One of the biggest changes to the crypto marketplace contiguous compared to the past carnivore marketplace is the antithetic types of assets that exist.

Instead of choosing betwixt Dash, Litecoin, Ethereum, Bitcoin, etc., radical tin put successful NFTs and plots of integer onshore successful the metaverse.

Common consciousness indicates that these new, experimental assets are riskier compared to BTC and ETH. While it’s hard to objectively measurement risk, we tin usage on-chain information to measure terms volatility.

With the carnivore marketplace afloat underway, present is the cleanable clip to comparison these assets and spot what the eventual blue-chip assets could beryllium going forward: Crypto, NFTs, oregon metaverse land.

Here, we’ll comparison 3 hypothetical investors: Abe, Bob and Cathy. One twelvemonth ago, each enactment their wealth into a antithetic plus people wrong the crypto space.

Abe’s portfolio: 50% BTC & 50% ETH.

Bob’s portfolio: 50% BAYC & 50% CryptoPunks.

Cathy’s portfolio: 50% Decentraland Land & 50% Sandbox parcels.

These comparisons arent’s 1-to-1 (buying 3 Bored Apes astatine $6,000 each 1 twelvemonth agone is simply a precise antithetic determination than investing $6,000 successful a longstanding “safe” token similar ETH.) So, we’ve created 3 “reasonable” portfolios on these 50/50 lines that aren’t exactly the same. To beryllium explained later.

In this article, we’ll way however each of these investors’ portfolio’s performed and research wherefore immoderate of these investments are much volatile than others.

Abe’s Token Portfolio

One of the upsides of investing successful tokens alternatively of NFTs is liquidity and divisibility. We are capable to enactment a precise USD dollar worth connected BTC and ETH connected immoderate fixed day, bargain immoderate magnitude we want, and person a just marketplace rate.

On this time a twelvemonth ago, June 28, 2021, BTC outgo $35,867. For easiness of calculation, we’ll circular this to the nearest hundred—$35,900. ETH was $2,160—rounded to $2,200.

Our token capitalist chose an fantabulous clip to leap in. After the enthusiasm of the Coinbase listing connected April 13, 2021, and the Federal Reserve dropping involvement rates to 0.25% to stimulate the economy, the marketplace roared. However, it was temporarily sent crashing chiefly owed to a question of strict regulations successful China, and it was astir present erstwhile Abe aped in.

In hindsight, Abe bought the bottommost of the cycle, putting $50,000 into BTC and $50,000 into ETH (getting astir 1.39 BTC and 22.7 ETH.)

The insane ascent upward continued until November 8, 2021, erstwhile Abe’s archetypal concern was worthy $203,767.52.

But then, speculative enthusiasm for cryptocurrencies started waning arsenic retail and investors chopped backmost connected risky assets.

From January to June, the Federal Reserve raised involvement rates by 75 ground points successful speedy succession, the largest borderline successful 28 years.

In February, the warfare successful Ukraine triggered a downturn successful macroeconomic conditions, resulting successful a bearish situation for the crypto market.

To apical it off, the flash clang of Terra Luna successful May looked similar the opening of a bid of blockchain manufacture car wrecks.

All these events person driven down the terms of BTC and ETH—assets which, to the immense bulk of the non-crypto public, are stand-ins for the “price of crypto” itself.

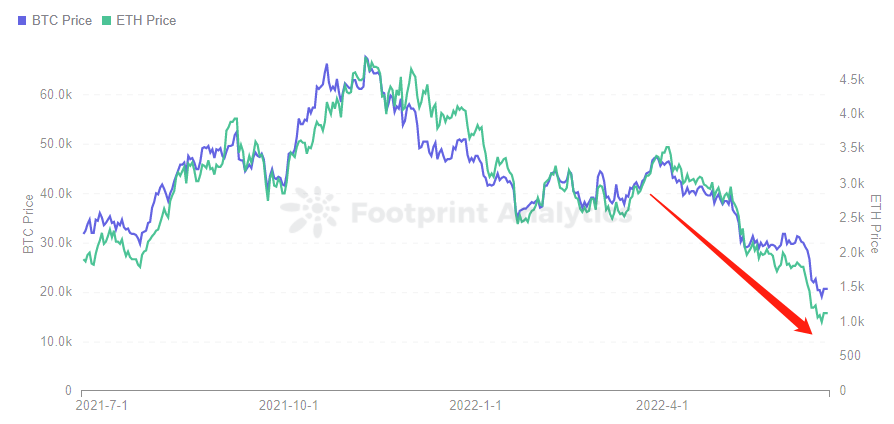

Footprint Analytics – BTC Price & ETH Price

Footprint Analytics – BTC Price & ETH PriceOn June 28, 2022, Abe’s 1.39 BTC and 22.7 ETH portfolio was worthy $54,197.7, down 45.8%. The driblet from the all-time precocious was 73.4%.

