If you thought ostentation was the worst happening that could hap economically arsenic the satellite grapples with a post-pandemic recovery, get acceptable for stagflation.

The word hasn’t been needed overmuch since the 1970s.

Stagflation describes an system with higher-than-normal ostentation and unemployment rates but small to nary economical growth. The past clip the U.S. system entered specified a authorities was successful the 1970s, erstwhile erstwhile President Richard Nixon took the United States disconnected the golden standard.

Since 1960, the Standard & Poor's 500 Index of ample U.S. stocks has averaged +2.5% per quarter, but during periods of stagflation, it saw a 2.5% decline, Scott Bauer, a erstwhile Goldman Sachs trader who's present CEO of Prosper Trading Academy, told CoinDesk.

With the user terms scale rising 7.5% implicit the past 12 months, the highest ostentation since 1982, analysts are already worried, and caller tensions successful Eastern Europe marque things adjacent much dicey. Oil prices went implicit $100 a tube aft Russian president Vladimir Putin decided to invade Ukraine, and the anticipation of losing entree to different Russian commodities has been driving prices for different earthy materials arsenic well.

“Stagflation is simply a reality,” said Bob Iaccino, main strategist astatine Path Trading Partners and co-portfolio manager astatine Stock Think Tank. “Because of the affirmative correlation betwixt crypto and the NASDAQ (it keeps getting tighter and tighter arsenic clip goes on) the stagflation playbook could surely wounded the crypto markets,” helium wrote successful a note.

He predicts precocious request for Treasury bonds, U.S. dollars, gold, user staples and existent estate, and he's bullish connected small-cap stocks – companies with a marketplace capitalization beneath $2 cardinal – and tech.

“Bouts of stagflation person historically been associated with declining nett margins, arsenic companies look higher prices and dwindling sales,” said Bauer.

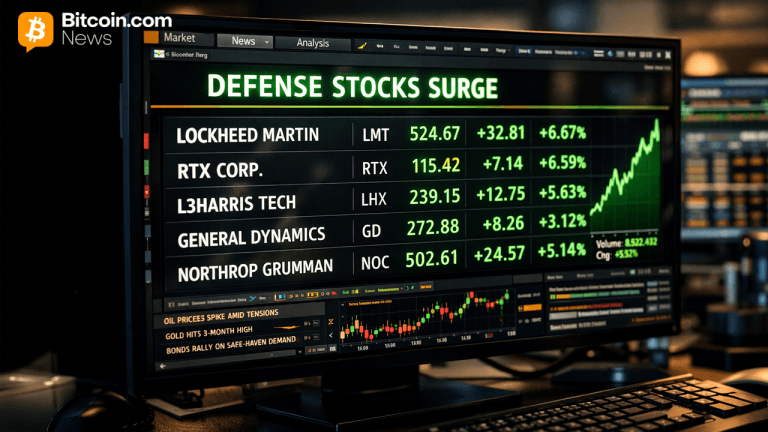

“In periods of stagflation, the request for antiaircraft assets increases," helium said. "If rates spell up and the system slows, galore plus prices whitethorn decline, including bitcoin.”

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)