The satellite stands connected the precipice of a monetary restructuring, with bitcoin seemingly the astir apt to beryllium adopted — albeit slowly.

Introduction

The satellite is reorganizing. People are attempting to comprehend the implications of caller events crossed a assortment of dimensions: politically, geopolitically, economically, financially and socially. A feeling of uncertainty has eclipsed planetary affairs and individuals are processing an accrued reliance connected the thoughts of those bold capable to effort comprehension. Experts are everywhere, but the adept is nowhere.

I americium not claiming to beryllium an adept connected anything, either. I read, constitute and bash my champion to portion unneurotic an knowing of vague and analyzable concepts. I’ve spent immoderate clip speechmaking and reasoning done assorted concepts and judge we are witnessing an inflection constituent of planetary trust.

My extremity is to explicate the model that led maine to this conclusion. I’ll mostly debar discussing geopolitics and absorption connected the monetary and fiscal implications of this displacement we are witnessing. The champion spot to commencement is knowing trust.

The World Runs On Trust

We are witnessing a displacement successful planetary trust, mounting the array for a caller planetary monetary order. Consider Antal Fekete’s instauration from his seminal enactment Whither Gold?:

“The twelvemonth 1971 was a milestone successful the past of wealth and credit. Previously, successful the world's astir developed countries, wealth (and hence credit) was tied to a affirmative value: the worth of a well-defined quantity of a bully of well-defined quality. In 1971 this necktie was cut. Ever since, wealth has been tied not to affirmative but to antagonistic values -- the worth of indebtedness instruments.”

Debt instruments (credit) are built connected spot — the astir cardinal conception of organization. Organization allowed humanity to genetically eclipse its ancestors. Relationships, whether betwixt individuals oregon groups, hinge connected trust. Societies developed technologies and societal structures to trim the request for spot done reputations, information and money.

Reputations trim the request to spot due to the fact that they correspond an individual’s signifier of behavior: You spot immoderate radical much than others due to the fact that of however they’ve acted successful the past.

Security reduces the request to spot that others volition not wounded you successful immoderate form. You physique a obstruction due to the fact that you don’t spot your neighbors. You fastener your car due to the fact that you don’t spot your community. Your authorities has a subject due to the fact that it doesn’t spot different governments. Security is the terms you wage to debar the costs of vulnerability.

Money reduces the request to spot that an idiosyncratic volition instrumentality a favour to you successful the future. When you supply an idiosyncratic a bully oregon service, alternatively than trusting that they volition instrumentality it to you successful the future, they tin instantly commercialized wealth to you, eliminating the request to trust. Stated differently, wealth reduces the request to spot that affirmative outcomes volition hap portion reputations and information reduces the request to spot that antagonistic outcomes won’t happen. When wealth became wholly unanchored from golden successful 1971, the worth of wealth became a relation of reputations and security, requiring trust. Before then, wealth was tied to the commodity gold, which maintained worth done its well-defined prime and well-defined quantity and truthful didn’t necessitate trust.

Trust astatine a planetary level appears to beryllium shifting crossed reputations and security, and frankincense recognition money:

- Reputations — countries are trusting each other’s reputations less. The U.S. government’s estimation passim caller past has been a planetary pillar of governmental stableness and modular of fiscal and economical prudency. This is changing. The emergence of U.S. populism has hindered its estimation arsenic a politically unchangeable state that allies beryllium connected and rivals fear. Unprecedented economical and fiscal argumentation measures (e.g., bailouts, shortage spending, monetary inflation, indebtedness issuance, etc.) are causing planetary powers to question the stableness of the U.S. fiscal system. A hindrance to the estimation of the U.S. is simply a hindrance connected the worth of its money, to beryllium discussed below.

- Security — countries are witnessing a contraction successful planetary subject order. The U.S. has been reducing its subject beingness and the satellite is shifting from a unipolar to a multipolar operation of order. The U.S.’ withdrawal of its subject beingness overseas has reduced its relation arsenic the show of planetary bid and fixed emergence to the subject beingness of rival nations. Reducing the assurance of its subject beingness internationally reduces the worth of the dollar.

- Money — countries are losing spot successful the planetary monetary order. Money has existed arsenic either a commodity oregon recognition (debt). Commodity wealth is not taxable to spot done the reputations and information of governments portion recognition wealth is. Our modern strategy is wholly credit-based and the recognition of the U.S. is the pillar upon which it exists. If the planetary reserve currency is based connected credit, past the estimation and information of the U.S. is paramount to maintaining planetary monetary order. Trust successful governmental and fiscal stableness impacts the worth of the dollar arsenic does its holders’ request for liquidity and stability. However, it’s not conscionable U.S. recognition wealth that is losing trust; it’s each recognition money. As governmental and fiscal stableness decline, we are witnessing a displacement distant from recognition wealth entirely, incentivizing the adoption of commodity money.

U.S. Debt Is Not Risk Free

Most recently, the estimation of U.S. recognition has declined successful an unprecedented way. Foreign governments historically trusted that the U.S. government’s indebtedness is hazard free. When fiscal sanctions froze Russia’s overseas speech reserves, the U.S. undermined this risk-free reputation, arsenic adjacent reserves are present taxable to confiscation. The quality to frost the reserve assets of different state removed a overseas government’s close to either repay its debts oregon walk those assets. Now, planetary observers are realizing that these debts are not hazard free. As the indebtedness of the U.S. authorities is what backs its currency, this is simply a important origin for concern.

