We person yet to spot deeper levels of antagonistic backing implicit sustained periods of time, truthful this whitethorn archer america the worst of the carnivore marketplace is yet to come.

The beneath is simply a free, afloat excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

In today’s Bitcoin Magazine Pro, we volition screen the historically important 200-week moving mean arsenic good arsenic screen the play terms enactment and derivative marketplace movements.

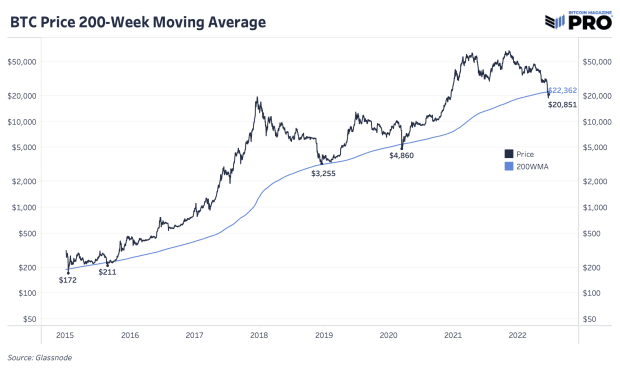

Bitcoin is presently beneath its 200-week moving average, which has lone happened 4 times passim bitcoin’s history, marking important cyclical bottoms, but nary person occurred during the unsocial economical concern we find ourselves successful today. Although contiguous and this past play apt volition look similar premier accumulation opportunities 5 years from now, it’s hard to reason that the worst is implicit and it's up lone from here, with perchance much cryptocurrency-native contagion and macro headwinds ahead. Regardless of the disfigured macroeconomic backdrop (which the marketplace has undoubtedly been pricing successful for the past six months), a elemental look astatine the 200-week moving mean to physique a model for bitcoin accumulation has served past marketplace participants highly well.

Bitcoin's 200-week moving average

Bitcoin's 200-week moving average

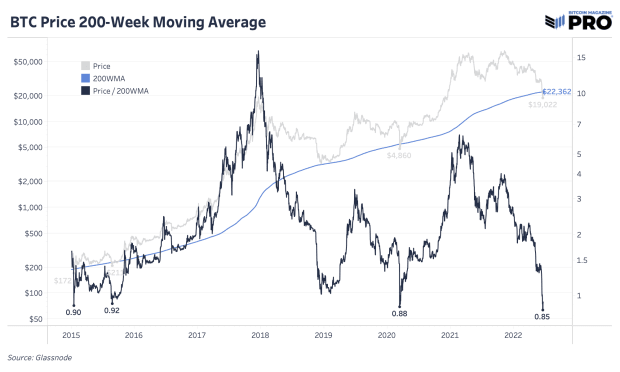

Bitcoin's terms divided by the 200-week moving mean gives america the Mayer Multiple

Bitcoin's terms divided by the 200-week moving mean gives america the Mayer Multiple

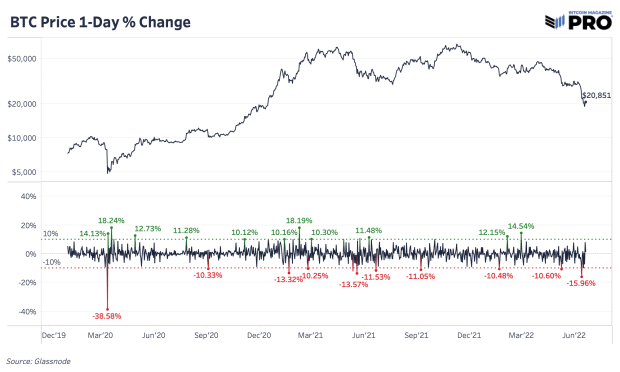

The one-day percent alteration successful bitcoin's price

The one-day percent alteration successful bitcoin's price

Derivative Market Shenanigans

Our issues past week were wholly focused connected the cryptocurrency-native contagion taking place, arsenic industry-wide panic occurred connected whether assorted counterparties were solvent, and whether funds connected assorted platforms were harmless for users/depositors.

Read past week's issues here:

- Monday’s contented - Celsius Exchange Halts Withdrawals: What Went Wrong?

- Tuesday’s contented - Celsius And stETH - A Lesson On (il)Liquidity

- Wednesday’s contented - Three Arrows Capital Faces Liquidation

- Thursday’s contented - Fears of Further Contagion

- Friday’s contented - 3AC And The Leaning Tower Of Babel

While overmuch of the sell-off was driven by forced selling owed to collateralized loans connected DeFi protocols (or the fearfulness thereof), the derivative marketplace connected centralized exchanges besides deserves a adjacent look, arsenic it inactive plays a captious relation successful the question of the marketplace implicit the short/medium term.

