Web3 is drowning successful metrics, astir of which overgarment an unclear picture. Transaction volumes, token prices and flashy headlines often disguise what truly matters: the prime of idiosyncratic engagement and the imaginable for organic, exponential growth. As the manufacture moves beyond the hype, reliable, data-driven signals of occurrence are nary longer optional — they’re essential.

Here’s the bully news: the tools to chopped done the sound already exist. By combining aggregate on-chain metrics into a azygous “health index” people indicating the extent and prime of wide idiosyncratic engagement, we tin place which chains are genuinely thriving and poised for semipermanent growth. With 2024 coming to a close, let’s excavation into what these signals uncover astir today’s starring chains, and what we tin expect successful 2025.

Assessing idiosyncratic prime utilizing aggregated, not isolated, data

When creating a sustainable on-chain ecosystem, it doesn’t marque consciousness to optimize immoderate azygous idiosyncratic action. What’s needed is discourse — a mode to quantify not conscionable everything users are doing, but however and wherefore it matters. One promising attack to execute this is to aggregate idiosyncratic behaviors into 5 halfway categories:

Transaction Activity, ranging from spot trades to astute declaration interactions.

Token Accumulation successful the medium-to-long-term, and different “investment” behaviors.

DeFi Engagement for activities similar staking, lending and liquidity provision.

NFT Activity specified arsenic minting, trading and utility-driven interactions.

Governance Participation to quantify DAO oregon protocol governance contributions.

Crucially, these metrics should not beryllium treated equally. A amended attack is to measurement and harvester them utilizing a Bayesian exemplary to make a azygous top-line “score.” Unlike accepted scoring systems that trust connected static thresholds oregon elemental averages, this lets america incorporated some anterior cognition (what we expect from an “average” wallet) and caller grounds (actual enactment observed on-chain). These dynamic, multi-variate scores are overmuch harder to crippled and truthful much apt to uncover accurate, actionable insights.

What the information tells america astir 2024

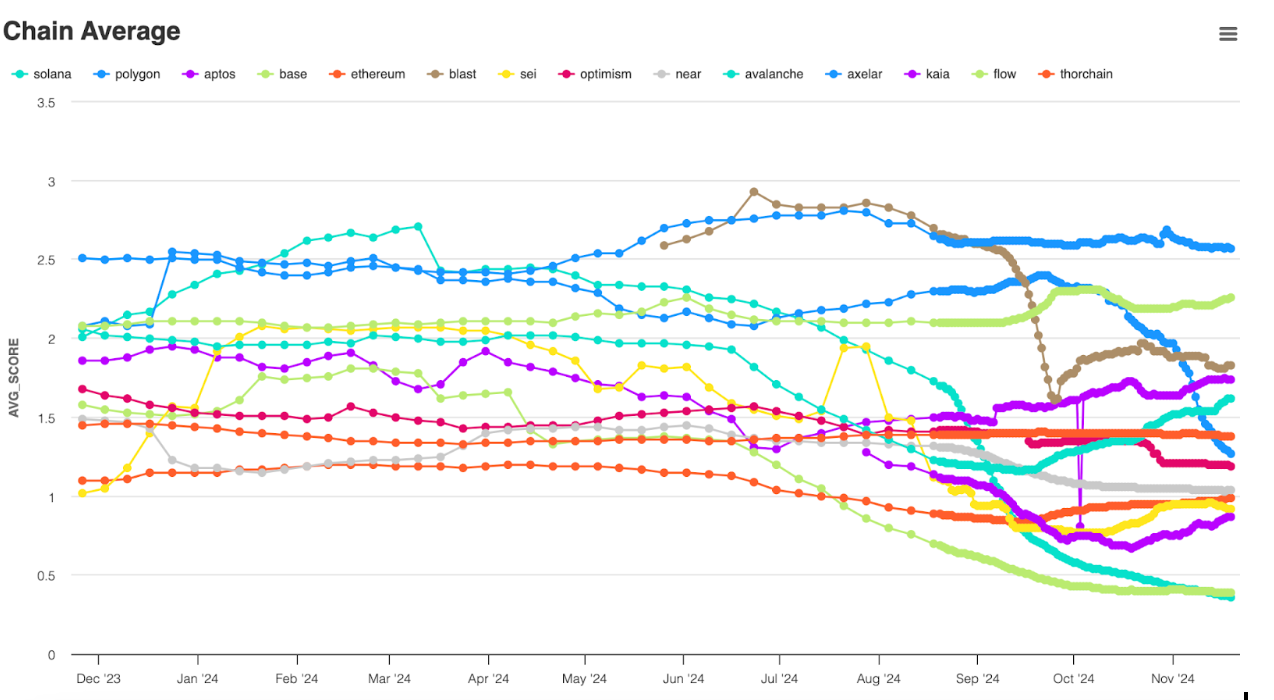

The supra attack provides a caller position connected each chain’s idiosyncratic enactment done 2024. Let’s zoom successful connected immoderate of the much astonishing findings.