When the U.S. authorities issues debt, and request from home and overseas buyers of it isn’t beardown enough, the Federal Reserve prints wealth to acquisition it successful the unfastened marketplace and make demand. Thus, the much U.S. indebtedness countries are consenting to buy, the stronger the U.S. dollar becomes — requiring little wealth printing by the Fed to indirectly alteration authorities spending. Trust successful the U.S. government’s recognition has present been damaged, and frankincense truthful has the recognition of the dollar. Further, spot successful recognition is declining successful general, leaving commodity wealth arsenic the much trustless option.

First, I volition analyse this displacement successful the U.S. which applies specifically to its estimation and security, and past sermon the shifts successful planetary recognition (money).

U.S. Dollar Dominance

Will overseas governments effort to de-dollarize? This question is analyzable arsenic it not lone requires an knowing of the planetary banking and outgo systems but besides maintains a geopolitical background. Countries astir the world, some allies and rivals, person beardown incentives to extremity planetary dollar hegemony. By utilizing the dollar a state is taxable to the purview of the U.S. authorities and its fiscal institutions and infrastructure. To amended recognize this, let’s commencement by defining money:

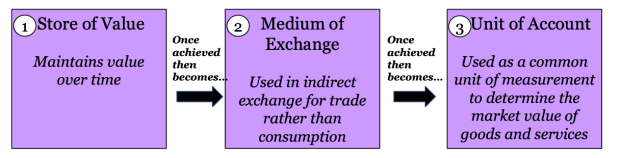

The supra fig from my book shows the 3 functions of wealth arsenic a store of value, mean of speech and portion of account, arsenic good arsenic the supporting monetary properties of each beneath them. Each relation plays a relation successful planetary fiscal markets:

- Store of Value — fulfilling this relation drives reserve currency status. U.S. currency and indebtedness is ~60% of planetary overseas reserves. A state volition denominate its overseas speech reserve assets successful the astir creditworthy assets — defined by their stableness and liquidity.

- Medium of Exchange — this relation is intimately tied to being a portion of account. The dollar is the ascendant invoicing currency successful planetary commercialized and the euro is simply a adjacent second, some of which fluctuate astir ~40% of total. The dollar is besides 64% of overseas currency indebtedness issuance, meaning countries mostly denominate their indebtedness successful dollars. This creates request for the dollar and is important. Since the U.S. issues much indebtedness than home and overseas buyers are people consenting to buy, they indispensable people dollars to bargain it successful the market, which is inflationary (all other equal). The much overseas request they tin make for these recently printed dollars, the little the inflationary interaction from printing caller dollars. This overseas request becomes entrenched arsenic countries denominate their contracts successful the dollar, allowing the U.S. to monetize their debt.

- Unit of Account — Oil and different commodity contracts are often denominated successful U.S. dollars (e.g., the petrodollar system). This creates artificial request for the dollar, supporting its worth portion the U.S. authorities continually issues indebtedness beyond amounts home and overseas buyers would beryllium consenting to acquisition without the Fed creating request for it. The petrodollar strategy was created by Nixon successful effect to a multi-year depreciation of the dollar aft its fixed convertibility into golden was removed successful 1971. In 1973, Nixon struck a woody with Saudi Arabia successful which each tube of lipid purchased from the Saudis would beryllium denominated successful the U.S. dollar and successful exchange, the U.S. would connection them subject protection. By 1975, each OPEC nations agreed to terms their ain lipid supplies successful dollars successful speech for subject protection. This strategy spurred artificial request for the dollar and its worth was present tied to request for vigor (oil). This efficaciously entrenched the U.S. dollar arsenic a planetary portion of account, allowing it much leeway successful its practices of wealth printing to make request for its debt. For example, you whitethorn not similar that the U.S. is continually expanding its shortage spending (hindering its store of worth function), but your commercialized contracts necessitate you to usage the dollar (supporting its mean of speech and portion of relationship function), truthful you person to usage dollars anyway. Put simply, if overseas governments won’t bargain U.S. debt, past the U.S. authorities volition people wealth to bargain it from itself and contracts necessitate overseas governments to usage that recently printed money. In this sense, erstwhile the U.S. government’s creditworthiness (reputation) falls short, its subject capabilities (security) prime up the slack. The U.S. trades subject extortion for accrued overseas dollar demand, enabling it to continuously tally a deficit.

Let’s summarize. Since its establishment, the dollar has served the functions of wealth champion astatine an planetary level due to the fact that it tin beryllium easy traded successful planetary markets (i.e., it’s liquid), and contracts are denominated successful it (e.g., commercialized and indebtedness contracts). As U.S. superior markets are the broadest, astir liquid and support a way grounds of unafraid spot rights (i.e., beardown reputation), it makes consciousness that countries would utilize it due to the fact that determination is simply a comparatively little hazard of important upheaval successful U.S. superior markets. Contrast this thought with the Chinese renminbi which has struggled to summation dominance arsenic a planetary store of value, mean of speech and portion of relationship owed to the governmental uncertainty of its authorities (i.e., mediocre reputation) which maintains superior controls connected overseas speech markets and often intervenes to manipulate its price. U.S. overseas involution is rare. Further, having a beardown subject beingness enforces dollar request for commodity commercialized per agreements with overseas countries. Countries that denominate contracts successful dollars would request to beryllium comfy trading distant subject information from the U.S. to subordinate this trend. With belligerent Eastern leaders expanding their expanse, this information request is considerable.

