In his latest video published connected December 21, crypto expert Rekt Capital tried to reply the question “What’s The Worst Case Scenario For Bitcoin Right Now?”. After reaching a caller all-time precocious astatine $108,374 connected December 17, the BTC terms is down much than -11%.

How Low Can Bitcoin Price Go?

Rekt Capital enactment the Bitcoin price pullback successful a humanities perspective, underscoring the humanities value of weeks 6, 7, and 8 successful a “price find uptrend.” Drawing upon past cycles specified arsenic 2013, 2016–2017, and 2021, helium explained that Bitcoin has a beardown inclination to close during these circumstantial windows, with immoderate dips reaching arsenic steep arsenic 34% oregon adjacent higher.

“Understanding these weeks is important due to the fact that they thin to beryllium problematic for Bitcoin,” Rekt Capital stated, referencing past cycles wherever important downturns occurred wrong this timeframe. For instance, successful week 7 of the 2013 cycle, Bitcoin experienced a melodramatic 75% pullback implicit 13 weeks. Similarly, the 2016-2017 play saw a 34% diminution successful week 8, underscoring the recurring vulnerability during these circumstantial weeks.

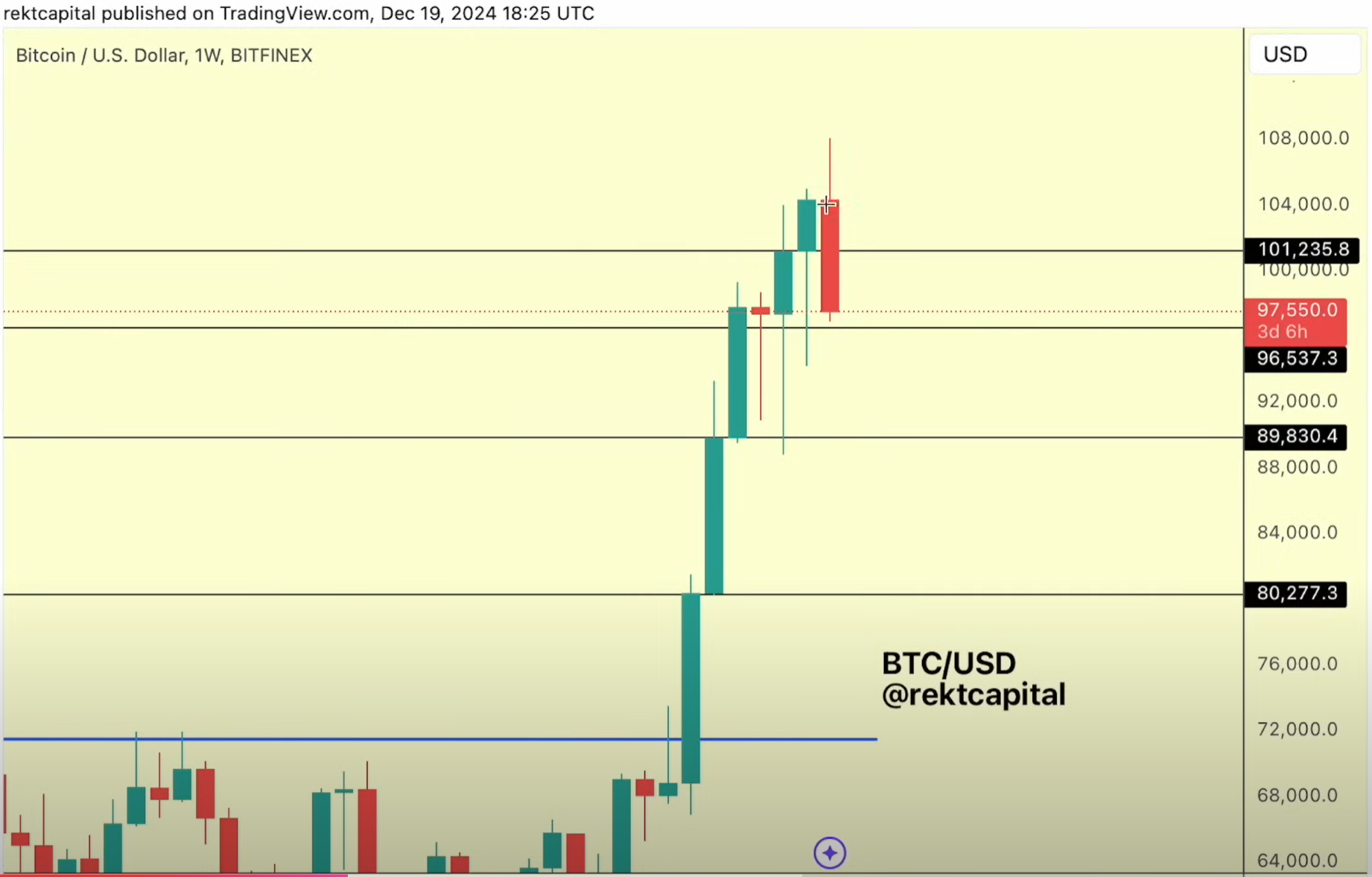

As of the existent cycle, Bitcoin has undergone a 10%+ retracement, bringing its terms into a historically captious enactment portion astatine $96,537 connected the play chart. Rekt Capital emphasized the value of this enactment level, noting, “This country of humanities enactment has enabled the determination to $108,000.” He cautioned that nonaccomplishment to support this enactment could trigger a much terrible correction down to $89,830.

