Can Fantom proceed its growth, adjacent present it ranks 2nd largest nationalist chain?

Since the opening of 2022, Bitcoin has fallen from $68,000 to $34,000, taking astir the full crypto marketplace down with it. One exception, however, is Fantom, which has continued increasing its TVL and surpassed Binance Smart Chain and Terra.

Here’s what caused Fantom’s precipitous emergence and the problems that mightiness bring it down.

Fantom Intro

Concept

Fantom is simply a fast, high-throughput, and easy scalable Layer 1 EVM compatible nationalist concatenation launched successful December 2019. It is the archetypal nationalist concatenation supported by Lachesis, an aBFT (asynchronous Byzantine Fault Tolerance) statement algorithm based connected DAG (directed acyclic graph). Its astir notable features are:

- Low transaction costs. Only astir $1 transaction interest for 10 cardinal transactions.

- Fast transactions. 1-2 seconds to corroborate a transaction.

- High throughput. Tens of thousands of transactions tin beryllium processed simultaneously each second.

Ecosystem

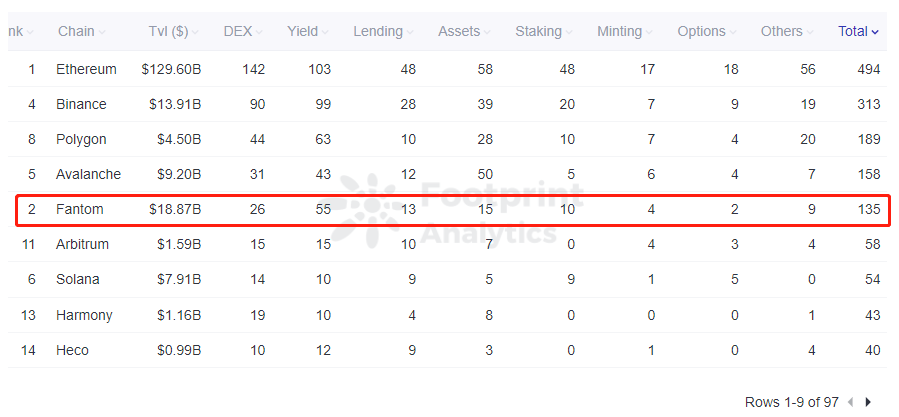

Fantom has deployed 135 protocols, covering DEX, yield, lending, assets, staking, minting, and derivatives. It is the fifth-largest nationalist concatenation successful presumption of protocols, down Polygon and Avalanche.

Footprint Analytics – Platforms Per Category by Chains

Footprint Analytics – Platforms Per Category by ChainsHowever, Fantom’s TVL is overmuch larger than Polygon oregon Avalanche, indicating a highly promising ecosystem with overmuch country for development.

In August, Fantom announced it would put 370 cardinal FTM to stimulate improvement connected the chain.

Financing

Fantom has closed 5 strategical backing rounds and has received implicit $100 cardinal successful investments from apical VCs including Alameda Research.

TVL

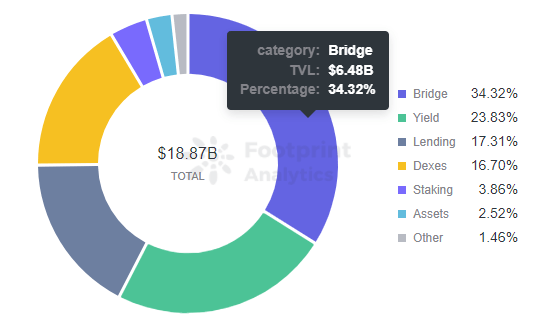

Fantom’s TVL has reached 18.87 billion, surpassing Terra and Binance to go the #2 nationalist chain. The biggest contributor to TVL are span projects, with 34.32%, followed by output projects, with 23.83%. In presumption of circumstantial protocols, Multichain (formerly AnySwap) is mode up of the rest.

Footprint Analytics – TVL Category Share of Fantom

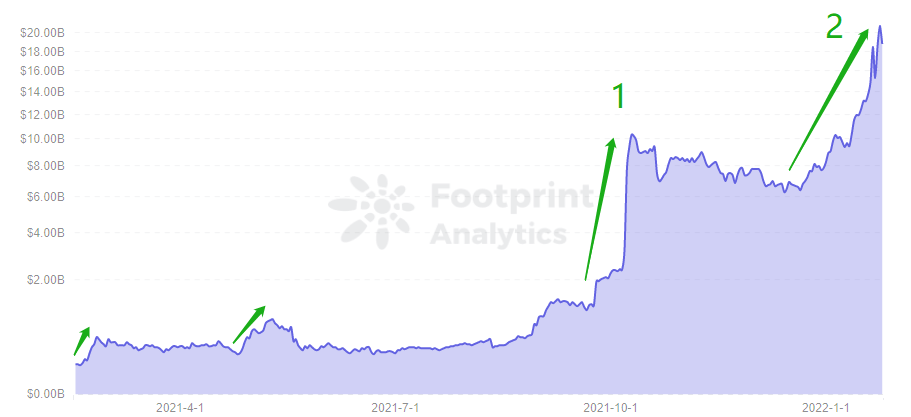

Footprint Analytics – TVL Category Share of FantomFantom TVL’s accumulation had 2 large accelerated maturation periods.

