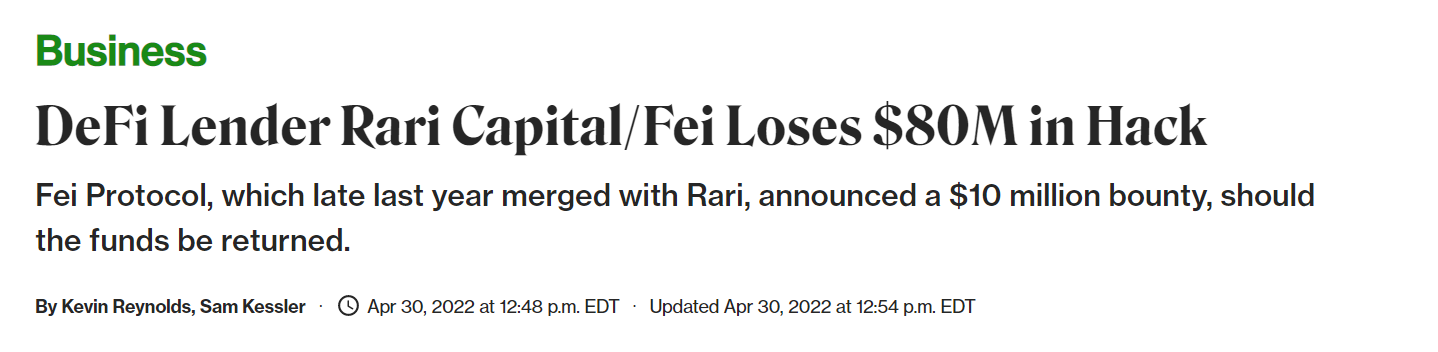

Something similar $200 cardinal successful assorted cryptos were stolen, exploited oregon conscionable plain burned implicit the past 8 days. Given that, is it immoderate wonderment that regulators similar Gary Gensler privation person oversight of the crypto sector?

You’re speechmaking State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Click here to motion up for aboriginal editions.

Crypto investors mislaid astir $300 cardinal to hacks and stratospheric state fees caused by a task minting a “digital onshore sale” implicit the past week. No friggin’ wonderment regulators are disquieted astir user protections.

The SEC seems to beryllium approaching crypto with an “enforcement-first” view. Securities and Exchange Commission (SEC) Chair Gary Gensler has said he’s acrophobic with capitalist protection, and it’s not hard to spot wherefore helium whitethorn consciousness justified successful giving the bureau greater oversight implicit the sector. The crypto manufacture whitethorn privation to look into champion practices and a ceremonial strategy targeted astatine protecting its users if radical privation to caput disconnected the regulatory agency.

Here’s a look astatine immoderate salient headlines implicit the past 7 days:

One of the communal refrains we’ve heard from SEC Chair Gary Gensler, arsenic good arsenic his predecessor Jay Clayton, is that the SEC is funny successful protecting consumers from risky situations. The manufacture has expressed its opposition to caller moves by the SEC to (possibly) found oversight of the integer currency sector, particularly decentralized finance (DeFi) platforms and projects.

Here’s the thing, though: It’s hard to reason Gensler doesn’t person a point. Crypto users mislaid millions implicit the past 7 days for assorted reasons, and they don’t presently person overmuch recourse beyond hoping the platforms tin either retrieve their mislaid funds oregon volition different marque them whole.

It’s worthy asking whether the SEC would beryllium arsenic guardant astir regulating crypto if these concerns were mitigated done different means. I’ve reported connected Gensler for the past twelvemonth and change, and respective individuals I’ve spoken to accidental he’s sincere erstwhile helium says he’s solely funny successful protecting consumers (as opposed to him conscionable conducting a “power grab” implicit the cryptocurrency manufacture for its ain sake).

In fairness, the $100 cardinal to $200 cardinal mislaid successful the past week whitethorn not look similar that overmuch erstwhile compared to crypto’s existent $1.8 trillion marketplace cap. But that’s inactive someone’s wealth that is present irrevocably gone.

Here’s the playbook: A task launches. Sometimes the codification is audited. Sometimes it isn’t. On juncture this task is exploited. A rogue programmer finds an accessible endpoint successful the wild oregon a savvy huckster someway acquires admin access keys oregon users are fooled into sending millions of dollars worthy of crypto to a shady address.

At immoderate rate, you present person users who are retired immoderate money. For those who person funds successful excess (*cough* they’re affluent capable that the nonaccomplishment of a fewer 1000 oregon adjacent cardinal dollars is nary large deal), this whitethorn beryllium astatine astir an inconvenience. For everyone else, though, this could beryllium catastrophic, and surely harmful.

There's nary consistency successful however companies respond close now, either. Some companies connection refunds oregon find ways of making users whole. If we excavation done the archives, exchanges similar Bitfinex created its ain tokens that it distributed to users. The tokens were redeemable for equity (or $1 apiece). Others raise funds to administer to users.

Other companies instrumentality wholly antithetic routes. Yuga Labs, the unit down the Bored Ape Yacht Club, for example, offered an apology for clogging up the Ethereum blockchain and contributing to precocious state prices, and suggested it would simply physique its ain furniture 1 blockchain to enactment aboriginal BAYC-related efforts ( immoderate judge the tweet and the web congestion that prompted it were deliberate).

That brings its ain risks, arsenic Sky Mavis precocious demonstrated with its Ronin hack, successful which the institution mislaid implicit $600 cardinal to North Korean hackers.

The question seems to maine to beryllium “is anyone really protecting users?”

Right now, the reply seems to beryllium “people connected Twitter,” a bully intuition and the uncommon existent audit. But again, there's nary consistency here.

