Terra is crumbling.

The blockchain task location to the fashionable algorithmic stablecoin TerraUSD (UST), which had precocious go the fourth-largest stablecoin by marketplace worth but now sits astatine fifth, is adjacent illness arsenic UST repeatedly fails to prolong its $1 peg and LUNA, the blockchain’s autochthonal token, nears zero.

Terraform Labs, the tech start-up down the improvement of Terra, halted the accumulation of caller blocks connected the web connected Thursday “to forestall goverance attacks pursuing terrible $LUNA ostentation and a importantly reduced outgo of attack,” it said connected Twitter.

A governance onslaught became little costly due to the fact that of the nearly-free terms of LUNA – an attacker could cheaply get capable LUNA tokens to socially onslaught the web by forcing a bulk vote. (Since Terra relies connected a derivation of proof-of-stake (PoS) for statement alternatively of hardware and energy arsenic successful Bitcoin’s proof-of-work (PoW), coin ownership equals power. In Bitcoin, the magnitude of BTC you ain doesn’t assistance you much powerfulness connected the network.)

The web went live a mates of hours aboriginal arsenic the bundle spot was released.

This is different important quality betwixt a web similar Terra and Bitcoin: portion successful the erstwhile a number of entities that tin ballot connected things similar halting the network, Bitcoin’s existent decentralization makes it immune to the whims of immoderate circumstantial group.

How Does UST Work?

Stablecoins are integer representations of worth successful the signifier of tokens that attemptively support a one-to-one parity with a fiat currency similar the U.S. dollar. Tether (USDT) and USD Coin (USDC) pb the market capitalization rank and are the astir fashionable and widely-used stablecoins. However, they are issued (minted) and destroyed (burned) by centralized entities that besides support the indispensable dollar-equivalent reserves to backmost the coin.

Terra’s UST, connected the different hand, sought to go a stablecoin whose minting and burning process was performed programmatically by a machine programme – an algorithmic process.

Under the hood, Terra “promises” that radical tin speech 1 UST for $1 worthy of LUNA (whose worth fluctuates freely according to proviso and demand) astatine immoderate fixed time. If UST breaks its peg to the upside, arbitrageurs tin speech $1 worthy of LUNA for 1 UST, capitalizing connected the premium with an instant profit. If it breaks the peg to the downside, traders tin speech 1 UST for $1 worthy of LUNA besides for an instant profit.

What Does Bitcoin Have To Do With This?

Terra grew successful consciousness among the Bitcoin assemblage aft Terraform Labs laminitis Do Kwon said earlier this twelvemonth that the task would get up to $10 cardinal of bitcoin for the reserves of UST.

The purchases would beryllium made and coordinated by the Luna Foundation Guard (LFG), a nonprofit enactment based successful Singapore that works to cultivate request for Terra’s stablecoins and “buttress the stableness of the UST peg and foster the maturation of the Terra ecosystem.”

While firm treasury allocations to bitcoin grew successful popularity implicit the past mates of years connected the heels of MicroStrategy’s continuous BTC buys, LFG’s determination represented the archetypal large BTC allocation arsenic a reserve plus by a cryptocurrency project. The quality was met with a premix of enthusiasm and skepticism among the community.

Bitcoin Magazine reported astatine the time that the algorithmic maneuver employed by the UST stablecoin to support its peg was of doubtful sustainability, and the bitcoin purchases did not marque UST a stablecoin “backed by bitcoin.” Even Terraform Labs acknowledged that “questions persist astir the sustainability of algorithmic stablecoin pegs.”

Terraform Labs besides discussed however determination needs to beryllium capable request for Terra stablecoins successful the broader cryptocurrency ecosystem to “absorb the short-term volatility of speculative marketplace cycles” and warrant a amended accidental of achieving semipermanent success. This is what the task sought with BTC – make request for UST by conferring much assurance successful peg sustainability.

How Did Terra Implode?

Given the galore unfastened questions astir the sustainability of specified an algorithmically-sustained peg, Terra’s plan failed to clasp successful a play of stress.

As UST began losing its peg to the downside, other unit was consequently enactment connected LUNA owed to the monolithic magnitude of UST progressively trying to exit and exchange

As UST began losing its peg to the downside, traders sought to exit by redeeming each of their UST for $1 worthy of LUNA. However, fixed the accelerated gait of devaluation, a monolithic magnitude of UST tried exiting – much than what Terra was capable to speech for LUNA. That stretched retired the on-chain swap dispersed to 40% and enactment other unit connected LUNA, sending its terms southbound sharply.

The token past went down a “death spiral.”

