Dec 2022, CoinGecko and Footprint Analytics Joint Report

There is an underlying presumption that the full NFT marketplace is fraudulent successful quality and lone consists of lavation traders. Unfortunately, we often spot media headlines pushing this narrative. After all, wherefore would radical walk millions of dollars connected a JPEG?

There is an underlying presumption that the full NFT marketplace is fraudulent successful quality and lone consists of lavation traders. Unfortunately, we often spot media headlines pushing this narrative. After all, wherefore would radical walk millions of dollars connected a JPEG?

Wash trading is the enactment of a trader buying and selling the aforesaid plus repeatedly to manipulate the trading volumes and the terms of an asset. Parties progressive whitethorn dwell of a azygous entity oregon a collusion of entities. It is amerciable successful accepted superior markets to lavation trade, arsenic the intent is often to mislead different buyers/sellers that the plus is worthy a batch much than it is and that determination is an artificially liquid marketplace for the asset.

Crypto, specifically NFTs, does not person strict regulations, and lavation trading tin sometimes beryllium rampant. In summation to the reasons stated supra for lavation trading, 2 different reasons are unsocial to NFTs: taxation nonaccomplishment harvesting and earning token rewards.

Wash Trading For Price/Liquidity Manipulation

Attention is everything for NFTs. In a abstraction wherever collections unrecorded and dice by the hour, founders volition bash immoderate they tin to pull eyeballs and make momentum. The easiest mode to garner attraction is by appearing connected the beforehand leafage of NFT marketplaces. OpenSea, LooksRare, Magic Eden, etc., each person a landing leafage that showcases trending collections.

Source: OpenSea

Source: OpenSeaWhile nary of the marketplaces are explicit astir however their trending algorithms operate, it is wide that trading volumes are a important origin for inclusion connected the Trending Collections list. This incentivizes NFT postulation founders to lavation commercialized to pump their trading measurement numbers, thereby expanding the accidental of their collections being listed connected Trending. Unfortunately, Wash trading besides gives a mendacious content of liquidity, generating mendacious assurance that determination is request and hype surrounding their NFTs. Inevitably, this whitethorn entice unsuspecting buyers into buying their NFTs astatine an inflated price.

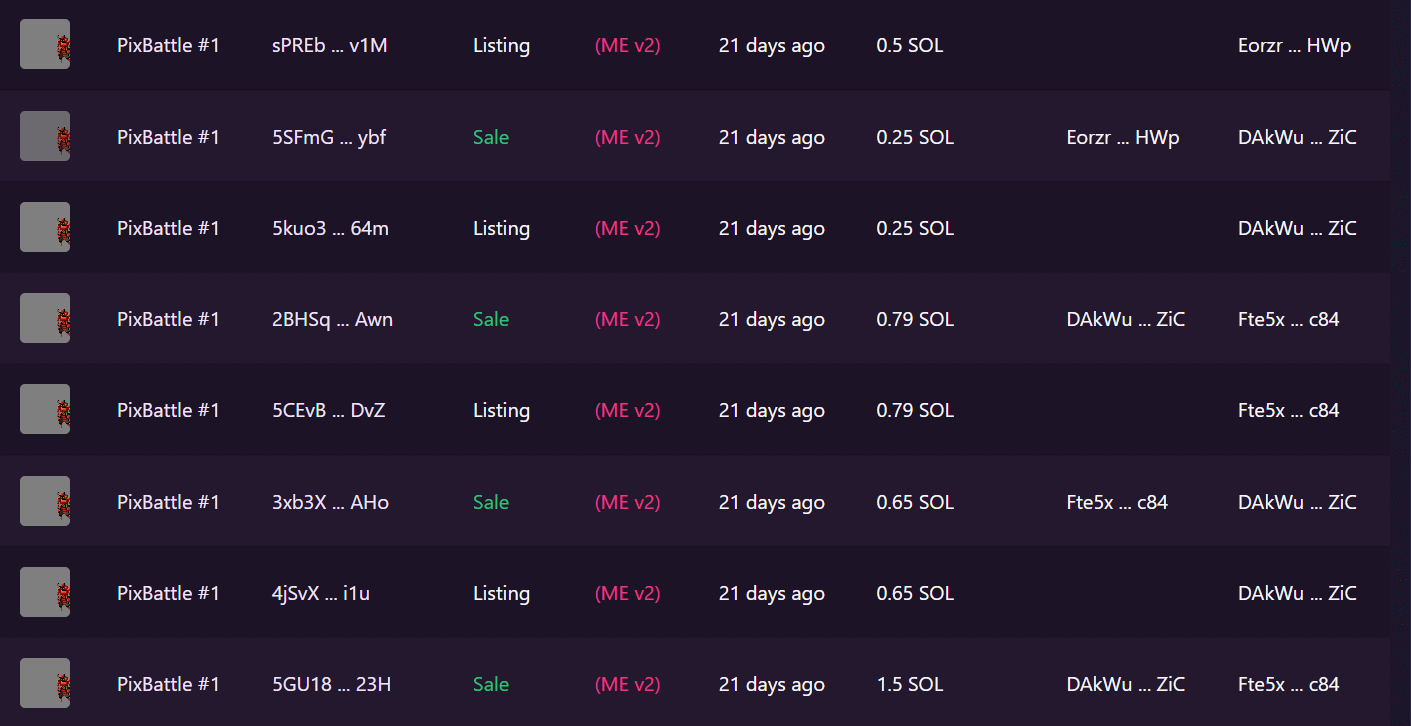

One illustration that we person identified is PixBattle #1, a gaming task who stylized itself arsenic the archetypal pixel crippled connected Solana.

