While StarkNet declined to remark connected whether this signaled the merchandise of a token, the decentralized autonomous enactment (DAO)/governance exemplary has often relied connected a governance token to found voting rights and align the protocol’s governance with investors successful the platform. Many projects successful crypto person tokens, and truthful wherefore would StarkNet’s imaginable motorboat beryllium important successful the industry? Ethereum’s furniture 2 protocols person frankincense acold been conflicted connected whether a token is needed oregon whether ether should beryllium the halfway token for each rollups, arsenic well.

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum 2.0 and its sweeping interaction connected crypto markets. Subscribe to Valid Points here.

Rollups similar Arbitrum and Optimism usage a “wrapped” ether arsenic their basal token, which pays for state and acts arsenic the main DEX (decentralized exchange) pairing connected galore decentralized finance (DeFi) assets. To station the batched rollup transactions to a mainnet, the protocols indispensable wage on-chain transaction fees that are subsidized by the users of the rollup.

In that sense, it is understandable that Ethereum-scaling tools would usage ether arsenic the autochthonal asset. Yet rollups person struggled to summation a pursuing comparable to what we’re seeing successful alternate furniture 1s, similar Solana, Avalanche and Binance Smart Chain. In the abbreviated term, the tokenless furniture 2s are facing an uphill conflict against furniture 1s with billion-dollar warfare chests that supply the quality to incentivize builders and users to lend to the network.