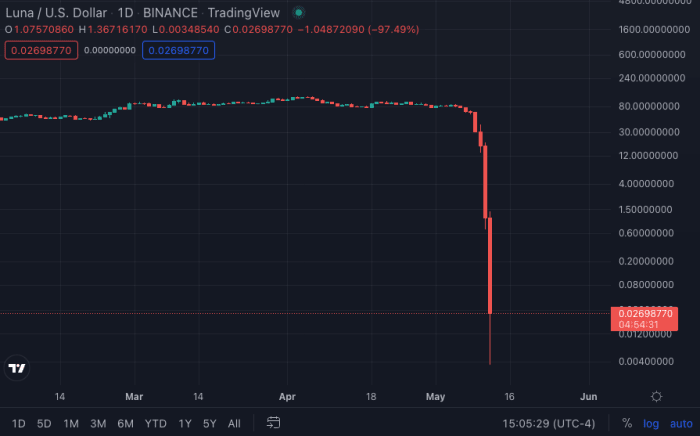

In a ripple effect, LUNA has plunged, dropping adjacent zero connected Thursday. Image source: TradingView.

What Does This Teach Us?

In short, it tin beryllium argued that the acquisition learned from this is: alternate cryptocurrency projects (altcoins) are but an experiment, portion Bitcoin is the lone tried and tested peer-to-peer integer money.

Bitcoin was calved retired of the ideals of the cypherpunks, a radical of aboriginal cryptographers with a shared imaginativeness that got unneurotic to research what privateness could mean successful the then-upcoming integer satellite – particularly arsenic it relates to money.

The cypherpunk question was spun out, for the astir part, of the enactment of Dr. David Chaum, a cryptography pioneer that brought the mathematical exertion retired of the hands of authorities bureaucrats and into the realm of nationalist knowledge. His explorations kick-started an full enactment of work, dedicated to uncovering however nine could larboard peer-to-peer wealth – currency – to a digitized economy.

With a wide extremity successful mind, those mathematicians began crafting what a solution could look similar done probe and experimentation. Decades later, Satoshi Nakamoto would enactment it each unneurotic and adhd their ain rotation to get astatine Bitcoin, the archetypal and lone decentralized and trustless signifier of integer money.

As Bitcoin grew successful popularity, alternate forms of what came to beryllium known arsenic a cryptocurrency – a currency that exists successful the integer realm done the usage of cryptography – started to beryllium created. While those coins initially were calved to vie with Bitcoin, a full caller slew of projects aboriginal began to look with antithetic worth propositions portion putting their ain rotation to the blockchain, statement and cryptography that made Bitcoin work.

Nakamoto designed the Bitcoin protocol to leverage PoW, a statement mechanics that relies connected computing powerfulness and escaped contention to mint caller BTC connected Bitcoin’s blockchain. The bitcoin mining race, arsenic it is known, comprises thousands of miners scattered astir the satellite with a azygous nonsubjective – find the adjacent valid artifact and person bitcoin arsenic reward.

The altcoins, however, person mostly drifted distant from PoW to favour different caller statement mechanisms. The astir fashionable alternative, PoS, allows participants to fastener their holdings of the fixed project’s autochthonal token to go artifact creators alternatively of letting them vie with mining hardware and energy to excavation caller coins.

While PoW brings real-world costs to miners, costs successful PoS are simply integer and correspond the magnitude of wealth spent to bargain those coins being staked. The presumption with PoS is that staking those coins ensures miners person tegument successful the crippled and are hence encouraged to behave honestly, but determination is nary grounds that specified committedness is capable of an incentive. Moreover, successful cases wherever a beardown devaluation happens arsenic with LUNA, the web risks being deed with a governance onslaught and whitethorn find itself having to instrumentality totalitarian actions similar halting artifact accumulation of what was expected to beryllium a permissionless and unstoppable decentralized network.

The PoW-PoS dynamic is important besides due to the fact that it highlights the experimental quality of altcoins.

Instead of copycatting Bitcoin’s exemplary – a strategy that has been proved unsuccessful clip and again – caller altcoin projects effort to “innovate” by copying immoderate parts of Bitcoin’s plan and changing up others.

As a result, projects being launched contiguous drift distant from astir of the ideals underpinning the cypherpunk question that started decades ago. Such projects telephone themselves decentralized but for the astir portion person a founding squad that hardly ever drops its controlling presumption and tin steer each determination that happens connected the network.

With specified a beardown tendency to innovate, “crypto” projects for the astir portion extremity up creating artificial problems that don’t beryllium truthful they tin invent a caller solution.

Dr. Chaum and the cypherpunks spotted a wide occupation successful society: How volition we person wealth successful the integer property that cannot beryllium spent doubly without a centralized authorization keeping way of balances? It took decades of probe for galore specialized scientists and mathematicians of antithetic backgrounds to yet culminate successful an elegant solution to this problem.

Today, however, cryptocurrency teams instrumentality but a mates of years from thought procreation to a minimum viable product, not enjoying an integrated maturation successful favour of immense amounts of superior that disproportionately favors insiders at the disbursal of the regular user.

3 years ago

3 years ago

English (US)

English (US)