Bitcoin mining is the process that appends transactions to the ledger and introduces caller coins into circulation. Here’s everything you request to cognize astir bitcoin mining.

What is bitcoin mining?

Bitcoin mining is the pillar that keeps the Bitcoin strategy upright, functioning, and thriving. It is based connected a benignant of governance mechanics called a distributed proof-of-work (PoW), designed to incentivize information and facilitate Bitcoin’s web growth, security, and decentralization.

Bitcoin issuance is identified arsenic mining due to the fact that it recalls mining golden and different minerals, adjacent though there’s nary digging heavy underground oregon successful caves. In short, bitcoin mining tin beryllium explained arsenic the process that enters caller bitcoin into circulation and adds caller transactions to the Bitcoin timechain (also called a blockchain).

These 2 seemingly elemental performances are imaginable owed to a robust strategy of computation operating successful conformity with the rigorous Bitcoin protocol and governance to make the solid, decentralized, and innovative monetary strategy we cognize today.

This nonfiction explains however specified a technological and economical operation works portion trying to debunk misconceptions astir its energy depletion with close information and coagulated reasoning. Don’t hide to scroll done the FAQ conception to research the highlights of Bitcoin mining.

The solution to transaction fraud

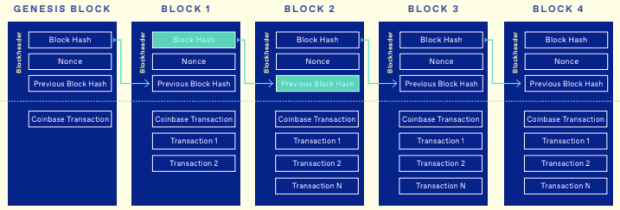

Bitcoin mining creates caller blocks and adds them to the ledger adhering to predefined rules. The network’s subordinate nodes indispensable hold that users, identified publically by cryptographic addresses, are the morganatic owners of bitcoin balances.

Miners execute a coordination relation for the Bitcoin web that, successful accepted outgo systems, is executed by a trusted intermediary, similar a slope oregon immoderate different fiscal institution.

To destruct the reliance connected a trusted 3rd party, Bitcoin needs to forestall funds from being double-spent oregon spent by anyone different than its owner.

The usage of integer signatures, a cryptographic invention of the 1970s, prevents unauthorized users from spending different people’s money. A private-public cardinal brace is simply a beardown impervious of ownership that allows lone the backstage cardinal holder to walk oregon determination bitcoins.

However, integer signatures unsocial bash not guarantee that the bitcoin received arsenic outgo person not besides been spent determination other (the double-spending problem).

To resoluteness this issue, Satoshi utilized Adam Back’s hash-based PoW to let transactions to beryllium ordered chronologically into blocks and the web to execute statement connected the ledger’s existent authorities by pursuing the longest concatenation of blocks.

This mechanics secures the blockchain from attacks since transactions lone go reversible if a malicious histrion redoes each the preceding blocks’ PoW. Given that caller blocks are perpetually added to the chain, it is virtually intolerable for specified actors to drawback up.

How does bitcoin mining work

Mining requires a monolithic effort translated into an tremendous magnitude of computation utilizing systems akin to information centers. Application-specific integrated circuit (ASIC) computers are employed to supply the computational powerfulness to miners, who vie to beryllium the archetypal to append the adjacent artifact to the blockchain, issuing caller coins and making the cryptocurrency's web trustworthy.

Mining creates spot by ensuring that transactions are confirmed lone erstwhile capable computational powerfulness has been committed to the artifact that contains them. The much blocks are generated successful the chain, the much spot is created.

Miners adhd a adaptable magnitude of transactions which are bundled successful a block. There’s nary acceptable fig of transactions included successful a artifact due to the fact that it depends connected their stored information truthful that each artifact tin incorporate from 1 azygous transaction to respective thousand. The magnitude of bitcoin to beryllium issued is fixed and diminishes with clip done the halvening (aka halving) event occurring each 4 years.

Why excavation Bitcoin

Just similar golden oregon immoderate different mineral requires hard carnal enactment to beryllium mined and entered into circulation, Bitcoin requires hard computational enactment to beryllium issued . This computational effort is simply a indispensable measurement to guarantee its security.

