With rampant ostentation and organization unease successful the air, bitcoin is prepared to summation exponentially.

This is an sentiment editorial by Adam Taha, an entrepreneur with 2 decades of authorities and firm concern experience.

The latest user terms scale (CPI) people came retired astatine a shocking 9.1% (9.8% successful cities), and galore speculators expected bitcoin’s terms to “moon.” What happened was the other and bitcoin’s terms enactment correlated with different hazard assets. Many threw an expected tantrum and asked why? “I thought BTC was a hedge against ostentation … erstwhile moon?”

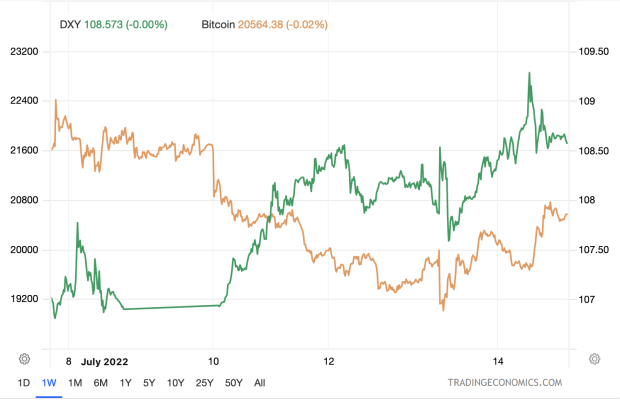

Keep successful caput that bitcoin is simply a 13-year aged resilient plus with conscionable 13 years of web effect. How is it resilient? While the dollar, arsenic we each know, has continued its meteoric climb, posting caller yearly highs versus the British pound, euro, and Japanese yen twelvemonth to date, making it a wrecking shot against astir overseas currencies and risk-on assets. However, for the past week thing unthinkable started happening: The terms of bitcoin (in USD) has been keeping an highly beardown level of enactment arsenic the dollar gains. This signifies a massively important lawsuit successful my opinion.

Image source: Tradingeconomics.com

Image source: Tradingeconomics.com

Bitcoin’s terms enactment frustrates immoderate retail investors. That’s due to the fact that the marketplace is not dominated by retail. It’s dominated by organization investors and “big money.” Institutions predominate the marketplace but are themselves bogged down by rules, regulations and policies. As such, they presumption bitcoin arsenic a risk-on plus and erstwhile ostentation runs blistery (latest people of 9.1%) past they spell risk-off — particularly erstwhile involvement rates are precocious (“quantitative tightening” (QT) environment). Generally, “cash is king” is simply a communal connection successful accepted concern and the existent fiat strategy for galore investors. Institutions merchantability their hazard assets (risk-off) and they bargain currency (USD) and cash-flow equities erstwhile the DXY rises.

Note that golden and metallic person importantly dropped successful the past fewer weeks. So, what happened to their harmless store-of-value proposition? Nothing. The proposition itself apt inactive holds. It’s not astir the assets themselves, it’s astir accumulating dollars close now. Having liquid currency is amended for institutions and investors than having a invaluable yet illiquid asset. Remember, institutions presumption currency arsenic king successful times of precocious ostentation and QT.

To reiterate, Bitcoin is lone 13 years aged and it is taking clip for retail and institutions to recognize the existent worth of bitcoin. For now, organization investors proceed to presumption currency arsenic king, and galore radical successful retail inactive don’t recognize what benignant of wealth bitcoin is. So, for present we’re inactive stuck successful the Federal Reserve Board’s monetary world.

The Fed’s argumentation is unsustainable. They cognize that, we cognize that. They can’t and won’t halt printing by adding liability to their equilibrium sheets (debt to beryllium paid disconnected by aboriginal generations). What is the solution? Bitcoin is the solution. Sure, successful 2 months currency volition inactive stay king, but successful 2 years currency volition instrumentality to its archetypal form: trash. Meanwhile, bitcoin volition support doing its happening and investors (both retail and institutions) volition recognize its value.

The pursuing connection is relative: “Bitcoin is simply a hedge against inflation.” I accidental comparative due to the fact that for idiosyncratic who bought bitcoin years agone (before 2017) that connection holds true. But for idiosyncratic who bought recently, that connection is taken with immoderate skepticism. Long term, it surely is simply a hedge against inflation.

A recognition default swap oregon CDS is an security instrumentality that institutions usage erstwhile they ain a enslaved issued by an issuer similar a firm oregon authorities bond. They tin bargain security against that enslaved failing (issuer defaulting). For institutions and investors, Bitcoin tin and should beryllium their CDS connected the Fed failing. Bitcoin protects your wealthiness from debasement and it protects you similar a CDS connected the government. Bitcoin is your security argumentation against the government’s full monetary argumentation and its “scam token” (aka the dollar).

The aboriginal is astir wholly digitized. Money volition beryllium nary different. Bitcoin is without a uncertainty the lone solution for a sound, immutable, secure, integer wealth that gives radical their sovereignty. Banks are counterparties. Goldman Sachs, NYSE, Vanguard, Fidelity, and others are counterparties. With bitcoin, you ain the plus outright and not the underlying asset. In today’s system, the reliance oregon anticipation is connected the counterparty to uphold their extremity of the work and springiness what is owed to you erstwhile you request to liquidate an asset. Bitcoin flips this connected its caput utilizing an elegant strategy of incentives, encryption, proviso cap, decentralization, and a web that anyone tin enactment in.

Growing your purchasing powerfulness comes second. First, you person to support that purchasing power. How bash you support your purchasing power? Bitcoin.

This is simply a impermanent station by Adam Taha. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)