Bitcoin is money. That means it’s openly competing with the incumbent fiat monetary regime. A co-circulation of 2 types of wealth isn’t unprecedented, and the economical rule that describes the result is known arsenic Gresham's law. Applying Gresham’s penetration to the bitcoin-fiat dynamic, we find that HODLing is economically rational nether existent conditions.

The Hierarchy Of Monetary Needs

To recognize the rationality of HODLing, let’s concisely recap wherefore an precocious civilization needs decently functioning money.

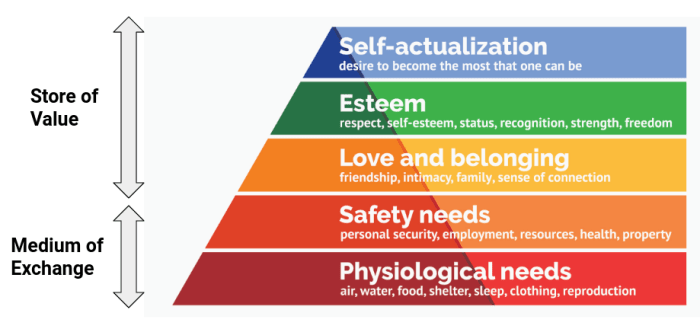

Human enactment is purposeful behavior, and the foremost intent connected everyone’s caput is to fulfill their astir pressing needs first. If a idiosyncratic owns wealth and their basal needs are not satisfied, they volition astir apt take to exchange their wealth for food, apparel and structure earlier thing else. Only erstwhile their basal needs are satisfied tin wealth beryllium saved to get the restitution of much blase needs successful the future.

Money needs to enactment arsenic a mean of speech archetypal and foremost. But the urgency of this relation is rapidly saturated and the store of worth relation of wealth rapidly becomes the astir important.

Medium Of Exchange Or Store Of Value?

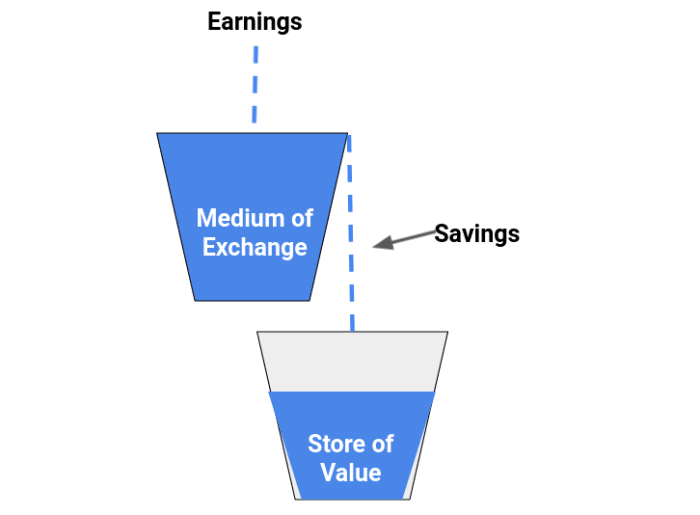

We tin exemplify the 2 functions of wealth and their narration successful the signifier of buckets. The mean of speech is the archetypal bucket we request to capable successful bid to fulfill our basal needs. Once that bucket is full, it overflows into the store of worth bucket. The mean of speech bucket has a constricted capacity, arsenic determination are a constricted magnitude of goods and services we request to bargain and devour successful a abbreviated clip frame. The store of worth bucket, connected the different hand, has an infinite capacity, arsenic we tin ever summation the size of our savings.

