Bitcoin experienced a important surge, climbing from a debased of $62,050 connected Sunday to a highest of $66,500 precocious Monday. As of Tuesday, the BTC terms is somewhat correcting beneath this cardinal absorption level, but hovering supra $65,000. Several captious factors person contributed to the rally, including a abbreviated compression coinciding with the upcoming US elections, beardown request successful the spot Bitcoin market, and important inflows into US spot Bitcoin Exchange Traded Funds (ETFs).

#1 Short Squeeze And US Election Influence

Yesterday’s terms surge tin beryllium partially attributed to the liquidation of leveraged abbreviated positions. Singapore-based trading steadfast QCP Capital writes successful their latest investor note that astir $80 cardinal worthy of Bitcoin and Ethereum leveraged shorts were liquidated, applying upward unit connected the market. While immoderate speculate that the postponement of Mt. Gox’s repayment deadline to October 2025 played a role, this quality was already published connected Friday, suggesting different factors were astatine play during Monday’s rally.

“Although determination could beryllium galore factors that could explicate today’s move, it is rather an absorbing clip if we look astatine humanities terms action. We are successful the mediate of October and conscionable 3 weeks distant from the US elections,” QCP Capital notes. In some 2016 and 2020, Bitcoin remained successful a choky trading scope for months earlier initiating a important rally astir 3 weeks earlier the US Election Day. In 2016, Bitcoin doubled successful terms from $600 by the archetypal week of January pursuing the election. Similarly, successful 2020, it surged from $11,000 to a precocious of $42,000 by January.

This year, October—often referred to arsenic “Uptober” owed to its historically beardown performance—has been underwhelming, with Bitcoin up conscionable 1.2% compared to an mean of 21%. The existent rally, occurring 3 weeks earlier the US elections, suggests that past mightiness beryllium repeating itself, perchance starring to further terms appreciation arsenic capitalist optimism builds.

#2 Strong Demand For Bitcoin

For the archetypal clip since mid-2023, Bitcoin’s bargain orders are matching merchantability orders successful spot marketplace bid books crossed exchanges. Ki Young Ju, Founder and CEO of CryptoQuant, highlighted this improvement via X: “Bitcoin bargain walls connected each exchanges are present beardown capable to neutralize merchantability walls.”

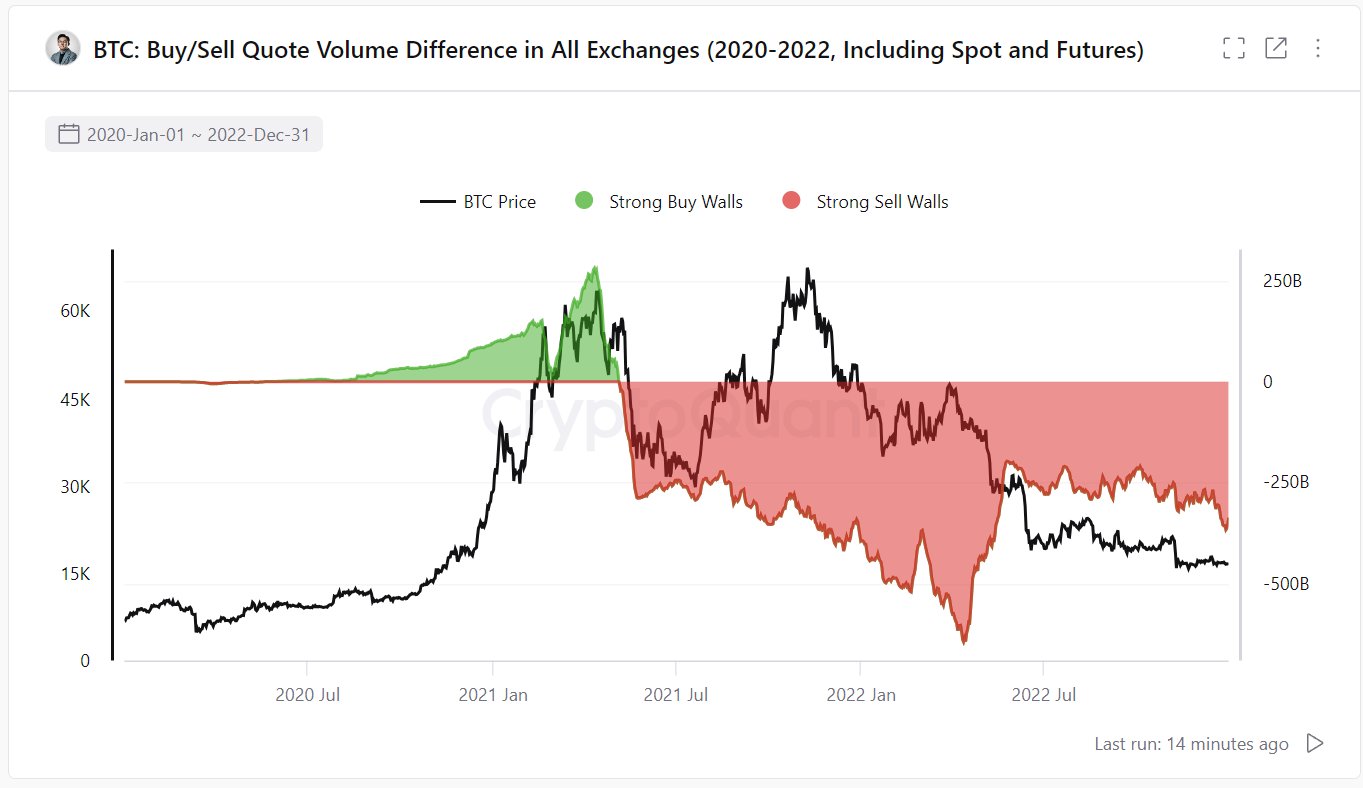

Bitcoin Buy/Sell Walls connected Exchanges (Spot and Futures) | Source: X @ki_young_ju

Bitcoin Buy/Sell Walls connected Exchanges (Spot and Futures) | Source: X @ki_young_juThis displacement marks a important alteration from the inclination observed since May 2021. “Data from the past rhythm (2020-2022). It’s the accumulated quality betwixt quoted bargain and merchantability volumes. Since May 2021, merchantability walls had been consistently thicker than bargain walls until the extremity of the cycle,” Young Ju shared.

Bitcoin Buy/Sell Walls connected Exchanges (2020-2022) | Source: X @ki_young_ju

Bitcoin Buy/Sell Walls connected Exchanges (2020-2022) | Source: X @ki_young_ju#3 Surge In Spot Bitcoin ETF Inflows

Monday witnessed 1 of the highest Bitcoin ETF inflows connected record, totaling $555.9 million—the largest nett inflow time since June 3. This important superior influx was dispersed among respective large plus managers. BlackRock received $79.5 million, Fidelity attracted $239.3 million, Bitwise accumulated $100.2 million, Ark Invest saw inflows of $69.8 cardinal and the Grayscale Bitcoin Trust (GBTC) experienced inflows of $37.8 million.

Nate Geraci, President of The ETF Store and big of the ETF Prime podcast, commented connected these inflows via X: “Monster time for spot btc ETFs… $550mil inflows. Now approaching *$20bil* nett inflows successful 10mos. Simply ridiculous & blows distant each pre-launch request estimate. This is NOT “degen retail” $$$ IMO. It’s advisors & organization investors continuing to dilatory adopt.”

At property time, BTC traded astatine $65,750.

BTC terms reclaims cardinal absorption country (red), 1-day illustration | Source: BTCUSDT connected TradingView.com

BTC terms reclaims cardinal absorption country (red), 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)