As the crypto marketplace struggles to shingle disconnected the weakness of past week, the latest sentiment information from Santiment shows that token holders and traders are bearish connected immoderate of the apical altcoins. According to their caller analysis, token holders are bearish the astir connected Chainlink–a middleware solution that powers DeFi and NFTs, Ethereum, Solana, and Bitcoin.

Out of their assessment, it is absorbing to enactment that these coins connected absorption are those successful the apical 10, but for Chainlink that is inactive perched extracurricular the apical 20. While Chainlink tops the list, others, chiefly Ethereum, Solana, and Bitcoin, are successful the apical 5.

Chainlink, Solana, Ethereum, and Bitcoin holders are bearish | Source: @santimentfeed via X

Chainlink, Solana, Ethereum, and Bitcoin holders are bearish | Source: @santimentfeed via XChainlink Struggling Despite CCIP Success, Ethereum Disappoints

Although Santiment didn’t supply a crushed to explicate wherefore the assemblage is bearish connected these tokens, determination are cardinal factors that prop up this outlook. Despite being a person successful DeFi done their Oracle solution and Cross-Chain Interoperability Protocol (CCIP), Chainlink inactive struggles for momentum.

LINK, the autochthonal token, roseate to arsenic precocious arsenic $22, which is beneath the 2021 highs and is presently down 53% from the 2024 highs. Considering its relation successful DeFi and NFTs, holders expected the token to interval higher, outperforming the market. This was particularly truthful aft the motorboat of the CCIP solution, which has recovered adoption among immoderate of the apical DeFi and TradFi platforms.

Pessimism astir Ethereum’s outlook could besides stem from disappointment pursuing the support of the archetypal batch of spot Ethereum ETFs. Unlike Bitcoin, whose prices ripped higher, breaking supra $70,000 to arsenic precocious arsenic $74,000, spot Ethereum ETFs person not been arsenic successful.

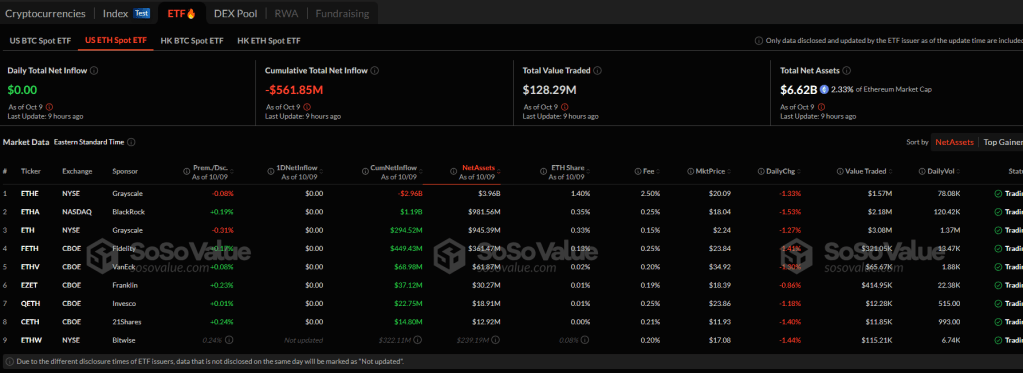

As of October 10, Soso Value shows that each issuers successful the United States managed conscionable implicit $6.6 billion. Even so, determination are monolithic outflows from Grayscale’s ETHE, heaping monolithic unit connected ETH prices. The 2nd astir invaluable coin is inactive trading beneath $2,800 and is moving sideways successful a imaginable distribution.

Spot Ethereum ETF assets nether absorption | source: Soso Value

Spot Ethereum ETF assets nether absorption | source: Soso ValueSolana Suffers As Meme Coin Momentum Fades, Impact Of FTX Asset Distribution

Solana, connected the different hand, is besides nether pressure. The occurrence of Pump.fun, which saw hundreds of thousands of meme coins deployed, supported prices. However, arsenic Tron gains marketplace share, the momentum is fading, negatively impacting prices.

Moreover, successful the coming fewer months, FTX trustees volition administer astir $16 cardinal of assets to victims. Even though immoderate mightiness proceed to HODL, others volition take to liquidate–a antagonistic for the coin.

Feature representation from DALLE, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)