Bitcoin and existent property spell manus successful hand. One is an illiquid, but carnal income-generating plus and the different is simply a highly liquid, integer asset.

This is an sentiment editorial by Leon Wankum, 1 of the archetypal fiscal economics students to constitute a thesis astir Bitcoin successful 2015.

Prologue

The pursuing nonfiction is portion of a bid of articles successful which I purpose to explicate immoderate of the benefits of utilizing bitcoin arsenic a “tool.” The possibilities are endless. I selected 3 areas wherever bitcoin has helped me. Bitcoin helped maine instrumentality my entrepreneurial endeavors to the adjacent level by allowing maine to easy and efficiently negociate my wealth and physique savings. This allowed maine to physique self-confidence and look to the aboriginal with much optimism. I've developed a little clip preference, meaning I worth the future, which leads maine to enactment much mindfully successful the present. All of this has had a affirmative interaction connected my intelligence health.

When I was caller to Bitcoin, truthful galore radical helped maine that I privation to stock immoderate of my affirmative experiences with you. The three-part bid includes this article, aimed astatine existent property investors, arsenic an introduction. Part Two looks astatine the affirmative implications for intelligence wellness and wide well-being erstwhile 1 adopts a “bitcoin standard,” e.g., utilizing bitcoin arsenic a portion of account. Part Three volition explicate wherefore bitcoin is simply a amended savings conveyance than an exchange-traded money (ETF), which has been 1 of the apical inflow savings vehicles implicit the past fewer decades, and the affirmative interaction bitcoin tin person connected status savings.

Why Every Real Estate Investor Should Own Bitcoin

Bitcoin is integer spot and should entreaty to immoderate existent property capitalist arsenic such. Real property capitalizes connected scarcity successful the carnal realm. Bitcoin introduced scarcity to the integer realm.

Bitcoin established the archetypal lawsuit of integer ownership. Bitcoin is integer property. Digital spot rights bring the transportation betwixt the net and the system into modernity. Therefore, existent property investors whose concern is the acquisition and operation of carnal spot are destined to clasp bitcoin arsenic it is the digitized signifier of carnal property. This connection whitethorn astonishment you, but who would person thought successful 1995 that astir retail stores would yet besides person a integer concern successful the signifier of a website oregon e-commerce store? Of course, e-commerce websites and retail stores are much alike than bitcoin and existent estate, but it's the champion examination to amusement the request for existent property investors to get progressive with bitcoin. I find specified comparisons adjuvant to explicate analyzable and caller technologies similar Bitcoin successful an understandable mode and to amusement wherefore the adaptation of specified a exertion is important.

As I explained successful my nonfiction “Why Bitcoin Is Digital Real Estate,” 1 of the galore things existent property and bitcoin person successful communal is that they some enactment arsenic a store of value. In theory, owning existent property is desirable due to the fact that it generates income (rent) and tin beryllium utilized arsenic a means of accumulation (manufacturing). But for the astir part, existent property present serves a antithetic purpose. Given the precocious levels of monetary ostentation successful caller decades, simply keeping wealth successful a savings relationship is not capable to sphere its worth and support up with inflation. As a result, galore radical — this includes affluent individuals, pension funds and institutions — typically put a important information of their disposable currency successful existent estate, which has go 1 of the preferred stores of value. Most radical don't privation existent property truthful they tin unrecorded successful it oregon usage it for production. They privation existent property truthful they tin store value.

However, existent property cannot vie with bitcoin arsenic a store of value. The properties associated with bitcoin marque it an perfect store of value. Its proviso is limited, it is easy portable, divisible, durable, fungible, censorship-resistant and noncustodial. It tin beryllium sent anyplace successful the satellite astatine astir nary outgo and astatine the velocity of light. On the different hand, existent property is casual to confiscate and precise hard to liquidate successful times of crisis. This was precocious illustrated successful Ukraine. After the Russian penetration connected February 24, 2022, galore Ukrainians turned to bitcoin to support their wealth, bring their wealth with them arsenic they fled, conscionable their regular needs and judge transfers and donations. Properties had to beryllium near down and were mostly destroyed. This could mean that once bitcoin has reached its afloat potential and radical worldwide recognize that it is simply a superior store of worth erstwhile compared to existent estate, the worth of carnal spot whitethorn illness to inferior worth and nary longer transportation the monetary premium of being utilized arsenic a store of value. It whitethorn instrumentality a agelong time, perchance respective decades, but the probability is there. Therefore, it makes consciousness for you arsenic a existent property capitalist to get progressive with bitcoin astatine an aboriginal stage. It is good known that those who follow caller technologies archetypal volition payment the most.

Source: Bitcoin Magazine

Source: Bitcoin Magazine

Real property investors are experts astatine utilizing existing properties arsenic collateral to rise indebtedness for the acquisition and improvement of caller properties. As I elaborate successful my nonfiction “Is Leveraging Legacy Assets To Buy Bitcoin A Good Strategy?” utilizing existing existent property to incur indebtedness and bargain bitcoin is perchance an adjacent bigger concern accidental arsenic the worth of bitcoin is apt to turn faster than the existent estate. Thus, a higher instrumentality whitethorn beryllium achieved. Real property (fully rented properties) is the cleanable collateral for taking connected indebtedness to bargain bitcoin since rent generates income. Therefore, you ne'er person to merchantability your bitcoin to wage disconnected debts, alternatively you tin usage the rental income. If my forecast seems excessively bullish to you, you tin besides usage a tiny portion of your existent property portfolio for specified a project, truthful the hazard is comparatively low, but the upside imaginable is inactive large.