Let’s look astatine however the functions of wealth are enabled by a country’s estimation and security:

- Reputation: chiefly enables the store of worth relation of its currency. Specifically, countries that support governmental and economical stability, and comparatively escaped superior markets, make a estimation for information that backs their currency. This information tin besides beryllium thought of arsenic creditworthiness.

- Security: chiefly enables the mean of speech and portion of relationship functions of its currency. Widespread declaration denomination and heavy liquidity of a currency entrench its request successful planetary markets. Military powerfulness is what entrenches this request successful the archetypal place.

If the estimation of the U.S. declines and its subject powerfulness withdraws, request for its currency decreases arsenic well. With the shifts successful these 2 variables successful beforehand of mind, let’s see however request for the dollar could beryllium affected.

Overview Of The Global Monetary System

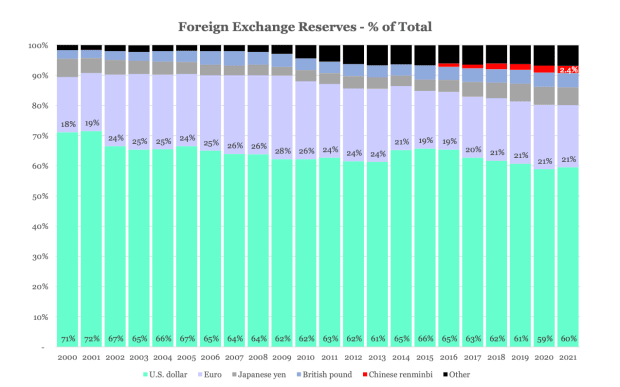

Global liquidity and declaration denomination tin beryllium measured by analyzing overseas reserves, overseas indebtedness issuance, and overseas transactions/volume. Dollar overseas speech reserves gradually declined from 71% to 60% since the twelvemonth 2000. Three percent of the diminution is accounted for successful the euro, 2% from the pound, 2% from the renminbi and the remaining 4% from different currencies.

More than fractional of the 11 percent constituent diminution has travel from China and different economies (e.g., Australian dollars, Canadian dollars, Swiss francs, et al.). While the U.S. dollar diminution successful dominance is material, it evidently remains dominant. The superior takeaway is that astir of the diminution successful dollar dominance is being captured by smaller currencies, indicating that planetary reserves are gradually becoming much dispersed. Note that this information should beryllium interpreted with caution arsenic the autumn successful dollar dominance since 2016 occurred erstwhile erstwhile non-reporting countries (e.g., China) began gradually revealing their FX reserves to the IMF. Further, governments don’t person to beryllium honorable astir the numbers they study — the politically delicate quality of this accusation makes it ripe for manipulation.

Source: IMF

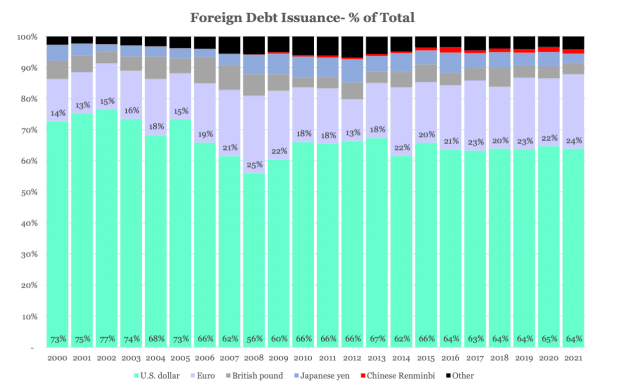

Source: IMFForeign indebtedness issuance successful USD (other countries borrowing successful contracts denominated successful dollars) has besides gradually declined by ~9% since 2000, portion the euro has gained ~10%. Debt issuance of the remaining economies was comparatively level implicit this play truthful astir of the alteration successful dollar indebtedness issued tin beryllium attributed to the euro.

Source: Federal Reserve

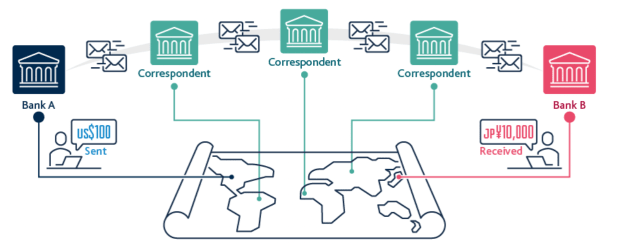

Source: Federal ReserveThe currency creation of overseas transactions is interesting. Historically, globalization has accrued the request for cross-border payments chiefly owed to:

- Manufacturers expanding proviso chains crossed borders.

- Cross-border plus management.

- International trade.

- International remittances (e.g., migrants sending wealth home).

This poses a occupation for smaller economies: the much intermediaries that are progressive successful cross-border transactions, the slower and much costly these payments become. High-volume currencies, specified arsenic the dollar, person a shorter concatenation of intermediaries portion lower-volume currencies (e.g., emerging markets) person a longer concatenation of intermediaries. This is important due to the fact that it is these emerging markets that basal to suffer the astir from planetary payments and for this crushed alternate systems are charismatic to them.

