Bitcoin’s sustained terms level supra $30,000 has Brough astir a noticeable displacement successful marketplace behavior, peculiarly among short-term holders.

Short-term holders (STHs), oregon those who person held Bitcoin for little than 155 days, play a important relation successful marketplace analysis. Their behaviour often provides insights into marketplace sentiment and imaginable terms movements.

Typically, they are much reactive to terms changes and thin to bargain oregon merchantability based connected caller marketplace trends. This tin pb to accrued volatility, arsenic their trading activities tin origin crisp terms swings.

For instance, erstwhile short-term holders commencement to hodl, it tin trim the sell-side unit successful the market, perchance starring to a much unchangeable terms environment.

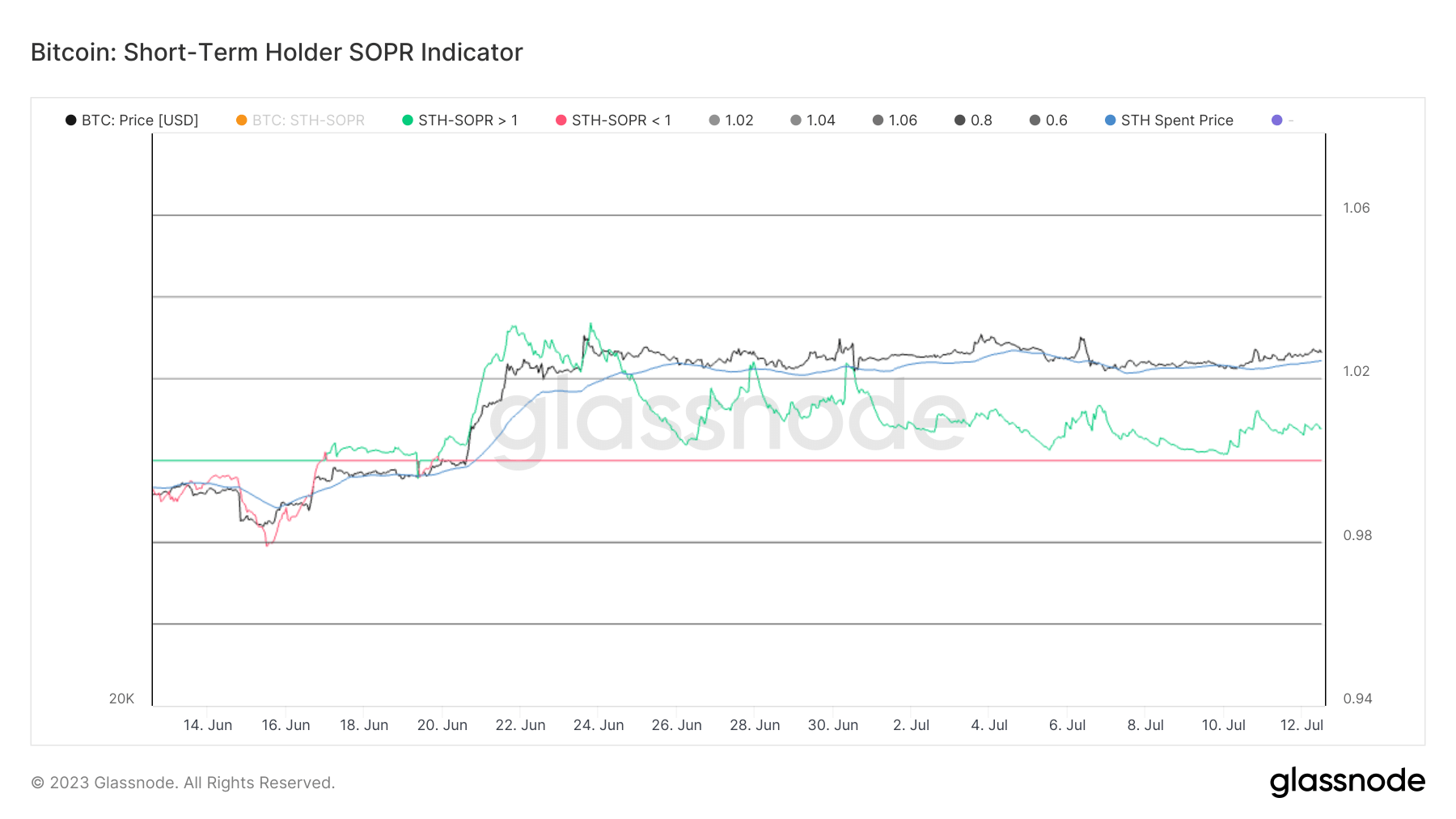

The caller surge successful Bitcoin’s terms from $26,000 to implicit $30,000 has enactment the bulk of STHs in profit. This is evident done the Short-Term Holder Spent Output Profit Ratio (STH-SOPR) metric. SOPR is simply a metric that calculates the nett ratio of coins moved on-chain, providing insights into whether holders are selling astatine a nett oregon loss. STH-SOPR focuses explicitly connected short-term holders.

Since June 20, STH-SOPR has trended supra 1, indicating that short-term holders are, connected average, moving their coins astatine a profit. The metric peaked astatine 1.033 connected June 21 and has since trended downwards, reaching 1.006 connected July 11. This suggests that portion STHs are inactive profiting, the nett borderline has decreased.

