One of the astir fascinating aspects of bitcoin is its humanities meteoric terms rise. Is bitcoin going to proceed connected this humanities way oregon is maturation going to slow, oregon adjacent halt?

The stock-to-flow (S2F) model, enactment guardant by PlanB, suggests that bitcoin’s aboriginal terms tin beryllium forecast rather precisely and that the terms volition proceed a dependable and awesome way upwards, with astir tenfold returns each 4 years. The S2F exemplary has attracted a batch of attention, and PlanB has amassed an awesome fig of followers (1.7 cardinal astatine the clip of writing).

Perhaps successful portion owed to its popularity, the exemplary has much precocious been met with a batch of criticism. An illustration of specified disapproval is a harshly-worded caller article published successful Bitcoin Magazine. Also, successful July 2020, Eric Wall enactment unneurotic a postulation of criticisms.

It appears that astir radical find themselves successful either of 2 camps: the “pro” S2F and the “con” S2F camps. How should we presumption ourselves?

Before I spell on: I person written negatively astir the S2F exemplary since 2019, erstwhile I predicted that the S2F model’s predictions would beryllium excessively bullish. I person besides exchanged with PlanB some publically connected Twitter (e.g. here), and privately. I person coauthored a much mathematical article unneurotic with InTheLoop, clarifying wherefore we some deliberation the S2F exemplary is excessively bullish. It mightiness truthful travel arsenic nary astonishment that I americium not precisely successful the S2F camp. However, I person besides noticed that immoderate of the criticisms towards the S2F are invalid. Other criticisms purport to woody a decease stroke to the S2F model, whereas successful fact, they bash not. I truthful anticipation to adhd immoderate clarity. It is important to beryllium close for the close reasons, due to the fact that close principles are our lone accidental of being close successful the future.

The S2F Model

The S2F exemplary states that the terms of bitcoin is driven by its scarcity. As the halvings guarantee that bitcoin becomes ever much scarce, its terms should continuously increase. The narration betwixt scarcity and terms is mathematically defined (using 2 empirically estimated parameters) and astir forecasts a tenfold summation successful terms each 4 years. This gives america a terms of $100,000 per bitcoin for this halving epoch, $1,000,000 for the next, and truthful on.

What’s incorrect with this model? Let’s look astatine immoderate arguments that are enactment guardant to discredit the model:

Tautological Specification

In their caller Bitcoin Magazine article, Level39 had this to accidental regarding the S2F model:

“Notice however the relation says ‘market value’ equals a relation of Stock-to-flow? This is simply a exemplary misspecification with tautological logic and truthful statistically invalid, for the elemental crushed that ‘market value’ decomposes to ‘stock / price’ portion ‘stock / flow’ is connected the different broadside of the equation. In layman’s presumption PlanB is fundamentally asserting that ‘stock is simply a relation of stock.’ A tautology is simply a trivial connection that is existent nether immoderate circumstances. It’s similar saying a banana is simply a benignant of banana. Of people banal is simply a relation of stock. This is wherefore the information fits, but is scientifically worthless. Tautologies are existent but bash not archer america thing useful. Rather, they are existent due to the fact that of the meanings of the terms.”

But is this truly so? Has PlanB truly fixed america a tautological formulation that doesn’t archer america thing useful, a spot arsenic if Isaac Newton had told america that F = F? Is banal truly connected some sides of the equation?

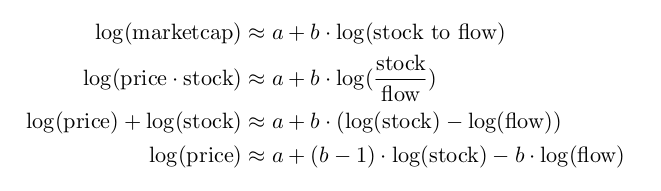

The S2F exemplary arsenic formulated by PlanB attempts to approximate the marketplace headdress of bitcoin utilizing stock-to-flow arsenic an input adaptable (where a higher stock-to-flow indicates higher scarcity). Two parameters (a and b) indispensable beryllium empirically estimated truthful arsenic to get the champion fit. Writing this down, it astatine archetypal mightiness look that so banal appears connected some sides of the equation (see the 2nd and 3rd lines, below). However, by simply rearranging terms, we spot that this is fine: the terms of bitcoin is connected the left-hand broadside of the question, banal and travel connected the close side.