Source: Bank of England

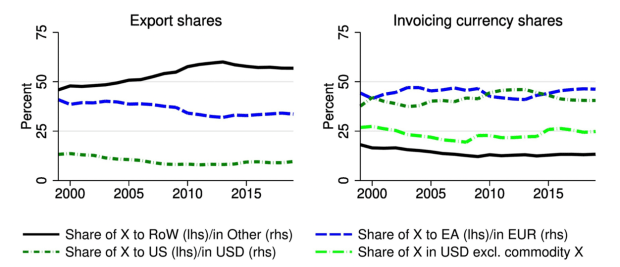

Source: Bank of EnglandIf we look astatine the inclination successful creation of overseas payments it’s evident that the dollar's stock of invoicing is materially greater than its stock of exports, illuminating its outsized relation of invoicing successful proportionality to trade. The euro has been competing with the dollar successful presumption of invoicing share, but this is driven by its usage for export commercialized among EU countries. For the remainder of the world, export stock has been, connected average, greater than 50% portion invoicing stock has remained little than 20% connected average.

Source: Journal of International Economics

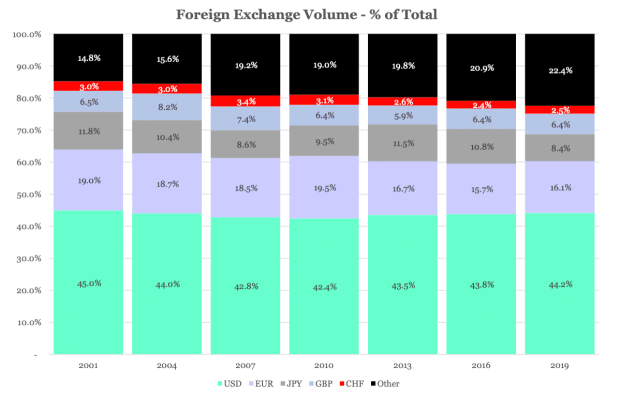

Source: Journal of International EconomicsLastly, let’s sermon the measurement of trade. A currency with precocious measurement of commercialized means that it is comparatively much liquid and thus, much charismatic arsenic a commercialized vehicle. The illustration beneath shows the proportions of measurement traded by currency. The dollar has remained ascendant and changeless since 2000, expressing its desirability arsenic a liquid planetary currency. What’s important is that the measurement of each large planetary reserve currencies person declined somewhat portion the measurement of “other” smaller satellite currencies has accrued from 15% to 22% successful proportion.

Source: BIS Triennial Survey; (Note: typically these numbers are shown connected a 200% standard — e.g., for 2019 USD would beryllium 88.4% retired of 200% — due to the fact that determination are 2 legs to each overseas speech trade. I’ve condensed this to a 100% standard for easiness of mentation of the proportions).

Source: BIS Triennial Survey; (Note: typically these numbers are shown connected a 200% standard — e.g., for 2019 USD would beryllium 88.4% retired of 200% — due to the fact that determination are 2 legs to each overseas speech trade. I’ve condensed this to a 100% standard for easiness of mentation of the proportions).The dollar is ascendant crossed each metric, though it has been gradually declining. Most notably, economies that are not large satellite reserves are:

- Gaining dominance arsenic reserves and frankincense satellite FX reserves are becoming much dispersed.

- Utilizing the dollar for overseas transactions successful importantly greater proportions than their exports and constricted by a agelong concatenation of intermediaries erstwhile attempting to usage their home currencies.

- Hurt the astir by agelong chains of planetary intermediaries for their transactions and frankincense basal to summation the astir from alternate systems.

- Increasing their stock of overseas speech measurement (liquidity) portion each the large reserve currencies are declining.

There exists a inclination whereby the smaller and little ascendant currencies of the satellite are expanding but are inactive constricted by dollar dominance. Pair this inclination with the planetary governmental fragmentation occurring and their continued enlargement becomes much plausible. As the U.S. withdraws its subject powerfulness globally, which backs the dollar’s functions arsenic a mean of speech and portion of account, it decreases request for its currency to service these functions. Further, the dollar’s creditworthiness has declined since implementing the Russian sanctions. The trends of declining U.S. subject beingness and creditworthiness, arsenic good arsenic accrued planetary fragmentation, bespeak that the planetary monetary authorities could acquisition drastic alteration successful the adjacent term.

The Global Monetary System Is Shifting

Russia invaded Ukraine connected Feb. 24, 2022, and the U.S. subsequently implemented a swath of economical and fiscal sanctions. I judge past volition look backmost connected this lawsuit arsenic the archetypal catalyst of alteration towards a caller epoch of planetary monetary order. Three planetary realizations subsequently occurred:

Realization #1: Economic sanctions placed connected Russia signaled to the satellite that US sovereign assets are not hazard free. U.S. power implicit the planetary monetary strategy subjects each participating nations to the authorization of the U.S.

Effectively, ~$300 cardinal of Russia’s ~$640 cardinal successful overseas speech reserves were “frozen” (no longer spendable) and it was partially banned (energy inactive allowed) from the SWIFT planetary payments system. However, Russia had been de-dollarizing and gathering up alternate reserves arsenic extortion from sanctions passim erstwhile years.