- Phase 1: Between Sept. 21 to Oct. 11: it roseate 856.5% to $10.24 billion, surpassing Tron, Avalanche, and Terra to go the fourth-ranked nationalist chain, down Ethereum, BSC, and Solana.

Reasons for accelerated growth: AnySwap and Geist Finance are the large reasons that helped Fantom explode. AnyAwap, with the summation successful request for Bridges arsenic nationalist chains battle, contributed 43% of TVL to Fantom. Geist Finance’s Staking attracted important superior astatine 14,580% APY, locking successful 34% of TVL for Fantom.

In addition, Andre Cronje announced the migration of Yearn Finance to Fantom, which gave assurance to players to participate Fantom’s DeFi project.

- Phase 2: From Jan. 1 to present. It has risen 224% to $20.83 billion, surpassing Terra and BSC to go the second-largest nationalist chain, down Ethereum.

Reasons for accelerated growth: The main crushed for this signifier is the assistance of Cronje’s influence.

On Jan. 1, Andre Cronje (founder of Yearn.finance) announced that helium would merchandise a caller protocol connected Fantom and past airdrop its token to the apical 20 TVL DeFi protocols connected the chain. The large DeFi protocols started to accumulate locked TVLs crazily, particularly 0xDAO, which uses vampire attacks to lock TVL. Eventually, Fantom TVL soared, surpassing Terra arsenic the 2nd nationalist chain.

Footprint Analytics – TVL of Fantom

Footprint Analytics – TVL of FantomInvestment Potential

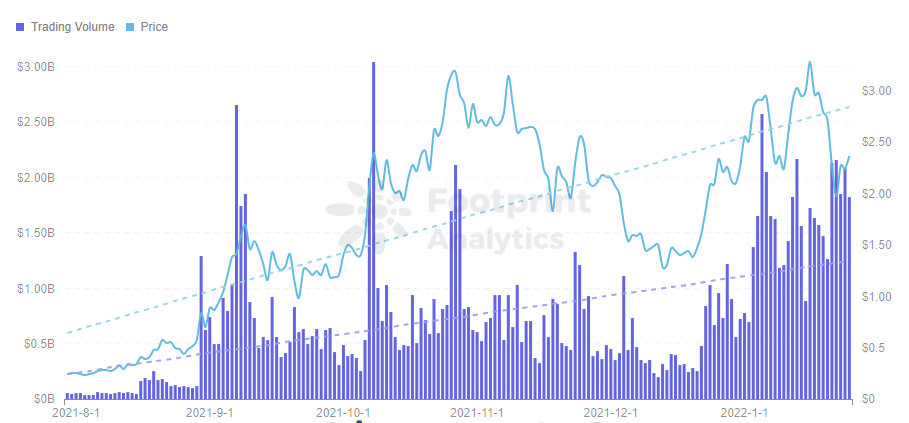

Fantom’s token was issued astatine $0.02, with a precocious terms of $3.28 and an ROI of 16,300%. The existent terms and marketplace headdress is not arsenic precocious arsenic different nationalist chains’ tokens, e.g. Terra (LUNA) and Solana (SOL).

Footprint Analytics – Trading Volume & Price of FTM

Footprint Analytics – Trading Volume & Price of FTMHowever, the accelerated maturation of Fantom has seen a turning constituent erstwhile the airdrop ended connected 25th Jan. Why?

Some thoughts connected Fantom’s existent problems…

Over-reliance connected personage influence

Fantom has seen unbelievable maturation successful the past respective months. However, it was astir wholly driven by Cronje’s support. This leaves it susceptible successful lawsuit things bash not cookware retired for him connected the protocol.

Lack of Ecosystem Attractiveness

Furthermore, portion its show is good, determination are not galore caller projects connected Fantom. Any task ecosystem needs a changeless travel of caller fresh projects to support growing.

Fewer Validator Nodes

Solana has 1,000 validator nodes and Terra has 100. Fantom has lone 50, comparatively fewer successful Top’s mature nationalist chains. Which results successful Fantom’s comparatively debased global, leaderless, and trustless nature. It means that the decentralization is not precocious capable to pull DeFi protocols, which affects TVL. That’s wherefore Fantom needs to adhd validators nodes.

In short, if Fantom wants to beryllium successful the 2nd oregon adjacent the apical presumption of the nationalist chain, the supra problems request to beryllium solved successful a bully way.

What is Footprint Analytics?

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

Jan. 2022, [email protected]

Data Source: Footprint Analytics Fantom Dashboard

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)