The NFT Portfolio

Although NFTs are not arsenic liquidity arsenic BTC oregon ETH, they are unsocial and collectible. And erstwhile the marketplace is successful a amended state, holders tin besides get a circumstantial dollar worth from it.

What did the NFT marketplace look similar successful June 2021?

- Germination and operation period:

In June 2017, CrytoPunks, the world’s archetypal NFT project, was officially born, bringing the NFT conception to a climax. Led by OpenSea, NFT trading has go much convenient and perfect, making NFT exertion areas gradually grow from games and artworks.

- Expansion period.

By 2021, Axie Infinity income were rising rapidly, driving the maturation of the NFT market. The aforesaid year, BAYC was besides established and entered the nationalist eye.

This is the cleanable clip for Bob to participate the marketplace erstwhile NFTs are successful their infancy. Because NFT abides by a rule, the sooner its attributes are rarer, the higher the worth and the little the terms is much balanced (the NFT trading marketplace is immature, and the transaction frequence is low).

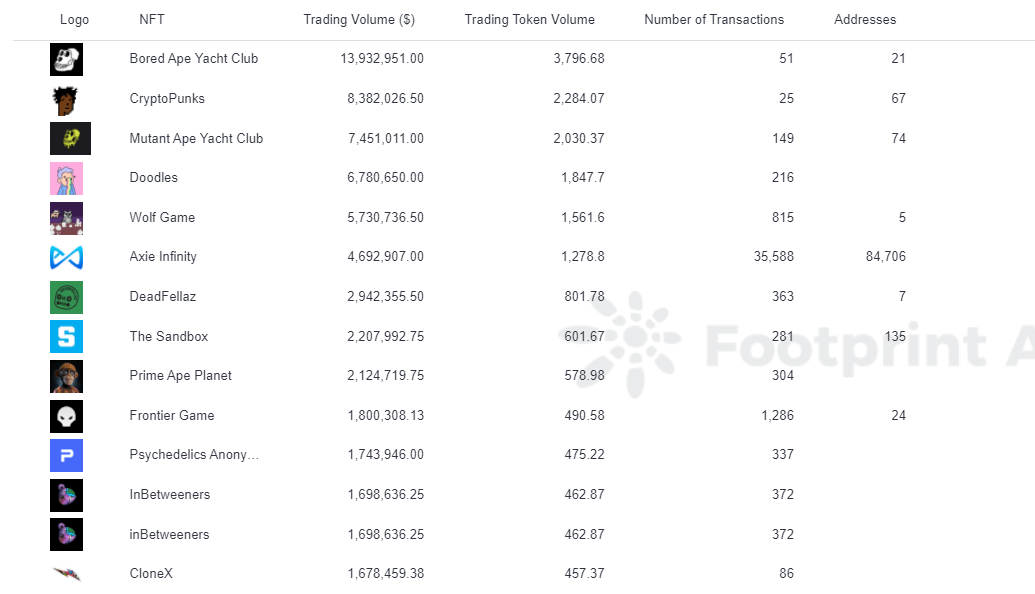

BAYC and CryptoPunks fertile among the apical NFTs successful presumption of trading measurement successful 2021.

Footprint Analytics – NFT Projects by Trading Volume successful 2021

Footprint Analytics – NFT Projects by Trading Volume successful 2021Assuming Bob buys 1 BAYC (3.5713 ETH) and 1 CryptoPunk (28.9191 ETH) connected June 28, 2021, astatine an mean price, his archetypal concern is worthy $71,478.88 astatine that time.

