The futures marketplace is simply a captious constituent of the Bitcoin market, enabling investors to hedge against terms volatility oregon to speculate connected aboriginal terms movements. Open involvement is peculiarly telling of marketplace sentiment erstwhile analyzing futures, arsenic it indicates the magnitude of wealth flowing into futures contracts.

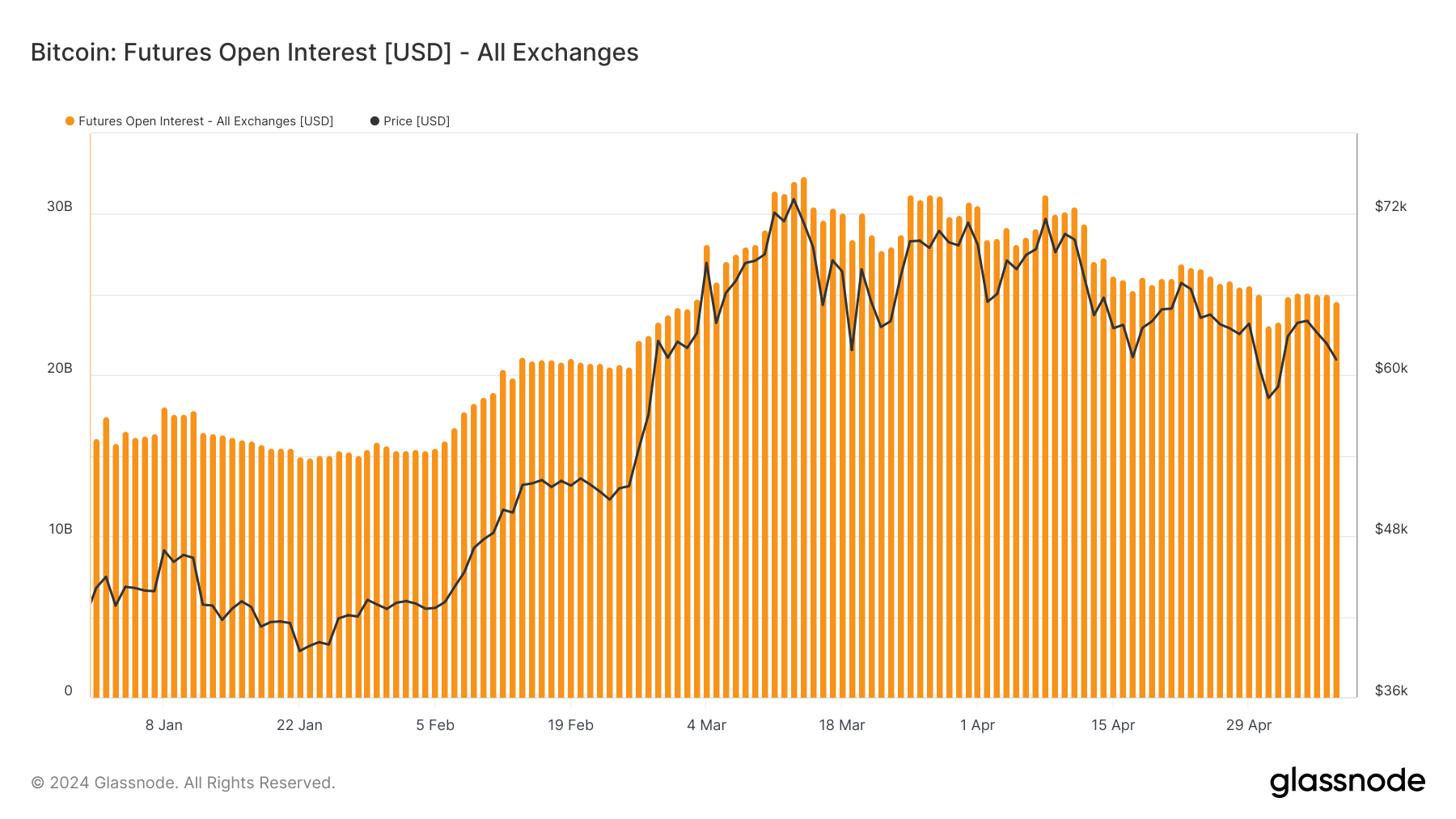

The futures marketplace has had a precise volatile twelvemonth truthful far. Starting the twelvemonth with an unfastened involvement of $16.087 billion, the marketplace saw a important uptick, starring to a highest of $32.366 cardinal by mid-March. It is the highest unfastened involvement recorded successful the market’s history—unsurprising arsenic it matched Bitcoin’s ascent to its caller ATH of $71,400 astatine the time.