Bitcoin terms investigation play illustration | Source: X @rektcapital

Bitcoin terms investigation play illustration | Source: X @rektcapitalExamining the terms enactment of the past fewer days, Rekt Capital pointed retired the emergence of a bearish engulfing candle successful the play timeframe—a method indicator often associated with imaginable reversals. “We’re losing resistances that turned into support,” helium observed. This nonaccomplishment signifies a imaginable modulation into a corrective period, arsenic the terms struggles to support its upward trajectory.

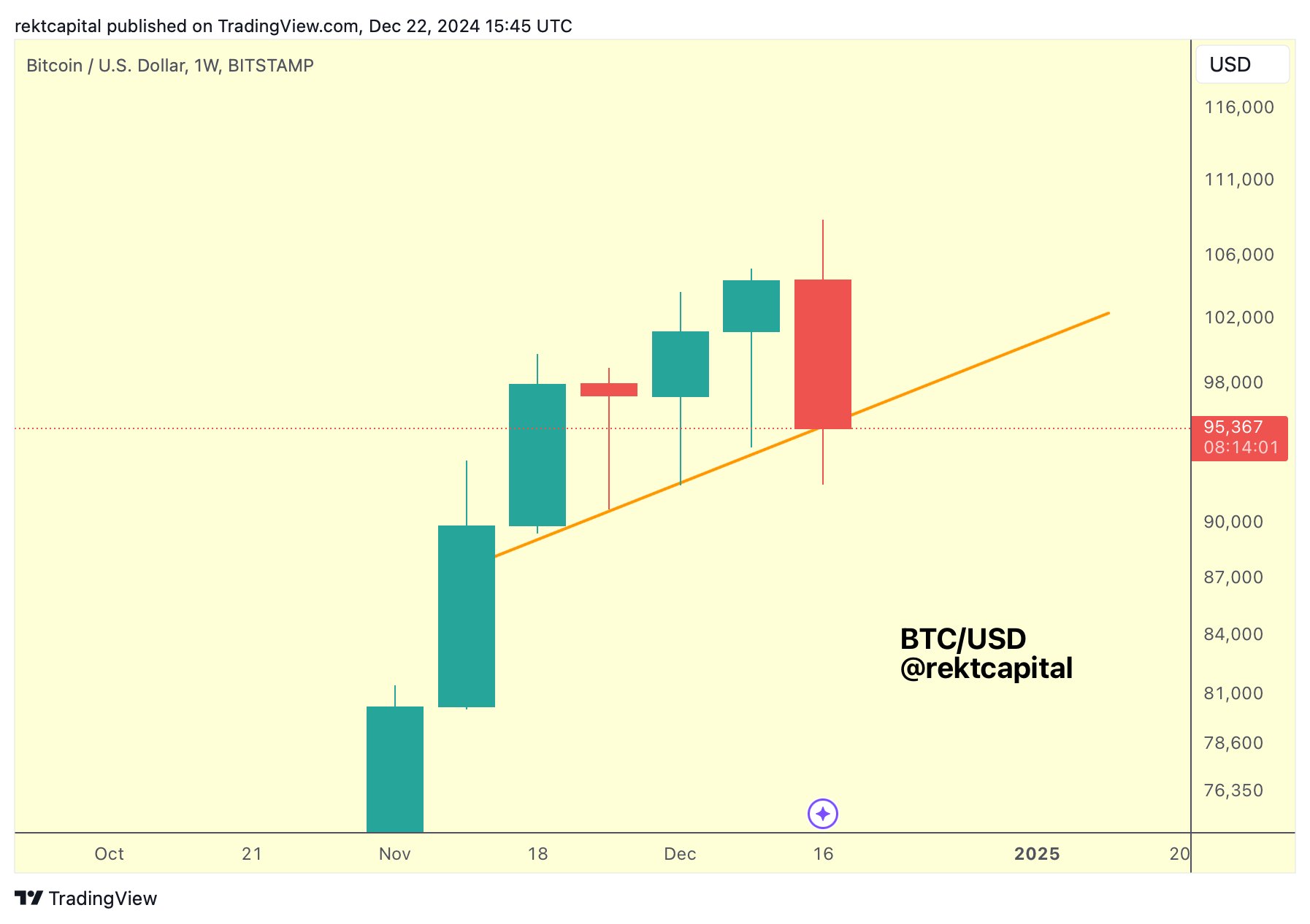

Rekt Capital besides pointed retired the value of maintaining the 5-week method enactment successful his analysis. “If we suffer this 5-week method uptrend and the orangish inclination line, it would beryllium mounting grounds that we mightiness beryllium transitioning into a corrective period,” helium warned.

Bitcoin play illustration | Source: X @rektcapital

Bitcoin play illustration | Source: X @rektcapitalFurthermore, helium addressed the CME gap betwixt the $78,000 and $80,000 terms levels, a captious country that has remained unfilled. “Delving into 26%, 27%, 28% dips could capable the full CME gap,” Rekt Capital noted.

Historically, CME gaps person the inclination to get filled whereas determination are a fewer ones which person ne'er been filled.

Despite each cautionary signals, Rekt Capital maintains a bullish stance successful the semipermanent “These pullbacks are what alteration aboriginal uptrends successful the parabolic signifier of the cycle,” helium explained. Drawing from erstwhile cycles, helium illustrated however corrections person historically provided the indispensable “breather” for the market.

In the 2021 cycle, for example, Bitcoin experienced a 16% pullback successful week 6 and an 8% dip successful week 8, yet the wide inclination continued upward. Similarly, the existent 10% retracement, portion significant, could service arsenic a preparatory signifier for the next limb of terms discovery.

At property time, BTC traded astatine $95,000.

BTC terms rejected astatine the channel, 4-hour illustration | Source: BTCUSDT connected TradingView.com

BTC terms rejected astatine the channel, 4-hour illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

9 months ago

9 months ago

English (US)

English (US)