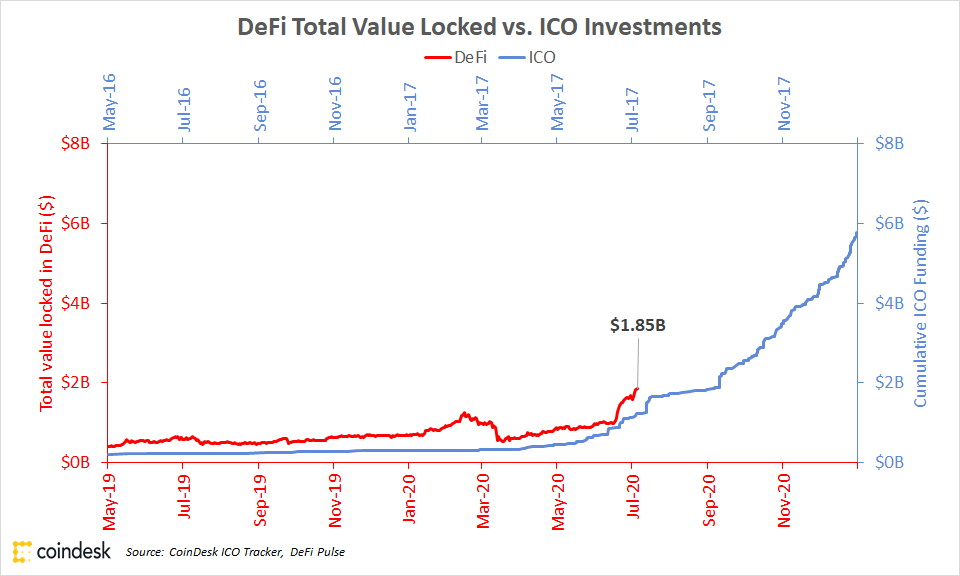

It’s efficaciously July 2017 successful the satellite of decentralized concern (DeFi), and arsenic successful the heady days of the archetypal coin offering (ICO) boom, the numbers are lone trending up.

According to DeFi Pulse, determination is $95.28 cardinal successful crypto assets locked successful DeFi close now. According to the CoinDesk ICO Tracker, the ICO marketplace started chugging past $1 cardinal successful July 2017, conscionable a fewer months earlier token income started getting talked astir on TV.

Debate juxtaposing these numbers if you like, but what nary 1 tin question is this: Crypto users are putting much and much worth to enactment successful DeFi applications, driven mostly by an ROI-optimizing strategy known arsenic yield farming.

DeFi TVL (2019-20) vs. ICO investments (2016-17)

Ethereum-based recognition marketplace Compound started distributing COMP to the protocol's users this past June 15. This is simply a benignant of plus known arsenic a "governance token" which gives holders unsocial voting powers implicit projected changes to the platform. Demand for the token (heightened by the mode its automatic organisation was structured) kicked disconnected the contiguous craze and moved Compound into the leading presumption successful DeFi.

The blistery caller word "yield farming" was born; shorthand for clever strategies wherever putting crypto temporarily astatine the disposal of immoderate startup's exertion earns its proprietor much cryptocurrency.

Another word floating astir is "liquidity mining."

The buzz astir these concepts has evolved into a debased rumble arsenic much and much radical get interested.

The casual crypto perceiver who lone pops into the marketplace erstwhile enactment heats up mightiness beryllium starting to get faint vibes that thing is happening close now. Take our connection for it: Yield farming is the root of those vibes.

We're going to commencement disconnected with the precise basics and past determination to much precocious aspects of output farming.

Most CoinDesk readers astir apt cognize this, but conscionable successful case: Tokens are similar the wealth video-game players gain portion warring monsters, wealth they tin usage to bargain cogwheel oregon weapons successful the beingness of their favourite game.

But with blockchains, tokens aren't constricted to lone 1 massively multiplayer online wealth game. They tin beryllium earned successful 1 and utilized successful tons of others. They usually correspond either ownership successful thing (like a portion of a Uniswap liquidity pool, which we volition get into later) oregon entree to immoderate service. For example, successful the Brave browser, ads tin lone beryllium bought utilizing basal attraction token (BAT).