Following the highest successful March, determination was a noticeable diminution successful OI, which dropped to $23.119 cardinal by aboriginal May. As of May 8, OI stands astatine $24.692 billion. The flimsy betterment OI has seen since the opening of the period follows BTC’s betterment from a debased of $58,295 to astir $61,300 astatine property time. While the magnitude of OI is precise precocious historically, it inactive falls abbreviated of this year’s highs and broader marketplace expectations.

Graph showing the unfastened involvement successful Bitcoin futures from Jan. 1 to May 8, 2024 (Source: Glassnode)

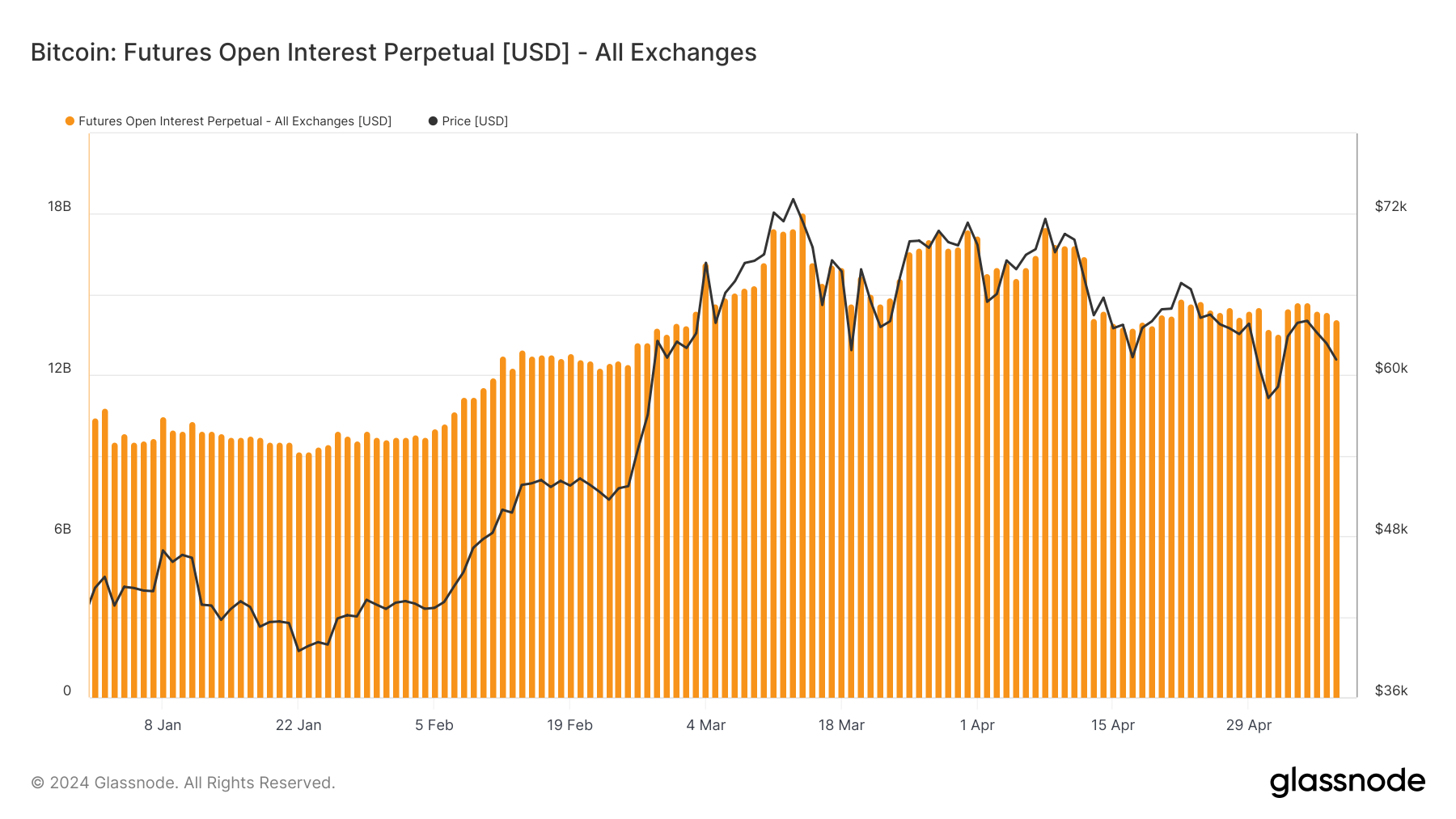

Graph showing the unfastened involvement successful Bitcoin futures from Jan. 1 to May 8, 2024 (Source: Glassnode)Perpetual futures followed a little volatile pattern. The OI successful perpetual futures started astatine $10.441 billion, accrued to $18.068 cardinal by mid-March, and past exhibited much volatility but remained robust, lasting astatine conscionable implicit $14 cardinal arsenic of May 8. As perpetual futures bash not person an expiration day and are often utilized for hedging, the deficiency of volatility successful this portion of the marketplace highlights a continuous involvement successful the merchandise going into May.

Chart showing the unfastened involvement successful perpetual Bitcoin futures from Jan. 1 to May 8, 2024 (Source: Glassnode)

