Thanks to 2021, astir radical person astatine slightest heard of crypto by present – not conscionable Bitcoin and Ethereum, but altcoins similar DOGE and SHIB, arsenic good arsenic presumption similar NFTs and the metaverse.

In CoinDesk Research’s 2021 Annual Crypto Review, we purpose to summarize immoderate of the cardinal themes and metrics that marked the past year’s advancement successful cryptocurrency markets.

As with each fiscal assets, marketplace show is usually the archetypal happening that comes to caput erstwhile considering a “year successful review.” Bitcoin (BTC) and ether (ETH), the 2 largest cryptocurrencies by marketplace cap, posted gains good successful excess of accepted macro assets, gaining 60% and 407%, respectively.

While ether, the autochthonal plus of the Ethereum blockchain, inactive has a mode to spell earlier accepted investors statesman to signifier their concern thesis, bitcoin cemented itself successful the minds of each nonrecreational investors, arsenic it eclipsed $1 trillion successful marketplace capitalization successful 2021. What’s more, bitcoin besides remained uncorrelated with each macro assets, which could marque for an absorbing worth proposition for the plus arsenic managers look to attack their portfolio operation successful 2022. That said, bitcoin’s correlation with the S&P 500 ticked up successful the 4th quarter, suggesting that investors are trading bitcoin and equities unneurotic arsenic risk-on assets.

Bitcoin adoption and tech development

Outside of marketplace performance, 2021 was a large twelvemonth for Bitcoin from an adoption and technological standpoint. In June, El Salvador announced that bitcoin would go ineligible tender; that declaration came to fruition successful September erstwhile a instrumentality that stipulated that bitcoin indispensable beryllium accepted arsenic a signifier of outgo everyplace successful the state went into effect.

