Last Tuesday, bitcoin (BTC) deed an all-time precocious measured successful rubles (RUB). Does that truly mean anything?

Price feeds don’t archer the afloat communicative erstwhile comparing plus prices crossed antithetic currencies, particularly erstwhile 1 of those currencies is issued by a state facing financial sanctions for invading Ukraine (and the different is magic net money).

Bitcoin All-Time High successful Rubles / Bloomberg

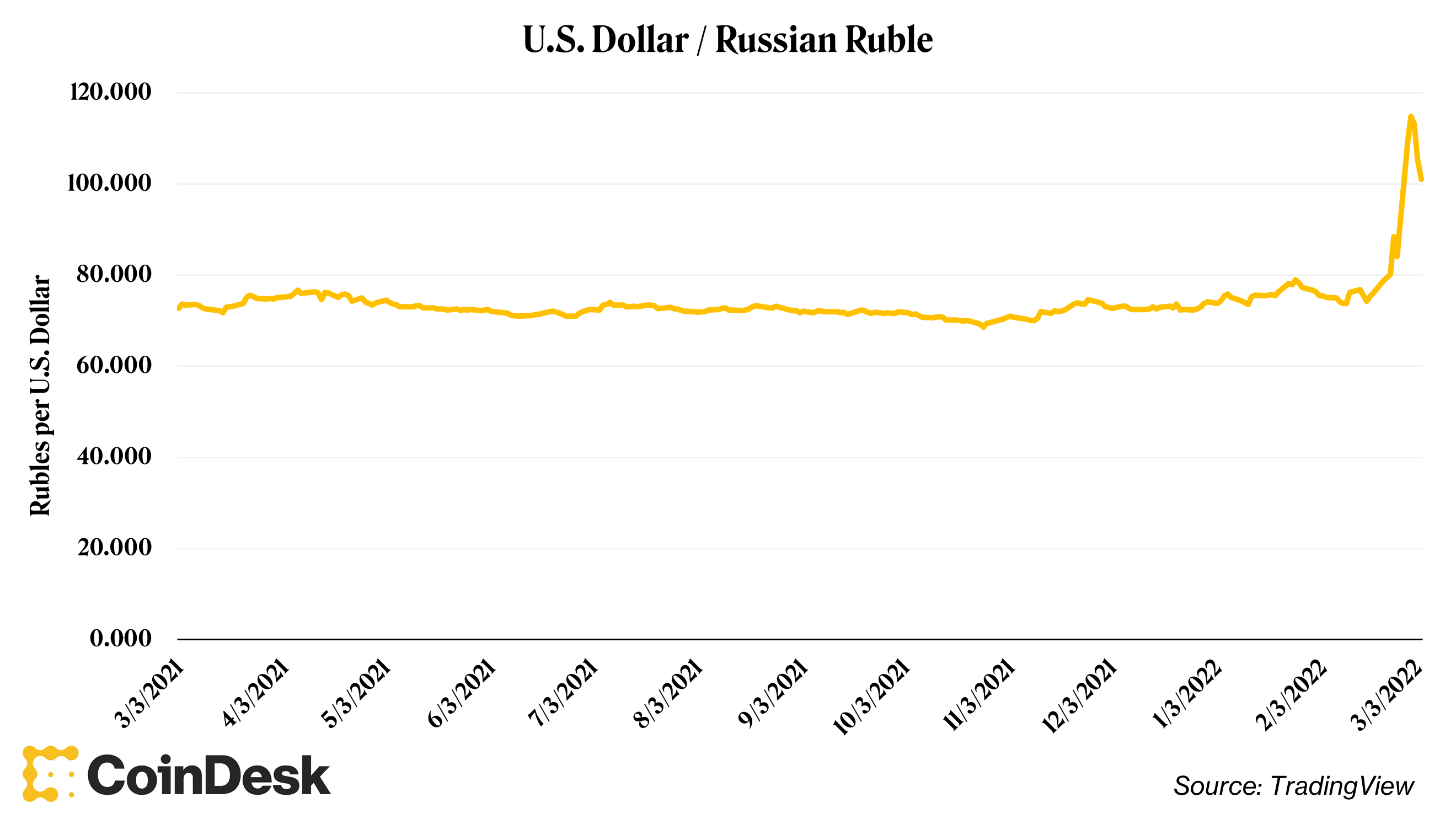

A speedy look astatine USD/RUB tells astir of the story. One U.S. dollar was worthy 84 rubles connected Friday, Feb. 25 and implicit 114 rubles connected Tuesday, March 1. With that benignant of devaluation, you mightiness reasonably expect galore assets priced successful rubles to deed all-time highs soon, particularly if the inclination continues.

USDRUB / TradingView

However, the ruble losing 37% of its U.S. dollar worth would explicate thing astir a 37% summation successful “bitcoin successful ruble” (USD and its stablecoin equivalents correspond the astir utilized trading brace for bitcoin, truthful this is an OK assumption). It wouldn’t instantly explicate wherefore bitcoin gained much than 55% (from 3.2 cardinal to 4.9 cardinal rubles); the excess summation suggests determination was immoderate different request origin astatine play. Plus, the USD terms of bitcoin is inactive much than 50% disconnected of all-time highs.

