U.S. equities markets jumped connected Thursday arsenic banal traders saw immoderate alleviation aft a fig of play losses. All the large banal indexes rebounded aft falling for astir 8 weeks successful a row, portion the crypto system took immoderate losses connected Thursday, losing astir 4% against the U.S. dollar during the past 24 hours. Meanwhile golden has been hanging beneath the $1,850 per ounce people arsenic Kitco’s Neils Christensen says golden markets stay “under pressure, seeing nary large buying momentum.”

Analyst Says ‘Doom and Gloom’ Predictions ‘May Have Been Overdone’ Amid Stock Market Rebound

The Dow Jones Industrial Average, S&P 500, the Nasdaq, and NYSE composite all rallied during Thursday’s trading sessions. The S&P 500 roseate astir 2% reaching 4,057.84 by the closing bell, portion Nasdaq spiked 2.7%, hitting 11,740.65.

Markets check: It's a amended time arsenic stocks continued to rebound from the lowest levels successful implicit a year.

Nasdaq 100 is presently up 2.99% https://t.co/SvxNwDuX3N pic.twitter.com/gbsgAlPP8B

— Bloomberg Markets (@markets) May 26, 2022

The Dow Jones jumped astir 1.6% connected Thursday afternoon, arsenic the scale recorded gains for the 5th consecutive time successful a row. Quincy Krosby, LPL Financial’s main equity strategist, believes the rebound whitethorn beryllium a motion that immoderate of past week’s doom and gloom predictions were overhyped.

“Although this was an expected, and highly talked astir imaginable ‘oversold’ rally, the underpinning for today’s marketplace ascent higher, suggests that past week’s doom and gloom astir the all-important U.S. user whitethorn person been overdone, on with the dire recession headlines,” Krosby told CNBC’s Tanaya Macheel and Jesse Pound connected Thursday.

Many Believe Cryptos Have Decoupled, Alex Krüger Says ‘Worst Case Scenario for Crypto Is Here’

Meanwhile, amid the equities rebound, the cryptocurrency economy faltered again connected Thursday, losing 4% during the past 24 hours of trading. Bitcoin (BTC) mislaid a tiny percent connected Thursday dropping astir 0.7%.

Ethereum (ETH), however, mislaid astir 6.9%, alongside a fig of alternate crypto assets that saw deeper losses than bitcoin. While banal markets person improved and crypto assets person not, a fig of traders person been discussing crypto decoupling from stocks successful presumption of correlation.

Crypto Twitter: crypto did not decouple!

Nasdaq: +4% this week

ETH: -3% this week (-13% unfastened to trough)

— Alex Krüger (@krugermacro) May 26, 2022

The economist and trader Alex Krüger spoke astir crypto decoupling from stocks connected Thursday.

“Worst lawsuit script for crypto is here,” Krüger said. “Apathy and decoupling. The correlation with equities is present broken. It’s been mostly gone since Monday afternoon. Now equities bounce alone.” After his statement, Krüger doubled down connected his commentary. “Watch radical who don’t commercialized and hardly ticker charts oregon correlations disagree with this tweet. It’s ok. Everybody copes differently,” Krüger added.