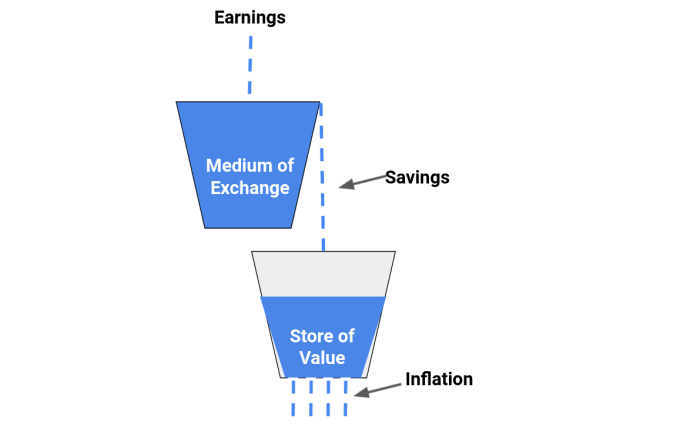

The occupation is that fiat wealth isn’t a precise bully savings container. Fiat is wealth with infinite supply, and each caller dollar dilutes the purchasing powerfulness of each the outstanding dollars. In the 20 months since January 2020, the U.S. dollar money supply roseate by 35% — that is, by $5.4 trillion — and this has resulted successful exploding prices each crossed the board: user goods, material, houses, fiscal instruments. Fiat is simply a precise leaky bucket, due to the fact that thing saved volition gradually suffer its purchasing power.

With those insights successful mind, let’s spot however Bitcoin fits in.

Gresham Meets Nakamoto

Bitcoiners sometimes invoke Gresham’s instrumentality arsenic a crushed wherefore Bitcoin volition succeed, but the information is that it’s not applicable successful its archetypal signifier to the contiguous situation.

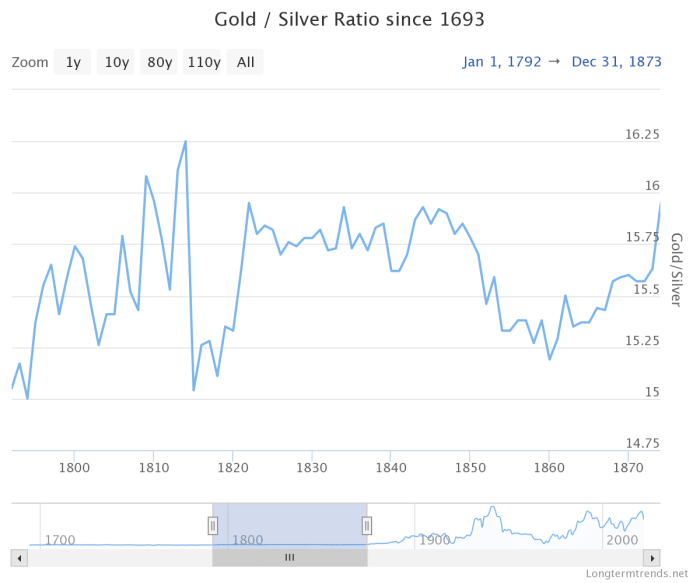

Gresham’s investigation covers a lawsuit of 2 currencies wherever the look worth of some currencies is acceptable by the government. The champion humanities illustration of Gresham’s instrumentality successful enactment is the epoch of bimetallism. Between the years of 1792–1873, the look worth of golden and metallic was fixed — astatine archetypal successful the ratio of 15 to 1 — truthful that 15 ounces of metallic were deemed adjacent to 1 ounce of gold. But the occupation was that the terms ratio of golden and metallic oscillated astir this parity implicit time, starring to 1 metallic being overvalued and the 2nd being undervalued. The authorities made respective adjustments to this fixed, face-value ratio until it yet relinquished the thought of bimetallism and shifted to a axenic golden modular successful 1873.

The marketplace ratio betwixt golden and metallic was volatile successful the U.S. bimetallism period. The fixed ratio betwixt the 2 metals was 15:1 successful 1792–1837, aboriginal changed to 16:1 successful 1837–1873. Silver became undervalued successful the second period, it was driven retired of circulation, and yet abandoned successful favour of the axenic golden modular (Source).

As Murray Rothbard points retired in, “What Has Government Done to Our Money,” the close phrasing of Gresham’s instrumentality isn’t the fashionable “bad wealth drives retired bully money” but alternatively “money overvalued artificially by authorities volition thrust retired of circulation artificially undervalued money.”

Clearly this doesn’t use to the bitcoin-fiat dynamic, arsenic the authorities doesn’t acceptable the look worth of bitcoin. So, successful bid to use the insights of Gresham's instrumentality successful the discourse of bitcoin, we request to dissect Gresham’s penetration and travel up with a modified mentation of the archetypal instrumentality that takes into relationship a co-circulation of fiat and non-fiat money.

For that, I judge that we request to further rephrase Rothbard’s mentation of Gresham’s law. What does it really mean that 1 benignant of wealth drives retired the different from circulation? Through the lens of monetary functions, it means that 1 currency takes connected the relation of being a mean of exchange, and the different a store of value.

