One of the main concern themes of 2021 was the alternate blockchain networks, the basal networks oregon furniture 1s, competing against Ethereum for decentralized applications.

Investments successful protocols Solana, Polygon, Fantom, Near, Avalanche, Arbitrum, Cosmos, Polkadot and others, arsenic good arsenic furniture 2 companion protocols, became progressively profitable.

These protocols are manufacturers of a peculiar bully – decentralized computation. Such computation tin powerfulness immoderate benignant of software, but is peculiarly apt for integer scarcity, spot rights and provenance. Decentralized computation has a supply, a definite magnitude of request and a adaptable terms successful the outgo of gas. Not dinosaur bony gas, but the integer 1 utilized to crook connected the planetary web machines.

Lex Sokolin, a CoinDesk columnist, is planetary fintech co-head astatine ConsenSys, a Brooklyn, N.Y.-based blockchain bundle company. The pursuing is adapted from his Fintech Blueprint newsletter.

The different model is simply a warfare implicit developers to physique applications wrong peculiar standards regimes. This is the communicative of Betamax vs. VHS, Apple vs. Windows, iOS vs. Android arsenic good arsenic the Chinese ace apps. There beryllium immoderate fig of applicable platforms – let's accidental much than 1 but less than 5 – which tin supply substitute versions of a peculiar operating stratum. Those platforms are invaluable lone if gardened by third-party gardeners, i.e., the developers that marque the applications.

If determination are galore applications, users look and usage them. Users often person the highest willingness to pay. You mightiness deliberation Facebook is free, but retrieve you paid $1,000 to Apple (AAPL) for the privilege of having a phone. Thereafter, if determination are users successful your platform, developers worth that arsenic a organisation transmission successful summation to a exertion enabler. Such viral loops tin make affirmative web effects, which let definite equilibria to hold, and others to collapse.

So furniture 1s bash some – they supply the computational portion arsenic good arsenic the marketplace discourse successful which that computational portion is generated and executed.

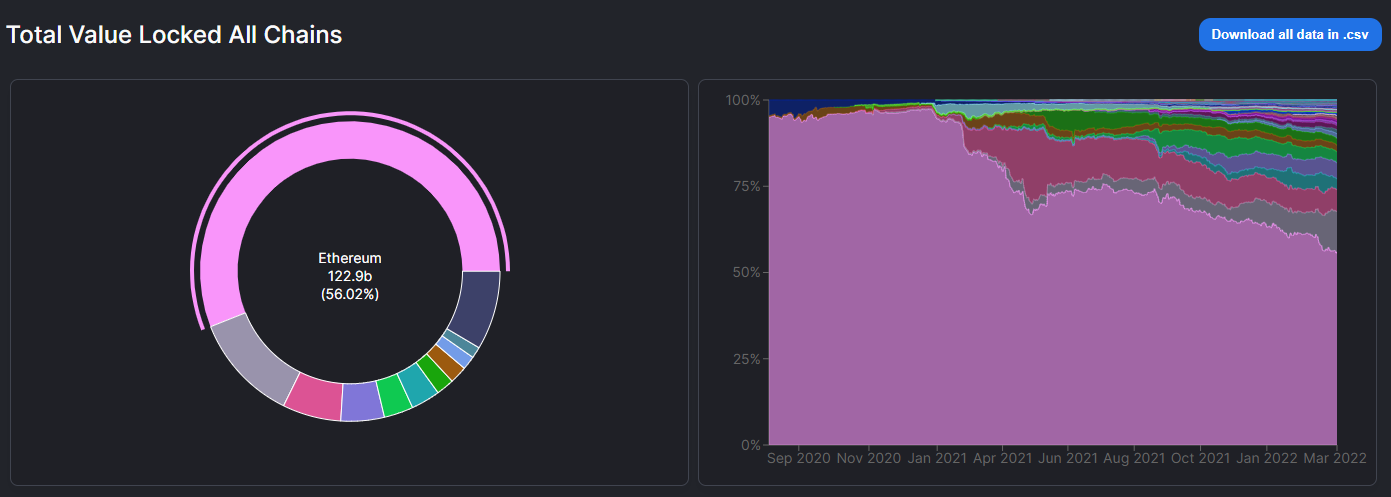

Ethereum’s stock of Total Value Locked falling (DeFiLlama)

So shouldn’t incumbents similar Ethereum triumph this powerfulness instrumentality game? Well, not if determination are ways to bribe and overpower the game. You tin spot that play retired contiguous successful the worth locked, i.e., collateral, moving astir things similar Terra, Avalanche, and (still) Binance Smart Chain. In September 2020, Ethereum had 90% of the assets connected the market, and contiguous it has astir 50%. It is important to recognize however and why.