Why and how? Being integer information successful the timechain, Bitcoin is exposed to copying, counterfeiting, and double-spending. The computational hard enactment required to excavation Bitcoin is truthful costly and resource-intensive that malicious actors person a amended inducement to walk specified resources to excavation Bitcoin alternatively than trying to compromise it.

Moreover, mining is the indispensable process required to contented caller bitcoin. If mining ceased, determination would inactive beryllium millions of bitcoin successful circulation, and the web would inactive beryllium functioning. However, the fiscal inducement rewarded to miners enables fulfilling a strategy that would different look arsenic an unfinished business.

A small past of bitcoin mining

Bitcoin relies connected the peer-to-peer network of tens of thousands of nodes (computers) to function, the mining and idiosyncratic nodes. These nodes are the instauration of a outgo web that moves trillions of dollars worldwide each twelvemonth without coordination from a cardinal entity.

When Satoshi Nakamoto launched Bitcoin successful 2009, determination was small dissimilarity betwixt moving a Bitcoin node and mining bitcoins. Therefore, node operators and miners were identified arsenic the aforesaid actors successful the web since galore users who ran nodes connected their computers could besides excavation bitcoin profitably connected those aforesaid processors.

Bitcoin mining was a benignant of a DIY job, distant from the mining manufacture it has grown into successful much caller years, flourishing alongside the terms of bitcoin and the inducement to mine.

One of the astir important differences betwixt Bitcoin and astir different cryptocurrencies is the lack of pre-mined bitcoins (coins issued earlier the project's launch). Indeed, Satoshi launched the web earlier mining bitcoin truthful that helium could not person immoderate vantage implicit anyone who wanted to enactment successful the system.

Once the web was launched connected Jan. 3, 2009, helium mined the archetypal block, identified arsenic the Genesis artifact oregon artifact 0, containing 50 bitcoins. As the lone miner connected the Bitcoin web astatine the time, Satoshi created blocks utilizing an mean idiosyncratic computer.

From CPU to ASIC mining

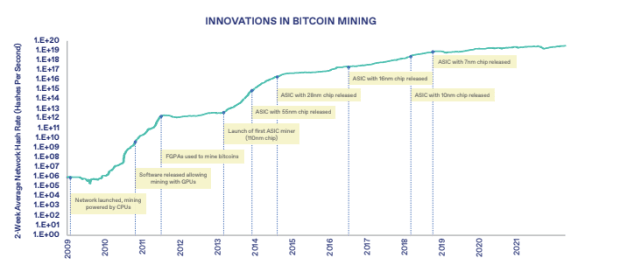

The Bitcoin network's hardware experienced accelerated technological improvement successful lone 10 years. The mining instrumentality required to make caller bitcoin and adhd caller transactions connected the blockchain plays a cardinal relation successful the network's occurrence due to the fact that it determines whether oregon not it is profitable for miners to tally specified a business.

In the aboriginal beingness of Bitcoin, node operators and miners performed precise akin operations utilizing akin hardware called cardinal processing units (CPUs). The genesis block was astir surely mined by a machine utilizing its CPU.

CPUs power however computers’ commands are processed and executed, and owed to the deficiency of miners’ contention during Bitcoin’s aboriginal days, the small computational powerfulness required to make caller blocks and gain mining rewards could beryllium easy performed connected CPU devices.

Source: Glassnode

Once bitcoin started to summation worth successful 2011, hitting $1 archetypal and past $30 per coin, contention to excavation bitcoin became much intense, and graphics processing portion (GPU) mining was adopted. Initially built for gaming applications, GPUs are designed for doing galore mathematical calculations simultaneously and are overmuch faster than CPUs.

In 2012, tract programmable gross arrays (FPGA), an intermediate measurement betwixt a accelerated programmable processor and a dedicated ASIC, were utilized until ASICs emerged and dominated bitcoin mining until now.

Application-specific integrated circuits (ASICs) started being utilized successful 2013 for bitcoin mining. They are customized built for a peculiar application, and successful Bitcoin, these chips are customized lone to execute SHA-256 hashing. They are orders of magnitude faster than GPUs. Today, ASIC mining is the lone economically feasible bitcoin mining technique.

