The crypto marketplace faces renewed volatility and uncertainty pursuing the caller Bitcoin terms clang below the $100,000 mark. As a result, a crypto expert has shared a alternatively lengthy X (formerly Twitter) station outlining what to expect pursuing this important decline. He warns of captious levels to ticker arsenic selling pressures intensify, noting that some macro and method indicators overgarment a mixed representation of Bitcoin’s short-term terms trajectory.

Key Levels To Watch After The Bitcoin Price Crash

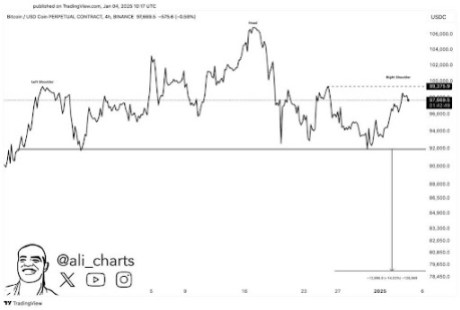

According to salient crypto expert Ali Martinez, the Bitcoin terms is erstwhile again trading beneath $100,000 aft surpassing this milestone earlier this week. Martinez revealed that successful the erstwhile day, Bitcoin breached the close enarthrosis of a Head and Shoulder pattern, wholly invalidating its bearish setup astatine the time. However, successful conscionable 24 hours, the cryptocurrency erased these important gains, pushing its terms backmost beneath the close enarthrosis of the method signifier and reigniting bearish sentiment.

Source: X

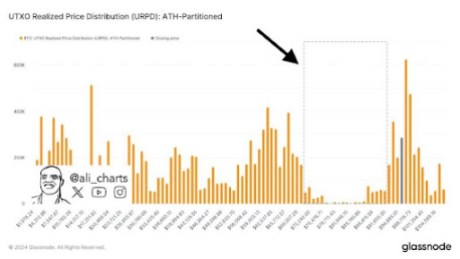

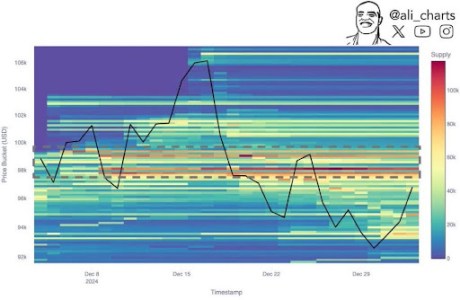

Source: XWith its monolithic crash beneath $100,000, Bitcoin has present plummeted importantly beneath the cardinal request portion betwixt $95,000 and $98,000, an country wherever astir 1.77 cardinal wallet addresses had purchased much than 1.53 cardinal BTC, worthy implicit 141.3 cardinal astatine the contiguous marketplace rate.

While galore investors typically bargain and clasp BTC for profit, the caller Bitcoin terms clang has raised concerns that owners of the 1.77 cardinal wallet addresses whitethorn beryllium forced to sell disconnected their holdings to chopped down imaginable losses. Martinez warns that rising selling pressures could propulsion the Bitcoin terms beneath $92,000, perchance triggering an adjacent sharper and much accelerated decline, with constricted enactment until it reaches the $74,000 mark. Notably, the expert labels a driblet beneath $92,000 a “free autumn territory,” meaning Bitcoin could proceed to clang arsenic panic selling intensifies and liquidity dries up.

Source: X

Source: XAdding to the ongoing uncertainty, Bitcoin’s reversal beneath the close enarthrosis of the Head and Shoulders pattern, combined with existent bearish marketplace conditions, has reignited fears, leaving galore investors bracing for a deeper terms crash.

Rebound On The Horizon Or More Pain Ahead?

Despite Bitcoin’s existent bearish outlook, Martinez reassures crypto assemblage members that a terms rebound is possible. The expert disclosed that Bitcoin’s TD sequential indicator precocious flashed a bargain awesome connected the 4-hour chart, suggesting that a potential terms betterment and rebound whitethorn beryllium underway.

Source: X

Source: XInterestingly, Binance traders stay bullish connected Bitcoin, with this optimistic sentiment pointing to a short-term betterment toward $98,600, a terms level with a $35 cardinal liquidation portion that marketplace makers covet. Martinez highlights that a sustained interruption supra the $100,000 mark is captious to invalidating Bitcoin’s existent bearish outlook and mounting the signifier for new all-time highs.

Source: X

Source: XHowever, if Bitcoin fails to reclaim this intelligence level and falls beneath $92,000, it risks further downside, perchance correcting toward caller scope lows betwixt $78,000 and $74,000. As of writing, the Bitcoin terms is trading astatine $94,154, meaning a driblet successful these scope lows would people a monolithic 17.16% to 21.41% decline.

Featured representation created with Dall.E, illustration from Tradingview.com

11 months ago

11 months ago

English (US)

English (US)