Bitcoin (BTC) took the spotlight from the remainder of the crypto marketplace successful 2024, but the Trump medication is rapidly changing the rules of the crippled and a rotation into different assets could extremity up happening, according to crypto information steadfast Kaiko Research

In fact, the decentralized concern (DeFi) assemblage isn’t looking excessively bad, Kaiko probe analysts Adam McCarthy and Dessislava Aubert wrote successful a caller report.

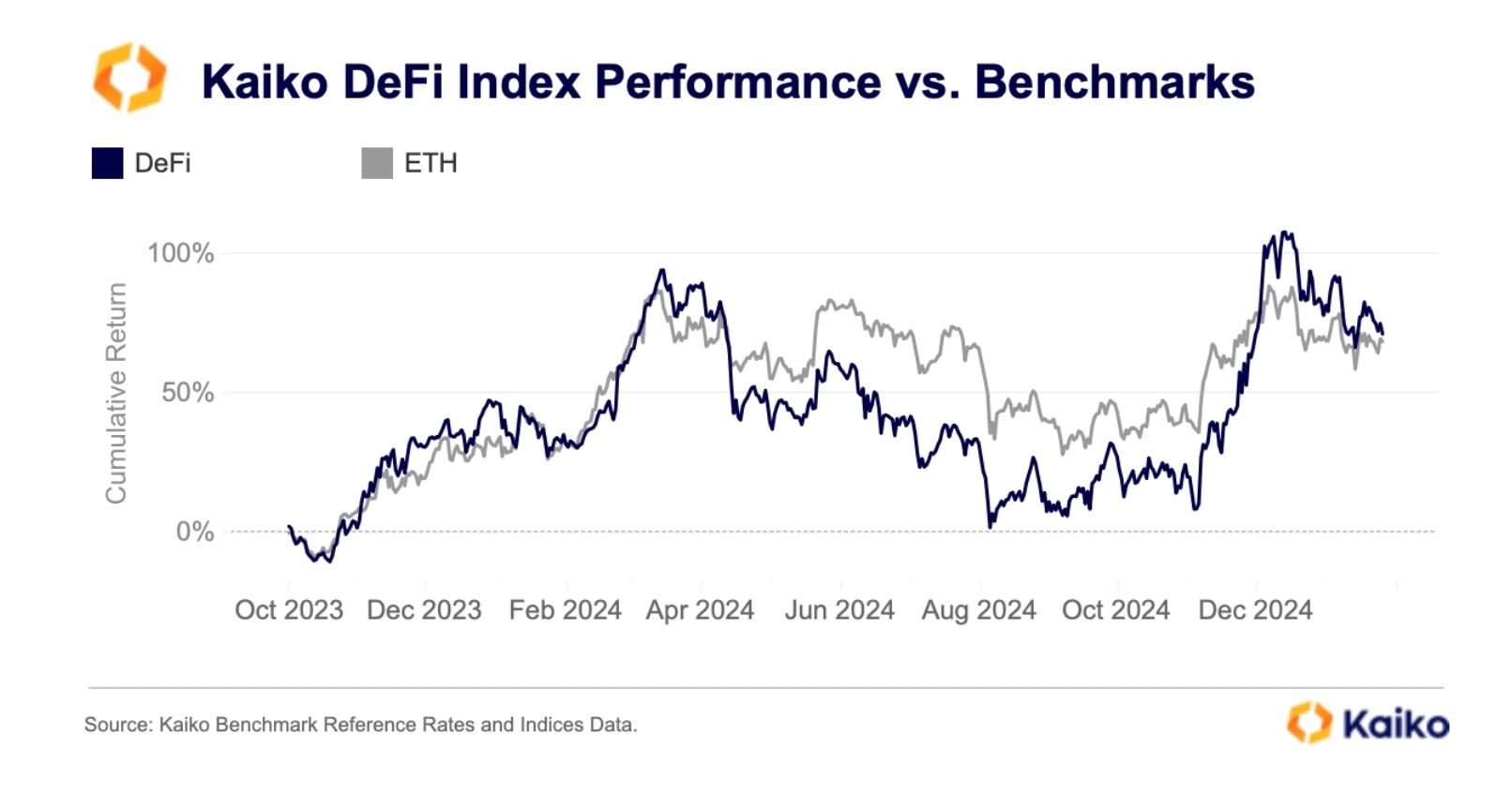

The company’s DeFi scale (KSDEFI) has outpaced ether (ETH) since the instrument’s inception successful October 2023, bringing successful astir 75% returns successful that span of time. That’s singular considering that astir of the protocols included successful the scale are built connected Ethereum.

“This outperformance whitethorn persist into the second fractional of 2025, arsenic respective assets wrong the scale payment from beardown tailwinds,” the study said. “This inclination highlights the decreasing correlation betwixt the DeFi scale and ETH implicit time, arsenic the decentralized concern assemblage continues to grow beyond the Ethereum ecosystem.”

The scale is composed of 11 DeFi tokens, the astir heavy weighted being UNI, AAVE and ONDO. At slightest 4 of these tokens person almighty tailwinds for the remainder of the year, the study said.

For example, regulatory developments successful the U.S. whitethorn unfastened up possibilities for decentralized speech Uniswap and decentralized lender Aave to instrumentality interest switches for each of their respective tokens, meaning that protocol fees whitethorn extremity up getting distributed to UNI and AAVE holders.

Tokenization protocol Ondo Finance, for its part, volition apt payment from an acceleration of the tokenization inclination arsenic Wall Street keeps wading deeper into crypto, the study said.

“Regulatory constraints successful cardinal markets person been a important hurdle [since 2020], but they are lone portion of the challenge. DeFi has besides faced structural issues, including precocious idiosyncratic friction owed to fees and information concerns. However, with regulatory scrutiny easing, the assemblage present has abundant opportunities for growth,” the study said.

7 months ago

7 months ago

English (US)

English (US)