Source: Magic Eden

Source: Magic EdenThe screenshot supra shows that a azygous NFT was repeatedly traded betwixt 2 addresses implicit a day. There is nary crushed for this to hap different than to falsify trading measurement and interest. The trader besides didn’t fuss to effort excessively hard to fell their tracks by repeatedly utilizing the aforesaid 2 addresses. Moreover, utilizing the NFT with the #1 ID (thereby indicating it was minted first) raises the likelihood that the trader was astir apt a laminitis of the postulation who knew firsthand erstwhile it would beryllium launched.

Source: Magic Eden

Source: Magic EdenIf we look astatine the illustration connected Magic Eden, we tin spot immoderate unwitting suspects buying the apical earlier liquidity dried up overnight and the postulation went to 0.

Identifying Wash Trades

While it is adjacent to intolerable to place each collections that transportation retired lavation trading arsenic it involves filtering an extended information acceptable based connected qualitative factors, these are immoderate communal signs to look retired for:

- Collection trades astatine a persistent terms level (i.e., nary outlier buys for ‘rares’).

- Collection has precocious trading measurement / is trending but has debased visibility / mediocre societal media metrics (e.g., debased Twitter follower count)

- An NFT was bought much than a mean magnitude of times successful a time (at Footprint Analytics, we estimation this to beryllium much than 3+)

- An NFT was bought repeatedly by the aforesaid purchaser code implicit a abbreviated period, accidental 120 minutes.

Wash Trading For Harvesting Tax Losses

Another crushed for lavation trading is for taxation nonaccomplishment harvesting. Certain jurisdictions, specified arsenic the US and Europe, dainty NFTs arsenic superior assets and enforce immoderate signifier of superior gains tax. This means that traders wage taxation connected gains but tin typically offset concern losses successful the last taxation calculation. However, this lone applies erstwhile the capitalist has realized their gains and losses, i.e., they request to merchantability their assets. Under these circumstances, buyers who bought the apical but are present down severely whitethorn beryllium incentivized to merchantability their NFTs astatine a nonaccomplishment to offset gains they whitethorn person made successful different superior assets. Technically, tax-loss harvesting is neither uncommon nor is it an amerciable phenomenon. However, due to the fact that of the easiness with which NFTs tin beryllium lavation traded, we judge this warrants a mention.

It is casual to merchantability an NFT to different wallet that you really power ‘at a loss’ connected an NFT marketplace. Setting the terms astatine a nominal magnitude (e.g., 1 USDC) allows the idiosyncratic to harvest taxation losses portion possessing the expected ‘disposed of’ asset. Unfortunately, the deficiency of regulatory oversight implicit NFT marketplaces and the trouble of proving taxation fraud promote this technique.

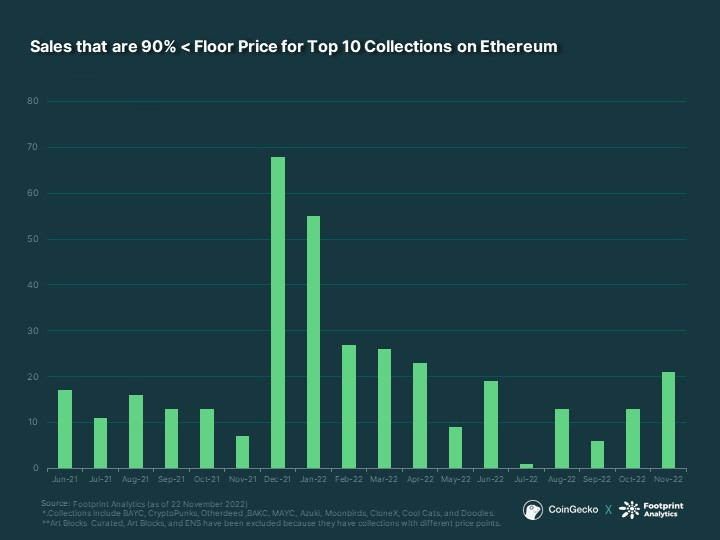

If we look astatine the Top 10 Collections connected Ethereum, we tin spot that determination are actors successful the abstraction who bash instrumentality vantage of this. We person filtered the transactions based connected income beneath 90% of the level terms astatine the time.

Source: Footprint Analytics (as of 22 November 2022)

Source: Footprint Analytics (as of 22 November 2022)Looking astatine the income pattern, the highest monthly income occurred successful December 2021, followed by January 2022. Coincidentally, this is the adjacent of the taxation reporting play for galore jurisdictions. It is astir apt harmless to presume that astir (if not all) of these transactions progressive immoderate intent to harvest taxation losses during this play arsenic plus holders hole to record their taxation returns.

