Bitcoin’s terms saw a important summation successful February, jumping from $43,049 astatine the opening of the period to $49,900 connected Feb. 12, arsenic of property time. Crossing $49,000 marks a important milestone for BTC, arsenic it indicates the imaginable to breach the $50,000 absorption and determination person to its all-time high. Alongside its terms surge, Bitcoin’s marketplace capitalization accrued dramatically by implicit $102.5 cardinal successful February. During the aforesaid timeframe, Bitcoin’s realized headdress saw a much humble increase, rising conscionable implicit $4 billion, from $447.48 cardinal to $451.66 billion.

Understanding the differences and increases successful these 2 metrics is important for marketplace analysis. While some mightiness look excessively wide to connection penetration into subtle marketplace movements, their difference, and semipermanent trends are often among the champion marketplace wellness indicators. This is particularly existent for realized cap, an often overlooked metric that provides invaluable accusation astir the aggregate outgo ground for the full market.

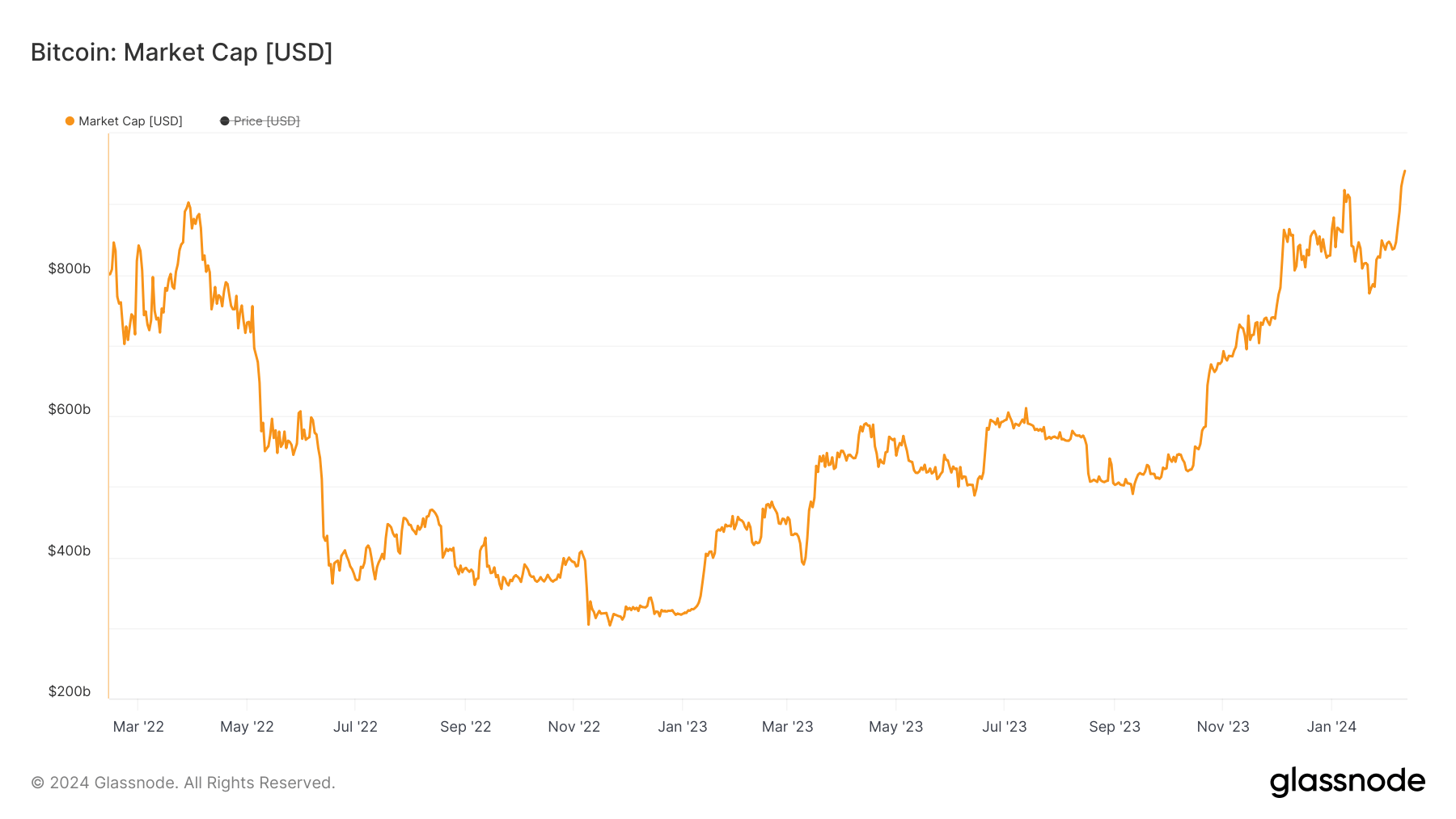

Market capitalization is calculated by multiplying Bitcoin’s existent marketplace terms by the full fig of coins successful circulation. It’s a precise crude metric but a wide utilized one, arsenic it’s the champion mode to contiguous the size of a peculiar plus oregon market. Market headdress is highly responsive to terms fluctuations and often experiences important shifts wrong abbreviated periods, mirroring the contiguous marketplace sentiment and speculative activities. An uptick successful Bitcoin’s marketplace terms tin rapidly and aggressively grow the marketplace cap, showing the existent valuation of each Bitcoins astatine BTC’s latest marketplace price.

Graph showing Bitcoin’s marketplace capitalization from February 2022 to February 2024 (Source: Glassnode)