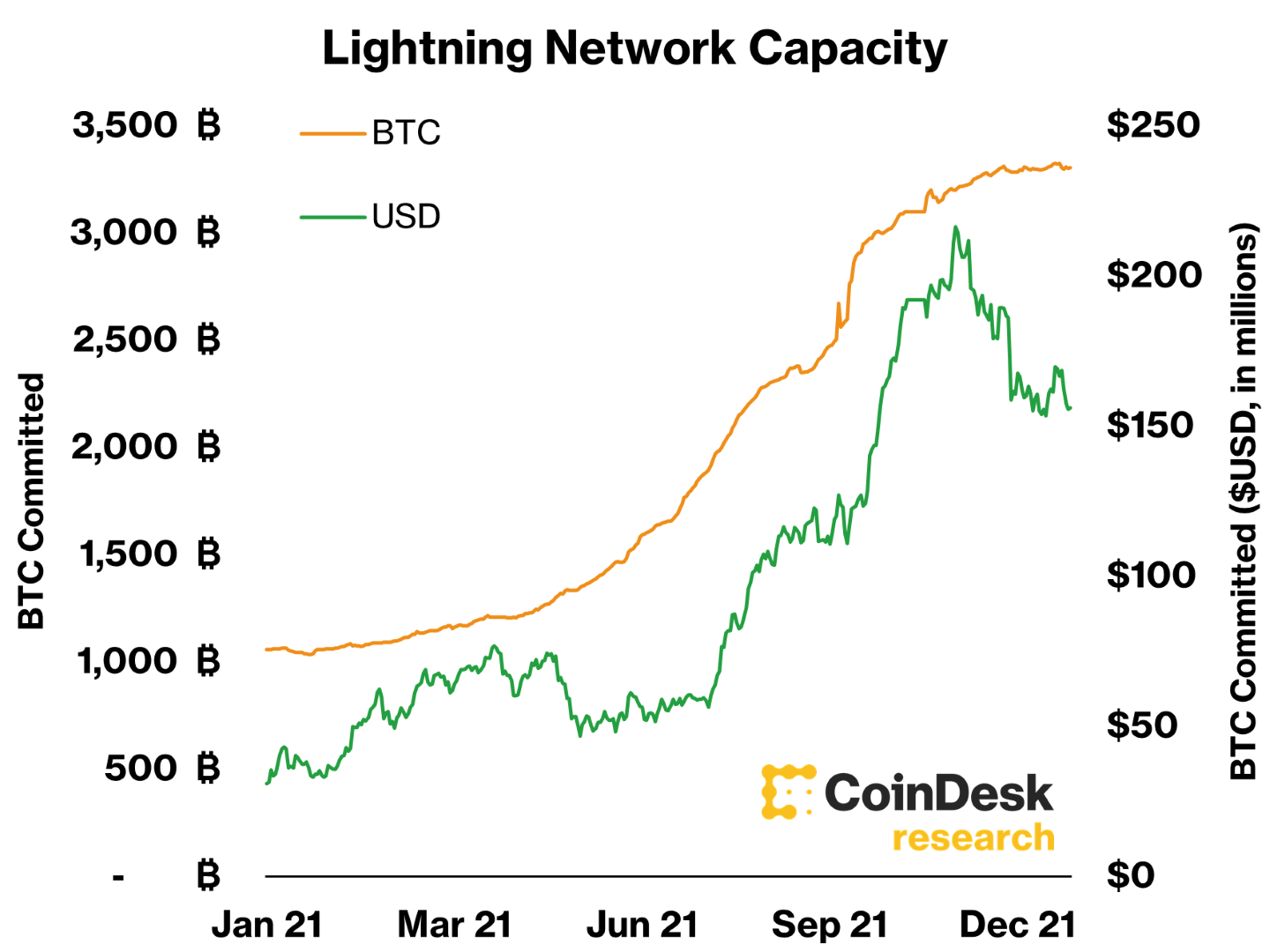

With that came aggregate bitcoin purchases by the government, carried retired from the president’s cellphone. Meanwhile, a escaped $30 worthy of bitcoin was sent to Salvadorans who signed up to usage Chivo, the country’s authoritative bitcoin wallet, and a committedness was made to usage the Lightning Network, the commerce furniture for Bitcoin (read much here), to alteration a much frictionless bitcoin economy. The magnitude of bitcoin committed to the Lightning Network grew incredibly accelerated successful 2021, injecting renewed beingness into the integer currency usage lawsuit for Bitcoin.

Bitcoin committed to the Lightning Network exceeded 3,300 BTC successful 2021. (https://bitcoinvisuals.com/ln-capacity)

2021 besides marked the twelvemonth of an important technological upgrade to the Bitcoin protocol known arsenic Taproot (read much here). Taproot is simply a bundle of 3 upgrades that improves web security, privateness and scalability. Taproot is the astir important upgrade to the Bitcoin web since the activation of the artifact capableness enhancement of Segregated Witness successful 2017. Taproot was a reminder that Bitcoin is simply a exertion that tin alteration successful bid to amended usability and idiosyncratic experience. Taproot’s occurrence successful the aboriginal volition basal arsenic a objection that Bitcoin tin adapt.

