You’re reading State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Click here to motion up for aboriginal editions.

The U.S. Federal Reserve yet published its cardinal slope integer currency (CBDC) report! The long-awaited missive outlined the Fed's main questions astir CBDCs and provided a model into its reasoning connected the issue.

The Fed is yet giving america a bully look astatine however it's approaching CBDCs. What's more, the cardinal slope wants the wide nationalist to measurement in.

So, archetypal off: I’m inactive not convinced the Fed really wants to contented a cardinal slope integer currency.

The Fed doesn’t perpetrate 1 mode oregon different connected whether oregon not it wants to make a CBDC successful the report published past week. This is nary surprise. Fed Chair Jerome Powell has said arsenic overmuch connected galore occasions.

From this view, thing successful the study was truly new. The Fed is looking astatine privateness issues, fiscal stableness concerns, applicable applications and whether determination truly is simply a request for a integer dollar. Powell has outlined these aforesaid questions successful assorted confessional hearings.

In the Fed's view, a hypothetical integer dollar would fundamentally beryllium a integer analog to the existent fiscal system, with the Fed issuing the currency but intermediaries giving retail users access.

"The Federal Reserve’s archetypal investigation suggests that a imaginable U.S. CBDC, if 1 were created, would champion service the needs of the United States by being privateness protected, intermediated, wide transferable, and individuality verified. As noted above, however, the insubstantial is not intended to beforehand a circumstantial argumentation result and takes nary presumption connected the eventual desirability of a U.S. CBDC," the study said.

(It's worthy noting that this study is abstracted from what the Boston Fed and MIT mightiness publish. That task is looking astatine method bases for cardinal slope integer currencies, alternatively than the argumentation questions astir issuing one.)

Also, we didn't larn that the Fed inactive truly wants Congress to authorize a CBDC earlier it'll instrumentality immoderate enactment toward doing so. Again, we knew this. What's more, adjacent if Congress does authorize a integer dollar, the Fed announced that past week's study is conscionable the archetypal measurement successful a "broad consultation," implying a lengthy outreach process.

Speaking of which, members of the nationalist tin measurement successful earlier May 2022 if they truthful choose. The Fed has a database of 22 questions, and responses tin beryllium sent via a web portal.

Despite however overmuch of this study wasn't excessively new, a fewer details stood out.

The archetypal is the Fed's tendency to play a relation successful guiding CBDC improvement elsewhere successful the world.

"Irrespective of immoderate eventual conclusion, Federal Reserve unit volition proceed to play an progressive relation successful processing planetary standards for CBDCs," the study said.

Part of this planetary coordination would beryllium to assistance cross-border payments, per the report. But the existent cardinal present seems to beryllium a tendency to support the dollar hegemony wrong the planetary fiscal system.

"The dollar’s planetary relation besides allows the United States to power standards for the planetary monetary system," the study noted.

The Fed's attack to privacy is besides going to beryllium a spot of a sticking point.

The cardinal slope wants to marque definite that a CBDC is transacted done entities with the due know-your-customer (KYC) and anti-money laundering (AML) frameworks successful place.

"A general-purpose CBDC would make information astir users’ fiscal transactions successful the aforesaid ways that commercialized slope and nonbank wealth generates specified information today. In the intermediated CBDC exemplary that the Federal Reserve would consider, intermediaries would code privateness concerns by leveraging existing tools," the study said.

If this is so however the integer dollar is acceptable up, it won't beryllium a cleanable analog to the carnal dollar. At slightest astatine the moment, it's unclear whether there's a mode to transact without intermediaries, whereas I tin springiness anyone currency without going done a KYC process. Digital dollar proponents volition accidental that it should alteration this benignant of privacy.

And finally, as pointed out by my person Michael McSweeney implicit astatine The Block, the study highlights existing backstage stablecoins, though it stops abbreviated of a elaborate investigation connected what relation the Fed sees them playing successful a satellite wherever the cardinal slope has its ain integer currency.

The study besides mentions concerns astir fiscal stability, a communal 1 among regulators ever since this 1 societal media elephantine announced plans to make a stablecoin.

Last week’s House Financial Services Committee connected Energy and Commerce (Oversight and Investigations Subcommittee) proceeding connected crypto’s vigor usage was beauteous interesting, to maine astatine least. It started retired with immoderate basal questions and explanations (“Bitcoin does not adjacent blockchain”), not to notation respective off-topic complaints, but evolved into an in-depth discussion, adjacent a statement betwixt immoderate of the witnesses connected however to measurement things similar crypto mining’s vigor efficiency.

The debate, betwixt Cornell Tech Professor Ari Juels and BitFury CEO Brian Brooks, whitethorn person been the astir absorbing facet for me. Brooks pointed retired that crypto mining machines are becoming much vigor businesslike each the time, but Juels pointed to the vigor utilized per fig of transactions processed to reason that much businesslike machines does not mean a much businesslike network.

This statement mightiness beryllium cardinal to however lawmakers attack crypto mining regulation, if determination is immoderate specified rulemaking successful this field.

One contented that was not discussed, but possibly should person been, was the contented of discarded from facilities powering crypto miners. Environment & Energy Publishing, an energy-focused quality enactment (that is simply a subsidiary of Politico), reported past week that the Environmental Protection Agency (EPA) rejected applications from Greenidge Generation and Sioux Energy Center (run by Ameren) to proceed moving ember ash ponds beyond their existent federally-mandated deadlines.