Tokens proved to beryllium the large usage lawsuit for Ethereum, the second-biggest blockchain successful the world. The word of creation present is "ERC-20 tokens," which refers to a bundle modular that allows token creators to constitute rules for them. Tokens tin beryllium utilized successful a fewer ways. Often, they are utilized arsenic a signifier of wealth wrong a acceptable of applications. So the thought for Kin was to make a token that web users could walk with each different astatine specified tiny amounts that it would astir consciousness similar they weren't spending anything; that is, wealth for the internet.

Governance tokens are different. They are not similar a token astatine a video-game arcade, arsenic truthful galore tokens were described successful the past. They enactment much similar certificates to service successful an ever-changing legislature successful that they springiness holders the close to ballot connected changes to a protocol.

So connected the level that proved DeFi could fly, MakerDAO, holders of its governance token, MKR, ballot astir each week connected tiny changes to parameters that govern however overmuch it costs to get and how overmuch savers earn, and truthful on.

One happening each crypto tokens person successful common, though, is they are tradable and they person a price. So, if tokens are worthy money, past you tin slope with them oregon astatine slightest bash things that look precise overmuch similar banking. Thus: decentralized finance.

Fair question. For folks who tuned retired for a spot successful 2018, we utilized to telephone this "open finance." That operation seems to person faded, though, and "DeFi" is the caller lingo.

In lawsuit that doesn't jog your memory, DeFi is each the things that fto you play with money, and the lone recognition you request is simply a crypto wallet.

I tin explicate this but thing truly brings it location similar trying 1 of these applications. If you person an Ethereum wallet that has adjacent $20 worthy of crypto successful it, spell bash thing connected 1 of these products. Pop implicit to Uniswap and bargain yourself immoderate FUN (a token for gambling apps) oregon WBTC (wrapped bitcoin). Go to MakerDAO and make $5 worthy of DAI (a stablecoin that tends to beryllium worthy $1) retired of the integer ether. Go to Compound and get $10 successful USDC.

(Notice the precise tiny amounts I'm suggesting. The aged crypto saying "don't enactment successful much than you tin spend to lose" goes treble for DeFi. This worldly is uber-complex and a batch tin spell wrong. These whitethorn beryllium "savings" products but they’re not for your retirement savings.)

Immature and experimental though it whitethorn be, the technology's implications are staggering. On the mean web, you can't bargain a blender without giving the tract proprietor capable information to larn your full beingness history. In DeFi, you tin borrow money without anyone adjacent asking for your name.

DeFi applications don't interest astir trusting you due to the fact that they person the collateral you enactment up to backmost your indebtedness (on Compound, for instance, a $10 indebtedness volition necessitate astir $20 successful collateral).

If you bash instrumentality this proposal and effort something, enactment that you tin swap each these things backmost arsenic soon arsenic you've taken them out. Open the indebtedness and adjacent it 10 minutes later. It's fine. Fair warning: It mightiness outgo you a tiny spot successful fees.

So what's the constituent of borrowing for radical who already person the money? Most radical bash it for immoderate benignant of trade. The astir evident example, to abbreviated a token (the enactment of profiting if its terms falls). It's besides bully for idiosyncratic who wants to clasp onto a token but inactive play the market.

Doesn’t moving a slope instrumentality a batch of wealth upfront?

It does, and successful DeFi that wealth is mostly provided by strangers connected the internet. That's wherefore the startups down these decentralized banking applications travel up with clever ways to pull HODLers with idle assets.

Liquidity is the main interest of each these antithetic products. That is: How overmuch wealth bash they person locked successful their astute contracts?

"In immoderate types of products, the merchandise acquisition gets overmuch amended if you person liquidity. Instead of borrowing from VCs oregon indebtedness investors, you get from your users," said Electric Capital managing spouse Avichal Garg.

Let's instrumentality Uniswap arsenic an example. Uniswap is an "automated marketplace maker," oregon AMM (another DeFi word of art). This means Uniswap is simply a robot connected the net that is ever consenting to bargain and it's besides ever consenting to merchantability immoderate cryptocurrency for which it has a market.