Source: Footprint Analytics (as of 22 November 2022)

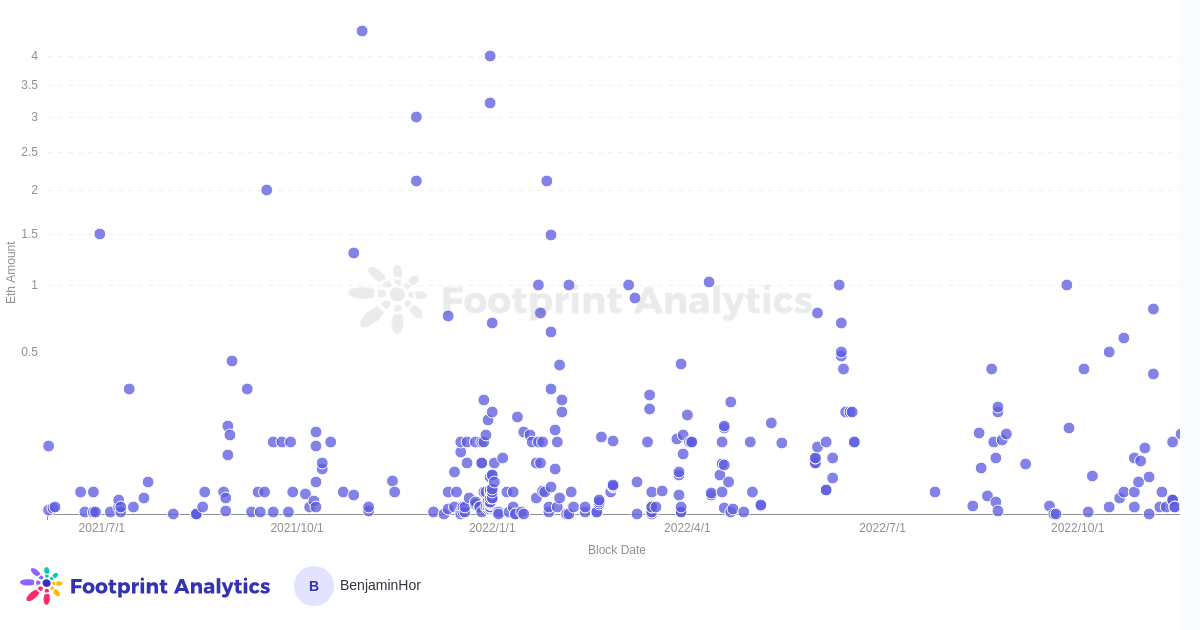

Source: Footprint Analytics (as of 22 November 2022)Within the Top 10 ETH Collections, the apical 3 favourite collections for harvesting taxation losses are MAYC (117), Cool Cats (74), and CloneX (61). Furthermore, lavation traders nether this class look to merchantability astatine meager prices, i.e., beneath 0.5 ETH and astir adjacent to 0, making them evident outliers for immoderate on-chain observers.

Nevertheless, it is worthy mentioning that determination whitethorn beryllium different reasons for having these low-priced sales, specified arsenic incorrect listing prices and selling to idiosyncratic astatine a discount.

Wash Trading For Tokens

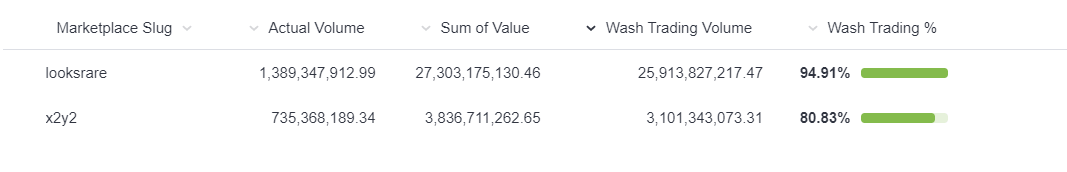

LooksRare and X2Y2 are the astir well-known NFT marketplaces with their ain token. Currently, tokens are distributed to high-volume traders connected their respective platforms. Wash traders instrumentality vantage of this look and maximize their rewards by generating sizeable trading measurement regular done back-and-forth trading betwixt wallets they own. To place these types of transactions, we person filtered transactions connected some LooksRare and X2Y2 according to the pursuing formula:

- Overpriced NFT trades (10x OpenSea Average Price)

- Collections with 0% royalties (except CryptoPunks and ENS)

- An NFT bought much than a mean magnitude of times successful a time (currently filtered for much than 3+)

- An NFT purchased by the aforesaid purchaser code successful a abbreviated play (presently filtered for 120 minutes)