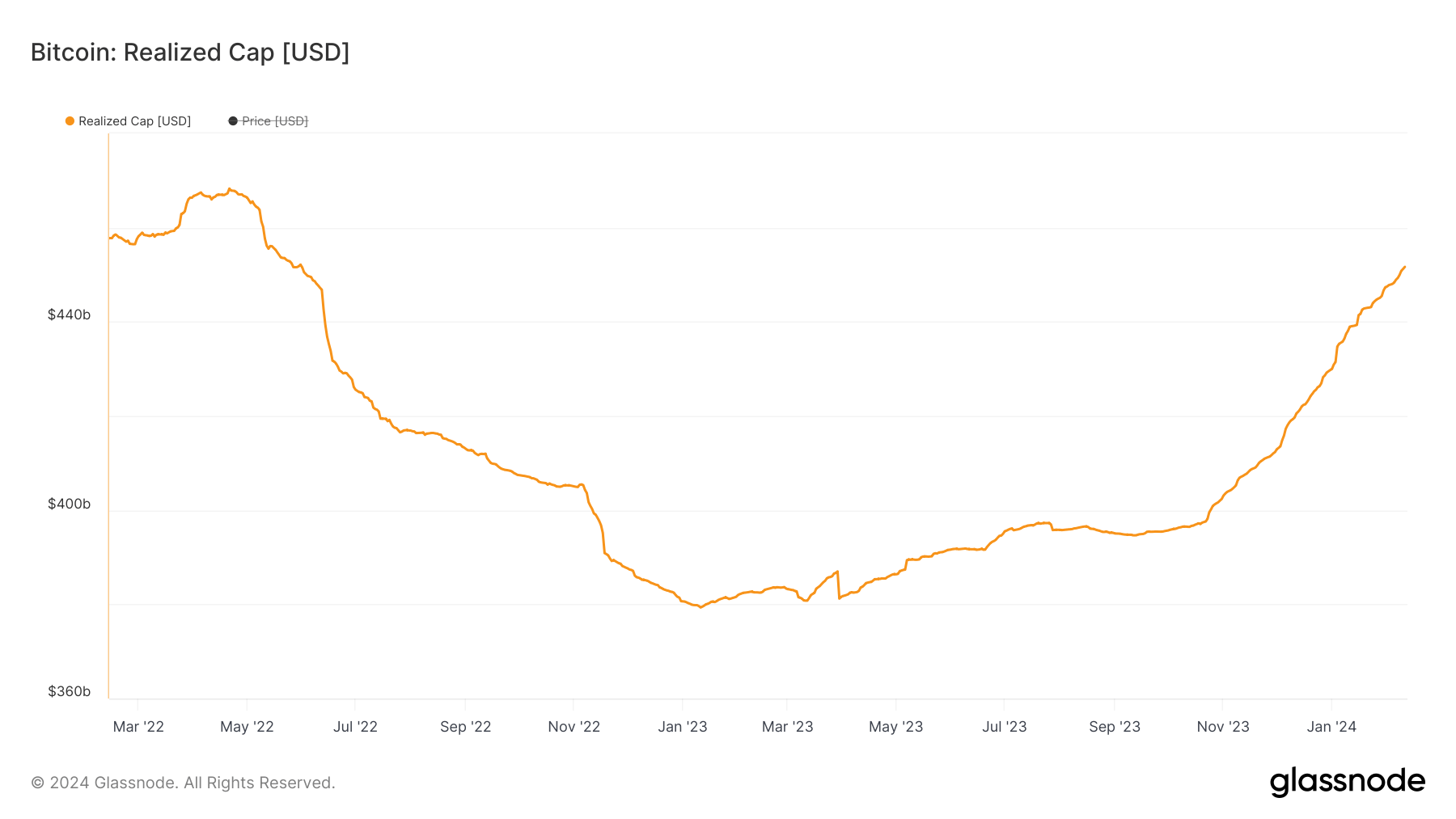

Graph showing Bitcoin’s marketplace capitalization from February 2022 to February 2024 (Source: Glassnode)Realized cap, connected the different hand, provides a much nuanced position of Bitcoin’s value. Unlike marketplace cap, which lone considers Bitcoin’s latest marketplace price, realized headdress considers the past of each coin to recognize its publication to the full worth of the Bitcoin network. This method looks astatine the terms astatine which each Bitcoin was really moved. By focusing connected these transaction prices, realized headdress offers a snapshot of the marketplace that considers the existent prices radical paid for their BTC alternatively than the existent marketplace price, which tin beryllium influenced by short-term trading.

When Bitcoins are traded astatine prices higher than the terms astatine which they were past moved, the realized headdress increases. This is due to the fact that the newer, higher transaction prices are present considered, raising the wide “cost basis” oregon the aggregate magnitude spent connected acquiring Bitcoins. If, connected the different hand, Bitcoin is lone being moved astatine prices little than their past transaction price, the realized headdress decreases.

This “aggregate outgo basis” is simply a important conception arsenic it provides penetration into the existent concern poured into Bitcoin. It offers a much unchangeable and little volatile metric than the marketplace cap, which tin plaything wildly with terms changes. The realized cap, therefore, tin beryllium seen arsenic a much grounded measurement of Bitcoin’s economical footprint, reflecting the steadfast committedness of investors to the web implicit time.

Graph showing Bitcoin’s realized headdress from February 2022 to February 2024 (Source: Glassnode)