We person intelligibly demonstrated that the S2F exemplary is not afflicted by a tautology that renders it mathematically invalid. Still, determination is 1 much constituent to make. Level39 goes connected to explain:

“PlanB could debar the tautology by having terms unsocial connected 1 broadside of the equation and possibly physique a regression of terms connected travel oregon banal to flow, but the acceptable would beryllium antithetic without changing the parameters.”

In different words, if PlanB had attempted to exemplary (the log of) the terms utilizing a linear relation of stock-to-flow alternatively of the marketplace cap, the banal would not look connected some sides of the equation, and hence the expected tautology would disappear. In different words, successful bid to get a terms forecast based connected stock-to-flow, we could either:

- Model the marketplace cap, and construe the marketplace headdress backmost to prices. This is what PlanB did, and Level39 sees a tautology here, or:

- Model the terms directly. Level39 sees nary tautology here.

Level39 insinuates that A would nutrient a overmuch amended acceptable than B due to the fact that of the expected tautology. But is this truly the case? In the beneath crippled I person compared some models:

We spot the 2 models are highly akin to each other. There is nary tremendous quality successful the prime of acceptable betwixt the 2 models. Hence, adjacent if determination were a tautology successful the archetypal S2F formulation (there isn’t), the constituent would beryllium rather trivial, since it would not materially matter. The exemplary could beryllium rewritten to approximate terms alternatively of marketplace headdress and the effect would beryllium astir identical.

Hence, the full statement regarding a tautology is intelligibly moot. No decease stroke to the S2F exemplary here.

Autocorrelations

Another statement against the S2F exemplary I person often heard is besides mentioned by Level39:

“The different occupation is that the exemplary is autocorrelated, wherever the results of today’s worth is simply a relation of yesterday’s value. When you set for that, the R-squared (R2) worth is zero. Thus, scientifically speaking, stock-to-flow is nonsensical and cannot beryllium utilized to exemplary price.”

Another mode of stating this is to accidental that alternatively of trying to find a narration betwixt stock-to-flow and terms (or marketplace cap) 1 should alternatively effort to find a narration betwixt changes successful stock-to-flow and changes successful terms (or marketplace cap). The assertion is that changes successful stock-to-flow connected a day-to-day ground bash not look to origin a alteration successful terms connected the aforesaid clip scale, and hence determination supposedly can’t beryllium a causal narration betwixt stock-to-flow and price, meaning that the S2F exemplary indispensable beryllium incorrect.

But is this truly the case? Large changes successful stock-to-flow hap lone erstwhile each 4 years. The variations successful stock-to-flow betwixt the halvings are mostly tiny and person a beardown constituent of randomness. Must we truly expect that some tiny and ample changes successful stock-to-flow origin a alteration successful price? This would mean that we are assuming that determination is simply a linear response, which request not needfully beryllium the case: It could beryllium argued that lone ample changes successful stock-to-flow are meaningful.

Hence, the statement of auto-correlations besides does not output a decease stroke to the S2F model.

Ad Hominems

Another statement against the S2F exemplary I often brushwood is PlanB’s behaviour connected Twitter. Level39 has this to accidental astir it:

“[… ] anyone who points retired a flaw, imaginable problem, has a valid question oregon adjacent “likes” a valid enquiry into the validity of his assertions is blocked [by PlanB] […] If PlanB wants to honestly assertion that his models person a technological R2 worth successful the precocious 90s, past helium cannot beryllium blocking and censoring valid disapproval that shows otherwise.”

The reply I person to this is that PlanB tin bash immoderate helium feels similar connected Twitter. He is not obliged to behave successful a circumstantial mode oregon to reply immoderate peculiar questions. His behaviour has nary interaction connected whether the S2F exemplary is valid oregon not.