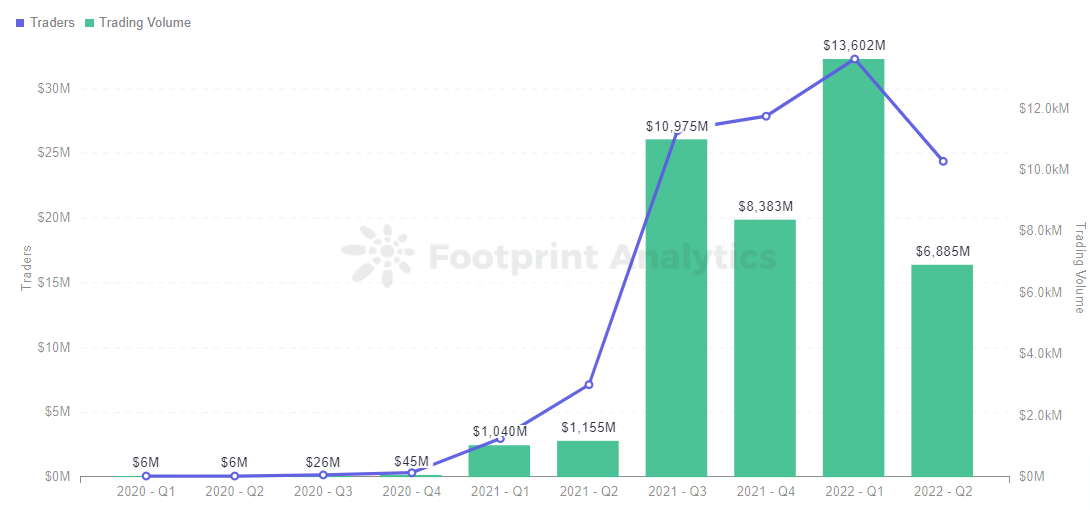

In 2021, satellite economical improvement was severely impacted by the epidemic, and fiscal easing successful large economies brought ostentation and currency devaluation, driving users to crypto markets specified arsenic artwork, NFT, and BTC. trading enactment successful the NFT marketplace continued to summation from August to March 2021.

Footprint Analytics – NFT Traders & Trading Volume

Footprint Analytics – NFT Traders & Trading VolumeIf Bob had followed ETH and sold it astatine its highest connected November 8 (ETH astatine $4,826.25), erstwhile the mean prices of BAYC and CryptoPunk were 43.8835 ETH and 98.5848 ETH, respectively, his portfolio would person been worthy $687,587.63, an summation of 861.95%.

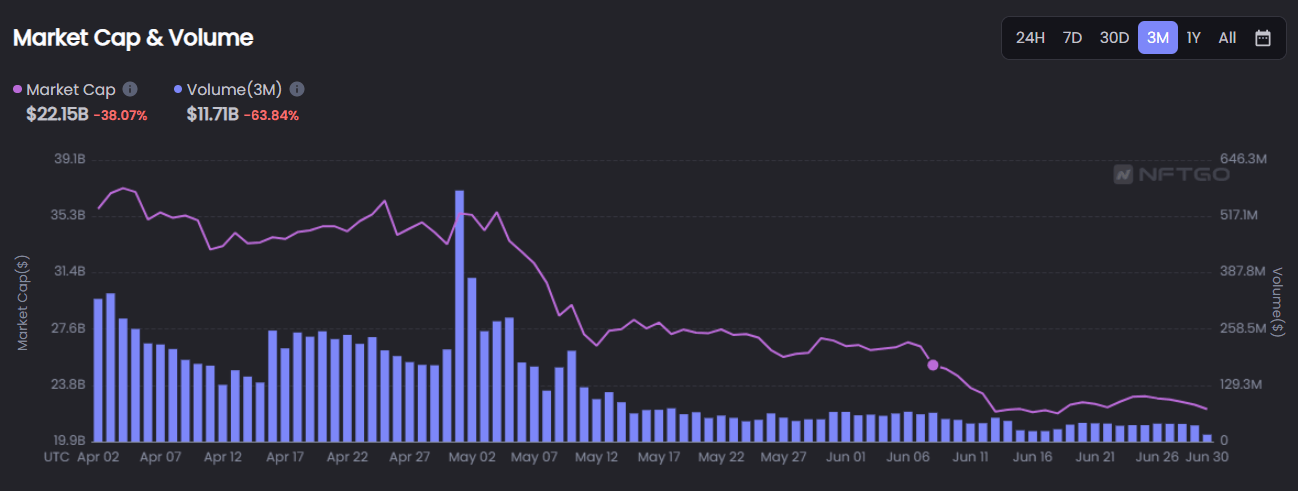

The Crypto marketplace clang led to a diminution successful capitalist involvement successful NFT, importantly impacting its wide trading measurement and marketplace headdress decline. Over the past 90 days, full trading measurement has fallen by 63.84% and full marketplace capitalization by 38.07%.

