat led to a humble 4% emergence successful the terms of Bitcoin, and wrong days, exchanges were offering low-fee promotional opportunities for traders consenting to utilize PayPal’s PYUSD. Before the extremity of August, Coinbase, Kraken, and HTX had listed the stablecoin, adding Venmo enactment just a period later.

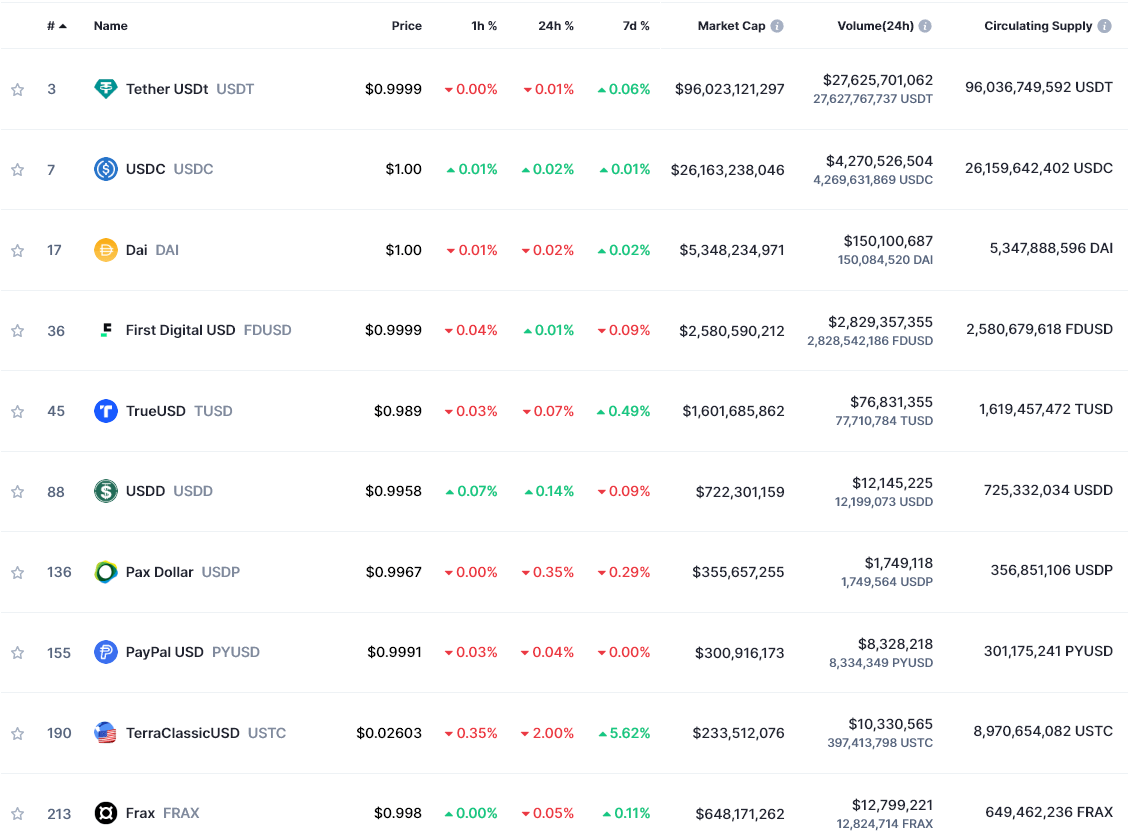

Five months aft its launch, PYUSD has present claimed the fig eight presumption by marketplace headdress successful the planetary stablecoin charts, having captured the $300 cardinal people astir Jan. 22. However, PYUSD drops to eleventh wide erstwhile ordered by volume, with conscionable $10 cardinal successful 24-hour commercialized volume. This puts it lone somewhat up of UST Classic, which, with a terms 98% disconnected its primitively intended $1 peg, traded conscionable $500,000 little implicit the past day.

Stablecoins by marketplace headdress (source: CMC)

Stablecoins by marketplace headdress (source: CMC)Still, PayPal’s PYUSD ascent to $300 cardinal successful worth locked successful 5 months is impressive. In summation to an summation successful marketplace cap, the token has seen steady on-chain activity, with a humble 200 – 400 transactions per day.