In summation to this, my ain acquisition with PlanB has been precise antithetic than the 1 described by Level39. I person openly criticized his exemplary connected Twitter successful 2019 (you tin witnesser specified a discussion here), and person not been blocked. We person exchanged privately and I cannot qualify PlanB’s behaviour arsenic thing different than precise friendly.

I person heard of events erstwhile radical were blocked by PlanB, but I americium not amazed by this: He has to negociate an assemblage of 1.7 cardinal people, which cannot beryllium easy. In immoderate lawsuit the advertisement hominem statement says thing astir the validity of the S2F exemplary and should beryllium disregarded.

Lack Of Cointegration

There has been a agelong debate regarding whether a definite spot known arsenic cointegration (pronounced co-integration, not coin-tegration) exists betwixt stock-to-flow and the terms of bitcoin. Cointegration is expected to hint astatine a causal narration betwixt the 2 variables. When it yet came retired that the cointegration spot does not beryllium betwixt stock-to-flow and price, this was interpreted arsenic meaning that a alteration successful stock-to-flow cannot perchance origin a alteration successful price. A decease stroke to the S2F model! But is that truly the case?

I had ne'er heard of cointegration anterior to 2019, erstwhile studying the stock-to-flow model. It is simply a conception that is wide utilized successful econometrics, but not successful immoderate different fields (as acold arsenic I americium aware). For example, successful March 2020 Judea Pearl, the de facto inventor of causal statistic and writer of “The Book of Why” had not heard of cointegration either! He gave 2 clarifying statements that cointegration might springiness an denotation that determination is causal relation, but that it by nary means implies a causal relation. In 2022, Pearl again lamented that nary 1 was capable to satisfactorily explicate the conception of cointegration to him.

The information that the inventor of causal statistic did not cognize astir the conception of cointegration is telling: The value of cointegration seems overblown. The deficiency of cointegration mightiness possibly hint astatine occupation for the S2F model, but it should not beryllium considered a decease blow.

Summary Of Anti-S2F Arguments

The arguments against the S2F exemplary we person seen truthful acold either person nary merit (supposed tautology, advertisement hominem attacks), oregon possibly weaken the credibility of the exemplary but bash not regularisation it retired (lack of cointegration, autocorrelations).

What we should bash is trust connected empiricism: Is the S2F exemplary capable to foretell aboriginal prices correctly? This is the litmus trial for immoderate terms model.

An Empirical Look At S2F

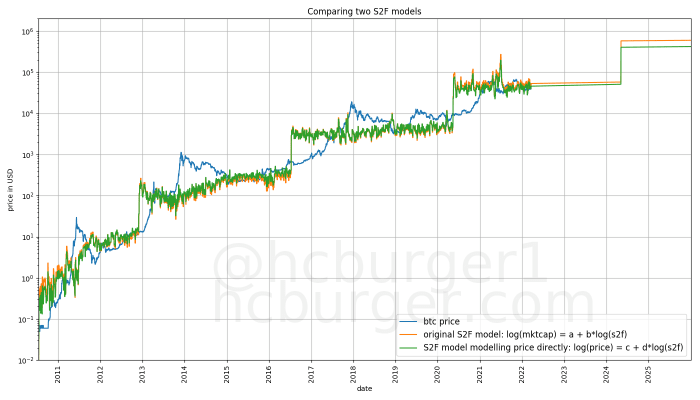

I person created a bitcoin terms exemplary called the power-law corridor of growth which relies connected the reflection (which I beryllium to Giovanni Santostasi’s reddit post) that bitcoin’s terms follows a consecutive enactment erstwhile plotted utilizing an x-axis that is scaled logarithmically.

This simply means that bitcoin’s terms maturation is slowing down. Whereas it utilized to instrumentality lone astir a twelvemonth for the terms to admit ten-fold, it present takes respective years. Returns are diminishing, and I expect this inclination to proceed into the future.