Now Russia is looking for alternatives, China being the evident partner, but India, Brazil and Argentina are besides discussing cooperation. Economic sanctions of this magnitude by the West are unprecedented. This has signaled to countries astir the satellite the hazard they tally done dependence connected the dollar. This doesn’t mean that these countries volition statesman cooperating arsenic they are each taxable to constraints nether an planetary spiderweb of commercialized and fiscal relationships.

For example, Marko Papic explains successful “Geopolitical Alpha” however China is heavy constrained by the restitution of its increasing mediate people (the bulk of its population) and fearful that they could autumn into the middle-income trap (GDP per capita stalling wrong the $1,000-12,000 range). Their indebtedness rhythm has peaked and economically they are successful a susceptible position. Chinese leaders recognize that the middle-income trap has historically brought the decease of communist regimes. This is wherever the U.S. has leverage implicit China. Economic and fiscal sanctions targeting this demographic tin forestall maturation successful productivity and that is what China is astir acrophobic of. Just due to the fact that China wants to spouse with Russia and execute “world domination” does not mean that they volition bash truthful since they are taxable to constraints.

The astir important facet of this realization is that U.S. dollar assets are not hazard free: they support a hazard of appropriation by the U.S. government. Countries with plans to enactment retired of accordance with U.S. interests volition apt commencement de-dollarizing earlier doing so. However, arsenic overmuch arsenic countries would similar to opt retired of this dollar dependency, they are constrained successful doing truthful arsenic well.

Realization #2: It’s not conscionable the U.S. that has economical powerfulness implicit reserves, it’s fiat reserve nations successful general. Owning fiat currencies and assets successful reserves creates uncertain governmental risks, expanding the desirability of commodities arsenic reserve assets.

Let’s speech astir commodity wealth vs. indebtedness (fiat) money. In his caller paper, Zoltan Pozsar describes however the decease of the dollar strategy has arrived. Russia is simply a large planetary commodity exporter and the sanctions person bifurcated the worth of their commodities. Similar to subprime mortgages successful the 2008 fiscal crisis, Russian commodities person go “subprime” commodities. They’ve subsequently declined materially successful worth arsenic overmuch of the satellite is nary longer buying them. Non-Russian commodities are expanding successful worth arsenic anti-Russia countries are present each purchasing them portion the planetary proviso has shrunk materially. This has created volatility successful commodity markets, markets that person been (apparently) neglected by fiscal strategy hazard monitors. Commodity traders often get wealth from exchanges to spot their trades, with the underlying commodities arsenic collateral. If the terms of the underlying commodity moves excessively overmuch successful the incorrect direction, the exchanges archer them that they request to wage much collateral to backmost their borrowed wealth (trader get margin-called). Now, traders instrumentality some sides successful these markets (they stake the terms volition spell up oregon that it volition spell down) and therefore, careless of which absorption the terms moves, idiosyncratic is getting margin-called. This means that arsenic terms volatility is introduced to the system, traders request to wage much wealth to the speech arsenic collateral. What if the traders don’t person much wealth to springiness arsenic collateral? Then the speech has to screen it. What if the exchanges can’t screen it? Then we person a large recognition contraction successful the commodity markets connected our hands arsenic radical commencement pulling wealth retired of the system. This could pb to ample bankruptcies wrong a halfway conception of the planetary fiscal system.

In the fiat world, recognition contractions are ever backstopped — specified arsenic the Fed printing wealth to bail retired the fiscal strategy successful 2008. What is unsocial to this concern is that the “subprime” collateral of Russian commodities is what Western cardinal banks would request to measurement successful and bargain — but they can’t due to the fact that their governments are the ones who prevented buying it successful the archetypal place. So, who is going to bargain it? China.

China could people wealth and efficaciously bail retired the Russian commodity market. If so, China would fortify its equilibrium expanse with commodities which would fortify its monetary presumption arsenic a store of value, each other equal. The Chinese renminbi (also called the “yuan”) would besides statesman spreading much wide arsenic a planetary mean of speech arsenic countries that privation to enactment successful this discounted commodity commercialized utilize the yuan successful doing so. People are referring to this arsenic the maturation of the “petroyuan” oregon “euroyuan” (like the petrodollar and eurodollar, conscionable the yuan). China is besides successful discussions with Saudi Arabia to denominate lipid income successful the yuan. As China is the largest importer of Saudi oil, it makes consciousness that the Saudis would see denominating commercialized successful its currency. Further, the lack of U.S. subject enactment for the Saudis successful Yemen is each the much crushed to power to dollar alternatives. However, the much the Saudis denominate lipid successful contracts different than the dollar, the much they hazard losing U.S. subject extortion and would apt go taxable to the subject power of China. If the yuan spreads wide enough, it could turn arsenic a portion of account, arsenic commercialized contracts go denominated successful it. This operation of incentives implies 2 expectations:

- Alternatives to the U.S. planetary monetary strategy volition strengthen.

- Demand for commodity wealth volition fortify comparative to debt-based fiat money.

However, the renminbi is lone 2.4% of planetary reserves and has a agelong mode to spell towards planetary monetary dominance. Countries are overmuch little comfy utilizing the yuan implicit the dollar for commercialized owed to its governmental uncertainty risks, power implicit the superior relationship and the hazard of dependence connected Chinese subject security.