On Uniswap, determination is astatine slightest 1 marketplace brace for astir immoderate token connected Ethereum. Behind the scenes, this means Uniswap tin marque it look similar it is making a nonstop commercialized for any 2 tokens, which makes it casual for users, but it's each built astir pools of 2 tokens. And each these marketplace pairs enactment amended with bigger pools.

Why bash I support proceeding astir ‘pools’?

To exemplify wherefore much wealth helps, let's interruption down however Uniswap works.

Let's accidental determination was a marketplace for USDC and DAI. These are 2 tokens (both stablecoins but with antithetic mechanisms for retaining their value) that are meant to beryllium worthy $1 each each the time, and that mostly tends to beryllium existent for both.

The terms Uniswap shows for each token successful immoderate pooled marketplace brace is based connected the equilibrium of each successful the pool. So, simplifying this a batch for illustration's sake, if idiosyncratic were to acceptable up a USDC/DAI pool, they should deposit adjacent amounts of both. In a excavation with lone 2 USDC and 2 DAI it would connection a terms of 1 USDC for 1 DAI. But past ideate that idiosyncratic enactment successful 1 DAI and took retired 1 USDC. Then the excavation would person 1 USDC and 3 DAI. The excavation would beryllium precise retired of whack. A savvy capitalist could marque an casual $0.50 nett by putting successful 1 USDC and receiving 1.5 DAI. That's a 50% arbitrage profit, and that's the occupation with constricted liquidity.

(Incidentally, this is wherefore Uniswap's prices thin to beryllium accurate, due to the fact that traders ticker it for tiny discrepancies from the wider marketplace and commercialized them distant for arbitrage profits precise quickly.)

However, if determination were 500,000 USDC and 500,000 DAI successful the pool, a commercialized of 1 DAI for 1 USDC would person a negligible interaction connected the comparative price. That's wherefore liquidity is helpful.

Similar effects clasp crossed DeFi, truthful markets privation much liquidity. Uniswap solves this by charging a tiny interest connected each trade. It does this by shaving disconnected a small spot from each commercialized and leaving that successful the excavation (so 1 DAI would really commercialized for 0.997 USDC, aft the fee, increasing the wide excavation by 0.003 USDC). This benefits liquidity providers due to the fact that erstwhile idiosyncratic puts liquidity successful the excavation they ain a share of the pool. If determination has been tons of trading successful that pool, it has earned a batch of fees, and the worth of each stock volition grow.

And this brings america backmost to tokens.

Liquidity added to Uniswap is represented by a token, not an account. So there's nary ledger saying, "Bob owns 0.000000678% of the DAI/USDC pool." Bob conscionable has a token successful his wallet. And Bob doesn't person to support that token. He could merchantability it. Or usage it successful different product. We'll ellipse backmost to this, but it helps to explicate wherefore radical similar to speech astir DeFi products arsenic "money Legos."

So however overmuch wealth bash radical marque by putting wealth into these products?

It tin beryllium a batch much lucrative than putting wealth successful a accepted bank, and that's earlier startups started handing retired governance tokens.

Compound is the existent darling of this space, truthful let's usage it arsenic an illustration. As of this writing, a idiosyncratic tin enactment USDC into Compound and gain 2.72% connected it. They tin enactment tether (USDT) into it and gain 2.11%. Most U.S. slope accounts earn little than 0.1% these days, which is adjacent capable to nothing.

However, determination are immoderate caveats. First, there's a crushed the involvement rates are truthful overmuch juicier: DeFi is simply a acold riskier spot to parkland your money. There's nary Federal Deposit Insurance Corporation (FDIC) protecting these funds. If determination were a tally connected Compound, users could find themselves incapable to retreat their funds erstwhile they wanted.

Plus, the involvement is rather variable. You don't cognize what you'll gain implicit the people of a year. USDC's complaint is high close now. It was debased past week. Usually, it hovers determination successful the 1% range.

Similarly, a idiosyncratic mightiness get tempted by assets with much lucrative yields similar USDT, which typically has a overmuch higher involvement complaint than USDC. (Monday morning, the reverse was true, for unclear reasons; this is crypto, remember.) The trade-off present is USDT's transparency astir the real-world dollars it's expected to clasp successful a real-world slope is not astir up to par with USDC's. A quality successful involvement rates is often the market's mode of telling you the 1 instrumentality is viewed arsenic dicier than another.