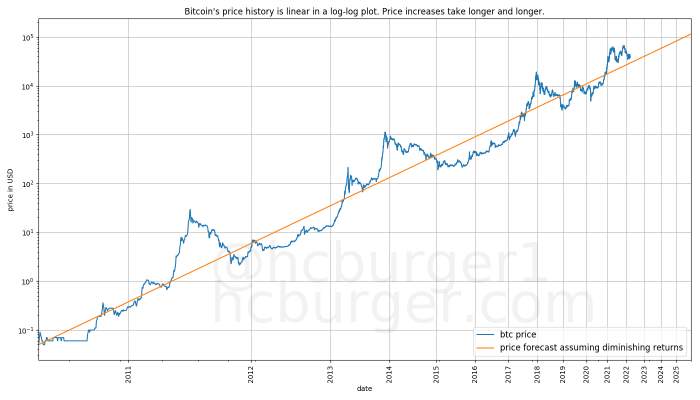

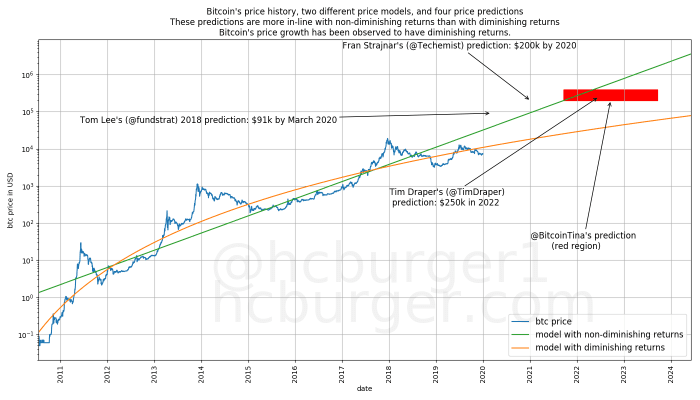

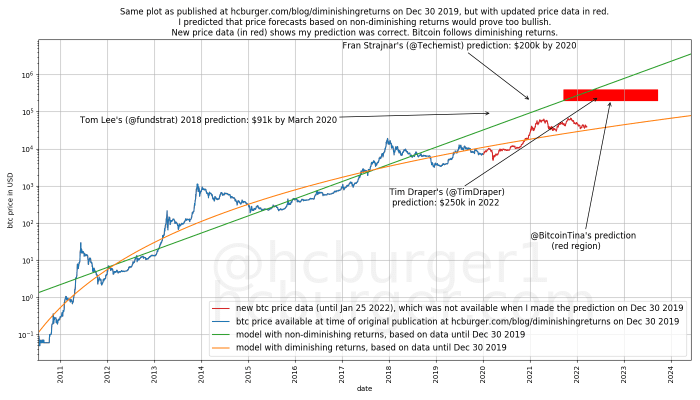

Yet, galore radical look to presume that bitcoin’s terms volition behave likewise successful the aboriginal arsenic it did successful the past. In different words, they expect terms increases to hap astatine the aforesaid gait arsenic successful the past. I have published the beneath crippled successful an article astatine the extremity of 2019. Various radical person made predictions seemingly based connected the presumption of nondiminishing maturation (roughly represented by the greenish line). I predicted that these forecasts would beryllium to beryllium excessively bullish, and that the terms would much intimately travel the orangish line, which is governed by diminishing returns.

How has my prediction fared? The adjacent crippled is the nonstop aforesaid arsenic the erstwhile one, but with the summation of terms information (in red) which is present disposable and that was not disposable astatine the clip I made the prediction.