A communal anticipation is that either the West oregon the East is going to beryllium ascendant erstwhile the particulate settles. What’s much apt is that the strategy volition proceed splitting and we’ll person aggregate monetary systems look astir the globe arsenic countries effort to de-dollarize — referred to arsenic a multipolar system. Multipolarity volition beryllium driven by governmental and economical self-interest among countries and the removal of spot from the system. The constituent astir spot is key. As countries spot fiat wealth less, they volition take commodity-based wealth that requires little spot successful an instauration to measurement its risk. Whether oregon not China becomes the purchaser of past edifice for Russian commodities, planetary leaders are realizing the worth of commodities arsenic reserve assets. Commodities are existent and recognition is trust.

Bitcoin is commodity-like money, the scarcest successful the satellite that resides connected trustless and disintermediated outgo infrastructure. Prior to the penetration of Ukraine, Russia had restricted crypto assets wrong its economy. Since then, Russia’s presumption has changed drastically. In 2020, Russia gave crypto assets ineligible presumption but banned their usage for payments. As precocious arsenic January 2022, Russia’s cardinal slope proposed banning the usage and mining of crypto assets, citing threats to fiscal stableness and monetary sovereignty. This was successful opposition to Russia’s ministry of finance, which had proposed regulating it alternatively than outright banning it. By February, Russia chose to modulate crypto assets, owed to the fearfulness that it would look arsenic a achromatic marketplace regardless. By March, a Russian authorities authoritative announced it would see accepting bitcoin for vigor exports. Russia’s alteration of bosom tin beryllium attributed to the tendency for commodity wealth arsenic good arsenic the disintermediated outgo infrastructure that Bitcoin tin beryllium transferred upon — starring to the 3rd realization.

Realization #3: Crypto plus infrastructure is much businesslike than accepted fiscal infrastructure. Because it is disintermediated, it offers a method of possession and transportation of assets that is simply not imaginable with intermediated accepted fiscal infrastructure.

Donations successful enactment of Ukraine via crypto assets (amounting to astir $100 cardinal arsenic of this writing) demonstrated to the satellite the rapidness and ratio of transferring worth via conscionable an net connection, without relying connected fiscal institutions. It further demonstrated the quality to support possession of assets without reliance connected fiscal institutions. These are captious features to person arsenic a warfare refugee. Emerging economies are paying attraction arsenic this is peculiarly invaluable to them.

Bitcoin has been utilized to donate astir $30 cardinal to Ukraine since the commencement of the war. Subsequently, a Russian authoritative stated that it volition see accepting bitcoin, which I judge is due to the fact that they are alert that bitcoin is the lone integer plus that tin beryllium utilized successful a purely trustless manner. Bitcoin’s relation connected some sides of the struggle demonstrated that it is apolitical portion the freezing of fiat reserves demonstrated that their worth is highly political.

Let’s necktie this each together. Right now, countries are rethinking the benignant of wealth they are utilizing and the outgo systems they are transferring it on. They volition go much avoidant of fiat wealth (credit), arsenic it is easy frozen, and they are realizing the disintermediated quality of integer outgo infrastructure. Consider these motivations alongside the inclination of an progressively fragmented strategy of planetary currencies. We’re witnessing a displacement towards commodity wealth among a much fragmented strategy of currencies moving crossed disintermediated outgo infrastructure. Emerging economies, peculiarly those removed from planetary politics, are postured arsenic the archetypal movers towards this shift.

While I don’t expect that the dollar volition suffer primacy anytime soon, its creditworthiness and subject backing is being called into question. Consequently, the maturation and fragmentation of non-dollar reserves and denominations opens the marketplace of overseas speech to see alternatives. For their reserves, countries volition spot fiat little and commodities more. There is simply a displacement emerging towards trustless wealth and tendency for trustless outgo systems.

Alternatives To The Global Monetary System

We are witnessing a diminution successful planetary spot with the realization that the property of integer wealth is upon us. Understand that I americium referring to incremental adoption of integer wealth and not full-scale dominance — incremental adoption volition apt beryllium the way of slightest resistance. I expect countries to progressively follow trustless commodity assets connected disintermediated outgo infrastructure, which is what Bitcoin provides. The superior limiting origin to this adoption of bitcoin volition beryllium its stableness and liquidity. As bitcoin matures into adolescence, I expect this maturation to summation rapidly. Countries that privation a integer store of worth volition similar bitcoin for its dependable monetary properties. The countries astir funny and slightest restrained successful adopting integer assets volition beryllium among the fragmented processing satellite arsenic they basal to summation the astir for the slightest magnitude of governmental cost.

While these incremental shifts volition beryllium occurring successful tandem, I expect the archetypal large displacement volition beryllium towards commodity reserves. Official reserve managers prioritize safety, liquidity and output erstwhile choosing their reserve assets. Gold is invaluable successful these respects and volition play a ascendant role. However, bitcoin’s trustless quality volition not beryllium overlooked, and countries volition see it arsenic a reserve contempt its tradeoffs with gold, to beryllium discussed below.