Depending connected which parts of Crypto Twitter you frequent, connected your familiarity with the past of cryptocurrency, your governmental leanings, your wide level of cynicism oregon your insistence connected being a Luddite, you mightiness person 1 of 2 antithetic hypotheses astir what is going on:

The ultra-wealthy Russians who started a warfare are utilizing bitcoin to sidestep sanctions due to the fact that they request wealth to proceed waging war.

The regular radical successful Russia and Ukraine are piling into bitcoin to sidestep sanctions due to the fact that they request wealth to unrecorded (or they privation to sphere immoderate wealth).

Between the two, the latter is much apt than the former. Anecdotal stories and “what-ifs” suggest masses tin heap into bitcoin to sphere wealthiness arsenic their countries spell to war, portion Bitcoin’s transparent ledger is not going to bash Vladimir Putin’s authorities immoderate favors successful avoiding sanctions (as we mentioned successful last week’s newsletter).

These conversations are amusive to have, but it whitethorn not beryllium regular radical either. This is simply a planetary plus aft all.

Let’s spot what the information says.

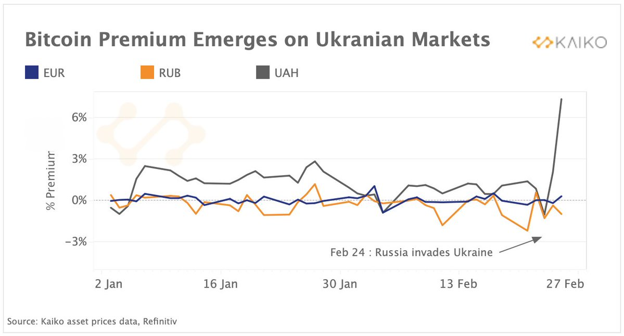

Unlike the ruble, the Ukrainian hryvnia (UAH) hasn’t mislaid excessively overmuch worth successful U.S. dollar terms. But, according to data from Kaiko, bitcoin traded astatine a 6% premium to USD connected Binance’s UAH marketplace pursuing Russia’s penetration of Ukraine connected Feb. 24, which suggests a request surge.

