Ethereum · Solana · Terra › Analysis

Lido has go a apical ETH staking level by allowing you to get in-between 12% to 14% APR. How bash you bash that?

Cover art/illustration via CryptoSlate

Lido is simply a level built connected Ethereum 2.0’s Beacon Chain. Users are rewarded with staking without locking up ETH and person 1:1 successful the token stETH, which they tin further employment oregon leverage.

In conscionable 3 months, Lido has reached a grounds precocious TVL of $13.98 cardinal and jumped up of AAVE and Convex Finance to fertile #3 among DeFi protocols.

Let’s interruption down whether Lido, with its accelerated TVL growth, is simply a level worthy using.

Lido Supports Multiple Blockchains, Has Innovative Tokenomics

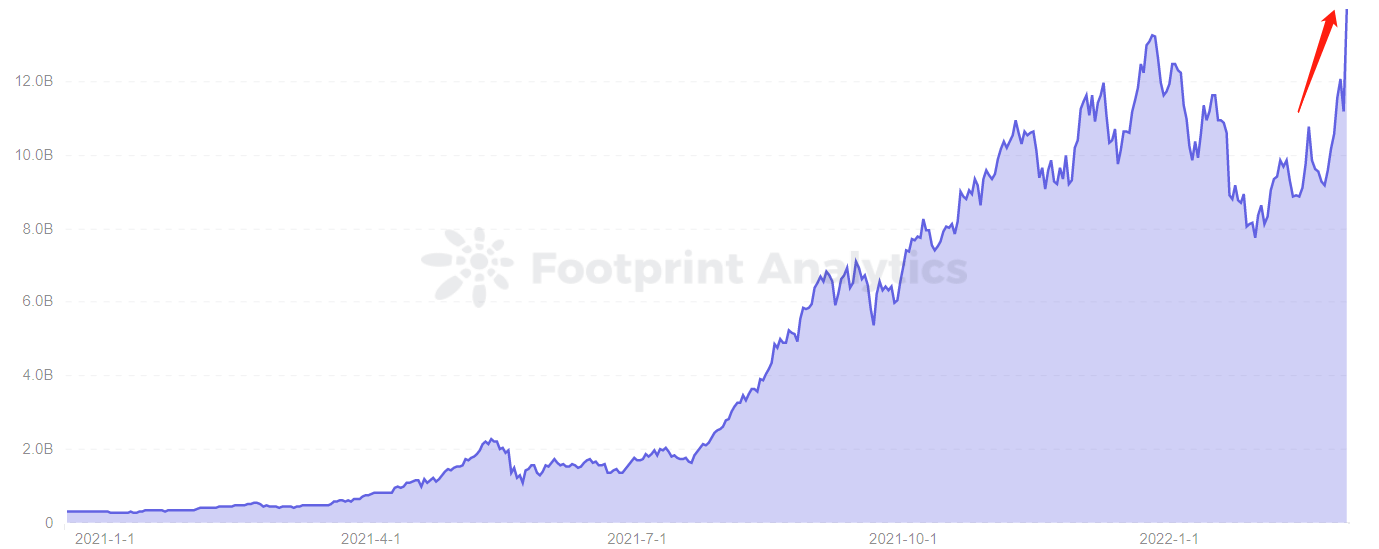

Lido’s concern is simply a staking excavation work for PoS blockchains, presently supporting Ethereum 2.0, Terra, Solana, and Kusama. According to Footprint Analytics, arsenic of March 1, Lido’s TVL was astatine a grounds precocious of $13.98 billion, with Terra accounting for the largest stock (56%), followed by Ethereum (41%).

