A look astatine erstwhile bitcoin carnivore marketplace cycles shows 2 chiseled phases of capitulation and tin springiness penetration into however overmuch longer the carnivore marketplace volition last.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Price-Based Capitulation Versus Time-Based Capitulation

A look astatine erstwhile bitcoin carnivore marketplace cycles shows 2 chiseled phases of capitulation:

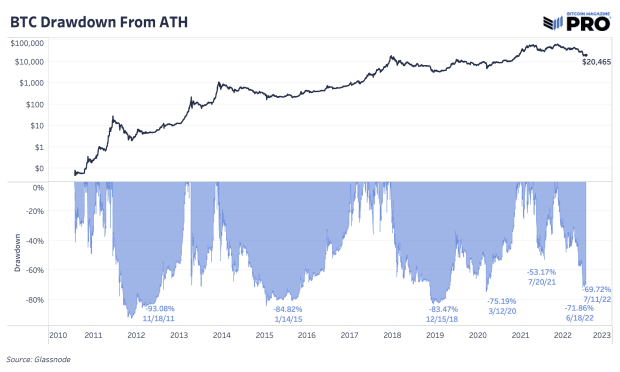

- The archetypal is simply a price-based capitulation, done a bid of crisp selloffs and liquidations, arsenic the plus draws down anyplace from 70 to 90% beneath erstwhile all-time-high levels.

- The 2nd phase, and the 1 that is spoken of acold little often, is the time-based capitulation, wherever the marketplace yet begins to find an equilibrium of proviso and request successful a heavy trough.

Let’s screen some of these phases with visuals and information derived from the blockchain.

Bitcoin Drawdowns from All-Time Highs

While overmuch has been written astir the macroeconomic backdrop regarding the bitcoin marketplace (with our investigation assuredly included), this bitcoin rhythm ironically does not look each that antithetic from the cycles of the past.

At the clip of writing, bitcoin is 69.72% beneath erstwhile all-time highs, with the highest of the drawdown reaching 71.86% connected May 18. Bear markets of bitcoin’s past saw drawdowns of 93.08%, 84.82% and 83.47% respectively. With this successful mind, contempt the implicit size of this cycle’s drawdown dwarfing erstwhile cycles, successful comparative presumption this was thing retired of the mean for bitcoin.

Bitcoin drawdowns from all-time highs amusement this driblet isn't retired of the ordinary

Bitcoin drawdowns from all-time highs amusement this driblet isn't retired of the ordinary

When the mean holder of bitcoin is underwater, contempt the parabolic gains seen crossed longer clip frames, we presumption this arsenic a classical price-based capitulation event.

Time-Based Capitulation

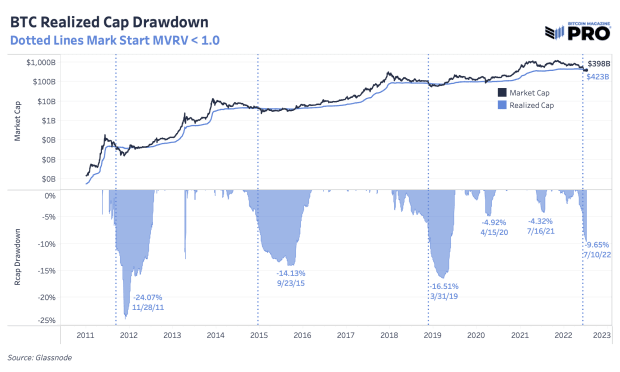

What follows the illness of the marketplace beneath the mean outgo ground of the mean holder is what we see the time-based capitulation event. As the mean holder is underwater, astir marginal sellers person already sold their holdings, and portion further downside is possible, the “pain” marketplace participants consciousness is successful the signifier of a prolonged play of clip spent underwater alternatively than rapidly declining prices that characterized the commencement of the carnivore market.

It is besides worthy noting that arsenic terms falls, and marketplace participants capitulate astatine a loss, the mean outgo ground (realized price) falls. To contextualize this diminution successful “fair” worth of bitcoin, the past of realized terms drawdowns is shown below.

History of realized terms drawdowns

History of realized terms drawdowns

Bear marketplace cycles instrumentality clip to play retired and alteration successful magnitude depending connected however you specify them.

In each likelihood, the brunt of the largest capitulation lawsuit successful the past of bitcoin has conscionable occurred. More equilibrium expanse contagion is surely connected the array (rather hiding nether it), and the macroeconomic situation looks progressively ugly. Holders should buckle in, not conscionable successful lawsuit of much terrible marketplace downturns, but the arguably much achy anticipation of extended sideways enactment unneurotic with little prices and plentifulness of sideways chop arsenic coins are transferred from anemic hands to beardown hands, and from the impatient to the convinced.

Bitcoin is present to stay. Your occupation is simply to survive.

3 years ago

3 years ago

English (US)

English (US)