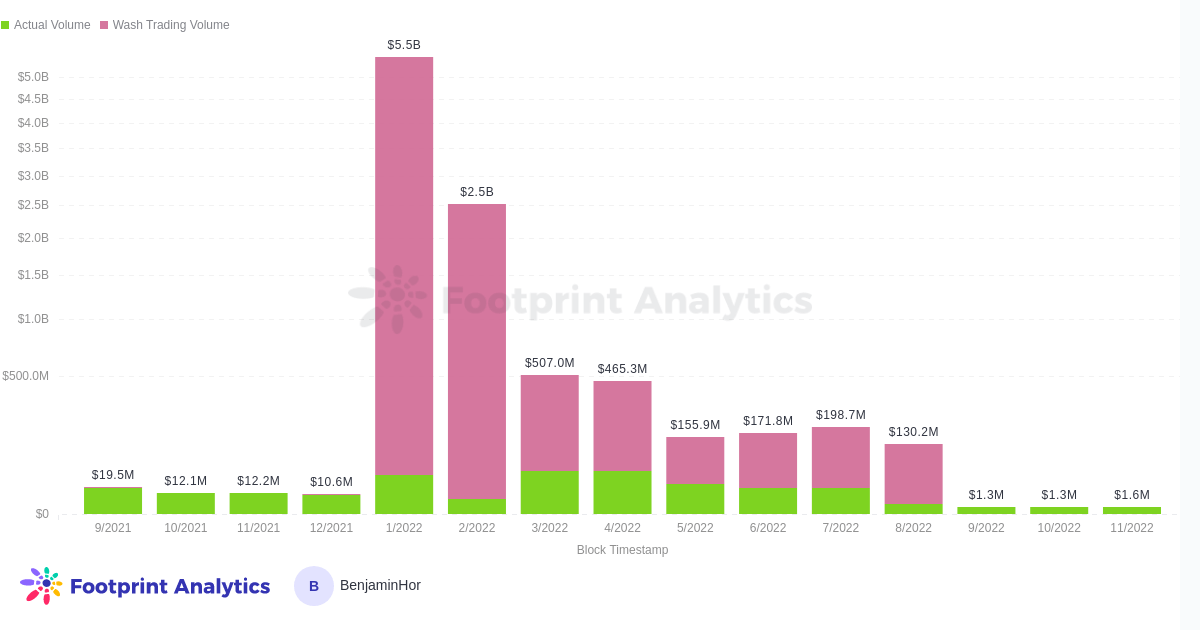

Applying these filters, it seems that much than 80% of the trading measurement for these 2 marketplaces are lavation trading transactions since launch:

Source: Footprint Analytics (as of 22 November 2022)

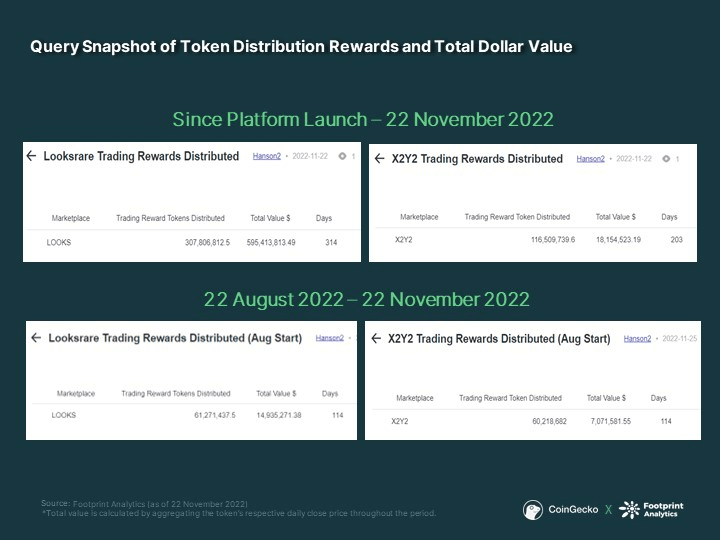

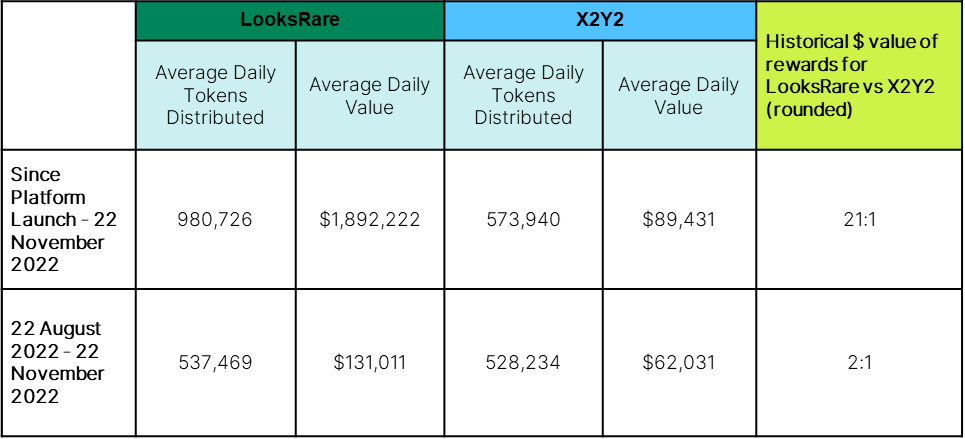

Source: Footprint Analytics (as of 22 November 2022)We judge LooksRare has a higher lavation trading measurement due to the fact that its rewards are much lucrative. Therefore, we’ve calculated the full worth of organisation rewards measured against each token’s regular adjacent terms since launch. Below are the results up till 22 November 2022.