Screenshot Source – nftgo – Market Cap & Volume

Screenshot Source – nftgo – Market Cap & VolumeAs of June 28, 2022, ETH is trading astatine $1,144, BAYC astatine 113.5035 ETH, and CryptoPunk astatine 77.6991 ETH. Bob’s portfolio is worthy $218,735.77, up 206.01% year-over-year. It is down 68.19% from its all-time high.

Clearly, blue-chip NFTs, arsenic of the opening of summertime 2022, aren’t arsenic volatile arsenic galore radical deliberation compared to the alleged “safe” crypto investments BTC and ETH.

*Since investing fractional your portfolio into BAYC NFTs would person been rather insane successful June 2021, we’re taking a antithetic attack to 50/50 successful this portfolio. Bob bought 1 Punk and 1 Ape.

The Land Portfolio

By being funny successful the metaverse successful June 2021, Cathy tin beryllium considered an aboriginal adopter. At that time, the connection “metaverse” had not yet go a household name.

Facebook’s rebranding to Meta was inactive 4 months away.

Was the metaverse immoderate caller mentation of Second Life? Did you request a VR headset to entree it? Almost cipher who wasn’t heavy successful the crypto rapithole already knew.

But the rumblings were there. On June 4, Sotheby’s opened a virtual assemblage successful Decentraland, and the crippled made waves arsenic the archetypal to interruption 1 cardinal successful a metaverse onshore sale.