So, the dissected mentation of the archetypal Gresham’s instrumentality would past read:

Overvalued wealth volition go the ascendant mean of speech successful the economy, portion the undervalued wealth volition go the ascendant store of value.

This is precisely what happened successful the bimetallism era, erstwhile golden became the preferred mean of speech instrument, portion metallic was “hoarded” arsenic a store of value.

Now to yet use this penetration to bitcoin versus fiat, we person to get escaped of the overvalued and undervalued parameters. I judge that these tin beryllium replaced by a forward-looking valuation of the respective monetary policies of fiat and bitcoin. Fiat is simply a benignant of wealth with perchance infinite issuance, portion bitcoin is simply a benignant of wealth with a guaranteed, fixed issuance. (For those wondering whether bitcoin’s issuance is truly guaranteed, I urge speechmaking done Parker Lewis’ “Bitcoin Is Not Backed by Nothing,” wherever helium explains the credibility of bitcoin’s monetary policy).

It’s harmless to presume that fiat volition support connected inflating and frankincense dilute the purchasing powerfulness of each the outstanding units.

It’s besides harmless to presume that bitcoin volition support existent to its monetary argumentation of fixed issuance, truthful the purchasing powerfulness of the outstanding units volition not beryllium diluted successful the future.

Now we tin restate Gresham’s instrumentality to relationship for the co-circulation of fiat and non-fiat money.

Presenting,

Nakamoto-Gresham’s Law

Bitcoin drives retired fiat arsenic a store of value.

Fiat drives retired bitcoin arsenic a mean of exchange.

In layman’s terms, it’s rational to walk fiat and HODL bitcoin. Fiat loses its worth implicit time, truthful we people look for ways to get escaped of it. Bitcoin gains successful worth implicit time, truthful we people look for ways to clasp connected to it.

We volition spot the strengthening effects of Nakamoto-Gresham’s instrumentality arsenic much radical recognize that (1) fiat volition support connected failing successful its relation arsenic a store of value, and (2) bitcoin volition support connected gaining traction for its store of worth function, mostly done its expanding credibility of being the world’s lone monetary instrumentality with a predictable monetary policy.

However, determination are 2 conditions to Nakamoto-Gresham’s law:

Condition A: Fiat is usable arsenic a mean of exchange. This is not the lawsuit successful immoderate countries (especially successful the lawsuit of cross-border payments), truthful we whitethorn spot bitcoin besides being utilized arsenic a mean of speech successful specified places. El Salvador’s rising usage of the Lightning Network for remittance payments is an apt illustration of bitcoin being utilized arsenic a mean of speech due to the fact that of fiat’s shortcomings.

Condition B: An idiosyncratic oregon institution receives fiat earnings. Fiat earners volition look to get escaped of fiat earlier bitcoin. If the fixed idiosyncratic oregon a institution is already afloat bitcoinized and handles bitcoin only, past bitcoin people becomes a mean of speech arsenic well.

Bitcoin Prevents Civilizational Degradation

Economists, pundits and talking heads of each kinds who knock bitcoin for not being a wide mean of speech are missing the point. In the leaky bucket situation we are in, we don’t request different mean of exchange, particularly erstwhile fiat inactive serves this relation satisfactorily and astir of our wages are inactive successful fiat. It would beryllium rather irrational to walk bitcoin portion we inactive person fiat to spend. HODLing bitcoin is simply a purely rational enactment arsenic it provides america with the store of worth relation that fiat progressively fails to sustain.

When fiat ceases to fulfill the relation of the mean of exchange, oregon erstwhile individuals person the entirety of their net successful bitcoin, lone past does it marque consciousness to regularly walk bitcoin connected regular purchases.

Bitcoin becoming a wide store of worth mightiness beryllium to beryllium a civilization-saving event. Developed civilizations request a reliable store of worth to physique and sphere wealth. When we don’t physique up savings and alternatively walk everything we gain (and more, via debt), our infrastructure becomes fragile, societal values go corrupt, and the aboriginal becomes highly discounted. We spot wherever this leads to done galore humanities examples: coin debasements of Ancient Rome led to the empire’s collapse; hyperinflations of the 20th and 21st period led to war, totalitarianism and famine. We tin flight this fate, some connected the idiosyncratic and societal level, by embracing Bitcoin.

This is simply a impermanent station by Josef Tětek. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC, Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)