Bringing this backmost to Gensler and the SEC, the industry’s taken contented with proposals that look similar they would bring decentralized exchanges and different akin projects nether the regulator’s purview.

Lots of projects don’t endure multimillion dollar exploits. But the projects that bash thin to get the headlines. And I’m definite that interest is beforehand and halfway connected Gensler’s plate.

There's besides a increasing question among immoderate lawmakers and manufacture participants to person the Commodity Futures Trading Commission (CFTC) enactment arsenic the superior regulator for crypto, but it doesn’t person a user extortion mandate successful the aforesaid mode the SEC does (the SEC’s mandate is focused connected disclosures). Further, waiting for Congress to instrumentality immoderate enactment present volition astir apt instrumentality a while.

The SEC is present astir doubling the size of its crypto enforcement team, opening 20 caller roles. There's been immoderate backlash from the crypto satellite fixed that these are specifically enforcement roles, alternatively than roles for individuals who could constitute guidance letters.

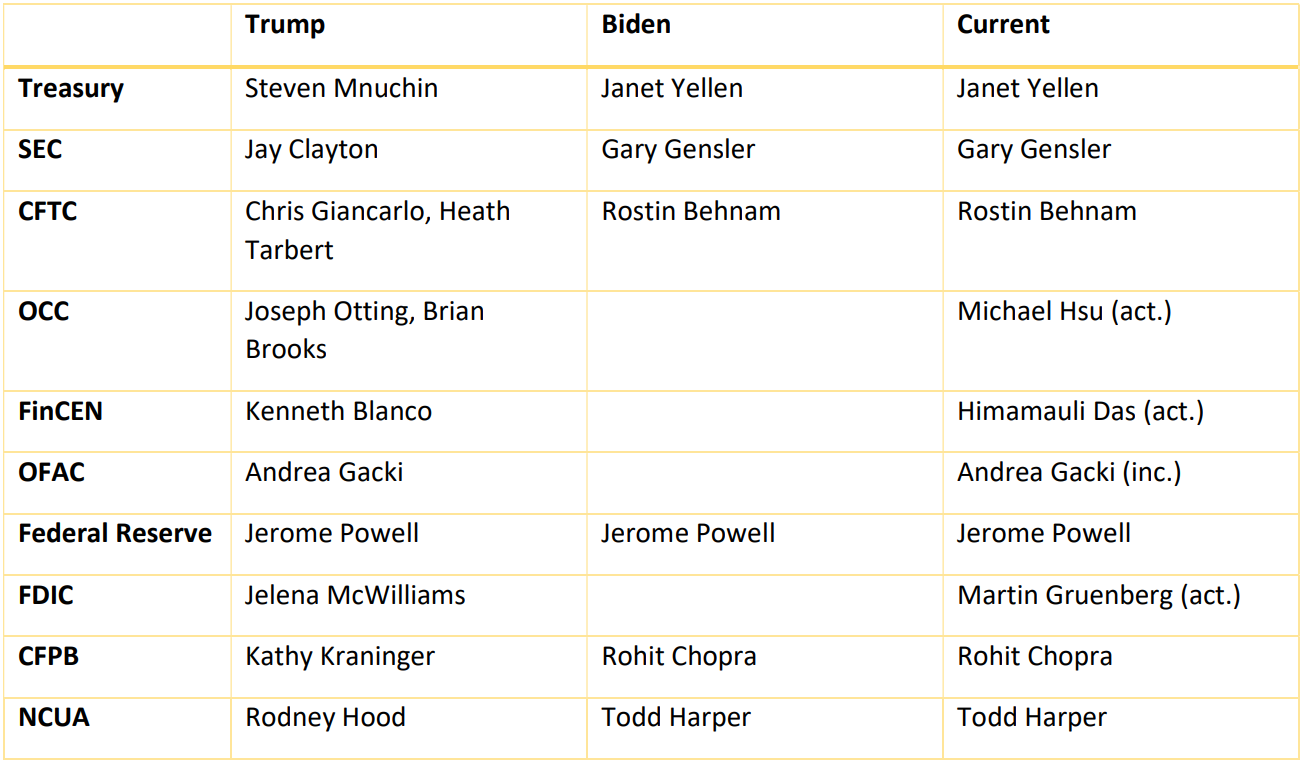

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

No caller nominees implicit the past week.

US Lawmakers Reintroduce Bill to Give CFTC Crypto Spot Market Oversight: Reps. Glenn Thompson (R-Pa.), Ro Khanna (D-Calif.), Tom Emmer (R-Minn.) and Darren Soto (D-Fla.) person reintroduced the Digital Commodity Exchange Act, which would springiness the CFTC greater oversight of spot crypto markets that database integer commodities (so bitcoin, ether, things similar that) portion leaving information token exchanges nether the SEC’s purview. Money services businesses would besides stay nether authorities regulatory purviews.

(Politico) The Supreme Court of the United States is poised to onslaught down Roe v. Wade, a 1970s Supreme Court lawsuit that enshrined the close to an termination into national law, according to a leaked draught ruling obtained by Politico. The ruling arsenic presently framed would look to person implications for different rights presently thought to beryllium protected, including a close to contraceptives, same-sex matrimony and adjacent privacy.

(Vice) Facebook has a ton of idiosyncratic data. And the institution can’t truly support way of who other tin entree that accusation oregon however it gets there.

(The Verge) The Verge’s Elizabeth Lopatto recaps Bitcoin 2022 successful Miami past month, wherever she observed thing interesting: There seems to beryllium much involvement successful “crypto” than successful “bitcoin” close now.

(Bloomberg) Crypto owe lenders are letting borrowers enactment thing down to bargain property.

If you’ve got thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Money Reimagined, our play newsletter exploring the translation of worth successful the integer age.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)