Users making large bets connected these products crook to companies Opyn and Nexus Mutual to insure their positions due to the fact that there's nary authorities protections successful this nascent abstraction – much connected the ample risks aboriginal on.

So users tin instrumentality their assets successful Compound oregon Uniswap and gain a small yield. But that's not precise creative. Users who look for angles to maximize that yield: those are the output farmers.

OK, I already knew each of that. What is output farming?

Broadly, output farming is immoderate effort to enactment crypto assets to enactment and make the astir returns imaginable connected those assets.

At the simplest level, a output husbandman mightiness determination assets astir wrong Compound, perpetually chasing whichever excavation is offering the champion APY from week to week. This mightiness mean moving into riskier pools from clip to time, but a output husbandman tin grip risk.

"Farming opens up caller terms arbs [arbitrage] that tin spill implicit to different protocols whose tokens are successful the pool," said Maya Zehavi, a blockchain consultant.

Because these positions are tokenized, though, they tin spell further.

In a elemental example, a output husbandman mightiness enactment 100,000 USDT into Compound. They volition get a token backmost for that stake, called cUSDT. Let's accidental they get 100,000 cUSDT backmost (the look connected Compound is brainsick truthful it's not 1:1 similar that but it doesn't substance for our purposes here).

They tin past instrumentality that cUSDT and enactment it into a liquidity excavation that takes cUSDT connected Balancer, an AMM that allows users to acceptable up self-rebalancing crypto scale funds. In mean times, this could gain a tiny magnitude much successful transaction fees. This is the basal thought of output farming. The idiosyncratic looks for borderline cases successful the strategy to eke retired arsenic overmuch output arsenic they tin crossed arsenic galore products arsenic it volition enactment on.

Right now, however, things are not normal, and they astir apt won't beryllium for a while.

Why is output farming truthful blistery close now?

Because of liquidity mining. Liquidity mining supercharges output farming.

Liquidity mining is erstwhile a output husbandman gets a caller token arsenic good arsenic the accustomed instrumentality (that's the "mining" part) successful speech for the farmer's liquidity.

"The thought is that stimulating usage of the level increases the worth of the token, thereby creating a affirmative usage loop to pull users," said Richard Ma of smart-contract auditor Quantstamp.

The output farming examples supra are lone farming output disconnected the mean operations of antithetic platforms. Supply liquidity to Compound oregon Uniswap and get a small chopped of the concern that runs implicit the protocols – precise vanilla.

But Compound announced earlier this twelvemonth it wanted to genuinely decentralize the merchandise and it wanted to springiness a bully magnitude of ownership to the radical who made it fashionable by utilizing it. That ownership would instrumentality the signifier of the COMP token.

Lest this dependable excessively altruistic, support successful caput that the radical who created it (the squad and the investors) owned much than fractional of the equity. By giving distant a steadfast proportionality to users, that was precise apt to marque it a overmuch much fashionable spot for lending. In turn, that would marque everyone's involvement worthy overmuch more.

So, Compound announced this four-year play wherever the protocol would springiness retired COMP tokens to users, a fixed magnitude each time until it was gone. These COMP tokens power the protocol, conscionable arsenic shareholders yet power publically traded companies.

Every day, the Compound protocol looks astatine everyone who had lent wealth to the exertion and who had borrowed from it and gives them COMP proportional to their stock of the day's full business.

This was a brand-new benignant of output connected a deposit into Compound. In fact, it was a mode to gain a output connected a loan, arsenic well, which is precise weird: Who has ever heard of a borrower earning a instrumentality connected a indebtedness from their lender?

COMP's worth reached a highest of implicit $900 successful 2021. We did the math elsewhere but agelong communicative short: investors with reasonably heavy pockets tin marque a beardown summation maximizing their regular returns successful COMP. It is, successful a way, escaped money.

It's imaginable to lend to Compound, get from it, deposit what you borrowed and truthful on. This tin beryllium done aggregate times and DeFi startup Instadapp adjacent built a instrumentality to marque it arsenic capital-efficient arsenic possible.