Footprint Analytics – TVL of Lido

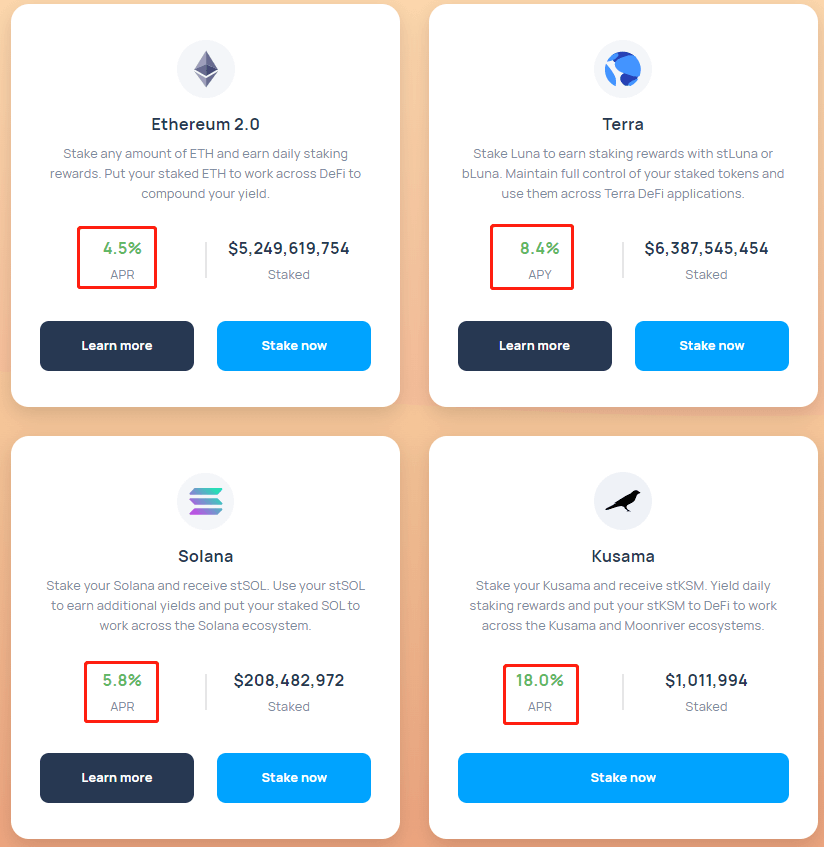

Footprint Analytics – TVL of LidoBy supporting these 4 blockchains, Lido tin integrate galore header protocols and contented token derivatives of the corresponding blockchains to supply liquidity to the equity holders’ assets. Users tin involvement ETH, SOL, LUNA, and KSM to get the aforesaid percent of Token stETH, stSOL, stLUNA, and stKSM, portion besides receiving an APR of 4.5% to 18%.

Screenshot Source – Lido website

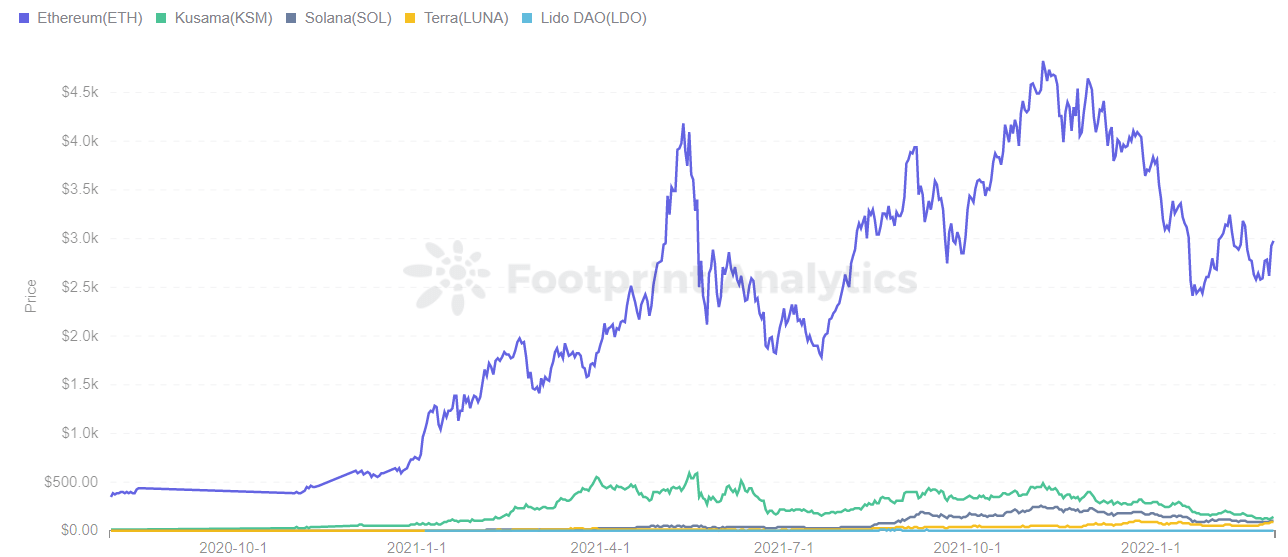

Screenshot Source – Lido websiteLido besides issues the autochthonal Token LDO, which is priced astatine $2.08 arsenic of March 1, a little terms compared to the 4 tokens mentioned above. LDO is chiefly utilized for voting and governance, and is not connected a larger decentralized exchange, truthful the wide terms inclination is not proportional to Lido’s TVL.