Bitcoin UAH Premium / Kaiko

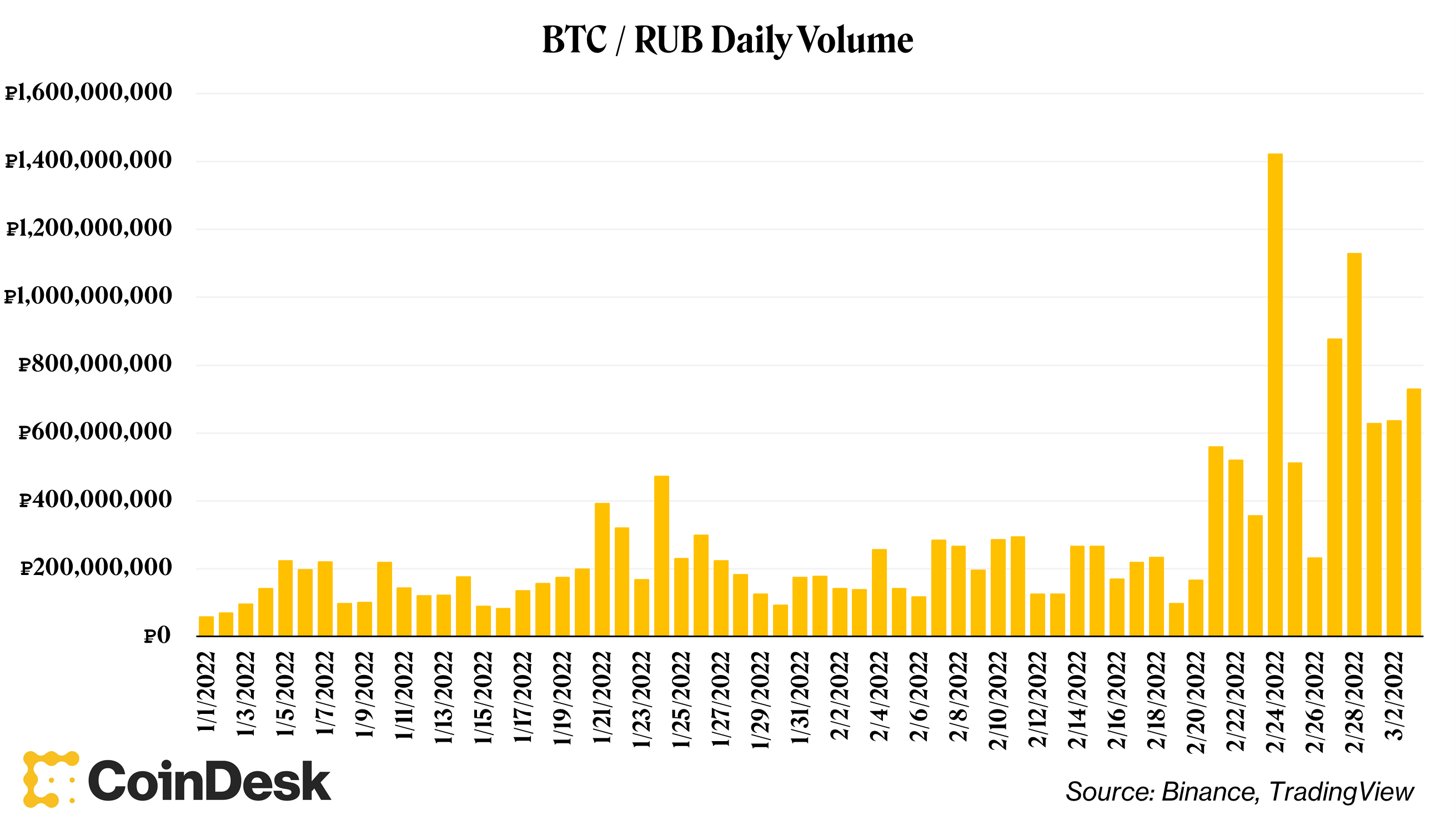

Additional information from Binance shows the measurement of the BTC/RUB trading brace spiked much than 240% supra the 30-day trailing mean successful RUB presumption connected Feb. 28 and much than 400% connected Feb. 24.