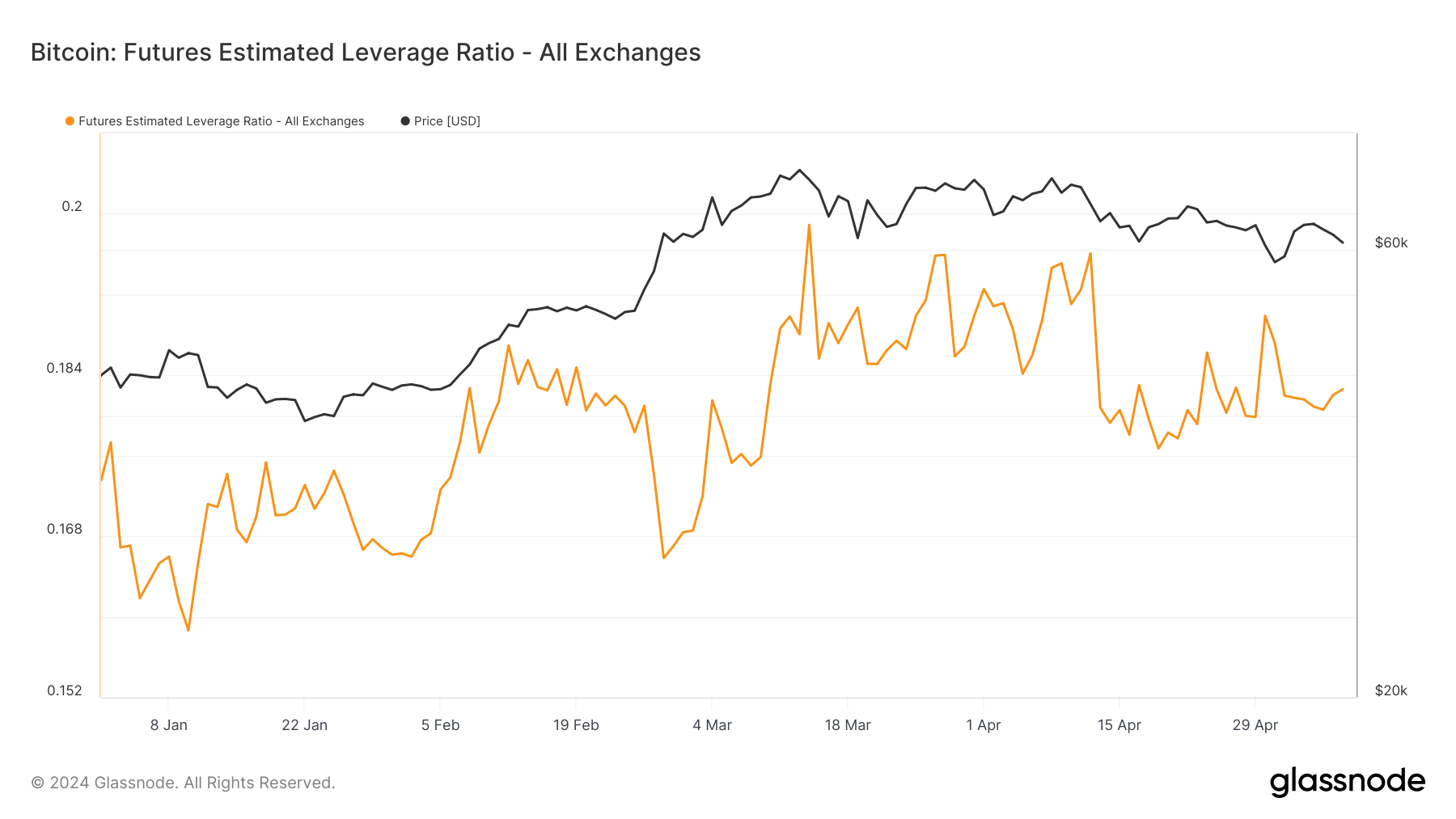

Chart showing the unfastened involvement successful perpetual Bitcoin futures from Jan. 1 to May 8, 2024 (Source: Glassnode)The crisp terms fluctuations we’ve seen this twelvemonth led to a precise volatile leverage ratio. Glassnode’s estimated leverage ratio indicates the mean leverage utilized successful the unfastened positions successful the futures market. The higher the leverage, the higher the hazard traders volition take.

The leverage peaked astatine 0.1989 successful mid-March erstwhile Bitcoin reached a caller ATH, showing traders were consenting to leverage their positions to stake connected a continued upward movement. However, arsenic BTC dropped, the leverage ratio besides dropped, settling astatine astir 0.1825 connected May 8.

While this shows there’s inactive rather a spot of leverage successful the market, it indicates traders are taking a much cautious approach.

Graph showing the estimated leverage ratio for Bitcoin futures from Jan. 1 to May 8, 2024 (Source: Glassnode)