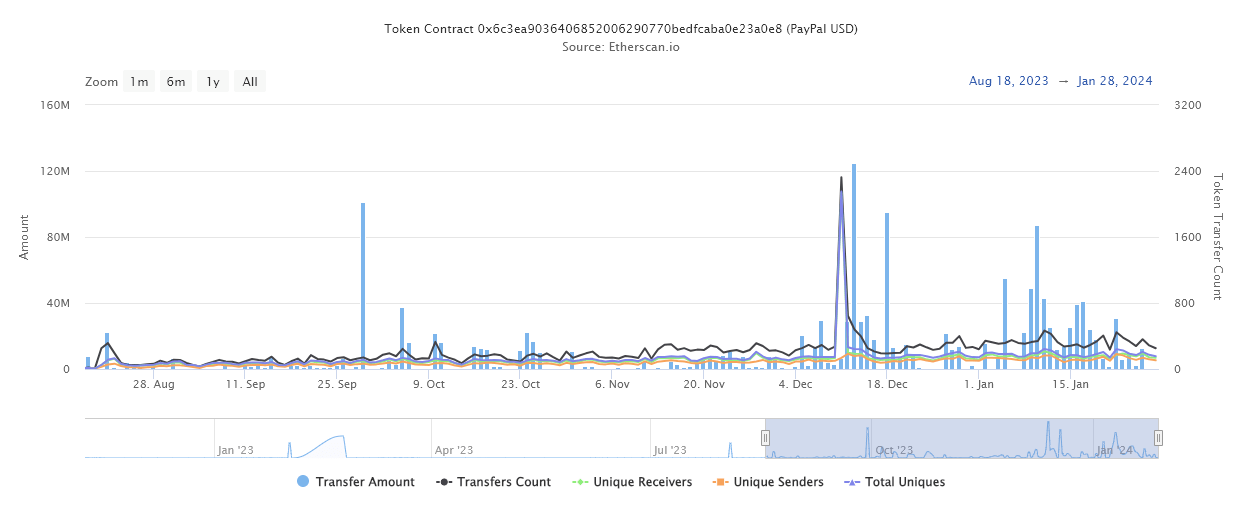

PYUSD transfers since motorboat (source: Etherscan)

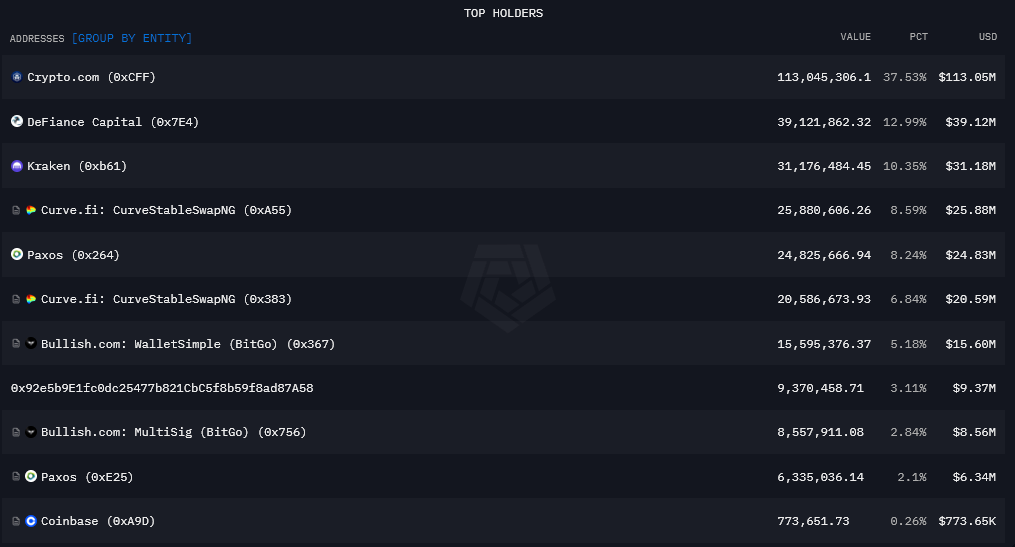

PYUSD transfers since motorboat (source: Etherscan)However, PYUSD has yet to interruption into the DeFi scenery successful immoderate meaningful way, arsenic the beneath array and diagram highlight. The bulk of the PYUSD liquidity sits connected centralized exchanges, with Crypto.com being the largest azygous holder of the token astatine $113 million, conscionable implicit one-third of the full marketplace cap.

PYUSD holders (source: Arkham Intelligence)