BTC / RUB Daily Volume / Binance, TradingView

With these 2 information points successful mind, it makes consciousness to past look astatine the types of bitcoin holders that whitethorn person emerged to fig retired if these are caller holders oregon thing different. Noelle Acheson (former CoinDesker and erstwhile writer of Crypto Long & Short) posted a large tweet thread outlining the workout that she, I and a batch of radical successful the manufacture went done past week. It’s long, but it's surely worthy speechmaking successful full if you person time. I'll summarize here.

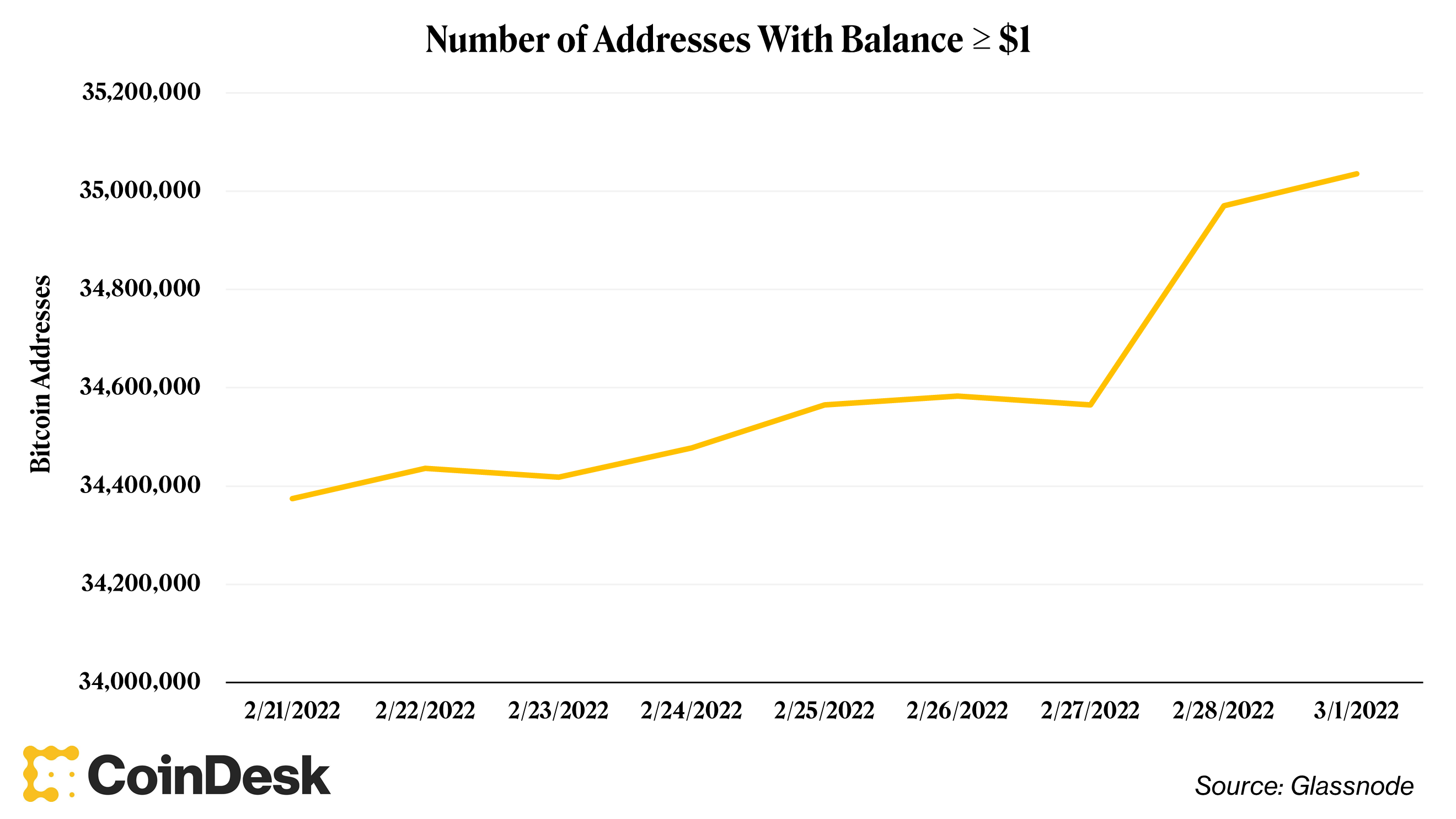

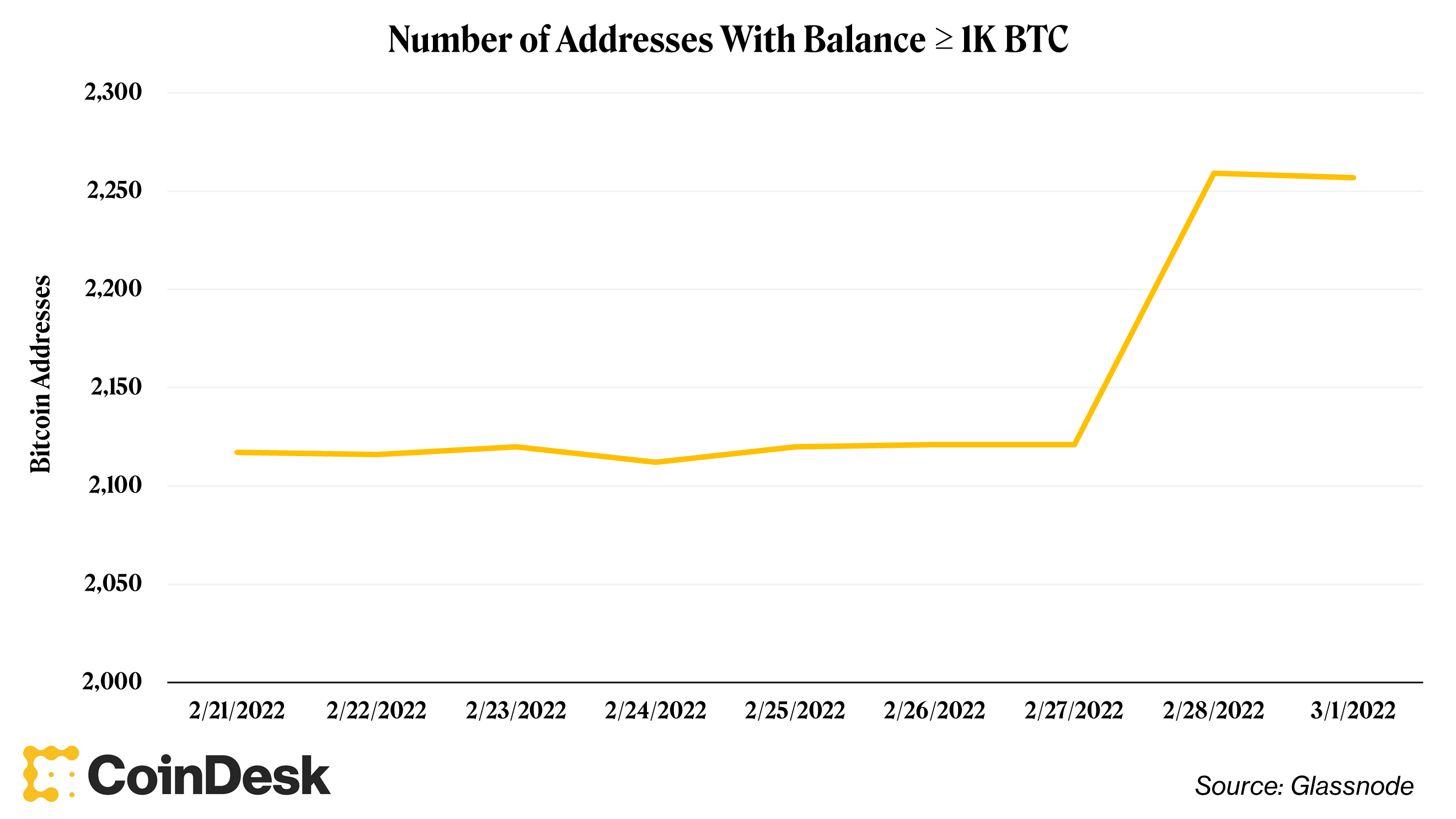

First, we see the fig of bitcoin addresses that are holding ≥ $1. There was an uptick from 34,564,788 to 35,035,127 from Feb. 27 to March 1. Digging successful further here, the fig of Bitcoin addresses that were holding > 1,000 bitcoin besides ticked up from 2,121 to 2,257 implicit the aforesaid period. While the wide maturation successful addresses supports the thought that regular radical are coming into Bitcoin, the maturation successful addresses with > 1,000 BTC (> $40 million) does not.