Here’s an example. Avalanche is launching a $290 cardinal inducement programme to turn the applications built connected its technology. The protocol’s afloat diluted marketplace headdress is astir $30 cardinal today. So we are talking astir a 1% walk of the marketplace headdress connected level maturation and recursive lawsuit acquisition.

This is not a unsocial strategy, of course. Consider Polygon, which launched a $100 cardinal ecosystem fund to people decentralized concern (DeFi) maturation past April. FYI, it worked; there’s present rather a spot of DeFi connected Polygon. We could item this occurrence communicative for each furniture 1 and instauration retired there.

The Solana, FTX, Silicon Valley story is besides a bully example. For Ethereum, ConsenSys played the relation of ecosystem money successful the aboriginal days, yet generating capable gathering and adoption by the community.

At a meta level, these funds are a committedness of immoderate magnitude of the protocol’s token proviso for selling and idiosyncratic acquisition. The users are applications builders, and they bring the consequent retail users thereafter. The recursive question is that erstwhile applications are built and radical walk their wealth connected purchasing the protocol’s product, which if you retrieve is decentralized computation, the worth of that computation rises, astatine slightest for immoderate time.

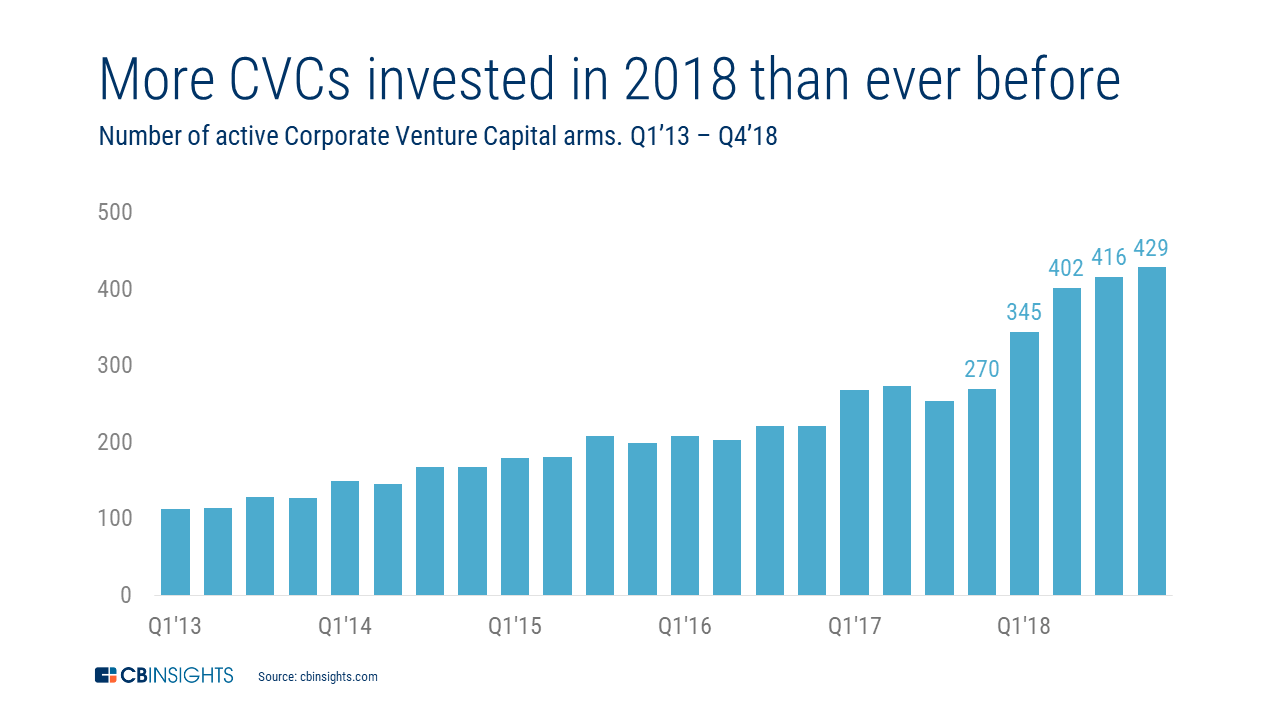

CVCs invested successful 2018 (CBInsights)

It’s the aforesaid happening arsenic Microsoft (MSFT) oregon Apple giving developers grants to beryllium archetypal successful a caller operating system. Or PayPal (PYPL) and Wells Fargo (WFC) paying caller users a $100 reward for opening an account. It’s the aforesaid happening arsenic endeavor launching firm task arms to seizure innovation, and redirect it to that enterprise’s halfway business, similar unreality for AWS oregon wealth question for Visa (V) and Mastercard (MA). It’s besides the aforesaid happening arsenic liquidity mining rewards for Compound oregon Uniswap.

