The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

CPI Volatility Doesn’t Disappoint

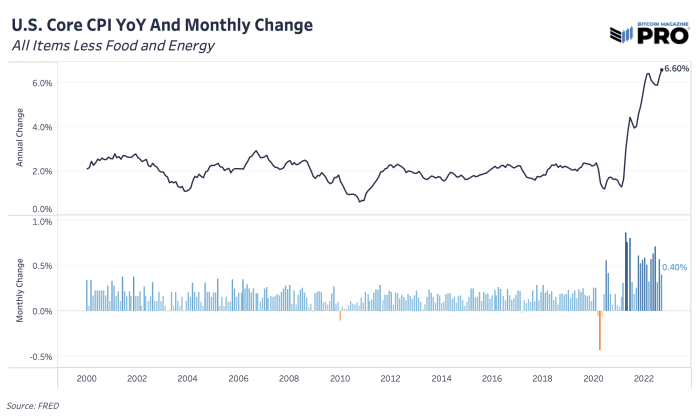

In the last article, we highlighted a imaginable for CPI to astonishment to the upside and bring much volatility — and that’s precisely what we got and more. We won’t screen the components that drove the astonishment successful item since we already highlighted overmuch of that, but the cardinal takeaway is that Core CPI came successful hotter than expected astatine 6.6% year-over-year and 0.4% month-over-month with structure (rent, lodging components, etc) and aesculapian services arsenic cardinal drivers. This is the fastest complaint of alteration successful yearly header Core CPI since 1982. To comparison the assorted components implicit the past 3 months, cheque retired this chart.

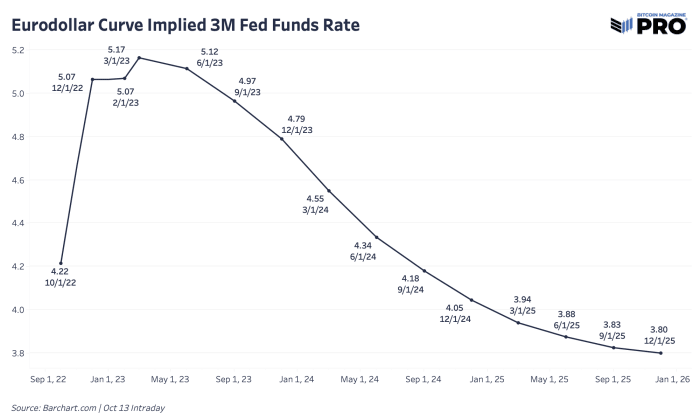

As for the rates, the latest implied national funds complaint from the eurodollar marketplace shows a highest conscionable supra 5% successful March 2023 earlier immoderate complaint cuts hap astatine the extremity of the year.

Where’s The Bitcoin Price Low?

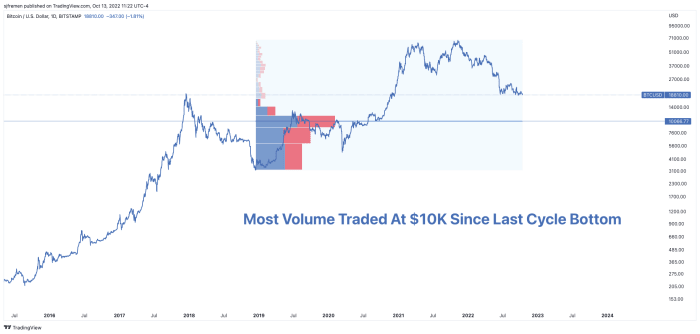

With a autumn to $18,000 inching person and bitcoin facing risks of caller year-to-date lows, it’s worthy taking a look astatine a fewer cardinal bottommost terms levels to gauge wherever the terms whitethorn extremity up. First, let’s look astatine the fixed measurement scope illustration of bitcoin since the December 2018 bottommost of past cycle. The overwhelming bulk of traded measurement successful the marketplace occurred close astir $10,000, besides a cardinal intelligence level. In a beardown downward move, $10,000 is simply a spot wherever galore successful the marketplace person their spot outgo ground and could commencement feeling immoderate existent drawdown symptom oregon deficiency of conviction.

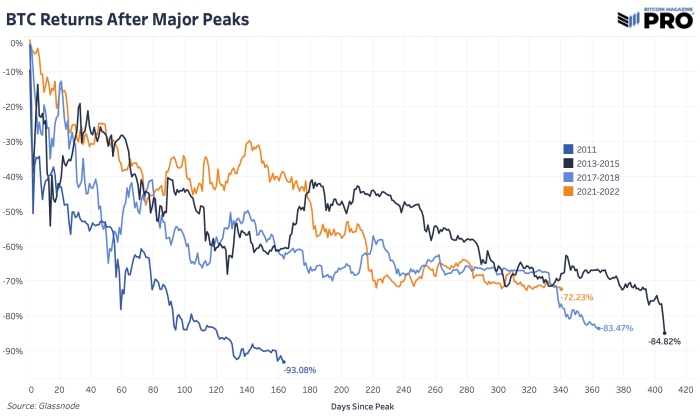

In presumption of carnivore marketplace and rhythm duration, let’s revisit the cyclical drawdown illustration for bitcoin successful existent and erstwhile cycles. Currently, we’re close astir a 72.23% drawdown from an all-time precocious closing terms of $67,589. If we are going to spot a max rhythm drawdown travel successful little than the past 2 cycles — let’s accidental astir 80% — past we’re looking astatine a terms astir $13,500. If we presume that this rhythm and popping of valuations volition beryllium overmuch worse, let’s accidental astir 85%, past we’re looking astatine a terms astir $10,100. The bull lawsuit is that we’ve recovered a durable bottommost astatine $18,000 and we won’t spot the max drawdown scope beyond 73%.

From an on-chain perspective, 1 of the much absorbing realized terms areas is the realized terms held by the cohort of addresses that person 10-100 BTC. Recall that realized terms is an estimation of the mean outgo ground based connected the terms erstwhile UTXOs past moved. This peculiar radical accounts for astir 22.6% of each circulating supply. This radical would surely bespeak a decent information of semipermanent holders and there’s a lawsuit to beryllium made that successful a deep, prolonged carnivore market, semipermanent holders person yet to consciousness the symptom oregon capitulation that we’ve seen successful the past.

3 years ago

3 years ago

English (US)

English (US)