Solana (the apical airy bluish enactment that peaks astatine ~2.75) attracted a immense stock of high-quality users betwixt February and mid-March, but engagement prime has fallen since. Interestingly, this downslide coincided with SOL’s archetypal terms and trading measurement spike of 2024, and has continued done the existent memecoin mania. Repetitive actions person diminishing returns erstwhile assessed utilizing a Bayesian model, meaning aggregate token swaps output smaller people improvements than engagement crossed aggregate types of activities, for immoderate fixed wallet. This suggests astir Solana users are presently engaged successful a constrictive scope of on-chain activities that aren’t contributing to Solana’s multi-sector growth.

As for Ethereum supporters (the bottommost orangish enactment that begins astatine conscionable supra 1) who expected this year’s ETH ETFs to beryllium a game-changer, the numbers overgarment a antithetic picture. Ethereum’s debased and unchangeable idiosyncratic people done H1 2024 suggests that this year’s bullish developments did not spur broader ecosystem information specified arsenic DeFi enactment and protocol governance.

It’s besides worthy noting that Axelar (the acheronian bluish lines that begins astatine 2.5) had the astir progressive users crossed the broadest scope of on-chain activities comparative to its full idiosyncratic base, according to the data. While Axelar is presently overmuch smaller by TVL than the bequest chains dominating today’s headlines, this is an intriguing awesome that warrants person inspection — and would person been missed if we were looking astatine marketplace headdress oregon trading measurement alone.

The takeaway present isn’t that Solana is doomed and Axelar volition inevitably go the world’s biggest chain. There is constricted worth successful comparing these types of scores crossed chains, since each people is proportional to the idiosyncratic prime of its corresponding chain. In different words, a Solana idiosyncratic with a people of “4” whitethorn beryllium precise antithetic from a “4” connected Axelar, fixed the differences successful each chain’s baseline activity. As such, these scores are astir utile erstwhile tracking changes successful the prime of a chain’s wide idiosyncratic enactment implicit time, not cross-chain comparisons.

Predictions for 2025

With that said, what does each chain’s idiosyncratic prime way grounds archer america astir adjacent year?

For starters, it’s wide that Solana faces important challenges and opportunities entering 2025. The chain’s trajectory depends connected its quality to clasp its monolithic casual idiosyncratic basal and grow their scope of on-chain interactions. Failure to bash truthful could effect successful a important slump erstwhile memecoins chill disconnected — though information from aboriginal 2024 suggests the concatenation has a ample contingent of prime users that volition endure careless of what happens short-term.

2024 demonstrated Axelar’s quality to pull a concentrated idiosyncratic basal engaged successful diverse, sustained on-chain activities, alternatively than speculative surges. Now, Axelar’s situation volition beryllium upscaling its ecosystem without diluting the prime of its idiosyncratic base. This whitethorn impact prioritizing high-profile partnerships to unlock caller audiences portion creating much newbie-friendly onramps crossed its dApp ecosystem.

Ethereum’s fragmentation has shifted galore progressive users to its faster, cheaper L2 ecosystem, and truthful we whitethorn spot mainnet enactment progressively consolidate astir halfway features protocol staking and governance. These activities are captious for the broader EVM ecosystem, but this trajectory whitethorn beryllium penalized by scoring systems that reward divers on-chain engagement.

This dynamic underscores a situation for scoring systems: prioritizing wide-ranging idiosyncratic enactment tin contiguous an incomplete representation erstwhile applied to task-specific networks (or wide intent chains that are evolving into thing much specialized). As a result, it’s important to intelligibly specify what occurrence means for immoderate concatenation is being evaluated and usage a scoring strategy that captures the corresponding idiosyncratic actions.

A amended mode to define, and drive, on-chain growth

Web3 has spent excessively agelong chasing the incorrect metrics and failing to presumption the information successful aggregate. In 2025, the winners volition beryllium those who find multivariate ways to measurement — and enactment connected — what matters most: idiosyncratic quality.

By incorporating caller scoring methods into their dashboards, on-chain quality platforms tin supply much meaningful insights to investors and manufacture observers. At the aforesaid time, Web3 builders tin usage these scores to clarify apical priorities and thrust idiosyncratic engagement and worth creation. Ultimately, this volition assistance the full manufacture displacement distant from hype-driven narratives to data-backed strategies that unlock the afloat imaginable of Web3 successful 2025 and beyond.

10 months ago

10 months ago

English (US)

English (US)