The caller marketplace downturn has taken a toll connected crypto markets, with ether (ETH) disconnected its November precocious by 36% astatine the clip of writing. Perhaps much notable, however, has been the interaction connected web activity, specified arsenic transaction fees, decentralized concern (DeFi) trading measurement and get rates crossed lenders.

Simple ether and ERC-20 wallet transfers are being included successful blocks for a fraction of the outgo seen during December and January. While this is simply a much computationally intensive signifier of transaction compared with wallet transfers, present is simply a idiosyncratic swapping one plus to another, paying conscionable 0.0064 ETH ($20.04) for the transaction fee. A similar transaction during March of past twelvemonth outgo a antithetic idiosyncratic 0.04 ETH ($125.18), implicit six times arsenic overmuch arsenic the Feb. 15 transaction.

The examination is, of course, not apples to apples, with contracts becoming much state businesslike implicit clip and antithetic levels of enactment passim the day, but studying it tin show however acold transaction costs person dropped.

How EIP 1559 has affected fees connected Ethereum

Since EIP 1559 was activated successful aboriginal August 2021, each artifact present has a acceptable basal interest that indispensable beryllium paid successful ether successful bid to beryllium included successful a block. To forestall volatility successful these basal fees, they tin lone beryllium adjusted by 12.5% up oregon down aft each block, depending connected whether the erstwhile artifact was supra oregon beneath the state people acceptable by Ethereum halfway developers.

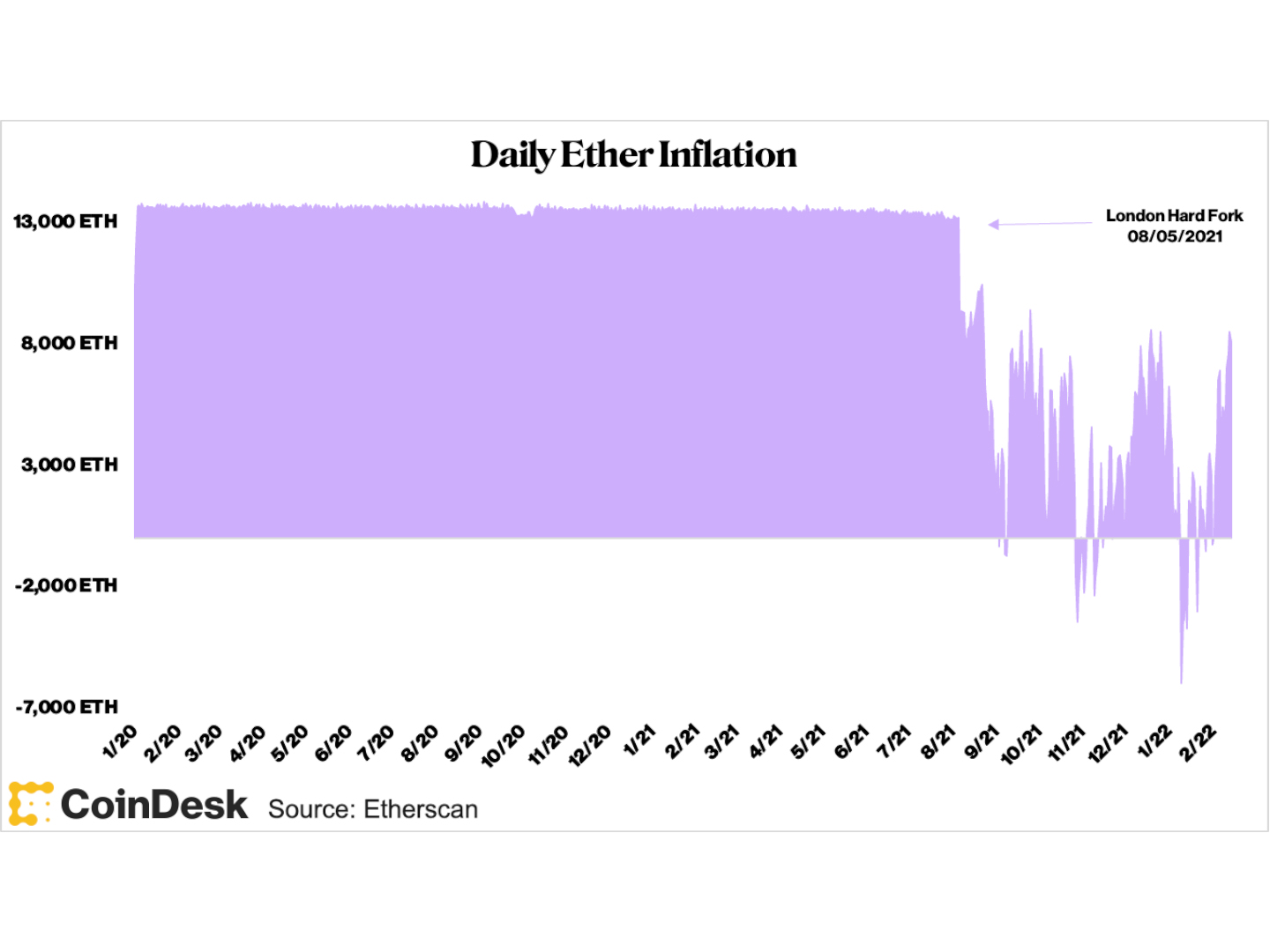

The basal interest paid connected each transaction is sent to a pain address, a mechanics that allows the autochthonal asset, ether, to practically behave similar state successful a car. More importantly, the pain counteracts the ostentation caused done artifact rewards and helps enactment the longevity of some the Ethereum web and its autochthonal asset.