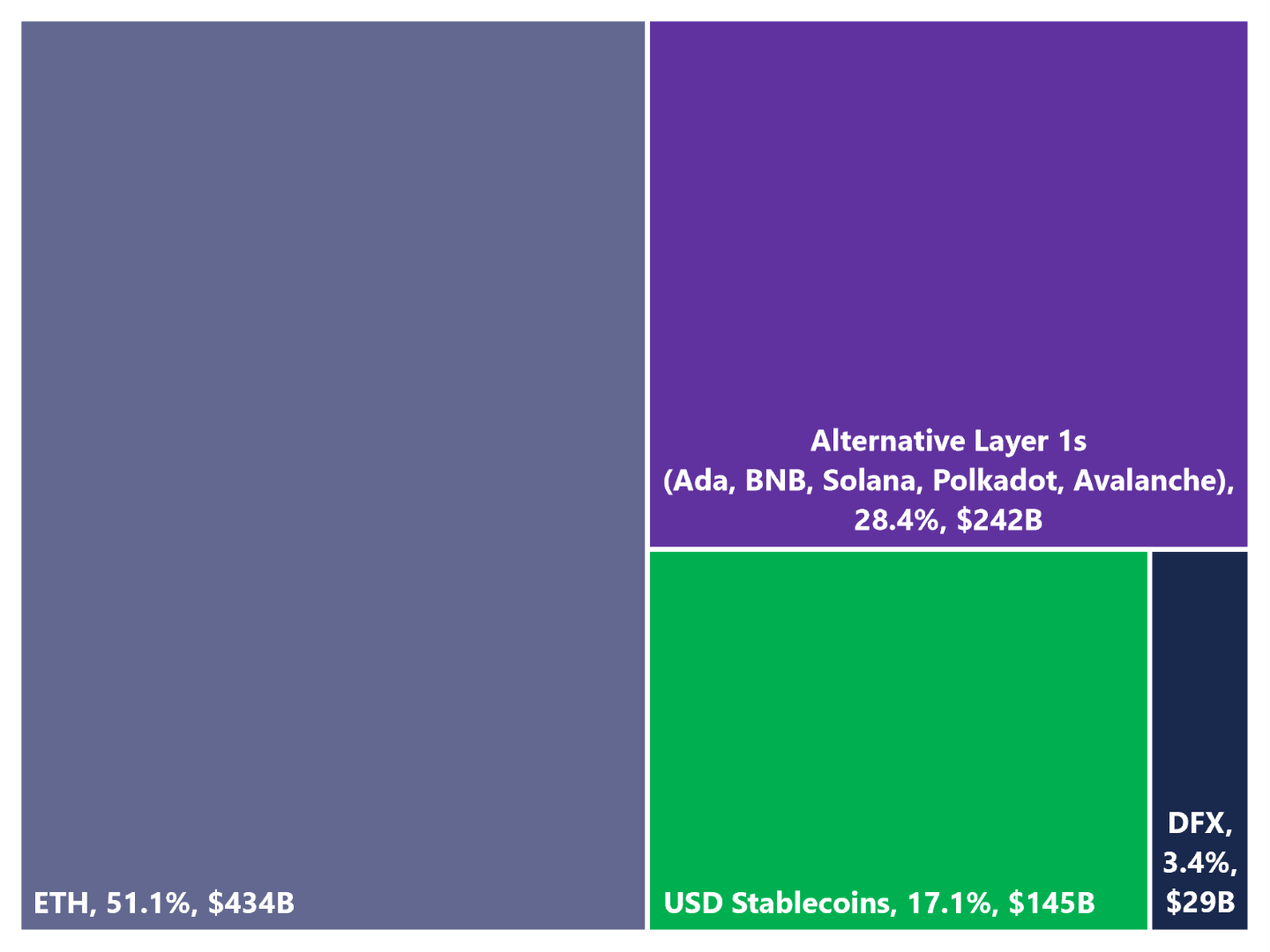

With ether’s superior plus terms show compared with bitcoin, it’s nary astonishment that bitcoin dominance, the measurement of BTC marketplace capitalization compared with the marketplace capitalization of each integer assets, fell during 2021 from 70.2% to 40.1%. ETH is not the sole crushed for bitcoin shedding its dominance; rather, crypto projects person sprung up with galore antithetic usage cases that are not competing straight with Bitcoin.

Ethereum has had large catalysts from EIP 1559 to the impending modulation to proof-of-stake. Both events play important roles not lone successful the maturation of Ethereum arsenic a technology, but besides successful processing a communicative for Ethereum’s autochthonal asset. EIP 1559 solidified ether’s relation arsenic “gas” wrong the ecosystem, demanding that the plus beryllium utilized and burned successful speech for gathering connected oregon interacting with the network. The “Merge” to proof-of-stake is an effort to make a secure, much scalable smart contract web without the request for miners and important vigor consumption.

Ethereum was the catalyst for the archetypal coin offering roar and bust successful 2017/8 and retired of the embers came the archetypal question of decentralized concern (DeFi). During 2019 and 2020, Ethereum-based projects specified arsenic Aave (formerly Lend), Compound and Uniswap recovered their footing. Using the crypto bull marketplace and liquidity mining (token incentives) arsenic fuel, DeFi projects were capable to get billions of dollars successful liquidity for businesslike decentralized lending and trading markets.

Ether remains ascendant implicit altcoins and stablecoins. (CoinDesk Research, CoinMarketCap)

Ethereum tin besides recognition a sizable information of its upswing to the emergence of non-fungible tokens (NFTs), which brought the protocol into the mainstream. NFTs are unsocial tokens that tin enactment arsenic integer representations of carnal items oregon digitally autochthonal items whose impervious of ownership tin beryllium verified connected a nationalist blockchain. As such, NFTs effort to basal successful arsenic the archetypal iteration of integer ownership of collectibles connected a blockchain. OpenSea was the darling of the NFT assemblage successful 2021, bringing a integer creation marketplace to retail investors.

Capital concern successful crypto and DLT companies

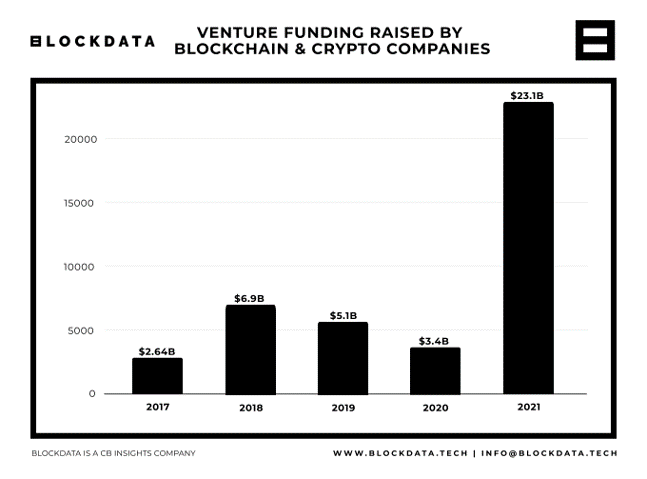

Crypto companies drew monolithic involvement from task funds successful 2021. (Blockdata)

Inside the satellite of institutions and regulation, superior poured into blockchain and crypto companies. According to information from Blockdata, $23 cardinal of backing reached these companies successful 2021, which is much than the full magnitude raised from 2017 to 2020. We adjacent saw a $1 cardinal superior rise successful December for crypto fiscal services steadfast NYDIG, and crypto speech FTX raised much than $1 cardinal crossed 2 backing rounds.

From a regulatory perspective, governments crossed the satellite are taking crypto seriously. We person seen China prohibition bitcoin mining and crypto trading outright. India and Nigeria person tried to bash the same. The Bank of England said successful a Financial Stability Report that the maturation of crypto assets poses a imaginable menace arsenic it becomes progressively linked to wider fiscal networks.

The connection “crypto” adjacent echoed successful the halls of Congress arsenic a $1 trillion infrastructure measure was held up successful portion owed to a crypto tax-reporting provision. Regulators’ engagement successful and treatment of crypto is indicative of the wide content that crypto is present to enactment and truthful should beryllium regulated to “keep citizens safe.”

Overall, 2021 was an bonzer twelvemonth for the cryptocurrency and blockchain industry. Read the afloat study here.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)