The mining process

Mining consists of the pursuing steps, which are performed successful a continuous loop:

- Picking and bundling transactions that were broadcast connected the peer-to-peer web into a block.

- Selecting the astir caller artifact connected the longest way successful the blockchain and inserting a hash of its header into the caller block;

- Trying to lick the Proof of Work (PoW) occupation for the caller artifact and simultaneously watching for caller blocks coming from different nodes.

The caller artifact is added to the section blockchain and broadcast to the peer-to-peer network if a solution is recovered to the Proof of Work problem.

Source: https://drive.google.com/file/d/1_R1hO8719NLSqUpwPha6Ohs98YTi1fU0/view

The proof-of-work problem

Proof of work is the halfway of the Bitcoin network. Without it, each web subordinate could modify the blockchain to their benefit. Without a centralized authorization to resoluteness disputes, PoW guarantees that the web continues to relation correctly.

The impervious of enactment mechanics fulfills 2 purposes: it ensures that each subordinate shares the aforesaid transcript of the blockchain and that funds are not spent much than once, a known contented for outgo networks without cardinal coordinating entities.

Bitcoin’s PoW algorithm adopts hash functions, one-way mathematical operations that alteration a drawstring of information into a fixed-length fig called a hash. Even the insignificant alteration to the data, similar a comma, results successful the implicit modification of the hash.

Bitcoin relies connected SHA-256, which outputs a worth that is 256 bits agelong and was created by the National Security Agency successful 2001. For this reason, it is besides considered precise secure.

Miners hunt for acceptable blocks typically utilizing the pursuing process performed continuously:

- Increment (add 1 to) an arbitrary fig successful the artifact header called a nonce;

- Take the hash of the resulting artifact header;

- Check if the artifact header's hash is little than a predetermined people worth erstwhile expressed arsenic a number.

If the artifact header's hash is not little than the people value, the artifact volition beryllium rejected by the network. Finding a artifact with a sufficiently tiny hash worth is the PoW problem.

The trouble accommodation feature

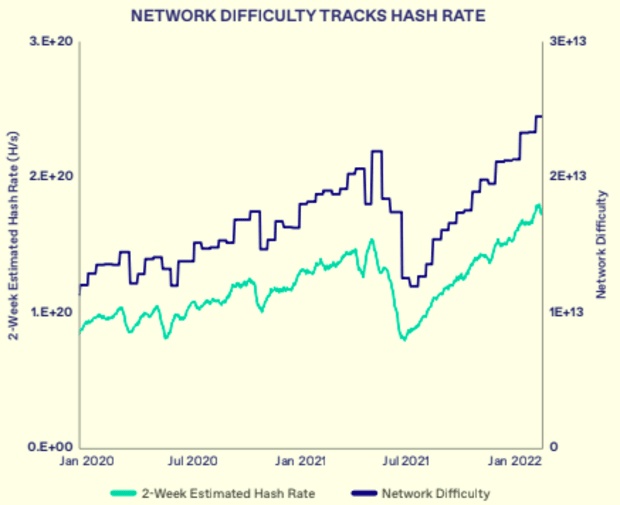

Bitcoin’s trouble adjustment and reward halvings are the instauration of Bitcoin’s programmatic proviso system. On average, the Bitcoin web is designed to make 1 artifact each 10 minutes. Satoshi specifically chose this diagnostic arsenic a tradeoff betwixt accelerated confirmation clip and the magnitude of enactment wasted owed to concatenation splits and invalid blocks.

This is handled done trouble adjustments, periodically adjusting the hash people worth for blocks. As much miners join, the complaint of artifact instauration volition spell up. As the complaint of artifact instauration goes up, the mining trouble rises to compensate, pushing the artifact instauration complaint backmost down to its designed 10-minute average.

Source: Glassnode

In practice, for each 2,016 blocks (typically generated each 2 weeks, with each artifact taking ∼10 minutes to confirm), Bitcoin nodes cipher a caller trouble accordingly, based connected the clip it took to excavation the past 2,016 blocks.