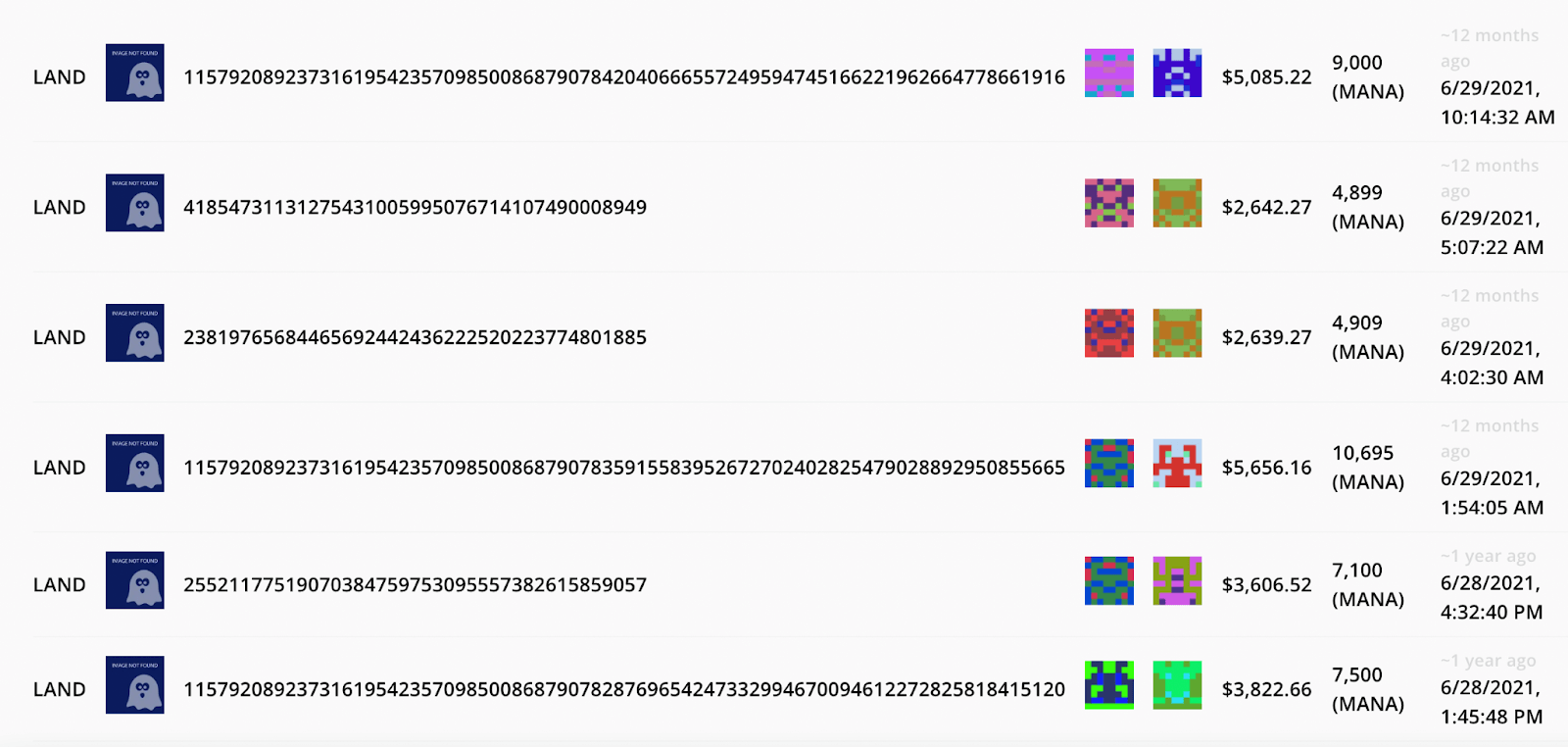

On June 28, 2021, Cathy became a metaverse landlord. Her acquisition was 1 of 37 NFT income successful Decentraland, which generated $148,500 successful total.

Because each the transactions connected the blockchain are connected a nationalist ledger, we tin really spot and analyse each the LAND sold connected this date.

Screenshot Source – nonfungible

Screenshot Source – nonfungibleThe mean merchantability terms connected June 28 was astir $4,000, which seems similar a tenable appraisal looking astatine these sales. (I.e., if determination were a azygous merchantability astatine an astronomical price, it would marque the mean a atrocious yardstick for however overmuch Cathy could person paid.)

So, dipping her toes into the metaverse, Cathy bought 1 crippled of onshore for $4,000—perhaps this one:

Screenshot Source – nonfungible

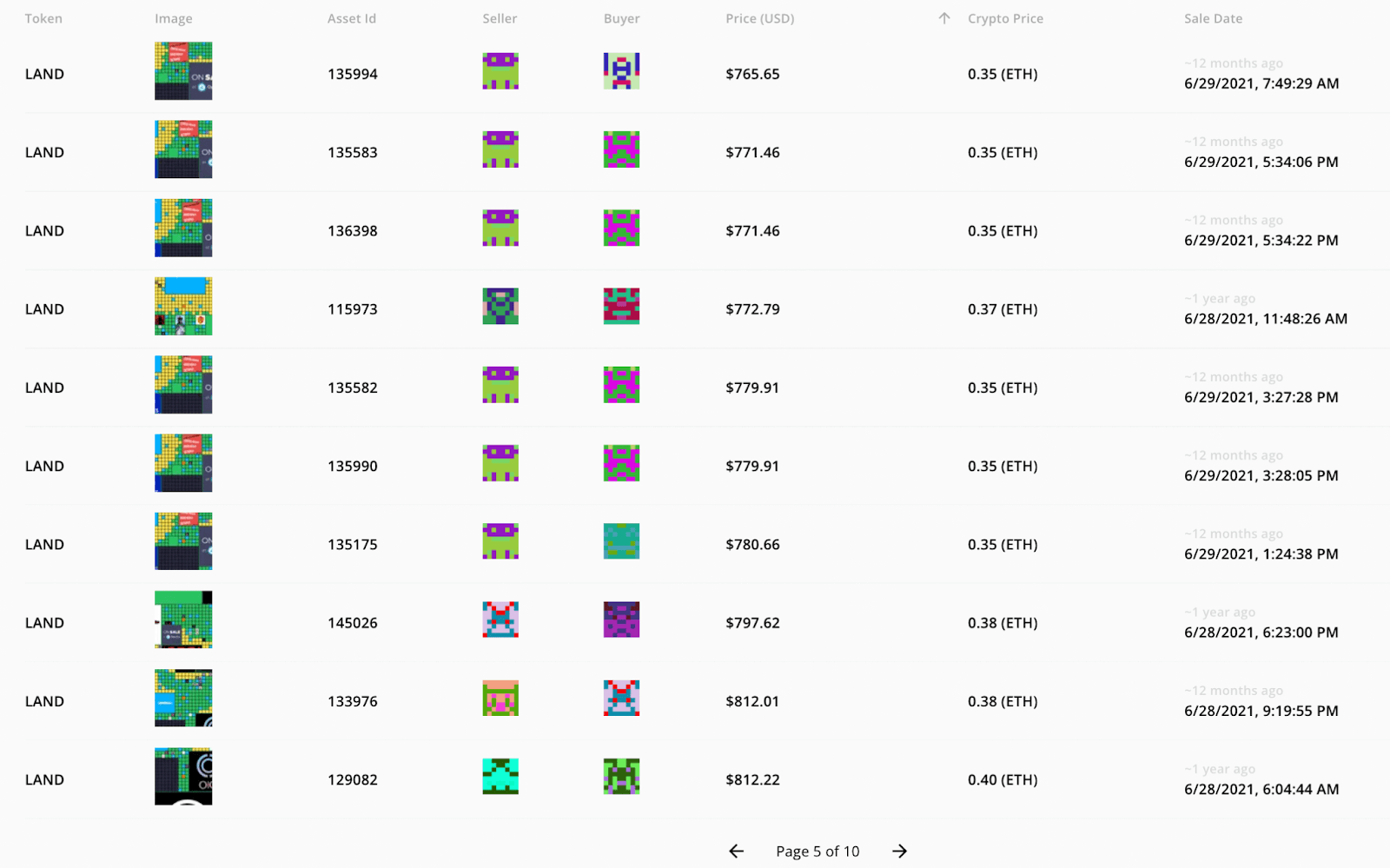

Screenshot Source – nonfungibleShe besides added a parcel successful The Sandbox. At that time, the hunt word “Sandbox” hardly brought to caput the metaverse rubric that would instrumentality implicit quality headlines successful conscionable a fewer months for the 3842% leap successful its token price.

On June 28, 46 NFTs were sold, bringing successful $43,500, an mean terms of $945. This is simply a fewer 100 higher than the median terms for the time but is inactive close capable to bash a wide analysis.

Screenshot Source – nonfungible

Screenshot Source – nonfungibleSo, to support a astir 50/50 allocation successful the 2 biggest-name products successful the plus category, Cathy bought 1 crippled of Decentraland onshore astatine $4,000 and 4 Sandbox lands astatine $945 each—a full metaverse onshore portfolio of $7,780.

Her judgement would beryllium visionary. By November 8, 2021, erstwhile ETH BTC peaked, the mean merchantability terms successful Decentraland accrued by 3.0469 ETH to $14,705. The mean terms of The Sandbox onshore skyrocketed to $6,096, a 734.62% percent increase.

If we’re conscionable going by averages, her 1 Decentraland crippled and 4 Sandbox parcels would beryllium worthy $39,089.

If we alternatively look astatine the existent plus shown supra that outgo conscionable nether $4,000 connected June 28, 2021, past it accrued by $59,135. It flipped hands for $55,313 connected November 15, 2021, the closest merchantability to the ETH peak.

Over the adjacent year, the prices of metaverse onshore declined sharply arsenic the measurement successful Decentraland and The Sandbox decreased to ATLs by 76.81% and 79.03% respectively.

On June 28, 2022, Cathy’s portfolio was down by $14,811 from ATH (-62%). A large hit, but inactive mode up from her archetypal investment. Metaverse onshore is intelligibly highly volatile and tin inactive beryllium called a Hail Mary play alternatively than a harmless blue-chip.

Summary

While the bull marketplace saw tremendous gains for NFTs and metaverse land, the on-chain information for apical projects indicates that prices are not arsenic volatile arsenic galore radical judge comparative to “safe” assets similar BTC and ETH.

In this article, we created 3 hypothetical portfolios and recovered that the harmless crypto stake had a steeper autumn from ATH (as of June 28) than investments into NFTs and metaverse land. The gains implicit the bull marketplace would person besides been importantly higher for the second 2 “riskier” assets.

While determination are respective imaginable explanations for this (e.g., harder for institutions to propulsion down the prices of NFTs and land), this information supports the thought thesis that the apical NFTs and metaverse onshore projects person performed exceptionally good done the entirety of the past year—booms, busts, crashes and all.

Date & Author: July 7, 2022, Vincy

Data Source: Footprint Analytics – BTC & ETH Trend Analysis

This portion is contributed by the Footprint Analytics community.

The Footprint Community is simply a spot wherever information and crypto enthusiasts worldwide assistance each different recognize and summation insights astir Web3, the metaverse, DeFi, GameFi, oregon immoderate different country of the fledgling satellite of blockchain. Here you’ll find active, divers voices supporting each different and driving the assemblage forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects, and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

The station What is the Ultimate Blue-chip Crypto Asset: BTC, NFTs, oregon Land? appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)