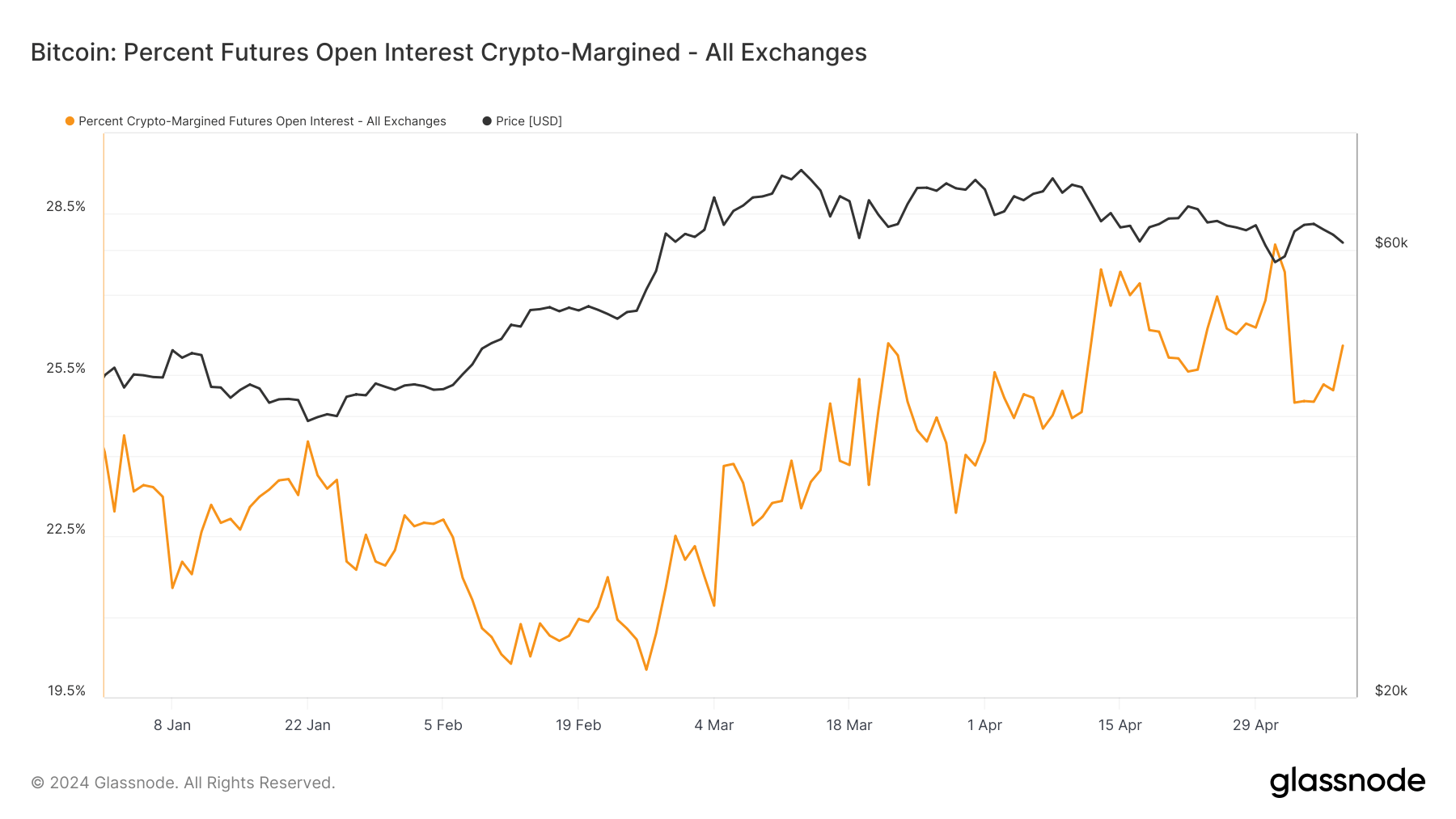

Graph showing the estimated leverage ratio for Bitcoin futures from Jan. 1 to May 8, 2024 (Source: Glassnode)And portion immoderate traders mightiness beryllium much cautious erstwhile it comes to leverage, we’ve seen a important summation successful traders consenting to usage Bitcoin arsenic a margin. Starting the twelvemonth astatine 24.064%, the proportionality of crypto-margined futures saw variations but mostly trended upwards, reaching 27.931% by aboriginal May and 26.048% by precocious May.

Despite terms volatility, the continuous maturation successful the percent of crypto-margined futures shows the futures marketplace has go much saturated with crypto-native traders and traders consenting to instrumentality connected blase positions without utilizing fiat arsenic a margin. It is simply a motion of a maturing marketplace wherever traders are much comfy holding and utilizing BTC contempt terms volatility.

Graph showing the percent of crypto-margined Bitcoin futures from Jan. 1 to May 8, 2024 (Source: Glassnode)

Graph showing the percent of crypto-margined Bitcoin futures from Jan. 1 to May 8, 2024 (Source: Glassnode)If Bitcoin’s terms continues its sideways chop astatine astir $61,000, we volition apt spot a corresponding stabilization successful OI. It could besides pb to a flimsy accommodation successful the existent leverage levels, starring to a comparatively dependable ratio hovering astir the 0.1805 to 0.1825 scope observed successful the past fewer weeks.

Price stableness could besides pb to an summation successful the percent of crypto-margined futures. While a unchangeable terms mightiness pb to a unchangeable OI for regular futures, perpetual futures mightiness amusement important involvement successful activity. The lack of an expiry day makes perpetual futures much charismatic for traders looking to support positions without the request to rotation implicit contracts.

On the different hand, immoderate upward volatility volition pb to an summation successful OI for some types of futures. Bitcoin regaining its ATH could propulsion the leverage ratio supra its yearly high, and we could spot an adjacent higher percent of crypto-margined contracts. Overall, a important terms summation successful the coming weeks would amplify the trends acceptable successful aboriginal May but bring astir much hazard erstwhile it comes to liquidations and volatility.

The station What the existent terms stableness means for the Bitcoin futures market appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)