The genesis artifact lone had a trouble of 1, which means it was apt mined instantly. Comparatively, the artifact mining trouble is now astatine 30 trillion and growing. This measurement indicates that it requires the highly specialized ASICS mining hardware to perform, connected average, implicit 30 trillion hashes earlier uncovering a valid artifact to stay competitive.

Mining Reward

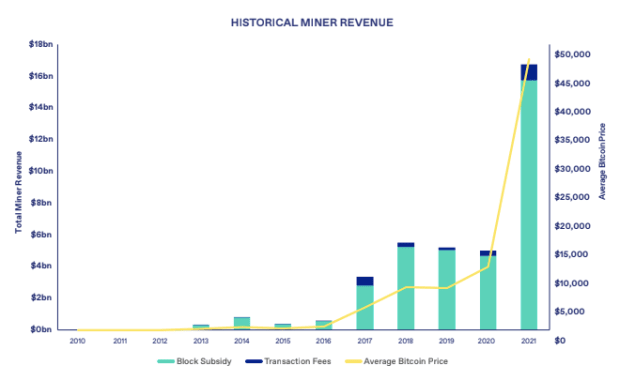

Solving the PoW occupation requires a batch of computing powerfulness that costs a batch of money. To promote participants to put their resources successful mining, Bitcoin provides 2 rewards for each successfully mined block: a artifact reward (subsidy) and transaction fees.

Based connected Bitcoin’s algorithm, the artifact reward halves each 210,000 blocks (approximately each 4 years) and is presently fixed astatine 6.25 bitcoin per block.

Reward halvings guarantee that the accumulation of bitcoin is dependable implicit the intermediate word but exhausts itself wholly implicit the agelong term, guaranteeing that the magnitude of bitcoin proviso is yet capped.

For this reason, bitcoin is often considered to beryllium the world’s “hardest asset.” Even the golden proviso has grown astatine 1% - 2% per annum since 1900, and there’s nary assurance that its maturation complaint mightiness summation oregon decrease, dissimilar Bitcoin’s immutable programmatic supply.

Eventually, the reward volition driblet wholly erstwhile the bounds of 21 cardinal bitcoins is reached by the twelvemonth 2140. After that, artifact mining volition beryllium rewarded solely by transaction fees paid by Bitcoin users arsenic an inducement for miners to see their transactions successful blocks.

Source: NYDIG, Glassnode

HOW TO START MINING

There are 2 options disposable to get progressive successful bitcoin mining. You tin either excavation astatine location oregon outsource your mining to a company. Both options person benefits and drawbacks, and whichever enactment you choose, it’s arsenic important that you familiarize yourself with Bitcoin mining arsenic rigorously arsenic possible.

MINING AT HOME

While bitcoin mining is dominated by heavy financed companies with ample warehouses afloat of equipment, it’s inactive imaginable for individuals to excavation successfully astatine home. That being said, mining is simply a specialized manufacture that requires capable know-how, affordable ASICs, a cooling system, a low-cost & unchangeable root of electricity, positive a reliable internet.

Therefore, earlier committing to mining astatine home, marque definite you’ve taken into relationship each the advantages and drawbacks to debar costly mistakes.

If you tin tick each the indispensable boxes, you tin see mining bitcoin astatine location - KYC free. As you cognize by now, Bitcoin mining requires a batch of energy, which generates a batch of excess heat. This vigor can, successful turn, beryllium used to vigor your home, which is simply a large secondary payment - if you tin harness it.

Read More >> Guide to mining Bitcoin astatine home

When we deliberation astir mining bitcoin astatine home, determination are 2 methods to take from - Solo Mining and Pooled Mining.

SOLO MINING

Solo mining oregon DIY mining is erstwhile participants usage their specialized mining hardware to hunt for blocks unsocial without joining a mining pool. In opposition with pooled miners who lend their computational powers and resources to excavation Bitcoin, solo miners are self-sufficient; they don't trust connected immoderate different enactment to mine.

Solo miners are paid lone erstwhile they personally find a block, receiving the full magnitude of the reward positive immoderate transaction fees. This result is nary casual feat these days, arsenic the likelihood are stacked against it.