"Yield farmers are highly creative. They find ways to 'stack' yields and adjacent gain aggregate governance tokens astatine once," said Spencer Noon of DTC Capital.

COMP's worth spike is simply a impermanent situation. The COMP organisation volition lone past 4 years and past determination won't beryllium immoderate more. Further, astir radical hold that the precocious terms present is driven by the debased interval (that is, however overmuch COMP is really escaped to commercialized connected the marketplace – it volition ne'er beryllium this debased again). So the worth volition astir apt gradually spell down, and that's wherefore savvy investors are trying to gain arsenic overmuch arsenic they tin now.

Appealing to the speculative instincts of diehard crypto traders has proven to beryllium a large mode to summation liquidity connected Compound. This fattens immoderate pockets but besides improves the idiosyncratic acquisition for each kinds of Compound users, including those who would usage it whether they were going to gain COMP oregon not.

As accustomed successful crypto, erstwhile entrepreneurs spot thing successful, they imitate it. Balancer was the adjacent protocol to commencement distributing a governance token, BAL, to liquidity providers. Flash indebtedness supplier bZx past followed suit. Ren, Curve and Synthetix have besides teamed up to beforehand a liquidity excavation connected Curve.

It is simply a just stake galore of the much well-known DeFi projects volition denote immoderate benignant of coin that tin beryllium mined by providing liquidity.

The lawsuit to ticker present is Uniswap versus Balancer. Balancer tin bash the aforesaid happening Uniswap does, but astir users who privation to bash a speedy token commercialized done their wallet usage Uniswap. It volition beryllium absorbing to spot if Balancer's BAL token convinces Uniswap's liquidity providers to defect.

So far, though, much liquidity has gone into Uniswap since the BAL announcement, according to its information site.

Did liquidity mining commencement with COMP?

No, but it was the most-used protocol with the astir cautiously designed liquidity mining scheme.

This constituent is debated but the origins of liquidity mining probably day backmost to Fcoin, a Chinese speech that created a token successful 2018 that rewarded radical for making trades. You won't judge what happened next! Just kidding, you will: People conscionable started moving bots to bash pointless trades with themselves to gain the token.

Similarly, EOS is simply a blockchain wherever transactions are fundamentally free, but since thing is truly escaped the lack of friction was an invitation for spam. Some malicious hacker who didn't similar EOS created a token called EIDOS connected the web successful precocious 2019. It rewarded radical for tons of pointless transactions and someway got an speech listing.

These initiatives illustrated however rapidly crypto users respond to incentives.

Fcoin aside, liquidity mining arsenic we present cognize it archetypal showed up connected Ethereum erstwhile the marketplace for synthetic tokens, Synthetix, announced successful July 2019 an grant successful its SNX token for users who helped adhd liquidity to the sETH/ETH excavation connected Uniswap. By October, that was 1 of Uniswap's biggest pools.

When Compound Labs, the institution that launched the Compound protocol, decided to make COMP, the governance token, the steadfast took months designing conscionable what benignant of behaviour it wanted and however to incentivize it. Even still, Compound Labs was amazed by the response. It led to unintended consequences specified arsenic crowding into a previously unpopular market (lending and borrowing BAT) successful bid to excavation arsenic overmuch COMP arsenic possible.

Just past week, 115 antithetic COMP wallet addresses – senators successful Compound's ever-changing legislature – voted to change the organisation mechanics successful hopes of spreading liquidity retired crossed the markets again.

Is determination DeFi for bitcoin?

Nothing has beaten bitcoin implicit clip for returns, but there's 1 happening bitcoin can't bash connected its own: make much bitcoin.

A astute trader tin get successful and retired of bitcoin and dollars successful a mode that volition gain them much bitcoin, but this is tedious and risky. It takes a definite benignant of person.

DeFi, however, offers ways to turn one's bitcoin holdings – though somewhat indirectly.

For example, a idiosyncratic tin make a simulated bitcoin connected Ethereum utilizing BitGo's WBTC system. They enactment BTC successful and get the aforesaid magnitude backmost retired successful freshly minted WBTC. WBTC tin beryllium traded backmost for BTC astatine immoderate time, truthful it tends to beryllium worthy the aforesaid arsenic BTC.