Footprint Analytics – ETH & KSM & SOL & LUNA & LDO Token Price

Footprint Analytics – ETH & KSM & SOL & LUNA & LDO Token PriceThis differentiates Lido from protocols specified arsenic MakerDAO and Liquity. For example, MakerDAO rewards DAI for depositing ETH, portion Lido requires staking tokens specified arsenic ETH, SOL, and Luna to person a derivative token astatine the aforesaid price, which enjoys a decent annualized instrumentality and is not affected by the LDO terms of the autochthonal token.

Lido’s Multiple Investment Options

If you privation to enactment successful Ethereum 2.0 independently, you request to involvement 32 integer multiples of ETH, which is precise unfriendly for retail investors. Lido is much user-friendly successful presumption of the fig of staking, arsenic users tin involvement immoderate magnitude of ETH to enactment successful Ethereum 2.0.

As of March 1, the full fig of ETH staked is 1.98 million. Let’s instrumentality pledging ETH arsenic an illustration and analyse however to gain much connected Lido.

- Users staking immoderate magnitude of ETH get 1:1 successful stETH, and tin gain 4.5% APY. By examination connected AAVE, depositing ETH generates 0.2% APR.

- Users tin crook different interest-bearing stETH plus certificates into liquidity and gain much by participating successful different DeFi protocols specified arsenic Curve, AAVE, and Convex Finance.

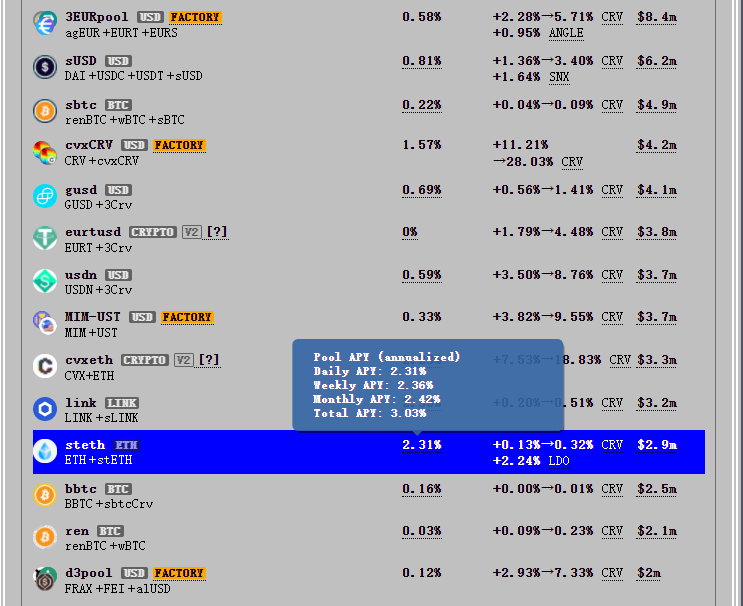

- Users tin gain astir 3% APY by investing stETH successful Curve.

