In the Bitcoin space, 1 question echoes persistently done the minds of enthusiasts and investors alike: When volition Bitcoin rocket to the moon? While nary 1 knows the answer, determination are on-chain metrics and humanities patterns that tin beryllium followed to way down the answer.

Bitcoin Price Analysis: When Will BTC Break Out?

Over the past 2 weeks, the Bitcoin terms has been successful a sideways trend. After the Bitcoin bulls were capable to crook the tide astatine $24,900, the terms has risen by much than 25%. Since then, however, BTC has been trading successful the scope betwixt $29.800 and $31.300. Neither bulls nor bears person been capable to summation the precocious manus and interruption retired of the trading scope successful higher clip frames.

BTC terms scope remains successful tact, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC terms scope remains successful tact, 4-hour illustration | Source: BTCUSD connected TradingView.comThe renowned crypto trader and expert “Rekt Capital” believes that each it takes is simply a affirmative catalyst to existent BTC terms action. According to him, Bitcoin’s existent sideways inclination wrong a choky scope is simply a specified measurement distant from its eventual demise. He affirms that “a BTC downtrend is lone ever 1 affirmative catalyst distant from ending. And a BTC uptrend is ever 1 antagonistic catalyst from ending”, adding:

BTC has performed a bullish Monthly adjacent but is primed for a steadfast method retest astatine ~$29250. With terms presently astir $30200… I wonderment what antagonistic catalyst volition soon look to facilitate this method retest.