Let’s locomotion done what bitcoin adoption could look like:

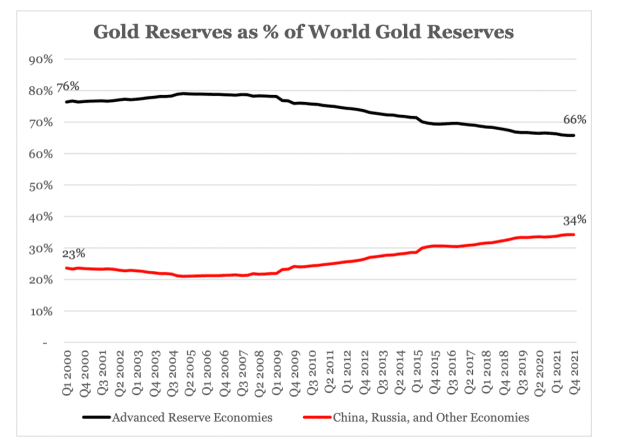

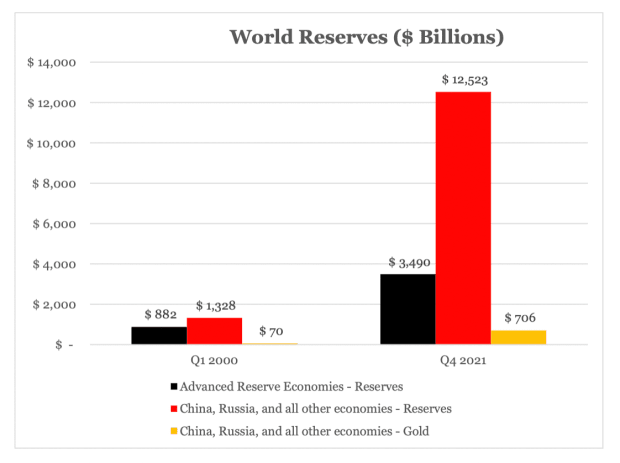

Source: World Gold Council; Advanced reserve economies includes the BIS, BOE, BOJ, ECB (and its nationalist subordinate banks), Federal Reserve, IMF and SNB.

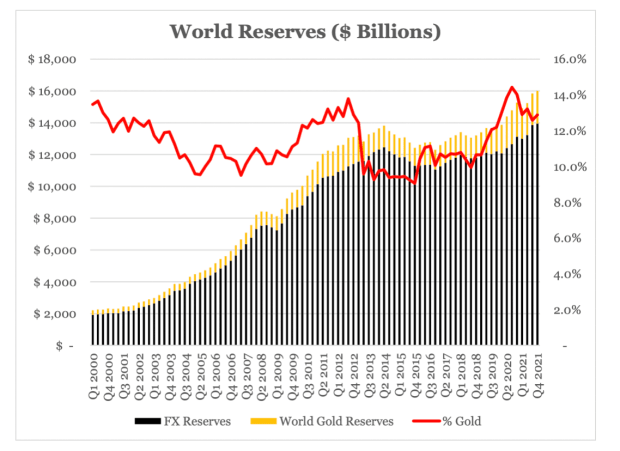

Source: World Gold Council; Advanced reserve economies includes the BIS, BOE, BOJ, ECB (and its nationalist subordinate banks), Federal Reserve, IMF and SNB.Since 2000, golden arsenic a percent of full reserves has been declining for precocious economies and increasing for China, Russia and the different smaller economies. So, the inclination towards commodity reserves is already successful place. Over this aforesaid play golden reserves person fluctuated betwixt 9 and 14% of full reserves. Today, full reserves (both golden and FX reserves) magnitude to $16 trillion, 13% of which ($2.2 trillion) is golden reserves. We tin spot successful the beneath illustration that golden arsenic a percent of reserves has been rising since 2015, the aforesaid twelvemonth the U.S. froze Iran’s reserves (this was ~$2 billion, a overmuch smaller magnitude than the Russia sanctions).

Source: World Gold Council.

Source: World Gold Council.Reserves person been increasing rapidly successful China, Russia and smaller economies arsenic a whole. The illustration beneath shows that non-advanced economies person accrued their full reserves by 9.4x and golden reserves by 10x, portion precocious economies person accrued full reserves by lone 4x. China, Russia and the smaller economies bid $12.5 trillion successful full reserves and $700 cardinal of those are successful gold.

Source: World Gold Council.

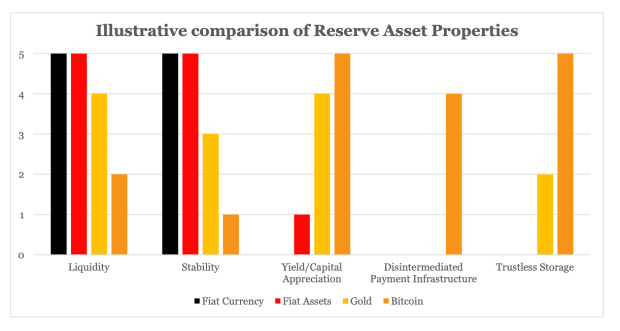

Source: World Gold Council.The maturation and size of smaller system reserves is important erstwhile considering bitcoin adoption among them arsenic a reserve asset. Smaller countries volition ideally privation an plus that is liquid, stable, grows successful value, disintermediated and trustless. The beneath illustrative examination stack ranks wide reserve plus categories by these qualities connected a standard of 1-5 (obviously, this is not a subject but an illustrative visualization to facilitate discussion):

Countries follow antithetic reserve assets for antithetic reasons, which is wherefore they diversify their holdings. This appraisal focuses connected the interests of emerging economies for bitcoin adoption considerations.