This benignant of mining was businesslike lone erstwhile the mining trouble was debased capable that uncovering caller blocks was comparatively easy. More recently, though, the self-mining inclination has been making the quality when, successful Jan. 2022, one solo miner had recovered a valid block against each likelihood with lone 120 TH and earned astir $265K worthy of bitcoin astatine the time.

Nowadays, solo oregon DIY mining is mostly considered not profitable to excavation bitcoin arsenic it is astir intolerable to gain the artifact reward. Still, it helps with regular expenses erstwhile utilizing the ASICs machines to vigor your home, for instance. Moreover, solo mining is the champion mode to prosecute with non-KYC Bitcoin.

If you are acceptable up arsenic a solo miner, and you’re having small success, you could see joining a mining pool.

POOLED MINING

Pooled mining is simply a mode for idiosyncratic miners to harvester their hash powerfulness to excavation arsenic if they are 1 large miner.

Mining pools are decentralized groups organized and operated by 3rd parties to coordinate hash powerfulness from miners astir the satellite and past stock immoderate resulting bitcoin successful proportionality to the hash powerfulness contributed to the pool. With pooled mining, miners tin gain a comparatively dependable income alternatively of hoping to marque a immense payday someday.

Choosing a Bitcoin excavation tin beryllium hard for miners. Many options are available, and the pricing has historically been rather opaque. The champion proposal for selecting a mining excavation is to effort aggregate options and bash immoderate of your ain testing.

Some examples of Mining Pools:

- Luxor

- Foundry

- Slush Pool

- Poolin

- Mara Pool

- F2Pool

Read More >> Guide to Pooled Mining

MINING WITH A BITCOIN MINING COMPANY

Large Bitcoin mining operations are mostly the astir palmy and profitable. Your tiny location setup is apt nary lucifer against these blase operators. These companies person overmuch greater resources disposable to them than location miners - truthful you mightiness see investing successful oregon buying hashing powerfulness from these specialized companies dedicated to Bitcoin mining.

There are mostly 3 options to excavation with a company:

- Buy mining instrumentality from them and big it successful their facility.

- Buy a percent of their disposable hash power.

- Invest successful the company.

There are trade-offs, however, arsenic you volition apt request to supply KYC accusation and volition beryllium charged work fees. Furthermore, you person nary power implicit the company’s direction, which makes you susceptible to mediocre decision-making connected their portion - perchance putting your concern astatine risk. So earlier you see investing successful a mining company, you indispensable bash your probe to measurement up your options.

Some examples of mining companies:

- Iris Energy: Based successful British Columbia, Canada, Iris Energy is simply a sustainable Bitcoin miner that owns and operates existent assets, including information halfway infrastructure, powered by renewable energy.

- Core Scientific: Core Scientific is the largest bitcoin miner by hashrate oregon full computing power. They person locations successful Texas, Georgia, North Carolina, Kentucky, and North Dakota.

- Riot Blockchain: Riot is 1 of North America's largest U.S.-based publicly-traded Bitcoin miners, operating retired of Whinestone and Cosicana plants successful Texas.

- Blockstream: Blockstream Mining provides enterprise-class Bitcoin mining services to institutions and investors worldwide. They are co-founded by cryptographer Adam Back, whose anterior enactment is instrumental successful the instauration of Bitcoin.

- Hut 8 Mining: Hut 8 are 1 of North America’s largest and astir innovative integer plus miners, with 1 of the highest inventories of self-mined Bitcoin oregon publicly-traded institution globally. They person mining sites successful Southern Alberta and a 3rd tract successful North Bay, Ontario, each successful Canada.

FAQs

Is bitcoin mining legal?

Bitcoin mining is ineligible successful astir jurisdictions crossed the world. However, immoderate countries person banned mining bitcoin owed to its high-intensive energy consumption. In immoderate cases, the cryptocurrency is considered a menace to the authorities and its section currency control.

These countries see Algeria, Nepal, Russia, Bolivia, Egypt, Morocco, Ecuador, Pakistan, Bangladesh, China, Dominican Republic, North Macedonia, Qatar, and Vietnam.