Addresses With > $1 / Glassnode

Addresses With > 1K BTC / Glassnode

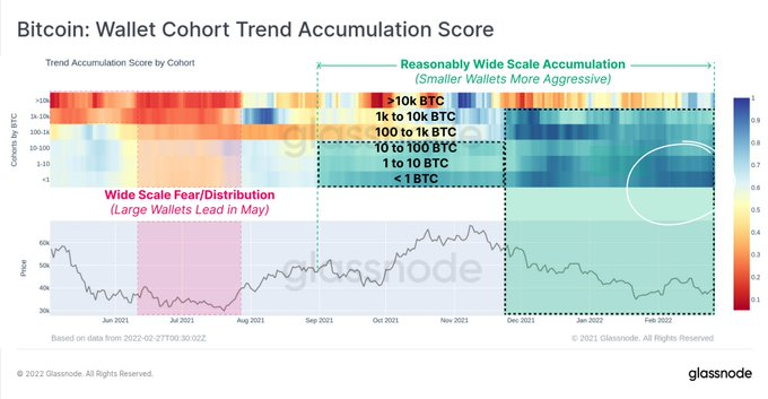

Digging a spot deeper here. Glassnode has an unreleased metric successful its merchandise offering called the “Wallet Cohort Trend Accumulation Score,'' which breaks down the size of wallets which are accumulating bitcoin. According to their astir caller illustration connected Feb. 27, smaller holders person been the astir assertive successful accumulating bitcoin.