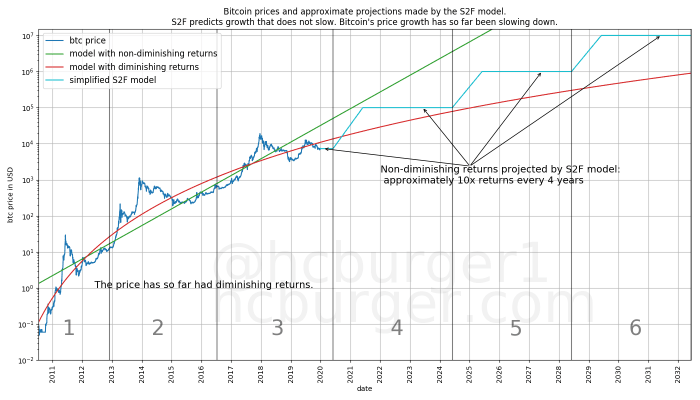

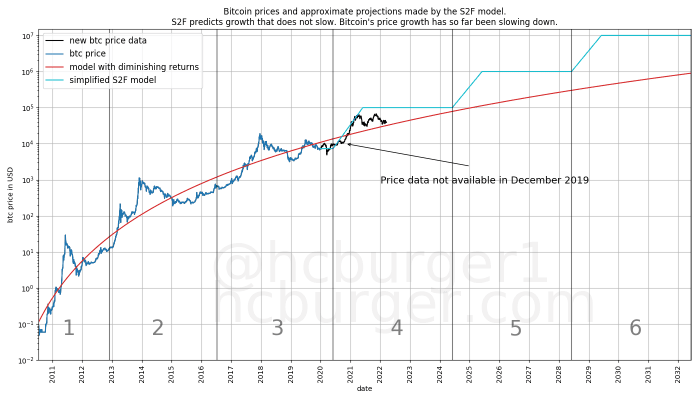

My 2019 prediction proves to person been prescient. What does this mean for the S2F model? In the aforesaid article I explained that S2F forecasts nondiminishing growth, and that I truthful besides expect it to beryllium excessively bullish, likewise to the forecasts made by the individuals above. Below is the crippled that I published:

The aforesaid crippled tin present beryllium filled successful with much caller terms data:

Again, it would look that bitcoin’s terms much intimately follows a trajectory with diminishing returns. I truthful expect the terms to determination further and further distant from the S2F forecasts successful the agelong term.

The much mathematically-inclined scholar mightiness beryllium interested successful an nonfiction I coauthored with InTheLoop which explains successful much item however the signifier of the S2F terms curve does not lucifer the existent terms information well.

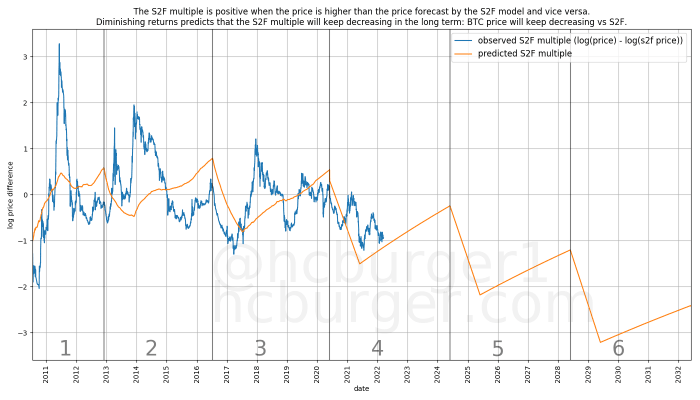

The fashionable Twitter handle s2fmultiple tracks however the terms is performing compared to the S2F forecasts. The metric is referred to arsenic the S2F multiple. A aggregate greater than 0 means that the terms is higher than the S2F multiple, and vice versa.

The past of the S2F aggregate truthful acold looks similar the beneath plot. There person often been precocious values earlier 2015, but not truthful overmuch aft that. This is simply a hint that the terms is not rather catching up to the S2F exemplary forecasts (and besides that the signifier of the S2F terms curve does not lucifer existent terms information well).

By comparing my ain power-law corridor of maturation forecasts to the S2F model, I americium capable to compute the trendline of however I expect the S2F aggregate to germinate successful the future:

Conclusion

The S2F exemplary has been heavy criticized, often unfairly. I americium highly assured that the S2F exemplary volition neglect to foretell bitcoin’s terms adequately, but my main statement is simply that the signifier of the S2F terms forecasts is incorrect and excessively bullish. The S2F exemplary forecasts nondiminishing growth, which is not justified by empirical observations, which alternatively powerfully hint astatine diminishing growth.

This does not mean that we should consciousness disappointed. Bright days prevarication up for the terms of bitcoin. In my archetypal article I person forecast a terms of $100,000 per bitcoin nary earlier than 2021 and nary aboriginal than 2028, and $1,000,000 per bitcoin nary earlier than 2028 and nary aboriginal than 2037. I inactive expect these forecasts to travel true.

This is simply a impermanent station by Christopher Burger. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)