Source: Footprint Analytics (as of 22 November 2022)

Source: Footprint Analytics (as of 22 November 2022)If we instrumentality the humanities average, for each dollar you gain connected X2Y2 from trading rewards, you would person earned twenty-one much connected LooksRare. However, this fig is misleading arsenic LooksRare launched astir 3 months earlier X2Y2 erstwhile the marketplace was inactive exuberant, and the prices of LOOKS (LooksRare’s token) were overmuch higher. After the archetypal hype died down and the carnivore marketplace kicked in, the trading rewards normalized to much adjacent levels. Even so, LooksRare inactive offers doubly arsenic overmuch dollar worth based connected the past 3 months.

Nevertheless, these are lone wide assumptions, arsenic the rewards are highly babelike connected the percent of the platform’s respective regular trading volumes. For example, X2Y2 tin person higher rewards for a peculiar time if the full income measurement is little (thus giving the seller a higher % of token rewards) oregon if the token’s terms is higher.

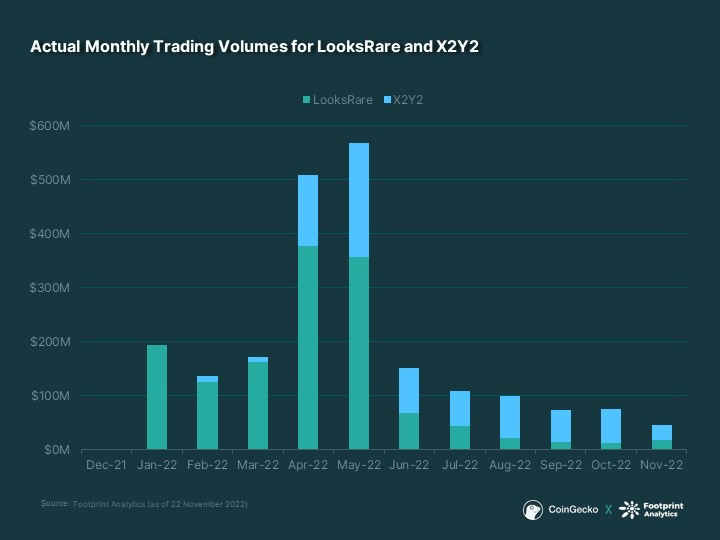

Funnily enough, though LooksRare distributes much worth connected average, X2Y2 has much integrated volumes. Moreover, since June 2022, X2Y2 has consistently outperformed LooksRare successful monthly trading volumes (disregarding lavation trading volumes).

Source: Footprint Analytics (as of 22 November 2022)

Source: Footprint Analytics (as of 22 November 2022)A apt mentation is an quality of being much cost-effective. X2Y2 charges a 0.5% marketplace interest and offers optional royalties (though this feature has been retracted arsenic of 18 November 2022), whereas LooksRare has a higher trading interest (2.0%). However, adjacent if we origin successful LooksRare’s higher trading fee, it has ever been cheaper to commercialized connected LooksRare aft we offset token rewards. We tin lone surmise that X2Y2’s selling strategy is much effectual wherever quality science favors ‘discounts’ implicit ‘cashback.’ This is besides contempt LooksRare’s mean staking rewards being higher for its token (53.61%) than X2Y2’s (38.81%) arsenic of 22 November 2022.

Trading Demographics and Patterns

Because of the prevalence of this lavation trading method, we thought it would beryllium absorbing to dive a small deeper into the trading patterns of LooksRare / X2Y2 lavation traders.