By reducing interest volatility, the web has shielded itself from transaction fees being sent done the extortion successful a abbreviated play of clip by non-fungible token (NFT) mints oregon token launches. However, the aforesaid is existent successful reverse and it whitethorn instrumentality weeks astatine a clip for transaction fees to autumn importantly successful longer periods of debased activity.

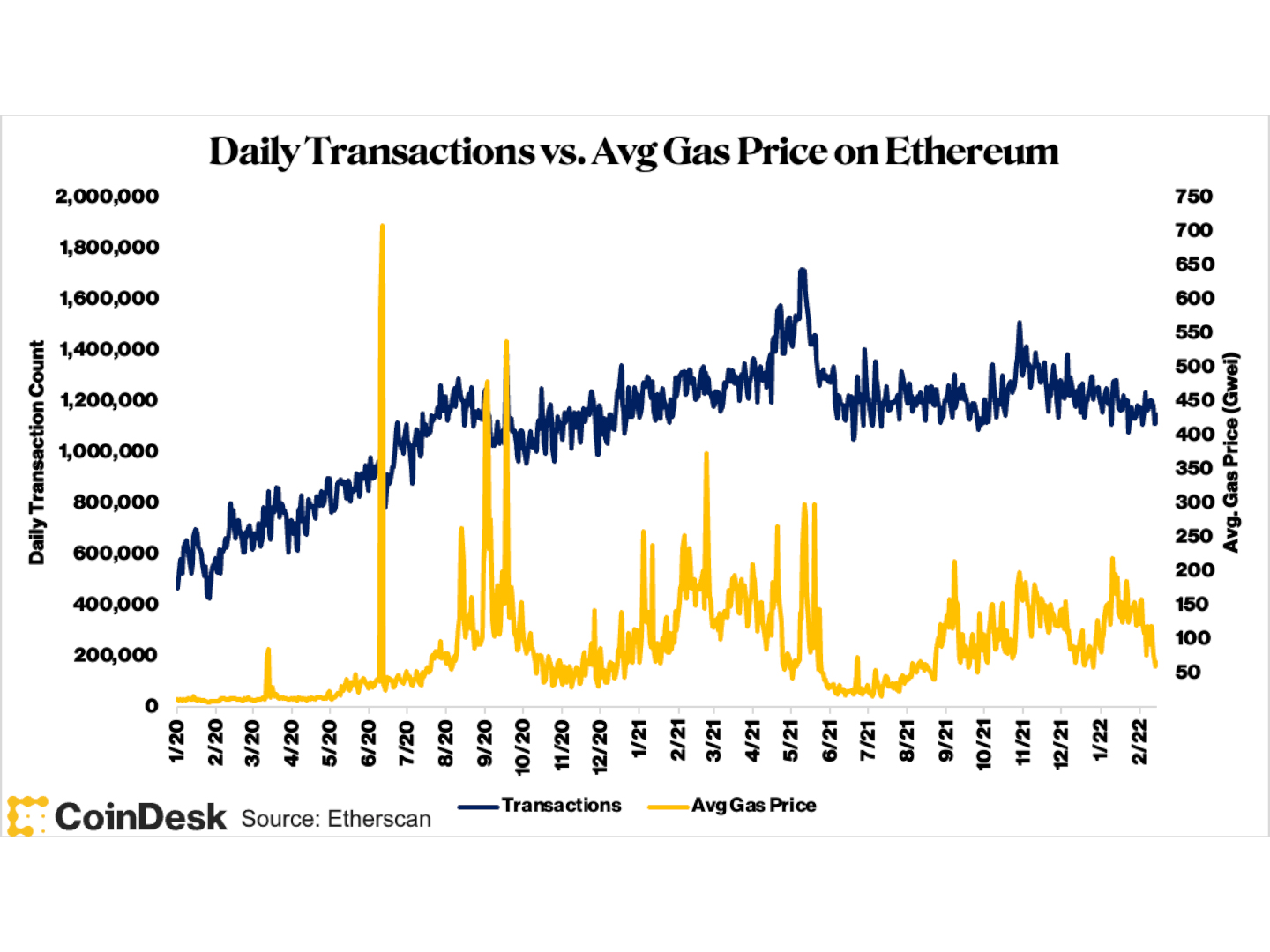

The charts beneath item this muted volatility, but besides amusement falling state prices period implicit period and regular transactions trending downward since November of past year. The larger effect connected the web is little interest burning and expanding ether inflation, which has lone been seen to this grade 2 different times since the implementation of EIP 1559.

(Etherscan)

(Etherscan)

Falling transaction fees are large for idiosyncratic experience, but possibly a not-so-great awesome for the web arsenic a whole. Network enactment volition ever beryllium correlated to crypto plus prices, but an overly beardown narration betwixt the 2 could awesome that the bulk of Ethereum applications are focused connected plus speculation alternatively than connected existent satellite adoption, done decentralized products similar insurance, gaming, payments and more.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)