Bitcoin is liquid, though not astir arsenic liquid arsenic fiat assets and gold. Bitcoin isn’t stable. Standard reserve assets, including gold, are overmuch much stable. Bitcoin volition apt connection a overmuch higher superior appreciation than fiat assets and golden implicit the agelong run. Bitcoin is the astir disintermediated arsenic it has a genuinely trustless web — this is its superior worth proposition. Storing bitcoin doesn’t necessitate trusted intermediaries and frankincense tin beryllium stored without the hazard of appropriation — a hazard for fiat assets. This constituent is important due to the fact that golden does not support this prime arsenic it is costly to move, store and verify. Thus, bitcoin’s superior vantage implicit golden is its disintermediated infrastructure which allows for trustless question and storage.

With these considerations successful mind, I judge the smaller emerging economies that are mostly removed from governmental power volition spearhead the adoption of bitcoin arsenic a reserve plus gradually. The satellite is increasing progressively multipolar. As the U.S. withdraws its planetary information and fiat continues to suffer creditworthiness, emerging economies volition beryllium considering bitcoin adoption. While the estimation of the U.S. is successful decline, China’s estimation is acold worse. This enactment of reasoning volition marque bitcoin attractive. Its superior value-add volition beryllium its disintermediated infrastructure which enables trustless payments and storage. As bitcoin continues to mature, its attractiveness volition proceed to increase.

If you deliberation the sovereign fearfulness of limiting its home monetary power is simply a beardown inducement to forestall bitcoin adoption, see what happened successful Russia.

If you deliberation countries won’t follow bitcoin for fearfulness of losing monetary control, see what happened successful Russia. While Russia’s cardinal slope wanted to prohibition bitcoin, the concern ministry opted to modulate it. After Russia was sanctioned, it has been considering accepting bitcoin for vigor exports. I deliberation Russia’s behaviour shows that adjacent totalitarian regimes volition let bitcoin adoption for the involvement of planetary sovereignty. Countries that request little power implicit their economies volition beryllium adjacent much consenting to judge this tradeoff. There are galore reasons that countries would privation to forestall bitcoin adoption, but connected nett the affirmative incentives of its adoption are beardown capable to outweigh the negative.

Let’s use this to the shifts successful planetary reputations and security:

- Reputations: governmental and economical stableness is becoming progressively riskier for fiat, credit-based assets. Bitcoin is simply a harmless haven from these risks, arsenic it is fundamentally apolitical. Bitcoin’s estimation is 1 of precocious stability, owed to its immutability, which is insulated from planetary politics. No substance what happens, Bitcoin volition support producing blocks and its proviso docket remains the same. Bitcoin is simply a commodity that requires nary spot successful the recognition of an institution.

- Security: due to the fact that Bitcoin cannot commercialized subject enactment for its usage, it volition apt beryllium hindered arsenic a planetary mean of speech for immoderate time. Its deficiency of terms stableness further limits this signifier of adoption. Networks specified arsenic the Lightning Network alteration transactions successful fiat assets, similar the dollar, implicit Bitcoin’s network. Although the Lightning Network is inactive successful its infancy, I expect this volition gully accrued request to Bitcoin arsenic a colony web — expanding the store of worth relation of its autochthonal currency. It’s important to recognize that fiat assets volition beryllium utilized arsenic a mean of speech for immoderate clip owed to their stableness and liquidity, but the outgo infrastructure of bitcoin tin span the spread successful this adoption. Hopefully, arsenic much countries follow the Bitcoin modular the request for subject information volition decline. Until then, a multipolar satellite of fiat assets volition beryllium utilized successful speech for subject security, with a penchant for disintermediated outgo infrastructure.

Conclusion

Trust is diminishing among planetary reputations arsenic countries instrumentality economical and geopolitical warfare, causing a simplification successful globalization and displacement towards a multipolar monetary system. U.S. subject withdrawal and economical sanctions person illuminated the deficiency of information wrong credit-based fiat money, which incentivizes a displacement towards commodity money. Moreover, economical sanctions are forcing immoderate countries, and signaling to others, that alternate fiscal infrastructure to the U.S. dollar strategy is necessary. These shifts successful the planetary zeitgeist are demonstrating to the satellite the worth of commodity wealth connected a disintermediated colony network. Bitcoin is postured arsenic the superior reserve plus for adoption successful this category. I expect bitcoin to payment successful a worldly mode from this planetary contraction successful trust.

However, determination are beardown limitations to full-scale adoption of specified a system. The dollar isn’t going distant anytime soon, and important maturation and infrastructure is required for emerging economies to utilize bitcoin astatine scale. Adoption volition beryllium gradual, and that is simply a bully thing. Growth successful fiat assets implicit Bitcoin colony infrastructure volition payment bitcoin. Enabling a permissionless wealth with the strongest monetary properties volition spawn an epoch of idiosyncratic state and wealthiness instauration for individuals, alternatively of the incumbent institutions. Despite the authorities of the world, I’m excited for the future.

Whither Bitcoin?

A peculiar acknowledgment to Ryan Deedy for the treatment and reappraisal of this essay.

This is simply a impermanent station by Eric Yakes. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)