Bitcoin trades northbound of the $40,000 terms people with bullish momentum successful the past 24 hours. Today, the U.S. Federal Reserve (FED) is expected to statesman its monetary tightening policy.

Related Reading | TA: Bitcoin Breaks $40K, Key Upside Break Suggests Trend Change

The fiscal instauration could rise involvement rates hikes, and dilatory propulsion liquidity from planetary markets. Bitcoin and risk-on assets, specified arsenic equities, are expected to crook bearish. So far, BTC’s terms has failed to conscionable expectations.

At the clip of writing, Bitcoin trades astatine $40,416 with a 4% nett connected the past day.

BTC with bullish momentum connected the regular chart. Source: BTCUSD Tradingview

BTC with bullish momentum connected the regular chart. Source: BTCUSD TradingviewBitcoin has been behaving connected its ain with resilience to a imaginable displacement successful the U.S. dollar monetary policy. In measurement of trading arsenic a stock, BTC’s terms seems much akin to Gold’s (XAU) terms action.

The precious metallic precocious broke supra the $2,000 but has backtracked connected immoderate of its gains. This downtrend could beryllium short-lived and could foretell what’s coming for Gold and Bitcoin. Two antithetic assets are sometimes traded nether the ostentation hedge narrative.

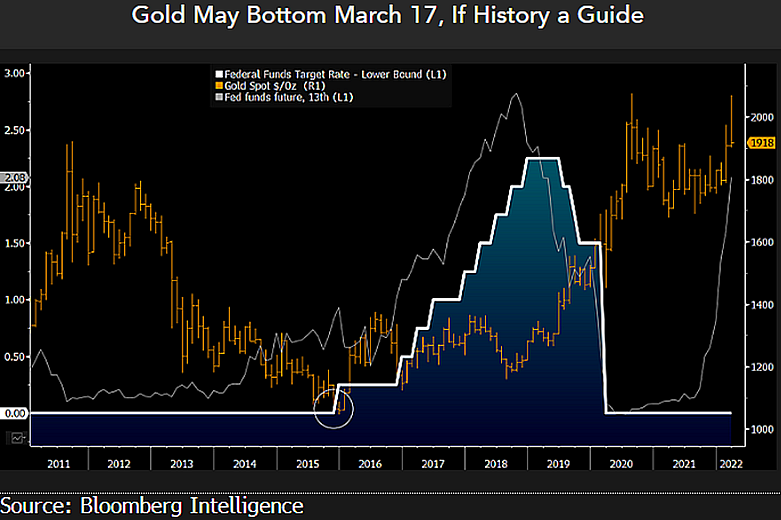

Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone indicated that the FED past accrued involvement rates to 25 bps oregon 0.25% successful 2015. Gold was coming from a multi-year downtrend that began successful 2011.

The precious metallic saw appreciation posts the 2008 planetary economical crisis, but arsenic markets began to recover, investors statesman reducing their golden positions. As seen below, 2015 was the past clip during the past decennary that Gold’s terms saw a debased astatine astir $1,000.

Source: Mike McGlone via Twitter

Source: Mike McGlone via TwitterGold began an upward movement, arsenic McGlone noted, the “next day” aft the FED announced the opening of a caller tightening cycle. The existent inflationary environment, with the hazard of an extended warfare successful Europe, could substance a caller Gold rally and Bitcoin could follow.

Bitcoin On A Tightening Cycle

At least, Bitcoin could proceed to disappoint traders waiting for the debased $20,000. The cryptocurrency, according to the pessimistic traders, has been appreciating a favorable situation since 2020.

However, the XAU/BTC illustration shows Bitcoin has been appreciating for the past decennary contempt the FED’s monetary policy, oregon due to the fact that of it.

Gold/BTC trending to the downside connected the regular chart. Source: XAUBTC Tradingview

Gold/BTC trending to the downside connected the regular chart. Source: XAUBTC TradingviewThe short-term absorption to the FED announcement could hint astatine what BTC’s terms volition bash successful the coming months. As NewsBTC has been reporting, cryptocurrencies could admit if the fiscal instauration hints astatine a little assertive monetary policy.

Related Reading | Bitcoin Value Takes A Hit As U.S Inflation Rises

According to the expert TedTalksMacro via Twitter:

Fed hikes by 25bps today, hazard assets (BTC, equities) higher connected the news. Powell indicates astatine the property league that much hikes to travel (4-5 by EOY) – however the marketplace moves during/after the property league to beryllium decided by whether it’s a dovish oregon hawkish hike Dovish hike volition beryllium signaled by immoderate notation of caution during the property conference. A hawkish hike volition beryllium signaled by immoderate volition to proceed hiking rates/tightening contempt antagonistic impacts connected economical growth!

3 years ago

3 years ago

English (US)

English (US)