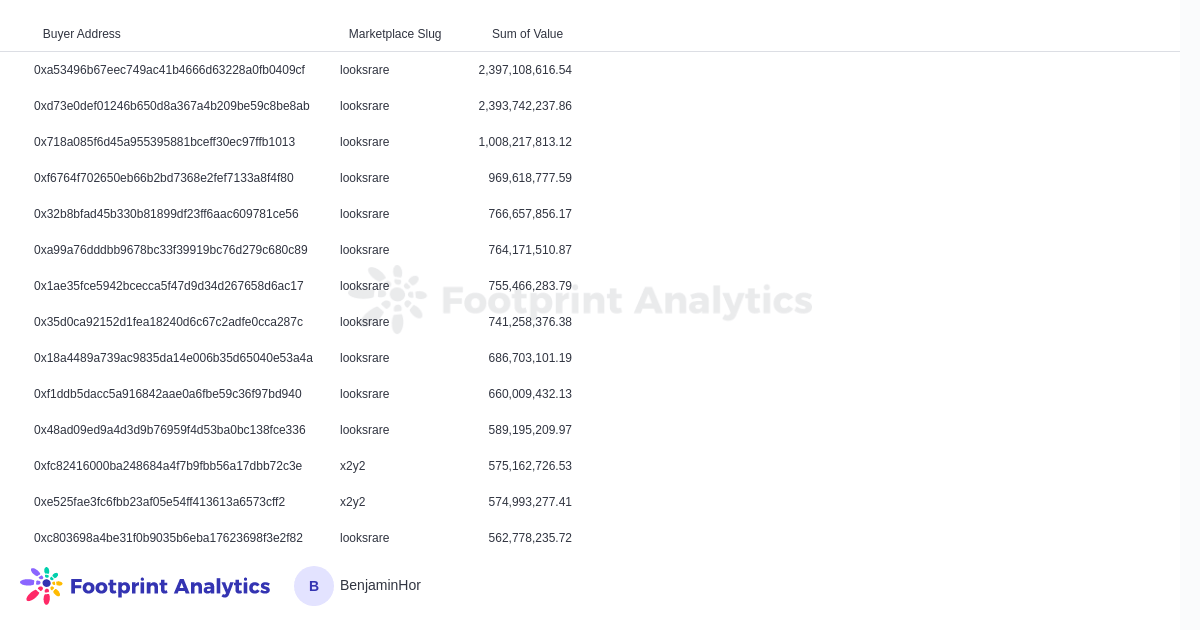

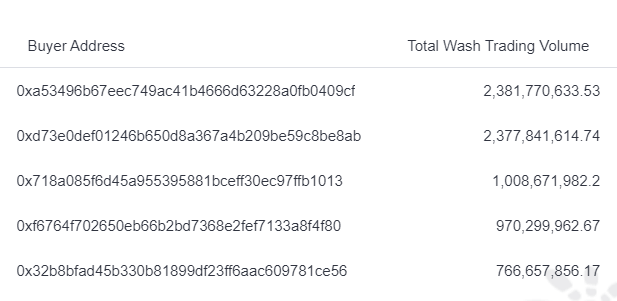

We person identified implicit 6442 addresses that lavation commercialized connected LooksRare and X2Y2. The Top 10 addresses are each from LooksRare, which aligns with the premise that determination is amended worth extraction from the token rewards.

Source: Footprint Analytics (as of 22 November 2022)

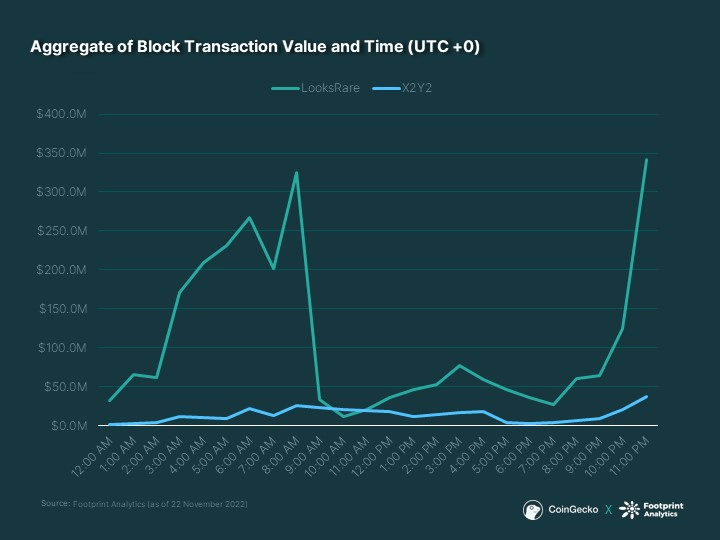

Source: Footprint Analytics (as of 22 November 2022)These traders person 2 chiseled trading times, spiking astatine 8 AM-9 AM (UTC+0) and towards the extremity of the day.

Source: Footprint Analytics (as of 22 November 2022)

Source: Footprint Analytics (as of 22 November 2022)Ethereum uses a Unix timestamp, i.e., UTC. Therefore, trading close earlier the time closes makes consciousness due to the fact that they are probably trying to summation their regular measurement stock connected the marketplace. Since trading rewards are based connected % of the marketplace’s regular full volume, it is amended to lavation commercialized arsenic precocious arsenic imaginable to find the magnitude of firepower/effort needed to bid a sizeable stock of rewards. As for the spike successful the morning, we speculate that these traders run successful timezones that are adjacent to midnight for them, which coincides with precocious evenings for the US.

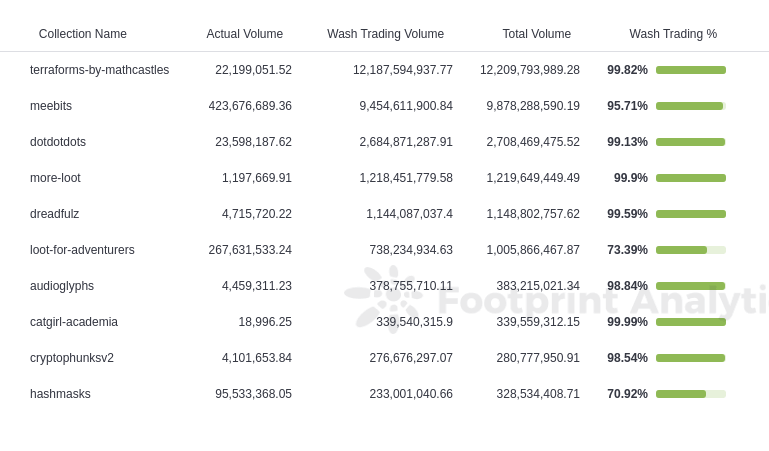

In presumption of the astir fashionable postulation for lavation trading, Terraform by Mathcastles takes the apical spot. Over $12B person been lavation traded, representing 99.82% of the collection’s corporate trading volumes connected LooksRare and X2Y2.