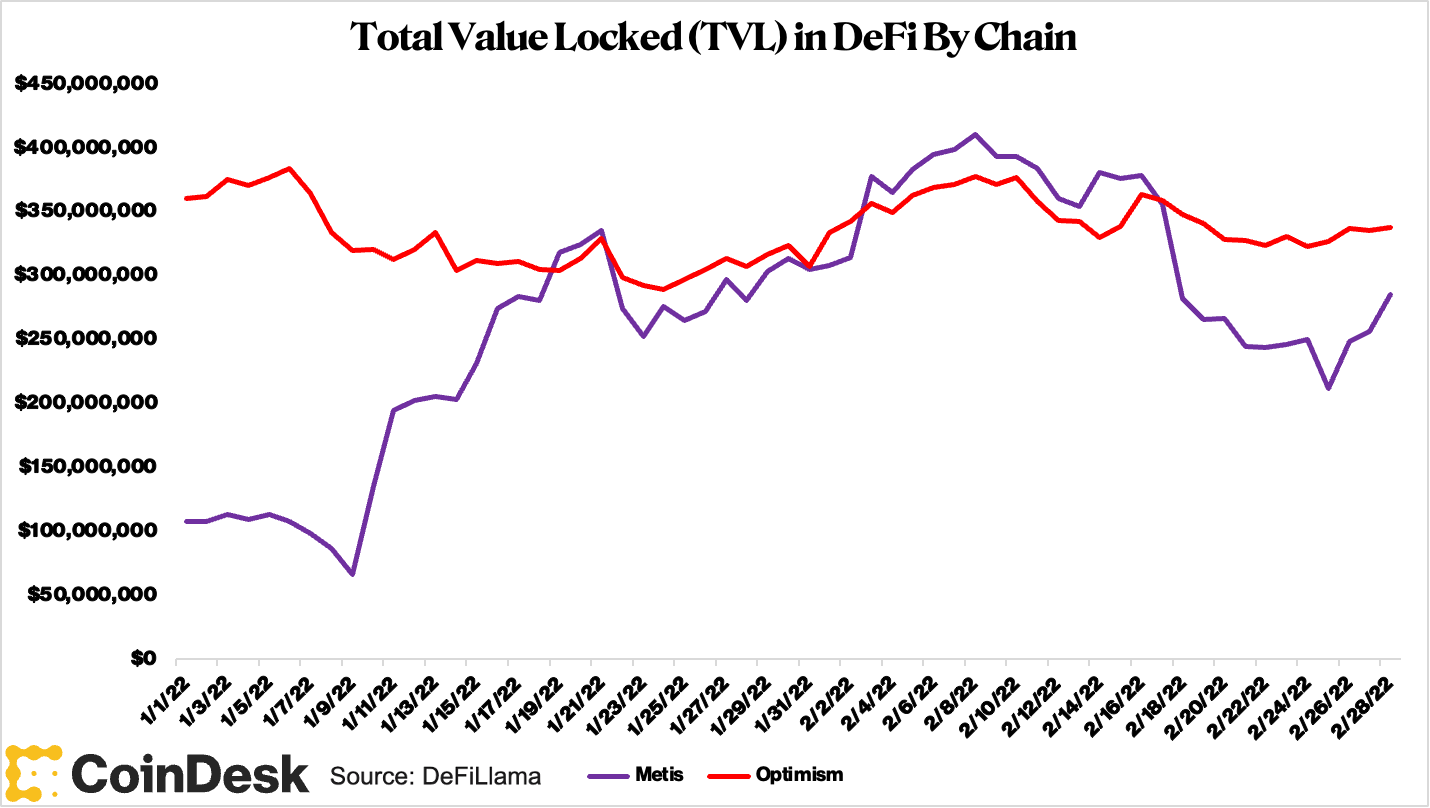

Ethereum’s Scaling Solutions Compete for Total Value Locked

By looking astatine the show of tokenized Ethereum scaling tools (Polygon, Metis, Boba) vs. tokenless furniture 2s (Arbitrum, Optimism, all ZK rollups), it's wide that the motorboat of a token system allows networks to make hype, physique assemblage and found grants utilized for innovation and security. The full worth locked (TVL) whitethorn not beryllium permanent, but the motorboat of a token oregon an inducement programme generates attraction and financially encourages builders and users alike to span to the network.

Metis is looking to get adjacent much originative with its tokenomics, utilizing the Metis token for transaction fees and returning 30% of the state paid to protocols that physique connected the network. The programme amended aligns Metis and the projects gathering connected the network, arsenic they present some payment financially from stealing marketplace stock from different chains and creating a stronger ecosystem.

Outside of DeFi, Metis besides uses its autochthonal token to promote decentralization and security. Metis’ Andromeda is an Optimistic rollup, which uses sequencers to verify transactions overmuch similar Abitrum and Optimism do. However, alternatively of relying connected a azygous sequencer tally by the squad down the protocol, Metis intends to let 3rd parties to besides tally sequencers by staking Metis to financially beryllium their honesty.

DeFiLlama

DeFiLlama

The token is conscionable 1 of respective differences betwixt Optimism and these different tokenized furniture 2s, and truthful aggregate factors similar idiosyncratic experience, decentralization and transaction fees are besides astatine play successful driving adoption. Yet, it seems apt that furniture 2 ecosystems would thrive similar alternate furniture 1s if they could besides marque usage of the speculative valuations that are seen passim the crypto industry.

All of this is not to accidental that tokenization solves everything. In fact, the tokenization of furniture 2s whitethorn origin immoderate issues wrong the broader Ethereum ecosystem. Crypto is truthful powerfully narrative-driven that liquidity tin go fragmented portion users pursuit incentives. This dispersal tin render applications and chains inefficient arsenic users and liquidity are divided crossed hundreds of applications and aggregate chains.

Furthermore, tokenization tin pb to short-term reasoning among some developers and ecosystem participants, slowing existent innovation and creating a antagonistic feedback loop. (This aforesaid dynamic is often seen with executives and banal options.)

So portion tokenization is nary one-size-fits-all solution, it volition surely springiness prime furniture 2s a instrumentality for encouraging maturation and innovation. A ample rollup supplier similar Arbitrum, Optimism oregon StarkWare could easy make a domino effect by launching a token, forcing different networks to travel suit to enactment relevant. Surely a large subordinate successful the Ethereum rollup crippled volition springiness mode to the demands of ecosystem participants and venture superior firms successful the adjacent future.

