The pursuing is simply a impermanent station by Vincent Maliepaard, Marketing Director astatine IntoTheBlock.

When you archetypal perceive astir Bitcoin staking, you mightiness presume there’s a mistake, fixed Bitcoin’s Proof of Work (PoW) mechanism. However, Bitcoin staking is so a reality, with thousands of addresses participating and generating returns connected their assets. Here’s what you request to know.

Bitcoin Staking Explained

Staking traditionally refers to the process wherever holders of a cryptocurrency fastener up their funds to enactment successful web operations, specified arsenic transaction validation connected Proof of Stake (PoS) blockchains. Bitcoin, however, operates connected a PoW statement mechanism, which does not natively enactment staking. This dynamic has changed with the instauration of Bitcoin staking done platforms offering Bitcoin-based Liquid Staking Tokens (LSTs). These platforms alteration BTC holders to prosecute successful staking activities indirectly.

EigenLayer, Babylon, and AVS’s

On Ethereum, the conception of “restaking” was introduced successful 2023 with EigenLayer, which gained important traction by mid-2024, reaching a full worth locked (TVL) of implicit $20 cardinal successful June. Normally, staking ETH helps unafraid the Ethereum network, rewarding stakers successful return. EigenLayer extends this conception by allowing users to “restake” their ETH to unafraid further services, earning other rewards.

Initially coined arsenic Active Validated Services (AVS) connected Eigenlayer, these applications by antithetic presumption depending connected their associated (re)staking platform. AVSs are applications oregon services that tin beryllium secured with restaked ETH. This conception is present being extended to the Bitcoin blockchain and BTC-pegged tokens. Babylon is starring this effort, gathering an architecture that allows applications to leverage Bitcoin’s crypto-economic security. Meanwhile, connected the Ethereum side, Symbiotic and soon Eigenlayer are restaking protocols accepting tokens specified arsenic Wrapped Bitcoin (WBTC) arsenic collateral to enactment applications that question to utilize these assets for enhanced security.

Understanding Bitcoin Staking

In Bitcoin staking, users deposit their BTC into a staking protocol and person Liquid Staking Tokens (LSTs) successful return. These LSTs correspond the staked BTC but often connection enhanced liquidity and different functionalities. This allows participants to prosecute successful DeFi activities without sacrificing staking rewards.

Currently, the astir fashionable Bitcoin LST is LBTC, originating from the Lombard protocol. Here’s a breakdown of however it works:

- How LBTC is Created: To mint LBTC, users nonstop their BTC to peculiar addresses linked to the Babylon protocol. This enactment creates LBTC connected Ethereum, acting arsenic a placeholder for the Bitcoin you sent.

- What Happens to the BTC: The existent BTC sent is held securely wrong Babylon protocol’s contracts. At present, this BTC isn’t being utilized oregon accessible, but it remains safely stored.

- Rewards for Depositors: While the BTC is held successful reserve, depositors are rewarded with points from some the Babylon and Lombard systems arsenic an inducement for their participation.

- The Future Plan: The extremity is to yet usage the BTC held by Babylon’s contracts to unafraid a broader ecosystem. This would impact allowing antithetic apps and chains to utilize this BTC to unafraid their networks portion maintaining a transportation to the main Bitcoin network.

Leading Protocols successful Bitcoin Staking

Several protocols person emerged arsenic frontrunners successful the Bitcoin staking arena:

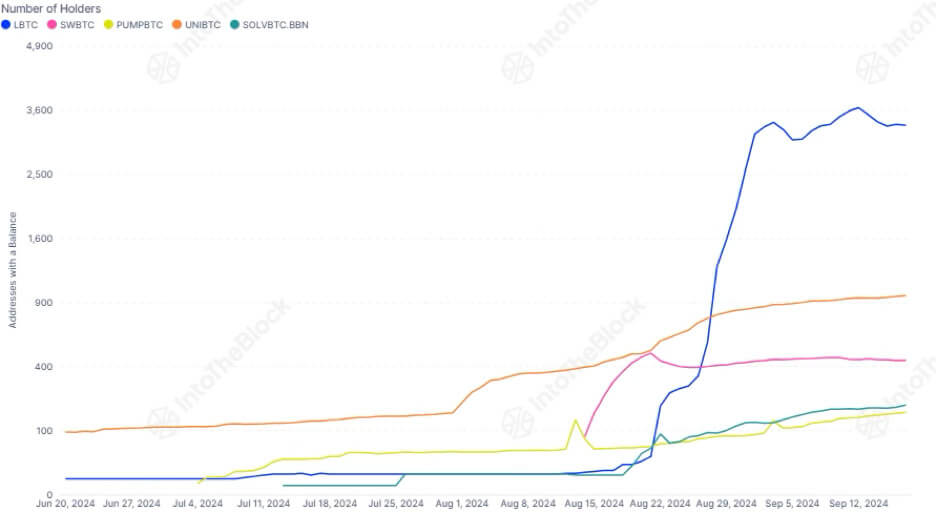

- Lombard Staked BTC (LBTC): As a person successful this market, LBTC has seen its marketplace headdress turn significantly, now sitting astatine $300 cardinal with implicit 3,000 holders.

- UniBTC: UnitBTC secured a important fig of holders aboriginal on. While LBTC has surpassed it, it inactive ranks 2nd with astir 1000 holders.

- Swell BTC (SWBTC): SWBTC had a beardown commencement and seemed apt to surpass uniBTC. However, maturation has slowed down and it presently ranks 3rd with astir 440 holders.

Source: IntoTheBlock

Source: IntoTheBlockIs Bitcoin Staking the Future of Bitcoin yield?

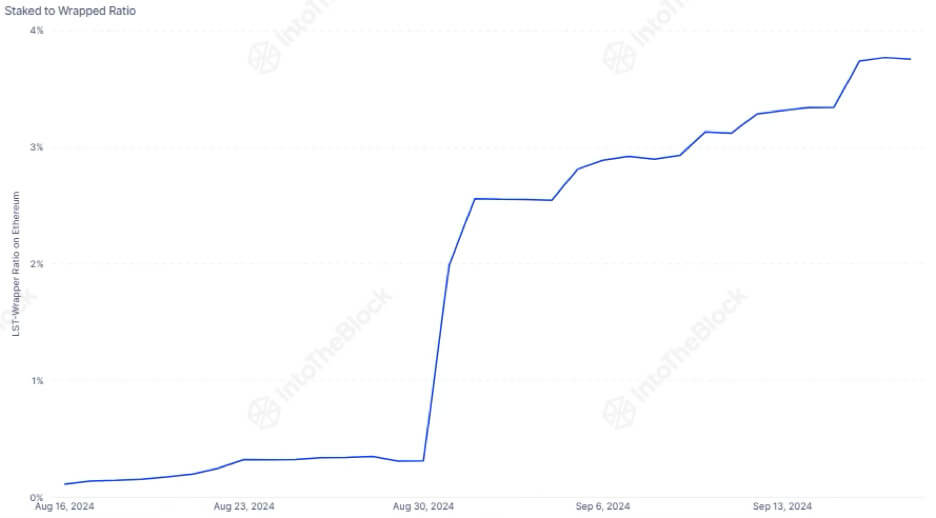

Bitcoin staking has seen a beardown start, with thousands of holders already earning points done starring protocols. Currently, staked Bitcoin represents 3.75% of each wrapped Bitcoin, indicating determination is inactive plentifulness of country for maturation successful the coming months.

The conception is promising, but its semipermanent occurrence volition beryllium connected whether the economics of staking marque consciousness beyond the archetypal constituent rewards. The cardinal origin volition beryllium the improvement of services built connected apical of these protocols. If a robust ecosystem of services develops, Bitcoin staking could go 1 of the astir charismatic output opportunities for Bitcoin holders.

The station What you request to cognize astir Bitcoin staking appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)