Coal ash is simply a “toxic slurry” byproduct from ember powerfulness plants. The facilities dump this byproduct into what are fundamentally unfastened tanks. The hazard of toxins from the ash leaching into the crushed oregon adjacent bodies of h2o is real, and truthful these facilities are regulated.

“EPA considered Greenidge disqualified from getting an exemption due to the fact that it nary longer uses ember for power. The bureau said Ameren’s exertion for an hold lacked each the accusation required for deciding connected its request,” EE News reported.

The powerfulness plants person a hairsbreadth implicit 4 months to study to EPA they are nary longer utilizing their ponds.

This benignant of enactment is worthy keeping an oculus connected – it’s each precise good to resurrect dormant powerfulness plants to tally crypto miners, but if these facilities can’t dump their discarded they whitethorn not beryllium capable to proceed operations for arsenic agelong arsenic their owners would like.

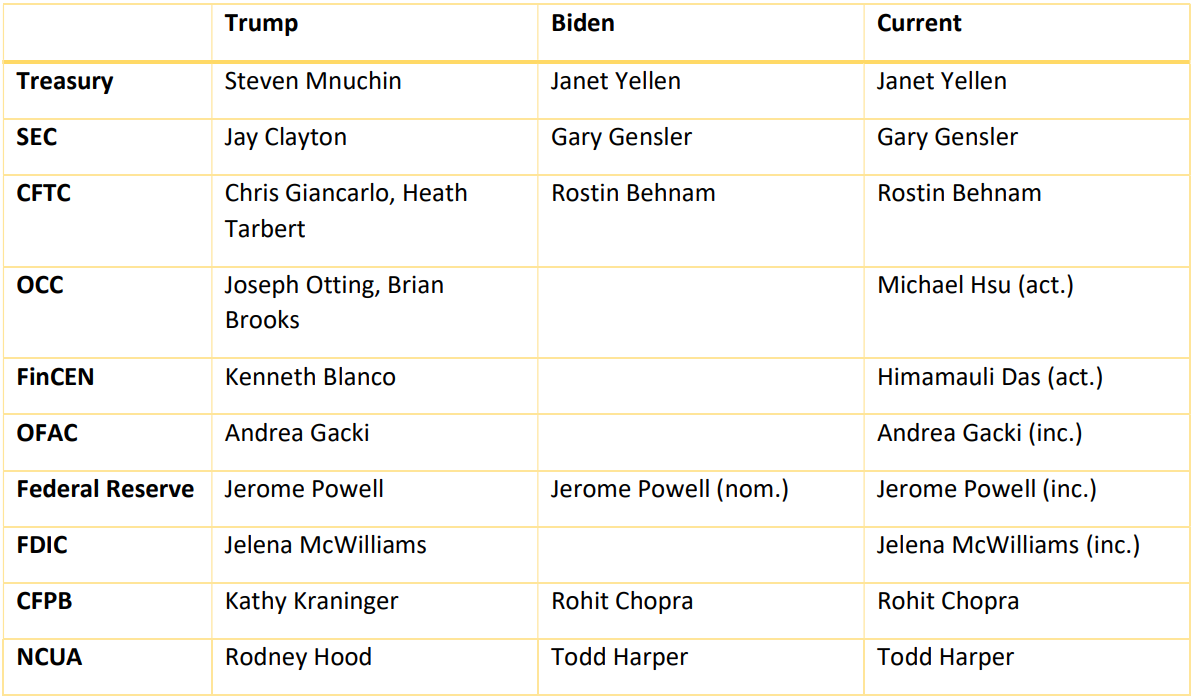

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

I deliberation we’re present erstwhile again waiting to spot who gets the motion to tally the Office of the Comptroller of the Currency, not to notation the Federal Deposit Insurance Corporation.

Introducing CoinDesk’s Privacy Week: CoinDesk is taking connected the planetary Data Privacy Week with features, explanations, sentiment submissions and a big of different pieces looking astatine privateness concerns and however cryptocurrency networks code them. They’re good worthy a read.

(Reuters) A long-form Reuters probe by Angus Berwick and Tom Wilson revealed that crypto speech Binance did not instrumentality beardown know-your-customer controls, and withheld accusation “about its finances and firm operation from regulators,” contempt what the speech claimed successful public. Reuters cited documents from Binance, correspondence betwixt Binance employees and regulators, interior documents and interviews with erstwhile speech employees and affiliates. Binance sent Reuters a connection but, according to the quality agency, did not respond to elaborate questions. Founder Changpeng Zhao has since tweeted “FUD,” continuing what appears to beryllium an ongoing animosity toward journalism.

(Reuters) Thomson Reuters Foundation News took a look astatine creation theft and fraud successful the NFT space. Avi Asher-Schapiro spoke to NFT artists and victims of theft successful laying retired what the concerns are. What stood retired to maine the astir though was a stat from DeviantArt, which present scans for creation turned into NFTs without the artists’ permission. “It has flagged much than 90,000 since it started scanning successful September,” Asher-Schapiro wrote.

(ScienceDirect) “Blockchain-based information transmission power for Tactical Data Link,” wherever TDL is simply a word referring to subject communications links. Yeah I really don’t adjacent cognize wherever to statesman with this one. Have astatine it folks.

If you person thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Money Reimagined, our newsletter connected fiscal disruption.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)