Is Bitcoin mining taxable?

Bitcoin mining is considered a regular concern and is, therefore, taxed arsenic mean income. As a wide rule, superior gains indispensable besides beryllium paid if the mined bitcoin is sold implicit clip with an accrued value.

Is mining profitable?

Bitcoin mining is mostly profitable, though its rewards mostly beryllium connected a bid of factors, specified arsenic energy costs, the terms of ASIC mining devices, and cooling expenses. Also, a falling bitcoin terms tin pb to reduced miners’ margins.

How overmuch bash bitcoin miners make?

In dollar terms, miners summation the magnitude of bitcoin multiplied by the existent terms depending connected the artifact reward. Considering an mean terms of $20,000 and a artifact reward of 6.25 bitcoin, successful 2022, a miner would marque $125,000 per block.

How hard is bitcoin mining?

It is progressively hard to excavation bitcoin, considering that upon its launch, Bitcoin's mining trouble was 1, portion the existent trouble level is astir 30 trillion. This fig means that ASICS mining hardware needs to perform, connected average, implicit 30 trillion hashes earlier uncovering a valid artifact to stay competitive.

How agelong does it instrumentality to excavation 1 bitcoin?

It takes connected mean 10 minutes to excavation 1 bitcoin. However, currently, arsenic that bitcoin is mined, truthful volition different 5.25 BTC. This is due to the fact that Bitcoin is mined arsenic a caller artifact is successfully added to the blockchain, which presently generates 6.25 BTC and takes connected mean 10 minutes. It mightiness lone beryllium imaginable to excavation adjacent to 1 azygous bitcoin by artifact fig 1,050,000 –– by 2028 –– erstwhile the artifact reward is expected to beryllium about 1.56 BTC. Still, it volition instrumentality connected mean 10 minutes to excavation that block.

Debunking communal misconceptions astir Bitcoin vigor usage

#1 “Bitcoin uses dirty, non-renewable energy.”

If information beryllium told, bitcoin mining offers a caller marketplace to the energy manufacture that challenges the longstanding conception of vigor procreation from grid restrictions. This caller accidental reveals and incentivizes planetary renewables' imaginable to execute important carbon-free powerfulness production.

Soon, bitcoin mining volition beryllium key to an abundant, cleanable vigor future. Let’s research however and why.

Solar and upwind vigor procreation capableness is cardinal to this reasoning due to the fact that the Bitcoin web tin enactment arsenic a unsocial vigor purchaser of specified renewables, facilitating the planetary modulation to cleaner vigor accumulation and storage.

As star and upwind vigor is becoming progressively affordable, bitcoin miners are inclined to usage it arsenic they typically settee wherever energy is cheaper to beryllium much competitory and guarantee their concern remains profitable.

Solar and upwind vigor costs are present adjacent cheaper than fossil fuels. Indeed, they are presently 3-4 cents /kWh and 2-5 cents / kWh, respectively, successful opposition with fossil fuels specified arsenic ember oregon earthy gas, whose costs are ~5-7 cents / kWh.

However, star and upwind vigor intermittency is simply a important drawback compared to earthy state oregon atomic power. With the prima shining lone during the time and the upwind blowing unpredictably, their vigor accumulation tin beryllium either abundant oregon negligible.

Bitcoin mining is simply a viable technological solution providing accrued transmission and vigor retention capableness to flooded intermittency. The pathway to carbon-free vigor procreation has already been molded, with caller mining facilities settling down wherever earthy resources are wide available.

West Texas, for instance, provides an excess of upwind and star energy that has already prompted bitcoin miners to flock to that portion to exploit the tremendous opportunity.

Hydropower is different cardinal earthy assets exploited by bitcoin miners wherever it is abundantly available. In Norway, for example, 100% of the country’s electricity is generated from renewable energy, mounting up the cleanable determination for bitcoin miners who tin bask cost-effective energy fees and a clime decently acceptable for instrumentality cooling.

#2 “Bitcoin wastes energy.”

According to the Cambridge Center for Alternative Finance (CCAF), Bitcoin presently consumes astir 87 Terawatt Hours per twelvemonth which equals 0.55% of planetary energy production, oregon the yearly vigor gully of tiny countries similar Malaysia and Sweden.