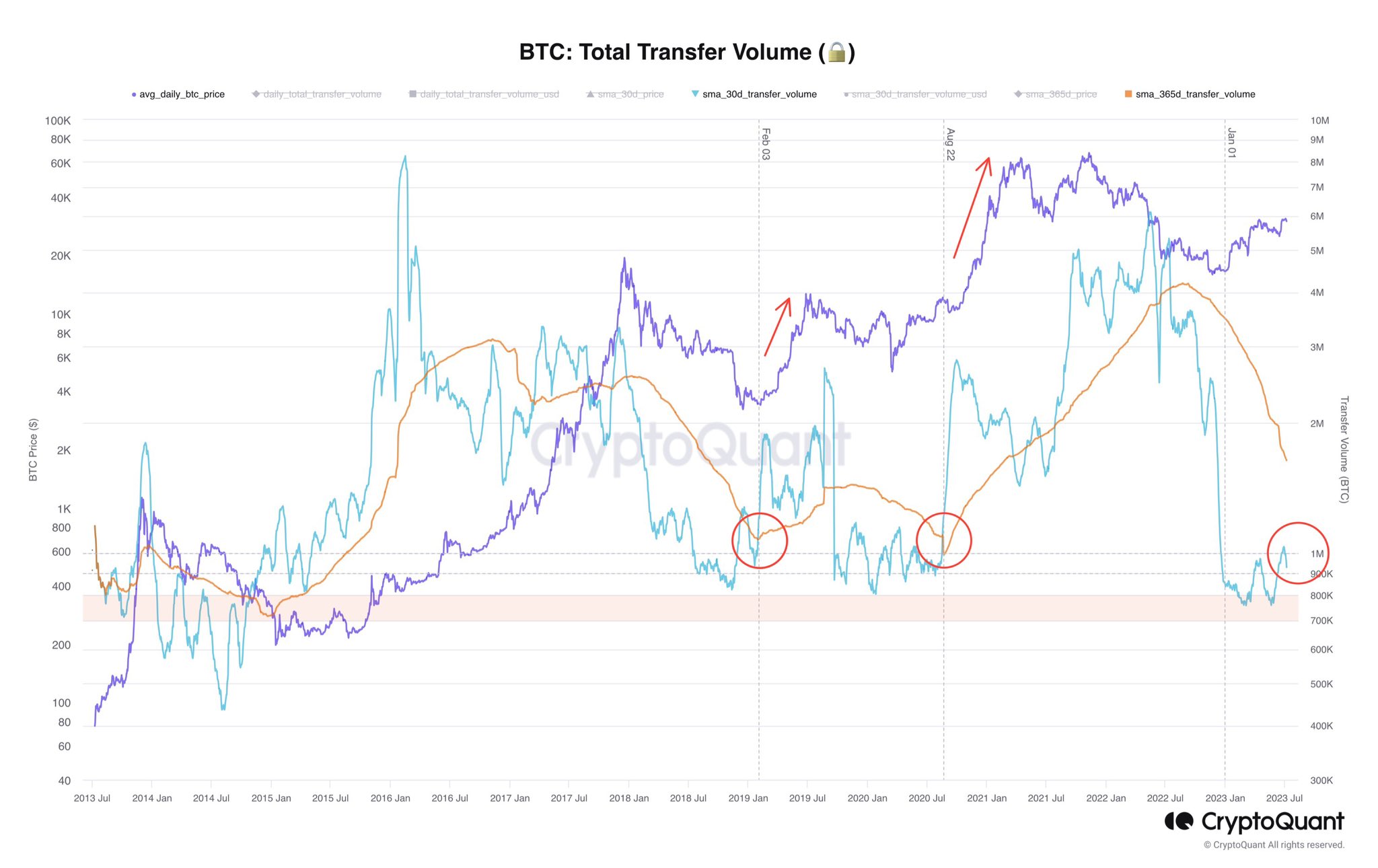

On-chain expert Axel Adler Jr echoes this presumption and points to BTC full transportation measurement arsenic indicator for a monolithic breakout move. While the nonstop timing remains elusive, Adler Jr suggests that the moonshot could beryllium triggered by a important lawsuit specified arsenic the approval of a Bitcoin Exchange-Traded Fund (ETF).

Drawing from humanities evidence, Adler Jr highlights the correlation betwixt explosive terms pumps and a surge successful BTC’s full transportation volume. Past instances, similar the melodramatic surges witnessed successful February 2019 and August 2020, lend value to the statement that a akin surge whitethorn loom conscionable astir the corner.

BTC transportation measurement | Source: Twitter @AxelAdlerJr

BTC transportation measurement | Source: Twitter @AxelAdlerJrBulls Vs. Bears And Whale Games

Daan Crypto Trades remarks connected the existent authorities of the market, “They telephone this candlestick pattern: Thanks for your stops.” Daan’s keen oculus eagerly awaits a decisive breakthrough that volition propel Bitcoin into a important move.

As the conflict betwixt bulls and bears ensues, helium perceives the ongoing range-bound enactment arsenic a prelude to an imminent explosion. “Until past it’s conscionable a batch of chop, halt hunts and liquidity grabs until 1 broadside comes retired victorious.” Once the shackles of this consolidation are shattered, Daan predicts that the resulting breakout volition people the apical for 2023:

If BTC were to grind backmost to the highs from here, I’d beryllium beauteous assured that the adjacent breakout volition beryllium the 1 wherever we yet interruption retired of this area. I besides deliberation this would beryllium the sharpest determination and apt sets the apical for 2023 followed by a dilatory remainder of the year. […]I would presume we’d sojourn astir 36-40K successful a speedy fashion.

Meanwhile, renowned expert Skew shed airy connected the intricacies of Bitcoin’s marketplace dynamics. With an eagle oculus connected the Binance Spot market, Skew discerns important BTC accumulation occurring. He revealed that the proviso is concentrated betwixt $31.3K and $32K, portion request persists betwixt $29.5K and $28K.

Unveiling the tactics of bigger players, Skew pointed to however whales employment assertive abbreviated positions to manipulate the terms wrong the constrictive hourly range, exploiting bid liquidity and supply.

BTC Perp CVD Buckets & Delta Orders – This 1 truly shows however rekt apes got earlier contiguous (Long/Short CVD). Whales playing the 1-hour scope betwixt bully bid liquidity & supply. TWAP orders / CVD shows assertive shorts walking terms backmost down from $31.4K to $30K.

Featured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)