Graph showing short-term holder SOPR indicator from June 11 to July 11, 2023 (Source: Glassnode)

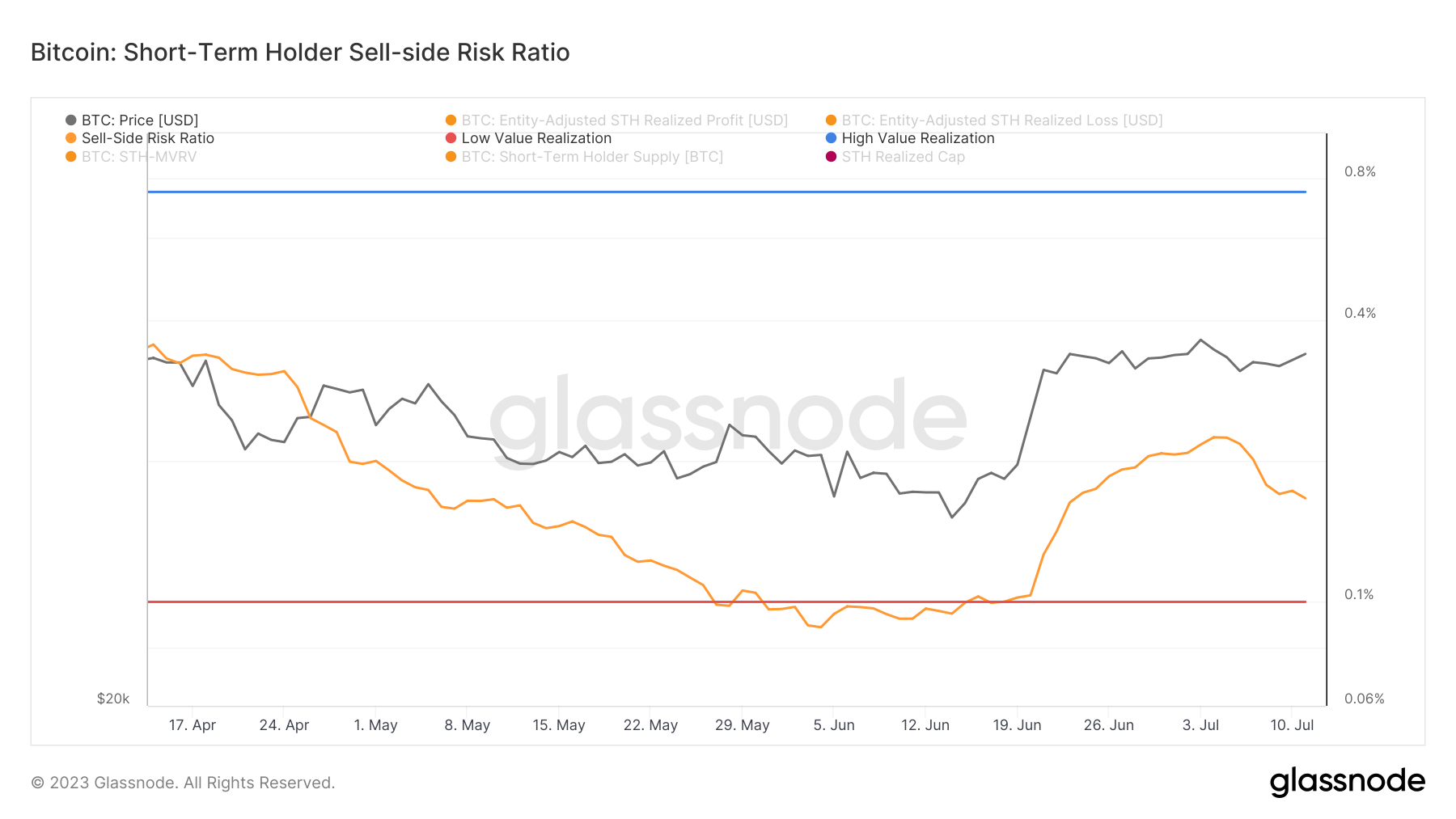

Graph showing short-term holder SOPR indicator from June 11 to July 11, 2023 (Source: Glassnode)Meanwhile, information from on-chain marketplace investigation level Glassnode shows that the sell-side hazard ratio for short-term holders has declined. The sell-side hazard ratio quantifies the aggregate sell-side hazard successful the marketplace by comparing the full USD worth that investors walk each time to the full short-term holder realized capitalization. High values are typically associated with dense profit-taking, portion debased values align with marketplace consolidation phases and carnivore markets.

The ratio began expanding connected June 21, peaking connected July 5. Since then, the ratio has sharply declined, indicating a alteration successful sell-side unit from short-term holders.

Graph showing the sell-side hazard ratio for short-term holders from April 14 to July 11, 2023 (Source: Glassnode)

Graph showing the sell-side hazard ratio for short-term holders from April 14 to July 11, 2023 (Source: Glassnode)The operation of these 2 metrics paints an absorbing picture. While the nett borderline for short-term holders is decreasing, truthful is the sell-side pressure. This could suggest that short-term holders are choosing to hold onto their Bitcoin, contempt the diminishing profits.

This behaviour could perchance stabilize the marketplace and make a coagulated basal for aboriginal terms increases.

The station Why are short-term holders HODLing alternatively of taking profits? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)