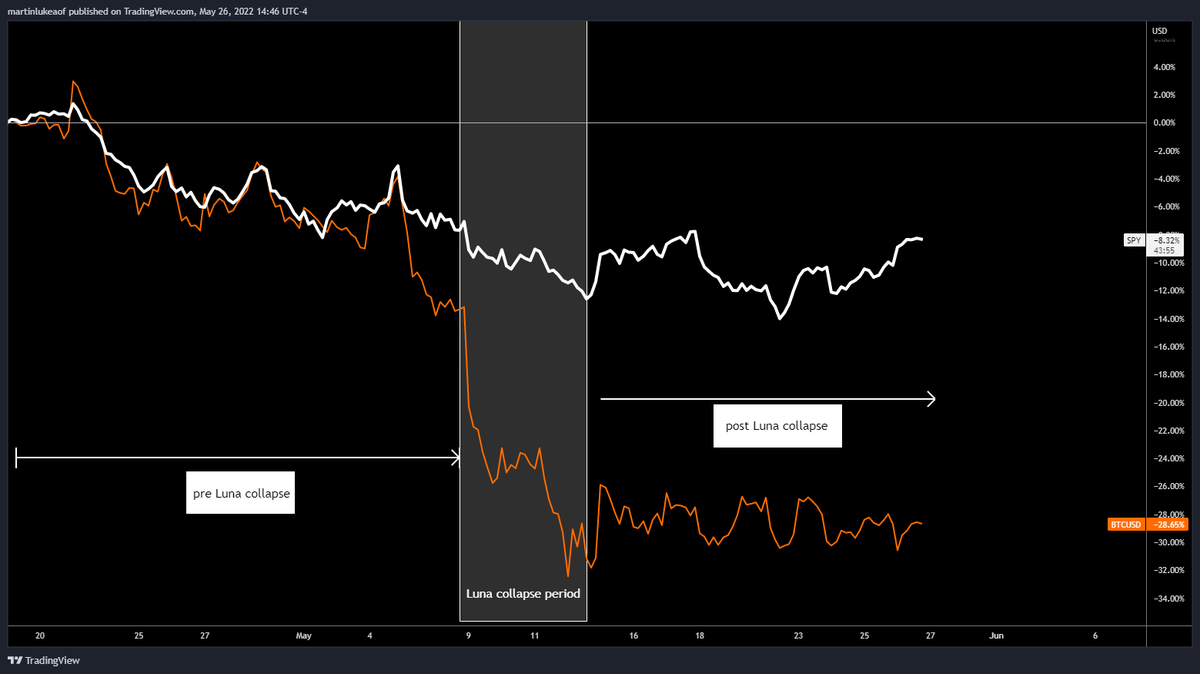

Chart shared by the Stacks podcast big Luke Martin, who discussed crypto decoupling connected Thursday.

Chart shared by the Stacks podcast big Luke Martin, who discussed crypto decoupling connected Thursday.The bitcoin proponent Luke Martin, big of the Stacks podcast, besides talked astir integer currencies not bouncing backmost with equities markets.

“Seeing tons of tweets astir stocks [and] crypto decoupling, and crypto not bouncing with stocks,” Martin tweeted. “Charting gives a amended representation of what’s happening: 1/ We had precocious correlation 2/ Luna illness leads to much terrible crypto selloff 3/ Post illness crypto not making up the difference.”

As Gold Markets Slump, Peter Schiff Discusses the US GDP Contraction and Bitcoin’s Decoupling

Gold has besides not accrued successful worth and remains nether the $1,850 per ounce terms scope against the U.S. dollar. 30-day statistic amusement an ounce of good golden is down 1.67% and 0.27% was mislaid during the past 24 hours. On Thursday, Kitco’s Neils Christensen discussed gold’s slump successful a study that highlights the caller U.S. Commerce Department study that notes the first-quarter gross home merchandise (GDP) declined astatine a 1.5% yearly rate. “The golden marketplace is not seeing overmuch absorption to the disappointing economical data,” Christensen explained connected Thursday.

Gold bug and economist Peter Schiff talked astir the GDP shrinking 1.5% and besides mentioned that bitcoin (BTC) has decoupled from Nasdaq. “The U.S. economy, supposedly the strongest it’s ever been, contracted by 1.5% successful Q1, .2% much than analysts expected,” Schiff said connected Thursday. “If [the] GDP contracts again successful Q2, past the system is officially successful a recession. If GDP contracts erstwhile the system is truthful [strong], ideate what happens erstwhile it’s weak,” the economist added.

Schiff continued connected Thursday and made definite to propulsion brackish connected bitcoin’s caller marketplace wounds. Schiff remarked:

Is bitcoin yet breaking escaped of its precocious correlation with the Nasdaq? While tech stocks are rising contiguous Bitcoin is falling, astir breaking beneath $28K. My conjecture is that Bitcoin volition proceed to support its affirmative correlation with the Nasdaq, but lone erstwhile it’s falling.

Tags successful this story

Alex Kruger, analyst, Bitcoin (BTC), Crypto, crypto economy, DOW, economists, equity strategist, Ethereum (ETH), gold, Gold Bug, Gold Markets, Jesse Pound, Kitco, LPL Financial, Luke Martin, Luna collapse, nasdaq, Neils Christensen, NYSE, Peter Schiff, Quincy Krosby, S&P 500, stock indexes, Stock Market, Tanaya Macheel, U.S. equities markets

What bash you deliberation astir the existent authorities of markets and the economy? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)