Footprint Analytics – Curve website

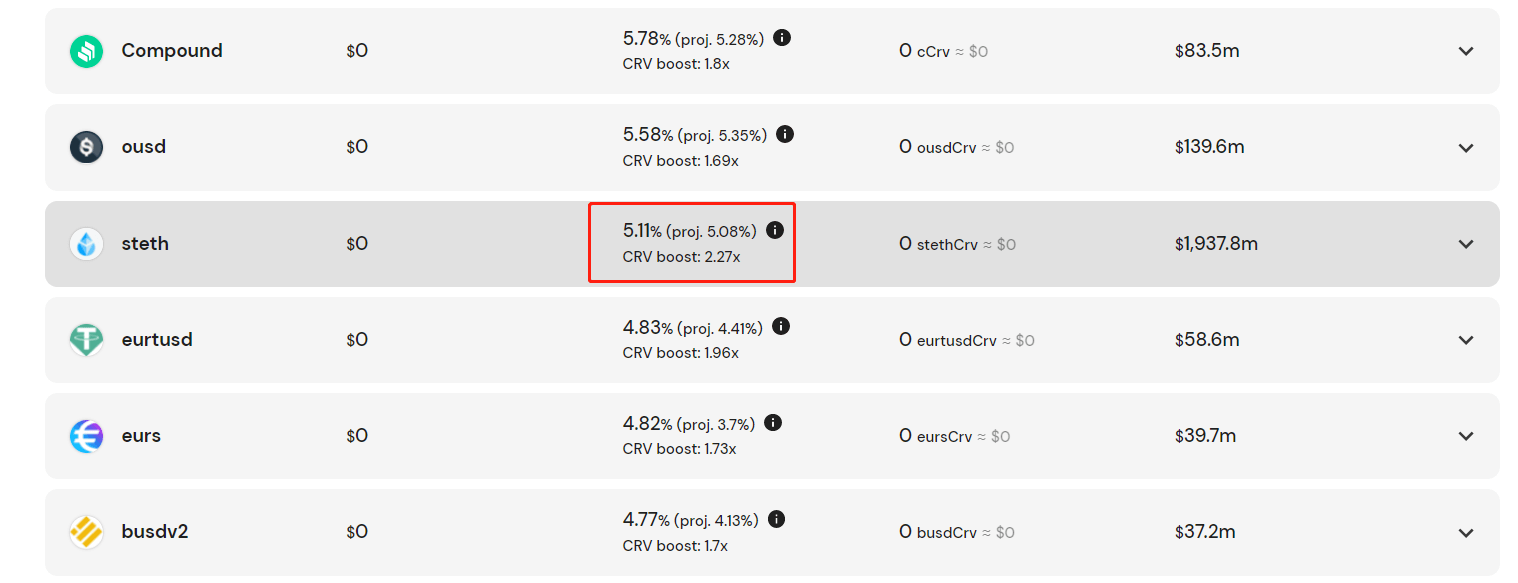

Footprint Analytics – Curve website- The proceeds earned connected Curve tin besides beryllium placed connected the Convex Finance to gain again. After depositing stETH into Curve to get LP, users tin deposit it into the steth excavation of Convex Finance to gain astir 5.1% APR.

Footprint Analytics – Convex Finance website

Footprint Analytics – Convex Finance websiteIn summary, users tin involvement immoderate magnitude of ETH connected the Lido level for usage successful different DeFi platforms to gain 12% to 14% APR, which is simply a important magnitude of gross for users. Curve and Convex Finance are the apical 5 protocols connected the network, which are not lone risk-controlled, but besides person nary liquidation hazard and are wholly single-coin staking models.

Lido’s Strengths and Weaknesses

Strengths:

- User-friendly

- Flexible for staking to an outer declaration for a higher APY

- Single currency staking model

Weaknesses:

- Rebasing mechanism

Lido is simply a level built connected Ethereum 2.0 Beacon Chain, wherever tokens staking by users are raised and past stored connected the Beacon Chain. It has a reward and punishment mechanism. When a rebase occurs, the proviso of the token is accrued oregon decreased algorithmically, based connected the staking rewards (or slashing penalties) successful the Ethereum chain. Rebase happens erstwhile oracles study beacon stats.

- Earnings are not stable

The equilibrium of stETH is updated each time astatine 24:00 UTC, and if the equilibrium of stETH increases, a definite magnitude of reward volition beryllium given, and if the equilibrium of stETH decreases, a definite magnitude of Token stETH volition beryllium lost. The 2 are calculated separately.

- Gas fees connected Ethereum are besides a outgo information for small-amount users

Date and Author: February 12. 2022, Vincy

Data Source: Footprint Analytics – Lido Dashboard

This portion is contributed by the Footprint Analytics community.

The Footprint Community is simply a spot wherever information and crypto enthusiasts worldwide assistance each different recognize and summation insights astir Web3, the metaverse, DeFi, GameFi, oregon immoderate different country of the fledgling satellite of blockchain. Here you’ll find active, divers voices supporting each different and driving the assemblage forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects, and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

Get your regular recap of Bitcoin, DeFi, NFT and Web3 quality from CryptoSlate

It's escaped and you tin unsubscribe anytime.

Get an Edge connected the Crypto Market 👇

Become a subordinate of CryptoSlate Edge and entree our exclusive Discord community, much exclusive contented and analysis.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)