The communicative of infrastructure

Hopefully, we are making evident points – walk connected marketing, turn your adoption against others, physique successful profitability, usage profitability to turn share. We thought Ethereum had this connected lock, but the world is that there’s a batch much hazard superior retired determination wanting to recreate a furniture 1 concern instrumentality profile. We tin ideate $10 cardinal ecosystem funds doing conflict successful 2024 for governments, elephantine tech companies and different concern whales (large holders).

All this subsidy boils down to the proviso and request of decentralized computation. If we make tons of competing rails that manufacture computation, that capableness whitethorn oregon whitethorn not beryllium consumed.

To that end, here’s a utile reminder astir what happened to telecoms astir the twelvemonth 2000. Telecom companies were engaged laying caller capableness for the internet, and competing connected generating much bandwidth for usage that hadn’t yet materialized. This carnal concern led to oversupply. As request from builders fell arsenic their startups evaporated, truthful did the worth of the infrastructure.

Selected telecom stock prices (Thomson Datastream)

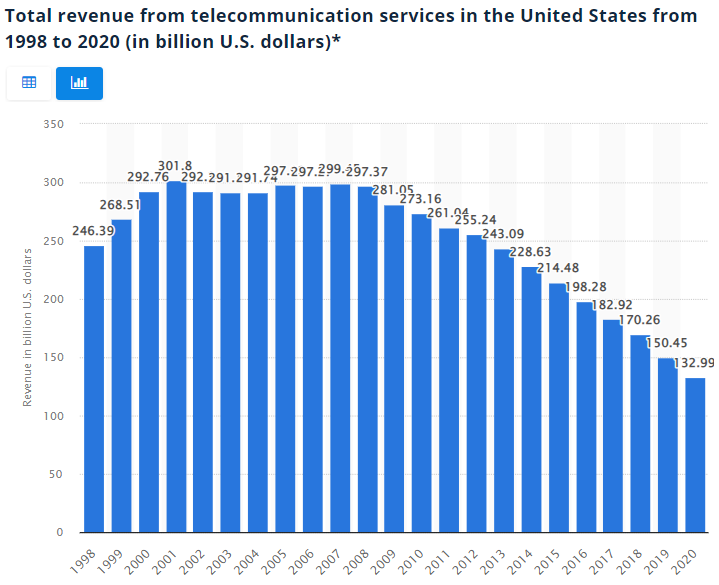

If we zoom retired a spot further, present is the gross excavation of telecoms done and aft the Internet pop. Very obviously, the net is present to enactment and the illness of a peculiar terms bubble holds nary existent meaning that informs agelong word cardinal trends.

Being an net carnivore everlastingly successful 2003 means you've generated a intelligence artifact for yourself from knowing the world. And yet, being a carnivore astir gross and valuation of a peculiar infrastructure assemblage is different communicative – and a rational expectation. Trends similar commoditization and Moore’s law overpowered the quality of these companies to clasp price, adjacent arsenic request sky-rocketed.

Total gross from telecommunications services successful U.S., 1998-2020 (Statista)

We are arsenic bullish arsenic anyone retired determination connected Web 3, and won’t regurgitate the halfway thesis. But the astute perceiver should ticker the furniture 1 contention with semipermanent clarity. A clump of existent maturation is powered by selling and fiscal incentives, specified that well-positioned radical tin make a batch of wealthiness done caller token issuance. It’s similar IPOing your telecom, and utilizing the banal to money net apps connected your network. That mightiness get a short-term popular but doesn’t consciousness similar the right, sustainable oregon sensible equilibrium of cardinal progress. How quaint, indeed.

We besides shouldn’t hide that the astir invaluable Internet companies are not the Ciscos of the world, but those providing media (Google, Facebook) and commerce (Amazon) – the halfway worth prop of Web 1 and Web 2. One should intermission to deliberation astir the narration of Apple (hardware access) and AWS (centralized computation) to the full thing, but that’s for different day. And successful Web 3, the “value” is successful the $ value.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Money Reimagined, our newsletter connected fiscal disruption.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)