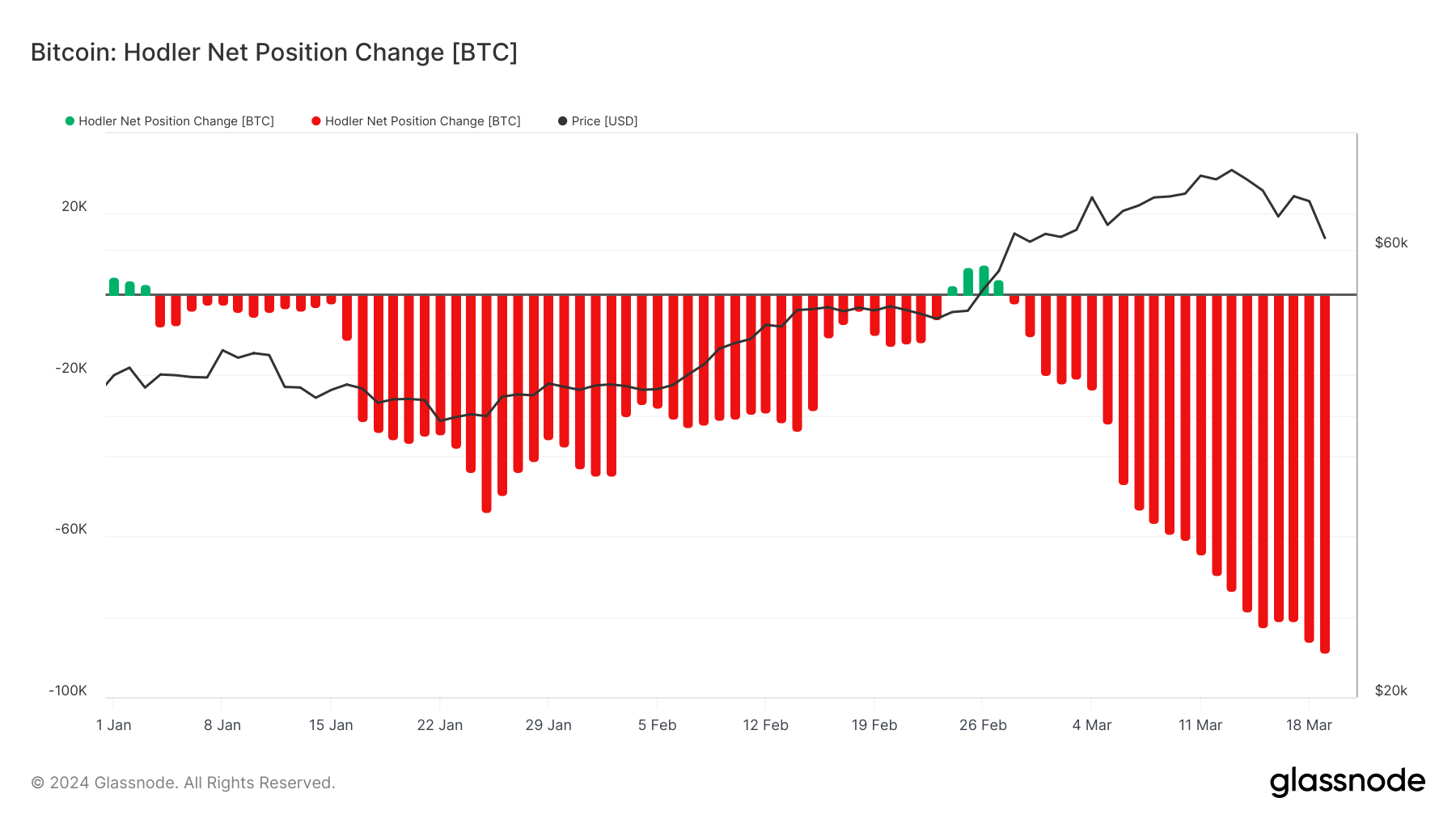

Glassnode’s hodler nett presumption alteration metric offers a granular presumption into the behaviour of Bitcoin’s semipermanent investors. The metric is calculated by tracking the inflows and outflows from wallets categorized arsenic holders — oregon those who person been “holding connected for beloved life” for a precise agelong time.

This metric is pivotal successful knowing marketplace sentiment, peculiarly the assurance levels of the investors known for their semipermanent committedness to holding Bitcoin, careless of marketplace volatility.

On March 19, the 30-day hodler nett presumption alteration reached -88,860 BTC, marking the astir important antagonistic displacement successful 3 years.

This downward inclination has persisted since Jan. 4, breached lone by a little 4-day play of affirmative alteration astatine the extremity of February. This sizeable alteration successful hodler balances comes aft a crisp correction successful Bitcoin’s terms — which dropped from a highest of $73,000 connected Mar. 13 to conscionable nether $61,000 by Mar. 20.

The 30-day nett alteration successful hodler presumption from Jan. 1 to Mar. 19 (Source: Glassnode)

The 30-day nett alteration successful hodler presumption from Jan. 1 to Mar. 19 (Source: Glassnode)Such a important antagonistic alteration successful hodler equilibrium typically signals a alteration successful semipermanent capitalist behaviour and tin bespeak reduced assurance successful Bitcoin’s terms stableness successful the adjacent term. The timing and standard of these changes tin suggest a notable displacement successful sentiment among these investors, who are mostly known for their resilience during marketplace volatility.

However, interpreting the authorities of the marketplace done a azygous metric, specified arsenic the hodler nett presumption change, tin beryllium misleading if different indicators aren’t considered.

Previous CryptoSlate analysis recovered that contempt the short-term terms volatility and the summation successful selling unit connected centralized exchanges, the underlying inclination of accumulation wrong the marketplace remained unaffected.

This is seen successful the divergence betwixt the marketplace headdress and the realized cap, indicating that the alteration successful marketplace worth did not deter the accumulation of Bitcoin, with the realized headdress showing an summation successful the realized worth of each coins moved connected the network.

Despite the alteration successful semipermanent holder balances since December 2023, this ongoing accumulation suggests that different factors are astatine play. The diminution successful over-the-counter (OTC) table balances and important outflows from Grayscale’s ETF are imaginable contributors to this trend.

OTC desks, serving large-volume traders and institutions, facilitate large transactions with minimal marketplace impact. A simplification successful OTC balances whitethorn bespeak that organization investors are transferring their holdings to exchanges, perchance successful anticipation of income oregon to conscionable liquidity needs. This contributes to the antagonistic hodler nett presumption alteration without needfully indicating a wide sell-off among idiosyncratic semipermanent holders.

Furthermore, outflows from Grayscale’s GBTC, a cardinal organization conveyance for Bitcoin vulnerability earlier the motorboat of spot Bitcoin ETFs, whitethorn person importantly influenced the hodler nett position. These movements could beryllium driven by investors reallocating to ETFs with much competitory fees oregon liquidating positions owed to marketplace conditions.

The information shows the value of considering aggregate sources and on-chain metrics to summation a broad knowing of the market. Institutional actions tin person outsized impacts connected marketplace indicators and whitethorn not ever align with the sentiment and behaviour of the broader capitalist community.

The station What’s pushing down Bitcoin’s hodler balances? appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)