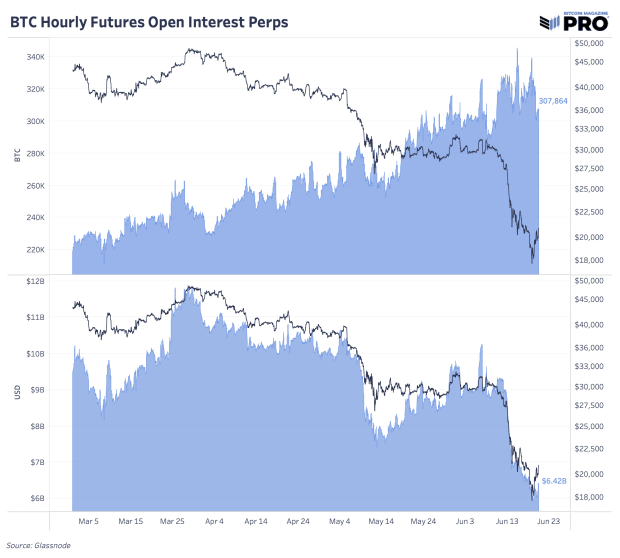

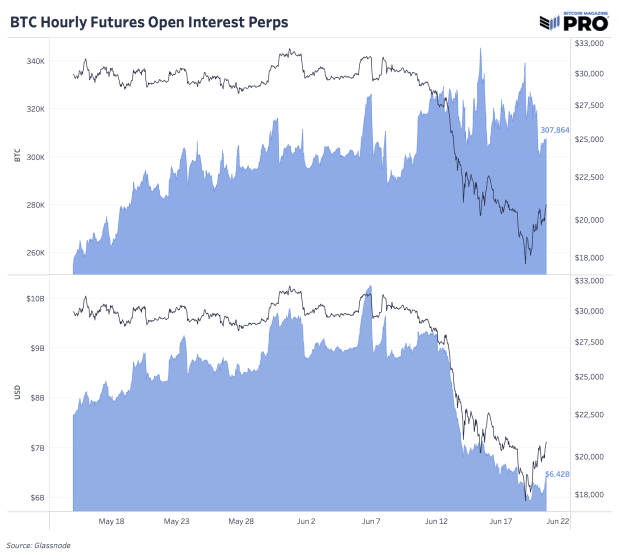

As terms fell beneath $20,000 for bitcoin and $1,000 for ether, perpetual swap futures unfastened involvement exploded and backing rates went sharply negative.

Bitcoin hourly futures unfastened interest

Bitcoin hourly futures unfastened interest

Bitcoin hourly futures unfastened interest

Bitcoin hourly futures unfastened interest

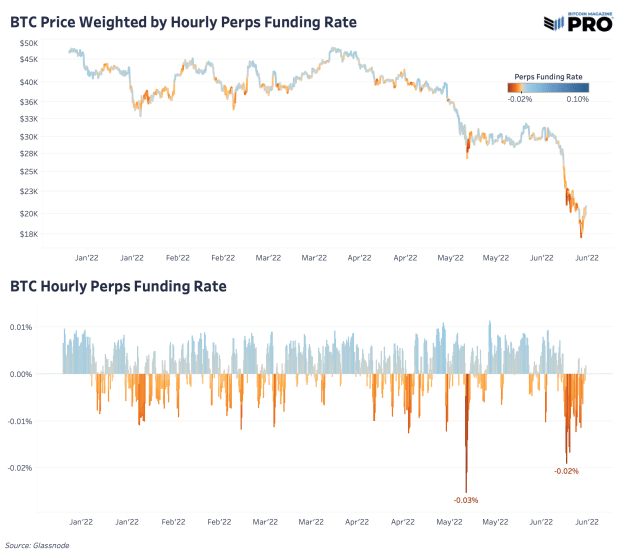

Bitcoin terms weighted by the hourly perps backing complaint and the hourly backing rate

Bitcoin terms weighted by the hourly perps backing complaint and the hourly backing rate

In layman's terms, this means that arsenic the markets fell, derivative traders drove the terms little with an expanding magnitude of leveraged capital, with antagonistic backing rates showing that perpetual futures contracts were starring the mode down.

As the terms reached the mid $17,000s and recovered a bid, precocious shorts recovered themselves offside, and became forced buyers higher arsenic the marketplace rapidly reversed and flew backmost to the $20,000 level earlier the play was over. There is nary escaped luncheon successful the market, and the bitcoin marketplace has a mode of punishing each undisciplined/over-leveraged marketplace participants done its notorious volatility. This derivative marketplace information leads america to the decision that the rally backmost to $20,000 was much a relation of shorts covering.

It should beryllium noted that 1 of the telltale signs of a bitcoin bottommost is simply a heavily-shorted market, and comparing the derivative marketplace information to that of erstwhile years shows that that play whitethorn precise soon beryllium upon us.

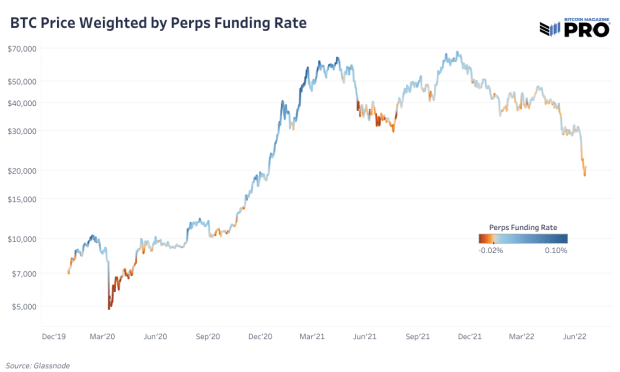

Bitcoin terms weighted by the hourly perps backing rate

Bitcoin terms weighted by the hourly perps backing rate

A heavily-shorted bitcoin derivatives marketplace is simply a marketplace primed to alert higher, and portion we saw a beardown reversal supra $20,000 owed to a compression of abbreviated positions implicit the weekend, the worst whitethorn beryllium yet to come.

Sustained periods of antagonistic backing for perpetual futures and backwardation (futures terms beneath spot price) are 2 of the biggest telltale signs of a marketplace primed for reversal to the upside.

While abbreviated positioning has been much predominant and terrible successful caller days than it has been implicit the people of the past six months, deeper levels of antagonistic backing implicit sustained periods of clip is what to look for during a existent marketplace rhythm bottommost (when analyzing past rhythm lows).

3 years ago

3 years ago

English (US)

English (US)