Source: Footprint Analytics (as of 22 November 2022)

Source: Footprint Analytics (as of 22 November 2022)We are not definite wherefore this is the case. The lone happening successful communal betwixt each these collections is that they person zero royalties (except Meebits), which means it costs little to lavation trade. We tin lone presume that a whale oregon a pod of whales person designated it arsenic their preferred lavation trading collection. Indeed, if we look astatine the database of lavation traders for Terraform, the apical 2 wallets person traded adjacent to $4.8B alone.

Source: Footprint Analytics (as of 22 November 2022)

Source: Footprint Analytics (as of 22 November 2022)Most likely, this is simply a azygous whale trading betwixt their wallets, contributing implicit 1/3rd of lavation trading volumes for the postulation alone.

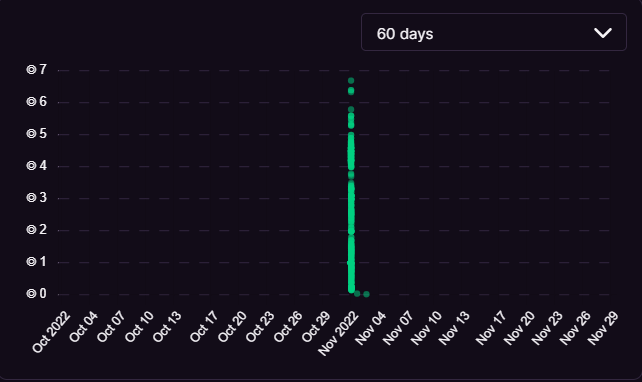

Before Terraform took over, it is worthy noting that Meebits was the favourite for lavation traders aft LooksRare launched until they implemented royalties successful September 2022. Wash trading volumes subsequently died overnight.

Source: Footprint Analytics (as of 22 November 2022)

Source: Footprint Analytics (as of 22 November 2022)Conclusion

Without due regulatory oversight and enforcement, NFT lavation trading is an unavoidable improvement connected NFT marketplaces. Traditionally, manipulating prices/volumes and fraudulently harvesting taxation losses are illegal, and that modular is apt to clasp for crypto. Wash trading to workplace token rewards, connected the different hand, is simply a caller benignant of enactment unsocial to crypto. While the superior victims astatine hazard are the marketplaces themselves, unsuspecting users whitethorn besides beryllium harmed during this activity. Although determination are ethical concerns, crypto natives would reason that codification is the law. If the NFT marketplaces person not imposed immoderate limitations connected reward distributions, wherefore shouldn’t users instrumentality vantage of this bug feature?

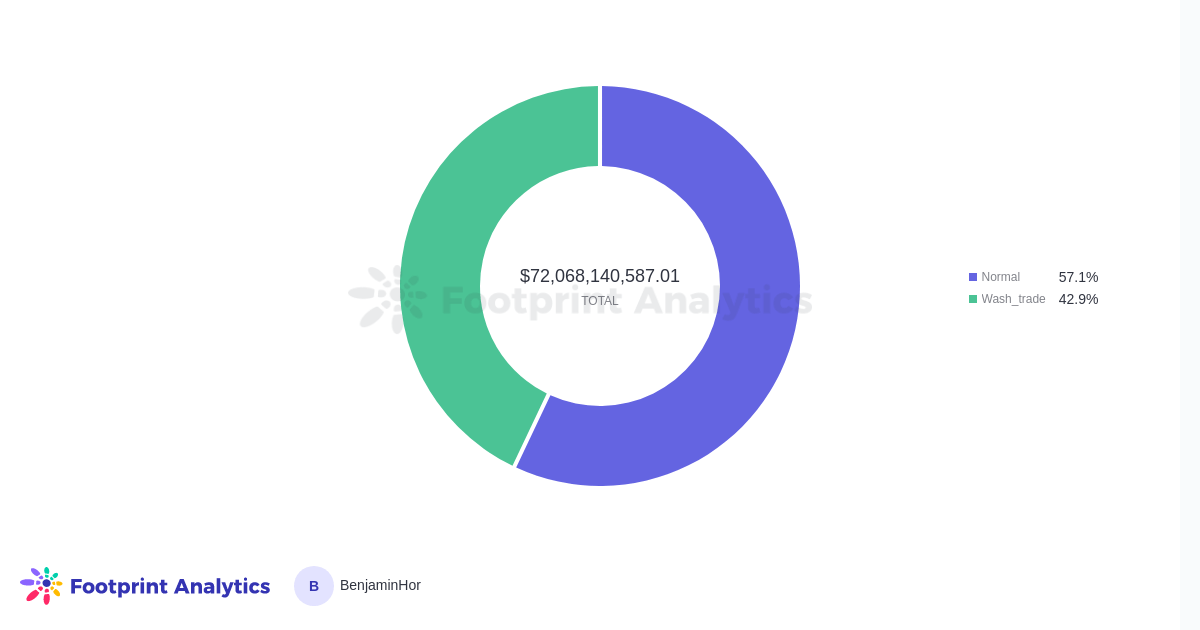

With each this successful mind, it is nary wonderment that everyone thinks NFTs are a scam. However, if we look astatine the full lavation trading volumes connected ETH, the representation is not precise pretty.