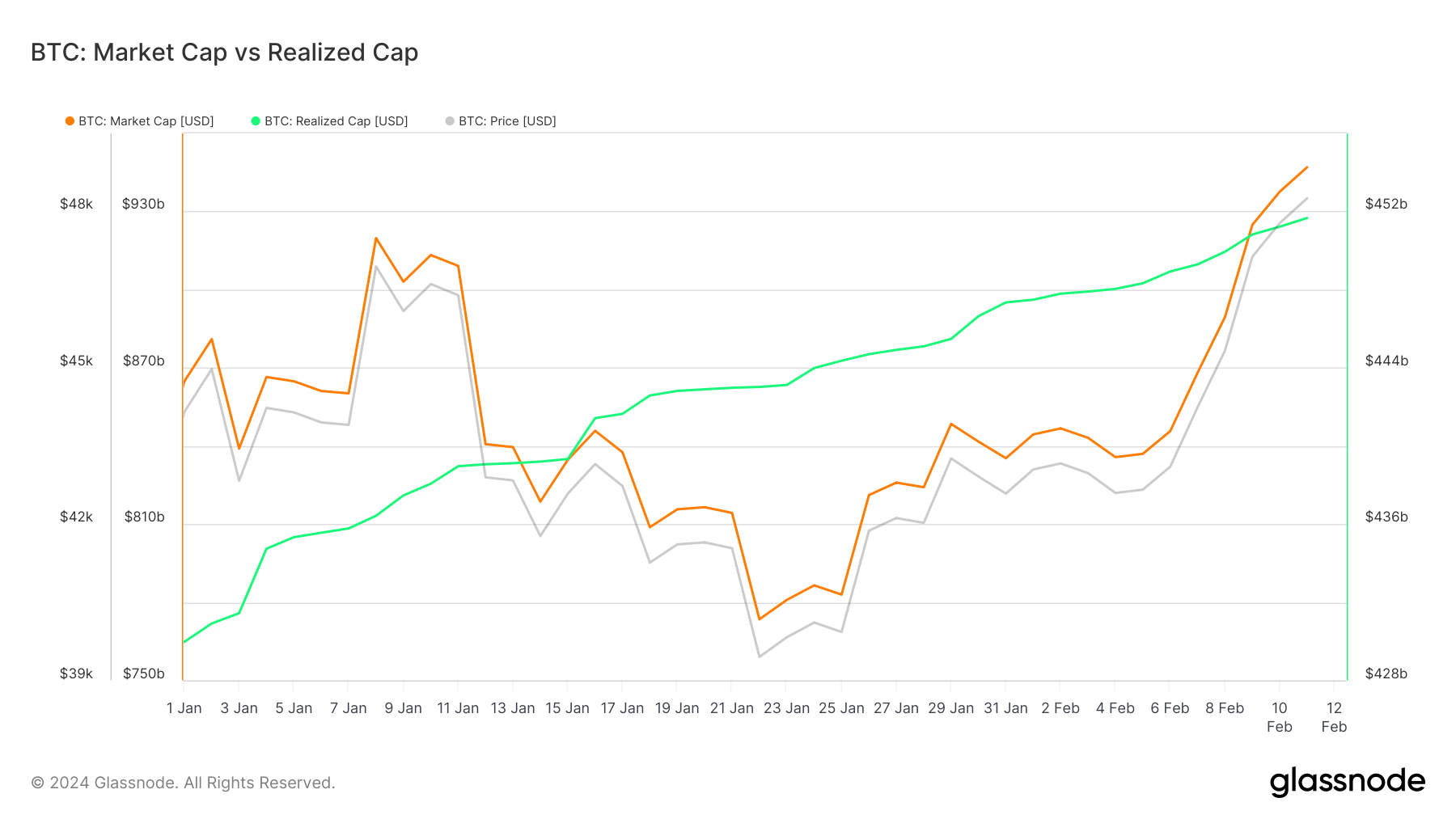

Graph showing Bitcoin’s realized headdress from February 2022 to February 2024 (Source: Glassnode)The opposition seen successful February — wherever the marketplace headdress saw a important emergence portion the realized headdress saw a much humble summation — shows a play of important terms appreciation. This divergence is attributable to the marketplace cap’s nonstop reflection of existent terms movements, arsenic opposed to the realized cap.

The surge successful marketplace headdress indicates the overarching marketplace sentiment and liquidity. A bullish sentiment tin catalyze much buying, propelling some the terms and marketplace headdress upwards. However, the realized headdress volition not promptly reflector this enthusiasm if this buying enactment is concentrated wrong the young proviso alternatively than involving long-held coins.

Graph comparing Bitcoin’s marketplace headdress and realized headdress from Jan. 1, 2024, to Feb. 11, 2024 (Source: Glassnode)

Graph comparing Bitcoin’s marketplace headdress and realized headdress from Jan. 1, 2024, to Feb. 11, 2024 (Source: Glassnode)The summation successful realized headdress suggests that a important measurement of Bitcoin has changed hands astatine prices higher than the humanities mean astatine which they were antecedently acquired. The continuous summation successful realized headdress since September 2023 shows that the marketplace is steadily absorbing selling pressure, with some caller and existing investors showing readiness to bargain astatine oregon supra existent prices.

This instauration tin service arsenic a launchpad for aboriginal terms increases, arsenic it reflects a coagulated underlying capitalist assurance and a valuation ground that is little apt to beryllium eroded by short-term marketplace volatility.

The station Why did Bitcoin’s marketplace headdress surge by implicit $102 cardinal portion realized headdress lone grew by $4 billion? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)