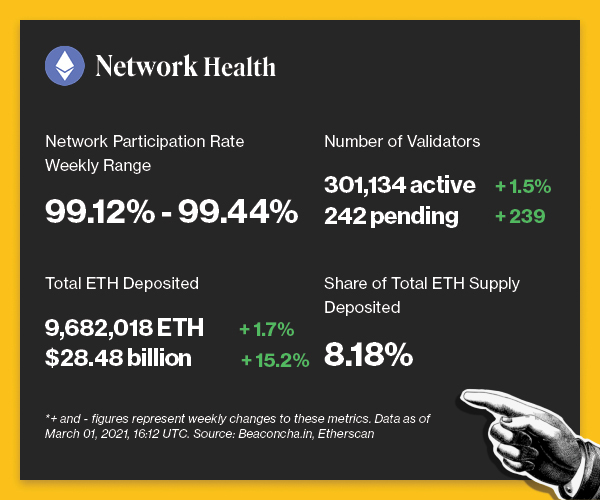

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

Beaconcha.in, Etherscan

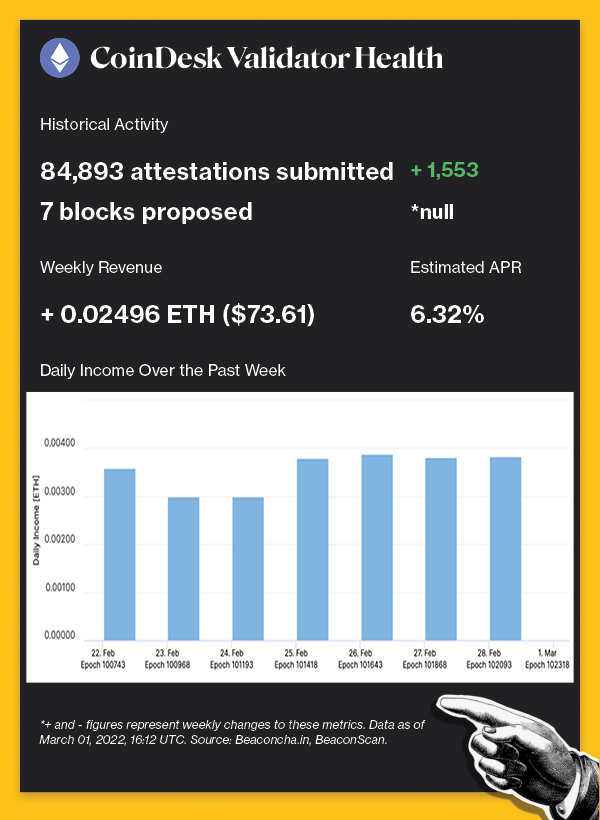

Beaconcha.in, Beaconscan

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

The Aave community unanimously approved a proposal to motorboat the Aave ecosystem connected StarkWare successful February. BACKGROUND: The bootstrapping volition beryllium executed implicit an estimated 3 months, successful a determination to connection Aave V3 connected Ethereum rollups. Deliverables for this task see “smart contracts (Ethereum/Starknet) for wrapping and bridging of aTokens,” arsenic Aave V3 focuses connected a multi-chain borrowing and lending acquisition for users.

The arrival of zkEVM signals the archetypal EVM (Ethereum virtual machine)-compatible ZK rollup connected Ethereum’s testnet. BACKGROUND: zkSYNC 2.0 is intended to beryllium a cardinal constituent successful Ethereum’s scalability endgame. The recently deployed instrumentality for Ethereum’s scaling issues is the archetypal implementation of a ZK rollup that would let developers to physique and deploy decentralized applications successful a low-fee, highly scalable furniture 2 situation utilizing Ethereum’s autochthonal programming language, Solidity.

An Ethereum address has received implicit $5 cardinal worthy of ETH to assistance Ukraine repel the Russian invasion. BACKGROUND: The authoritative Twitter accounts of the Ukrainian authorities and Minister of Digital Transformation Mykhailo Fedorov – @Ukraine and @FedorovMykhailo – provided this wallet code successful an effort to streamline planetary enactment for Ukraine against Russia. Cryptocurrency has again proven to beryllium an effectual measurement for crowdsourcing and funding.

KPMG successful Canada bought a World of Women non-fungible token conscionable weeks aft its archetypal BTC purchase. BACKGROUND: Global accounting steadfast KPMG’s Canada subdivision precocious marked its introduction into integer collectibles by purchasing an NFT from the World of Women postulation for 25 ETH. KPMG’s entrance into integer collectables is simply a measurement toward the steadfast gathering a firm NFT strategy for its clients.

Valid Points incorporates accusation and information astir CoinDesk’s ain Eth 2.0 validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)