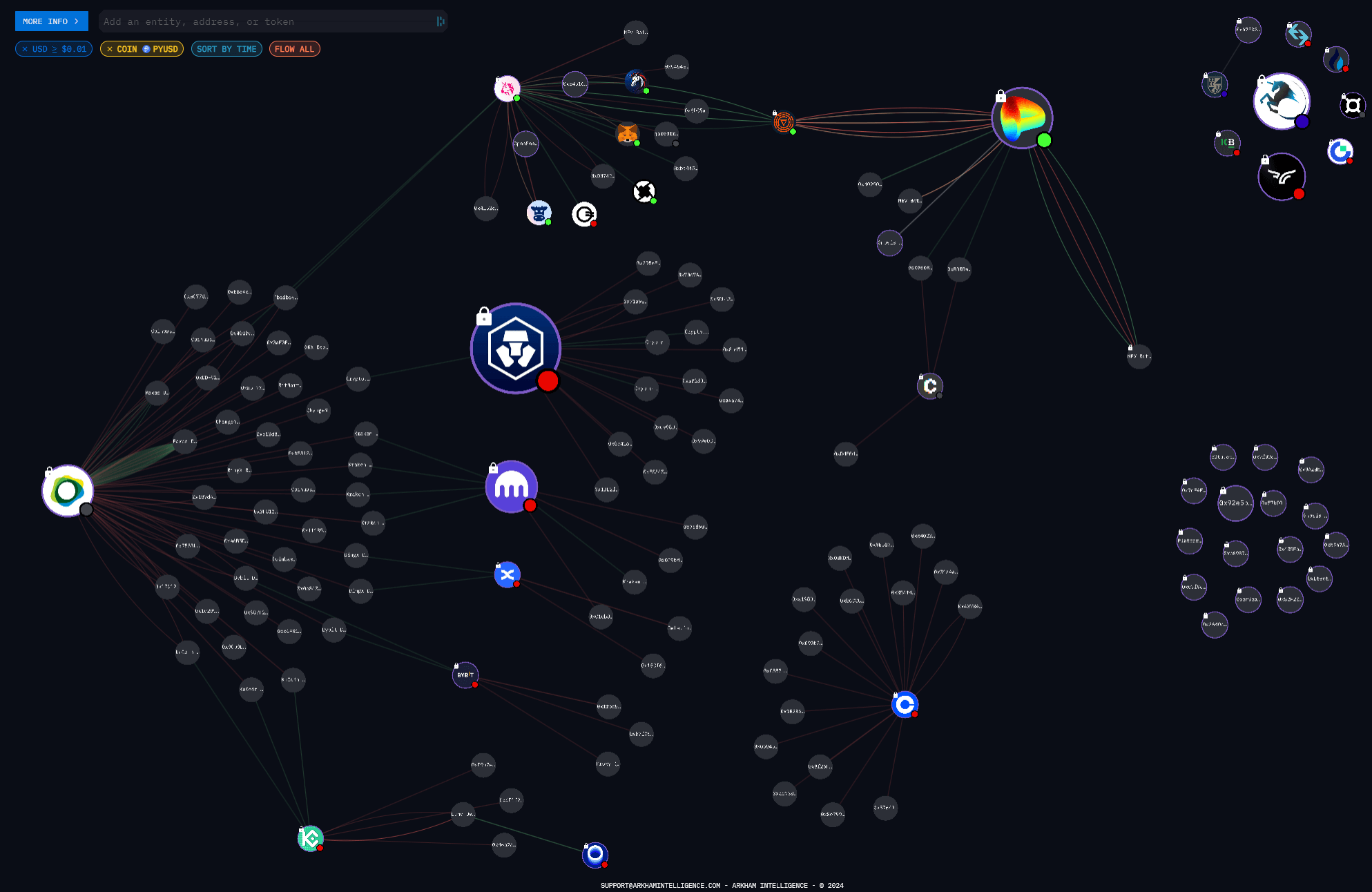

PYUSD holders (source: Arkham Intelligence)The visualization beneath depicts the transactions betwixt large entities exclusively for PYUSD. Entities with much important PYUSD holdings are shown larger than those with smaller amounts. The entities with nary logos connected the acold close are chartless wallets holding supra $30,000. The logos successful the apical close picture concern entity tokens, apt treasury holdings.

PYUSD ecosystem diagram (source: Arkham Intelligence)

PYUSD ecosystem diagram (source: Arkham Intelligence)Interestingly, determination are respective connections betwixt PYUSD issuer Paxos, Uniswap, and Curve. Yet, these entities bash not past nexus into the large exchanges, suggesting the DeFi and CEX ecosystems for PYUSD are wholly separate.

While PayPal was subpoenaed by the SEC erstwhile PYUSD had half the existent marketplace cap, it was reported to person complied with requests, and small has been heard connected the substance since. The announcement of the filing marked the section debased for PayPal’s banal terms also, with it rallying 24% since November.

Further, PayPal Ventures has precocious started utilizing the PYUSD stablecoin arsenic a mechanics for strategical investments, utilizing it for a involvement successful the organization crypto level Mesh. Amman Bhasin, Partner astatine PayPal Ventures, commented,

“As the satellite of fiscal services undergoes accelerated transformation, we judge that idiosyncratic ownership and portability of assets volition go a captious gathering artifact of merchandise innovation, with crypto serving arsenic the archetypal beachhead wherever this is possible.”

Thus, portion PYUSD inactive has immoderate mode to spell to drawback behemoths specified arsenic Circle and Tether, the debutant and web2 disruptor is surely successful the process of cementing its presumption successful the industry.

The station What happened to PayPal stablecoin PYUSD aft past year’s launch? appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)