Wallet Cohort Trend / Glassnode

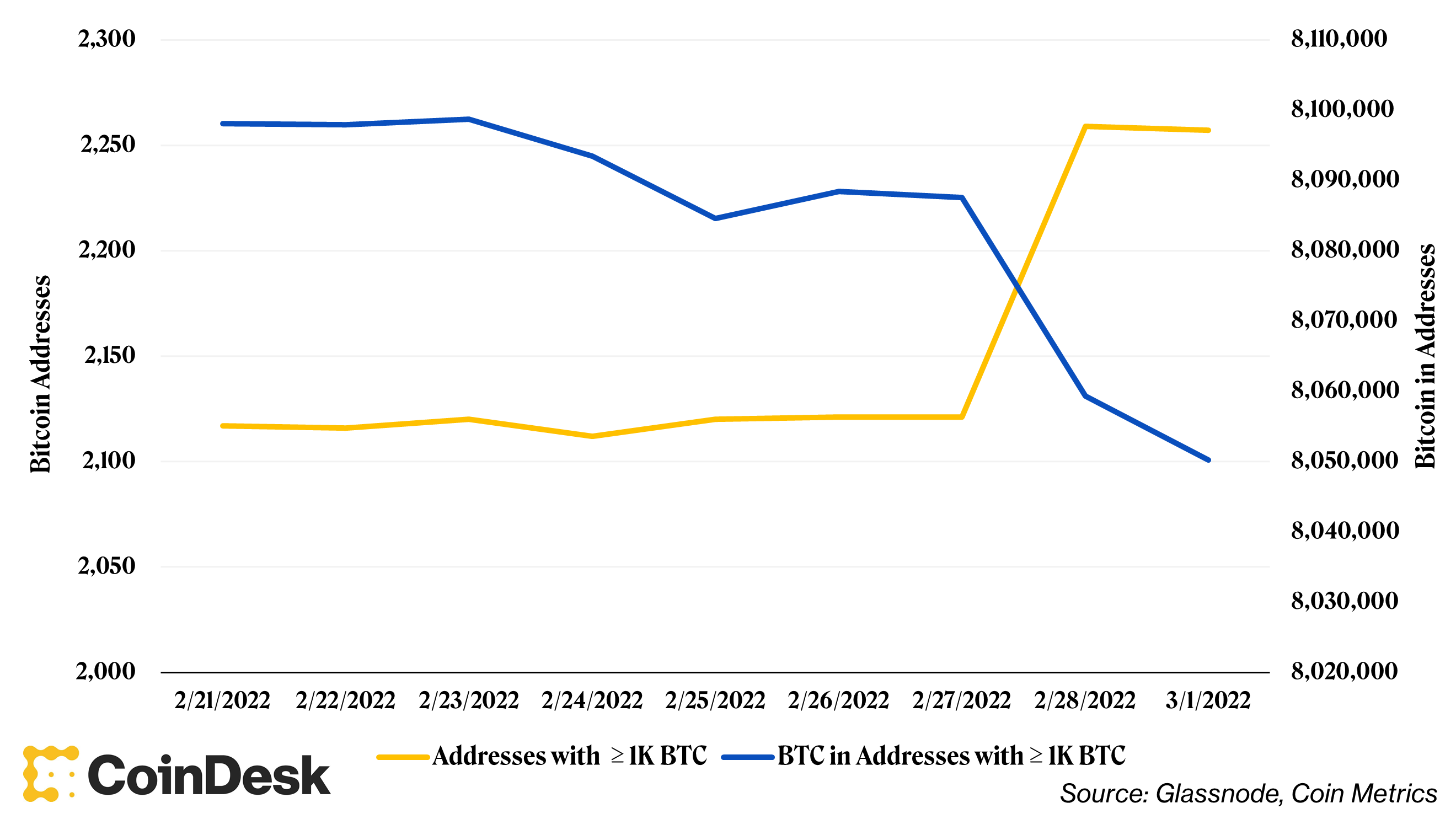

So that’s great, regular radical are getting bitcoin. But however bash we explicate the summation successful the magnitude of larger addresses? From Noelle’s tweet thread:

“But a look astatine the full magnitude of BTC held successful these addresses really declined, suggesting that this was much apt to beryllium a lawsuit of speech wallet reshuffling.”

The corresponding information is shown beneath and this presumption is mostly corroborated crossed the industry.

Exchange Wallet Shuffling / Glassnode, Coin Metrics

All of this supports what bitcoiners person been saying for a portion present – bitcoin is not being utilized by warmongers to debar sanctions (for now). Instead, I deliberation it is much apt that it is being utilized by regular radical hoping to sphere wealthiness arsenic warfare rages on.

However, determination isn’t a statement yet. Citigroup (C) analysts said the following, citing a illustration showing bitcoin purchases successful RUB rising successful implicit bitcoin presumption to astir 450 BTC:

"Russian volumes person been comparatively tiny truthful far, suggesting that the terms enactment is much owed to investors positioning for an expected uptick successful request from Russia, alternatively than Russian request itself."

This is simply a bully point. People similar making wealth adjacent successful the look of calamity (just check retired the spike successful donations to Ukraine aft the authorities confirmed, and past unconfirmed, an airdrop of caller tokens to donors). In the end, this could conscionable beryllium traders taking positions successful anticipation of accrued demand.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)