This should not distract from the profitable concern of existent property development. I'm not asking you to halt processing existent estate, I'm asking you to adhd a bitcoin strategy.

Real property improvement is highly babelike connected the quality to physique creditworthiness. Bitcoin tin assistance present too. The continued adoption of bitcoin is fuelled by its superior monetary properties. The expanding adoption is accompanied by a terms summation arsenic the proviso of bitcoin is limited. There is simply a affirmative feedback loop betwixt adoption and price. When request goes up and proviso remains astir constant, terms indispensable summation — mathematically. For you, arsenic a existent property developer, this means that the much bitcoin you own, the much collateral you person to past money existent property operation successful the future. Bitcoin should beryllium portion of each existent property investor's strategy arsenic it is simply a pristine collateral that volition assistance you physique your creditworthiness implicit the agelong term.

Sensibly utilizing your existent property arsenic collateral to get wealth and bargain bitcoin whitethorn lick different problem: liquidity. Real property is an illiquid and immovable asset. In German, existent property translates to “immobilien,” which virtually means “to beryllium immobile.” Using your immovable liquidity successful your income-generating properties to bargain bitcoin tin beryllium a bully concern accidental — and an enactment to support your wealthiness from confiscation should you request to relocate. Of course, you could conscionable merchantability existent property to bargain bitcoin, but that's a atrocious thought for 2 reasons. First, historically wealth is made from income-producing existent property by buying it and holding it for the agelong term. Second, a existent property capitalist typically purchased a spot with a loan, truthful the rental income is needed to work existing indebtedness obligations.

Conclusion

I judge that the “worlds” of existent property and bitcoin volition merge sooner oregon later. Both assets stock similarities and complement each other. Real property is an income-producing plus (rent), but it is precise immobile. Bitcoin does not make income but is highly liquid and mobile. The 2 are a bully match.

Bitcoin's volatility shouldn’t distract from the accidental it represents. Those who rejected the net missed retired connected 1 of the top concern opportunities of their lives. Those who cull bitcoin volition apt conscionable the aforesaid fate.

In addition, we volition astir apt not spot the aforesaid benignant of returns connected existent property investments arsenic we person successful the past. Since 1971, location prices person increased astir 70 times. This corresponds to the “Nixon shock” of August 15, 1971, erstwhile President Richard Nixon announced that the United States would extremity the convertibility of the U.S. dollar into gold. Since then, cardinal banks began operating a fiat-money-based system with floating speech rates and nary currency standard.

Monetary ostentation rates person risen steadily ever since. Real property served arsenic an plus for galore to sphere the worth of their money. However, bitcoin serves this intent overmuch better. This tin effect successful 2 things: First, existent property could suffer the monetary premium of being utilized arsenic a store of value. Second, if bitcoin (digital property) continues its adoption rhythm and replaces existent property (physical property) arsenic the preferred store of value, its complaint of instrumentality volition beryllium galore times higher than existent property successful the future, due to the fact that bitcoin is lone astatine the beginning of its adoption cycle.

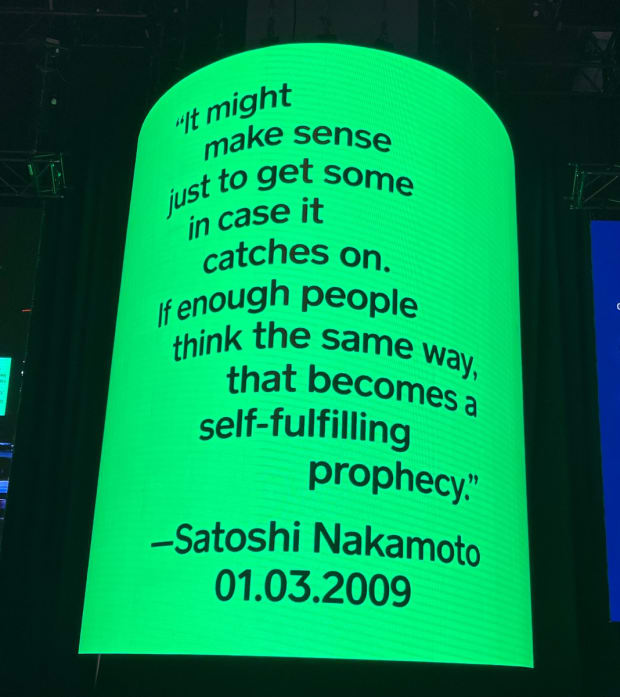

In conclusion, arsenic Satoshi Nakamoto said, “You mightiness privation to get immoderate conscionable successful case,” oregon to paraphrase Mark Twain, “Buy bitcoin, they're not making it anymore.”

This is simply a impermanent station by Leon Wankum. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

2 years ago

2 years ago

![Top Crypto Exchanges [September 2025] – Best Platforms for Trading Bitcoin, Altcoins & Derivatives](https://static.news.bitcoin.com/wp-content/uploads/2025/09/best-crypto-exchanges-sept-2025-768x432.png)

English (US)

English (US)