Source: Footprint Analytics (as of 22 November 2022)

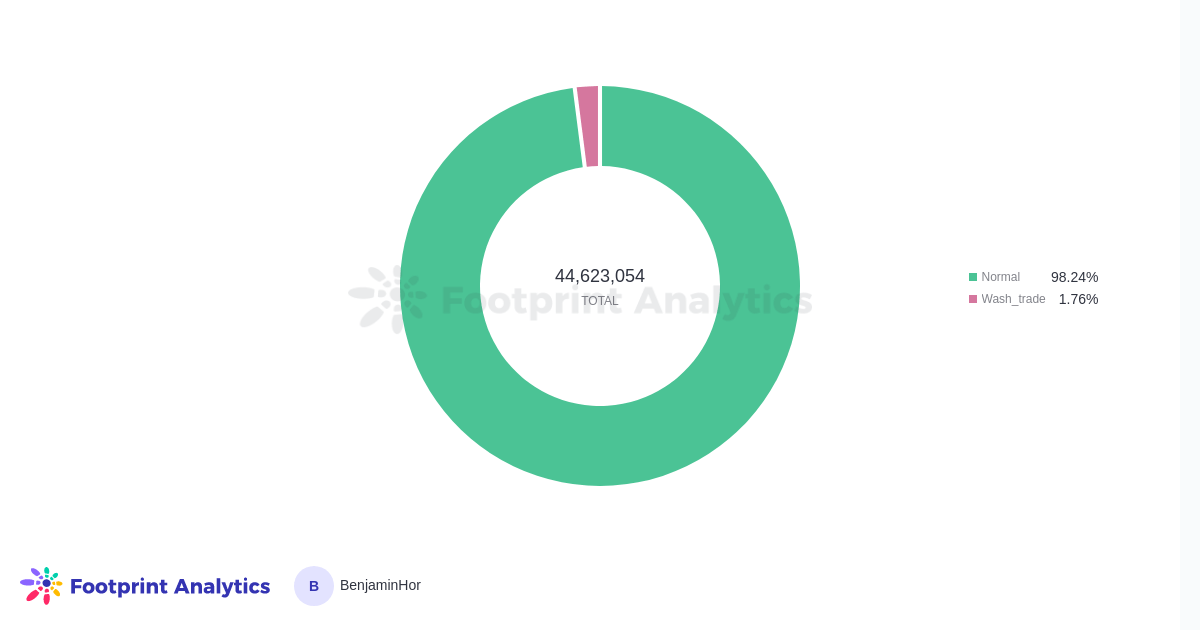

Source: Footprint Analytics (as of 22 November 2022)42.9% of each volumes are lavation trading volumes. The sensationalist mentation is that astir fractional the marketplace is simply a scam; however, a much tenable inference is that platforms similar LooksRare and X2Y2 person propped up the marketplace with fake volumes. Further, this does not alteration the information that determination are genuine buyers. Indeed, if we measurement the marketplace utilizing a antithetic metric, i.e. fig of transactions, a precise antithetic representation emerges.

Over 98% of full transactions person been identified arsenic genuine. In different words, it is imaginable that radical conscionable similar JPEGs. A survey connected OpenSea NFTs by a radical of researchers besides supports this thesis with a antithetic methodology.

Rather than being a lavation trading haven, the representation and estimation of the NFT manufacture are heavy distorted by whales and savvy degens. Of course, determination are limitations to this methodology, and we cannot relationship for each lavation trading transaction retired there. Nonetheless, we judge that this is simply a much close practice of the NFT market.

But this does not mean we should instrumentality things for granted. Blockchain exertion makes each transaction transparent, making it easier to place lavation trading and, thus, support ourselves.

The archetypal enactment of defence is education. NFT traders should larn to place lavation trading patterns earlier aping into lesser-known collections. Even then, immoderate of the astir fashionable collections, e.g., Meebits, whitethorn not beryllium immune to this activity. However, we tin besides expect lavation traders to go progressively blase and screen their tracks. Efforts to amended on-chain investigation and usage platforms similar Footprint Analytics would assistance users chopped done the sound but assistance users marque amended trading decisions.

Marketplaces should besides play a much progressive relation successful discouraging lavation trading, arsenic it harms existent users and themselves if idiosyncratic is actively farming their autochthonal tokens.

This nonfiction was written successful collaboration with Footprint Analytics. Footprint Analytics is gathering blockchain’s astir broad information investigation infrastructure with tools and API to assistance developers, analysts, and investors get unrivaled GameFi, DeFi, and NFT insights.

The motor indexes cleanable and abstracts information from 20+ chains and counting—letting users physique charts and dashboards without codification utilizing a drag-and-drop interface arsenic good arsenic with SQL.

The station What is NFT Wash Trading? Examples of How it Works appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)