Since May 2022, the Bitcoin (BTC) borderline markets connected the Bitfinex speech person been plagued by an unusually precocious unfastened involvement of implicit $2.7 billion. This accusation unsocial should rise a reddish flag, particularly successful airy of Bitcoin's terms diminution from $39,000 to little than $25,000 during the aforesaid period.

Traders seeking to leverage their cryptocurrency presumption had borrowed implicit 105,000 Bitcoin. Currently, the origin of this anomaly is unknown, arsenic good arsenic the fig of entities progressive successful the trade.

Cheap borrowing favors precocious demand

Bitfinex's sub-0.1% yearly complaint whitethorn beryllium a contributing origin to the size of the Bitcoin lending market. To date, this has been the norm and it creates tremendous incentives for borrowing, adjacent if determination is nary existent need. There are fewer traders who would crook down specified a ridiculously inexpensive leverage opportunity.

Margin borrowing tin beryllium utilized to instrumentality vantage of arbitrage opportunities, wherever a trader exploits terms discrepancies betwixt antithetic markets. For example, borrowing Bitcoin connected borderline allows a trader to instrumentality a agelong presumption successful 1 marketplace and a abbreviated successful another, profiting from the terms difference.

To recognize however Bitcoin borrowing tin beryllium utilized to nett connected derivatives markets, including those extracurricular of Bitfinex, 1 indispensable recognize the favoritism betwixt futures contracts and borderline markets. The borderline is not a derivative contract, truthful the commercialized occurs connected the aforesaid bid publication arsenic spot trading. In addition, dissimilar futures, borderline longs and shorts are not ever successful balance.

For example, aft purchasing 10 Bitcoin utilizing margin, the coins tin beryllium withdrawn from the exchange. Naturally, the trade, which is typically based connected stablecoins, requires immoderate signifier of collateral oregon a borderline deposit.

If the borrower fails to instrumentality the position, the speech volition liquidate the borderline successful bid to repay the lender.

Additionally, the borrower indispensable wage involvement connected the BTC acquired with a margin. The operational procedures alteration betwixt centralized and decentralized exchanges, but the lender typically determines the involvement complaint and duration of offers.

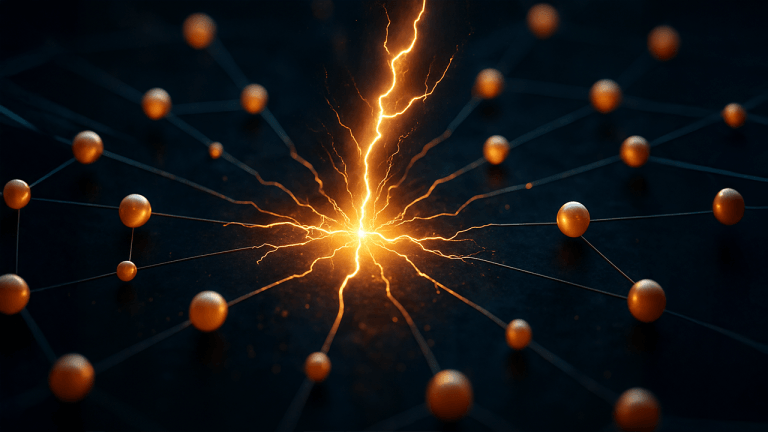

There was a 12,000 BTC borderline diminution successful a azygous trade

Historically, Bitfinex borderline traders person been known to determination ample borderline positions quickly, indicating the information of whales and ample arbitrage desks. In the astir caller instance, connected March 25, those investors reduced their agelong positions by 12,000 BTC successful minutes.

Bitfinex BTC borderline longs, successful BTC contracts. Source: TradingView

Bitfinex BTC borderline longs, successful BTC contracts. Source: TradingViewNotice however important the alteration was, contempt the information that it had nary effect connected the Bitcoin price. This supports the mentation that specified borderline trades are market-neutral due to the fact that the borrower is not leveraging their positions with the proceeds. Most likely, determination is immoderate arbitrage involving derivatives instruments.

Traders should cross-reference the information with different exchanges to corroborate that the anomaly affects the full market, fixed that each speech has chiseled risks, norms, liquidity and availability.

OKX, for example, provides an indicator for borderline lending based connected the stablecoin/BTC ratio. Traders tin summation their vulnerability connected OKX by borrowing stablecoins to acquisition Bitcoin. Bitcoin borrowers, connected the different hand, tin lone wager connected the terms decline.

OKX stablecoin/BTC borderline lending ratio. Source: OKX

OKX stablecoin/BTC borderline lending ratio. Source: OKXThe supra illustration shows that OKX traders' borderline lending ratio has been unchangeable for the past week adjacent 30, indicating that nonrecreational traders' long-to-short bets person not changed. This information supports the mentation that Bitfinex's diminution is owed to an arbitrage adjacent unrelated to Bitcoin terms movement.

Related: US authorities plans to merchantability 41K Bitcoin connected to Silk Road

Recent crypto slope closures could person triggered the movement

Another anticipation for the abrupt alteration successful borderline request is the $4 cardinal successful deposits associated with the present defunct Signature Bank and its integer banking business. Crypto clients were told to adjacent their accounts by April, according to a Bloomberg report.

While New York Community Bancorp (NYCB) purchased the bulk of Signature Bank's deposits and loans connected March 19, the woody with the FDIC did not see crypto-related accounts.

If those whales are forced to adjacent their banking accounts, they volition astir apt trim their arbitrage positions, including those successful borderline markets. For the clip being, each assumptions are speculative, but 1 happening is certain: the 12,000 BTC agelong borderline simplification astatine Bitfinex had nary effect connected Bitcoin prices.

The views, thoughts and opinions expressed present are the authors’ unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)