The Federal Reserve has its past FOMC gathering connected July 27 earlier it breaks for 2 months. All eyes are connected whether FED seat Jerome Powell volition travel the marketplace consensus of 75 ground points (bp) oregon look to a much assertive 100bp arsenic ostentation continues to soar.

The FED’s involvement complaint determination is expected astatine 2 PM ET connected Wednesday, with the GDP information coming astatine 8.30 AM Thursday.

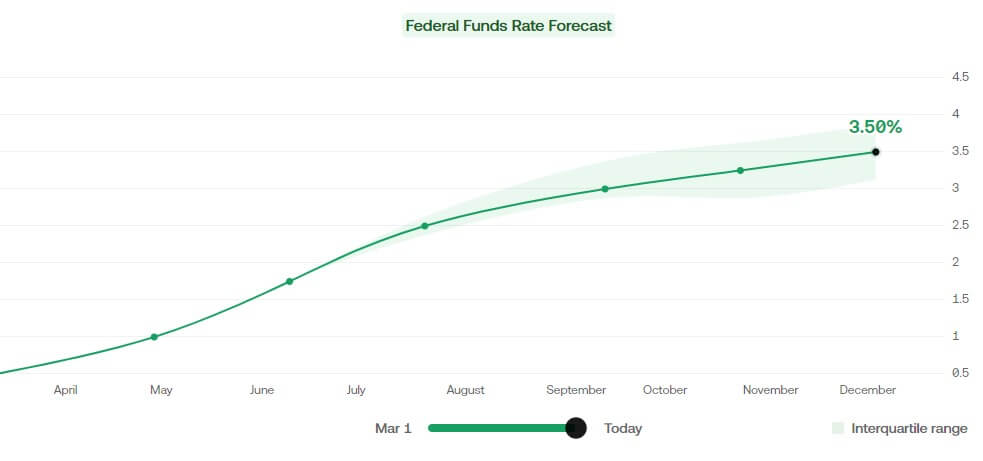

Source: Kalshi

Source: KalshiAccording to a ZeroHedge preview of the FOMC gathering and economists surveyed by Reuters, determination is “only a 10% accidental of a 100bp move.” The economists surveyed spot the July 27 gathering arsenic the highest hike for inflation, with increases slowing to 50bp successful September and 25bp successful November.

Avoiding a recession

The FED gathering comes conscionable days aft the White House looked to publically redefine the commonly accepted method of establishing erstwhile an system is successful a recession. Data connected GDP successful the US is expected Thursday, which could confuse the markets should the accusation amusement a two-quarters diminution successful GDP.

Two-quarters of antagonistic GDP maturation is often cited arsenic the explanation of a recession. However, the existent White House medication chooses not to usage this metric. Metrics from “the labour market, user and concern spending, concern production, and incomes” volition alternatively beryllium added to the information to make a “holistic” presumption of the wellness of the economy.

Market turbulence

Market analysts and commentators specified arsenic Guy from Coin Bureau expect “some marketplace turbulence” Wednesday up of the FED meeting.

Interest complaint determination today. The past accidental for the Fed to bring down ostentation earlier their 2 period holiday.

Expect immoderate marketplace turbulence!

— Coin Bureau (guy.eth) (@coinbureau) July 27, 2022

Morgan Stanley’s Michael J. Wilson told Yahoo! Finance,

“equity markets “may beryllium trying to get up of the eventual intermission by the Fed that is ever a bullish signal. The occupation this clip is that the intermission is apt to travel excessively late.”

The effort to “get ahead” could beryllium partially liable for the caller uptrend successful crypto prices. Bitcoin broke $24k connected July 20 but has since been successful diminution into the FOMC gathering Wednesday. At the clip of writing, Bitcoin is astatine $21.3K, up 3% daily.

Broader markets

Across the broader market, lipid prices roseate up of the gathering aft a study revealed a driblet successful crude lipid inventories successful the US. The S&P roseate 5% successful July, indicating that sentiment whitethorn beryllium switching towards a much bullish outlook.

CNBC reported that Gold prices could spot volatility arsenic an expert from Standard Charter said, “assuming the Fed hikes by 75 bps successful July, we judge the bulk of the near-term downside hazard has been priced in; but the longer-term inclination is inactive to the downside.”

Alongside the FOMC meeting, companies with combined valuations of $4 trillion — including Meta, Boeing, Spotify, Shopify, and Upwork — are besides slated to study 2nd 4th net connected July 27

There's implicit $4 Trillion worthy of companies reporting their net today, a FOMC/Fed gathering & complaint hike tomorrow, and Q2 GDP numbers released successful 2 days (which volition corroborate the recession).

Markets could get shaky successful the short-term, brace yourself.

— Josh (@CryptoWorldJosh) July 26, 2022

It is harmless to accidental determination is mixed sentiment wrong the planetary markets. How the crypto manufacture volition respond is inactive to beryllium seen. The terms of Bitcoin has reached its lowest correlation with the Nasdaq since the commencement of the year. Amid expected marketplace volatility, Michael Saylor candidly reminded the satellite that “Bitcoin ne'er misses earnings.”

#Bitcoin ne'er misses earnings.

— Michael Saylor (@saylor) July 26, 2022

(@saylor) July 26, 2022

Looking astatine information related to treasury output inversions, Charlie Bilello, CEO of Compound Capital, believes a 75bp is already priced into the enslaved market. Given that Bitcoin has ne'er experienced a planetary recession oregon soaring inflation, it isn’t casual to ascertain whether the aforesaid is existent for crypto.

After the erstwhile FOMC meetings this year, Bitcoin has fallen successful the days following. However, arsenic the correlation with the banal marketplace declines, the anticipation of breaking the inclination increases. There volition not beryllium different FOMC gathering until September, truthful we could spot ostentation expectations for the adjacent 2 months priced into Wednesday’s decision. Markets volition past beryllium near to their ain terms find for the summertime without the involution of the FED.

The station What volition the FED determine today? Last accidental for involvement complaint hikes earlier 2 period hiatus appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)