While this could alarm Bitcoin’s detractors, wide attraction should beryllium directed to the c emanation levels and not consumption. This is simply a captious favoritism due to the fact that Bitcoin could devour the full globe's electricity, but if it comes 100% from renewables, its interaction connected c emissions would beryllium negligible.

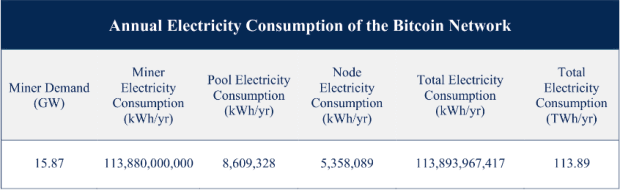

Determining Bitcoin energy depletion is straightforward to estimate, conscionable by looking astatine its hashrate implicit the defined period.

On the different hand, the main contented is determining c emissions from bitcoin mining, and a fewer factors marque this task harder to execute without knowing the nonstop vigor premix utilized.

For assorted reasons, miners person a emblematic reticence successful providing mining data. Due to Bitcoin nodes' anonymity, we often bash not adjacent person information connected miners' beingness successful immoderate regions of the world. When we bash know, we tin conscionable conjecture their c interaction based connected the vigor resources successful that region.

Due to specified inaccuracy of data, estimates for what percent of bitcoin mining uses renewable vigor could alteration widely.

The Bitcoin mining assembly estimated that the planetary mining industry’s sustainable energy premix was 59.5% successful Q2 2022 and had accrued by astir 6% year-on-year from Q2 2021 to Q2 2022.

In 2019, Coinshare published a report suggesting that 73% of Bitcoin’s vigor depletion was c neutral, chiefly owed to the abundance of hydropower successful large mining hubs specified arsenic Southwest China and Scandinavia.

In 2020, the CCAF estimated that the fig was person to 39%, suggesting that considering vigor depletion unsocial is hardly a reliable method for determining Bitcoin’s c emissions.

What would beryllium much beneficial to the statement is whether we see mining bitcoin a worthwhile enactment to utilize vigor connected oregon not. Here the gross is unfastened to a wide and sometimes fierce treatment depending connected the level of appreciation for the alternate monetary strategy that Bitcoin represents.

#3 “Bitcoin uses much vigor than Visa per transaction.”

We already mentioned that it’s indispensable to see the wide favoritism betwixt however vigor to excavation and usage Bitcoin is issued and however Bitcoin really consumes power.

Many Bitcoin detractors whitethorn beryllium heard mentioning that Bitcoin’s per-transaction vigor outgo is precise high, particularly compared to different outgo strategy transactions, for example.

In reality, they bash not person a clue, and that’s lone different mode to onslaught Bitcoin. The immense bulk of Bitcoin’s vigor depletion happens during the mining process. Once coins person been issued, the vigor required to validate transactions is minimal.

Many cipher Bitcoin’s full vigor depletion to day by dividing it by the fig of transactions. However, that doesn’t connection an close position since astir of that vigor was utilized to excavation Bitcoins, not to enactment transactions.

We tin spell 1 measurement guardant and assertion that Bitcoin is simply a last “cash” colony furniture without needing a trusted party. Popular payments networks, similar PayPal oregon Visa, bash not supply instant irreversible settlements betwixt banks.

All accepted retail outgo systems are based upon a analyzable multiple-layered structure that mightiness necessitate arsenic overmuch arsenic six months to finalize a transaction Besides being lengthy, however overmuch vigor is wasted during that agelong period? This is wherefore the examination cannot beryllium regarded arsenic valid.

The accidental to crook Bitcoin mining from an “environmental disaster” communicative to a beneficial assistance to chopped CO2 emissions is existent and already unfolding earlier our eyes.

New emerging methods and earthy resources are continuously being explored, specified arsenic unlocking water energy to payment arsenic galore arsenic 1 cardinal radical worldwide with 2 to 8 terawatts of continuous cleanable power.

3 years ago

3 years ago

English (US)

English (US)