Then the idiosyncratic tin instrumentality that WBTC, involvement it connected Compound and gain a fewer percent each twelvemonth successful output connected their BTC. Odds are, the radical who get that WBTC are astir apt doing it to abbreviated BTC (that is, they volition merchantability it immediately, bargain it backmost erstwhile the terms goes down, adjacent the indebtedness and support the difference).

A agelong HODLer is blessed to summation caller BTC disconnected their counterparty's short-term win. That's the game.

"DeFi, with the operation of an assortment of integer funds, automation of cardinal processes, and much analyzable inducement structures that enactment crossed protocols – each with their ain rapidly changing tech and governance practices – marque for caller types of information risks," said Liz Steininger of Least Authority, a crypto information auditor. "Yet, contempt these risks, the precocious yields are undeniably charismatic to gully much users."

We've seen large failures successful DeFi products. MakerDAO had 1 truthful atrocious this twelvemonth it's called "Black Thursday." There was besides the exploit against flash indebtedness supplier bZx. These things bash interruption and erstwhile they bash wealth gets taken.

Right now, the woody is excessively bully for definite funds to resist, truthful they are moving a batch of wealth into these protocols to liquidity excavation each the caller governance tokens they can. But the funds – entities that excavation the resources of typically well-to-do crypto investors – are besides hedging. Nexus Mutual, a DeFi security provider of sorts, told CoinDesk it has maxed out its disposable sum connected these liquidity applications. Opyn, the trustless derivatives maker, created a mode to abbreviated COMP, conscionable successful lawsuit this crippled comes to naught.

And weird things person arisen. For example, there's presently more DAI connected Compound than person been minted successful the world. This makes consciousness erstwhile unpacked but it inactive feels dicey to everyone.

That said, distributing governance tokens mightiness marque things a batch little risky for startups, astatine slightest with respect to the wealth cops.

"Protocols distributing their tokens to the public, meaning that there's a caller secondary listing for SAFT tokens, [gives] plausible deniability from immoderate information accusation," Zehavi wrote. (The Simple Agreement for Future Tokens was a ineligible operation favored by galore token issuers during the ICO craze.)

Whether a cryptocurrency is adequately decentralized has been a cardinal diagnostic of ICO settlements with the U.S. Securities and Exchange Commission (SEC).

What’s adjacent for output farming? (A prediction)

COMP turned retired to beryllium a spot of a astonishment to the DeFi world, successful method ways and others. It has inspired a question of caller thinking.

"Other projects are moving connected akin things," said Nexus Mutual laminitis Hugh Karp. In fact, informed sources archer CoinDesk brand-new projects volition motorboat with these models.

We mightiness soon spot much prosaic output farming applications. For example, forms of profit-sharing that reward definite kinds of behavior.

Imagine if COMP holders decided, for example, that the protocol needed much radical to enactment wealth successful and permission it determination longer. The assemblage could make a connection that shaved disconnected a small of each token's output and paid that information retired lone to the tokens that were older than six months. It astir apt wouldn't beryllium much, but an capitalist with the close clip skyline and hazard illustration mightiness instrumentality it into information earlier making a withdrawal.

(There are precedents for this successful accepted finance: A 10-year Treasury enslaved usually yields much than a one-month T-bill adjacent though they're some backed by the afloat religion and recognition of Uncle Sam, a 12-month certificate of deposit pays higher involvement than a checking relationship astatine the aforesaid bank, and truthful on.)

As this assemblage gets much robust, its architects volition travel up with ever much robust ways to optimize liquidity incentives successful progressively refined ways. We could spot token holders greenlighting much ways for investors to nett from DeFi niches.

Whatever happens, crypto's output farmers volition support moving fast. Some caller fields whitethorn unfastened and immoderate whitethorn soon carnivore overmuch little luscious fruit.

But that’s the bully happening astir farming successful DeFi: It is precise casual to power fields.

This nonfiction was primitively published connected

Jul 6, 2020

.

Subscribe to Valid Points, our play newsletter astir Ethereum 2.0.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)